Haddock Market Size

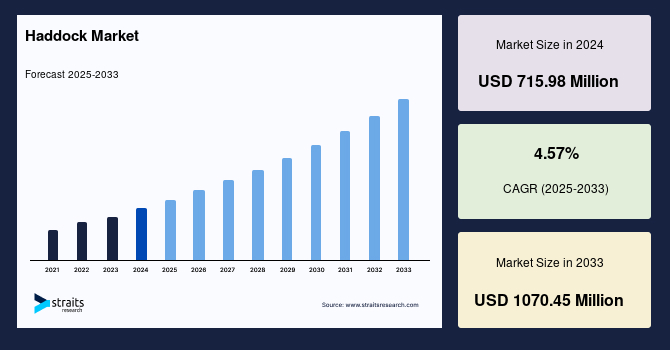

The global haddock market size was valued at USD 715.98 million in 2024 and is anticipated to grow from USD 748.70 million in 2025 to reach USD 1070.45 million by 2033, growing at a CAGR of 4.57% during the forecast period (2025–2033).

One of the primary drivers of the global haddock market is the rising awareness of its nutritional value. Haddock is a lean, high-protein fish rich in vitamin B12, selenium, and omega-3 fatty acids, making it appealing to health-conscious consumers seeking alternatives to red meat. With growing concerns around obesity, heart health, and overall wellness, many are incorporating this fish into their diets for its health benefits and mild flavor.

Additionally, the expanding foodservice sector is boosting the market growth for this fish. It is a staple in popular dishes like fish and chips, seafood chowders, and grilled fillets, and it is widely featured in restaurants, cafeterias, and institutional meal programs. As urban populations grow and more consumers dine out or order ready-made meals, demand for versatile, nutritious fish like haddock continues to rise, especially in regions such as Europe and North America.

Haddock Market Trends

Sustainable fishing practices

Sustainable fishing practices are shaping the future of the global market as regulators and consumers increasingly demand environmental accountability. These practices not only help preserve marine ecosystems but also secure long-term fish stock availability.

- In November 2023, Norwegian fisheries reclaimed Marine Stewardship Council (MSC) certification for inshore haddock and cod, after resolving previous bycatch issues involving coastal cod stocks. The recertification reinforces Norway’s commitment to sustainable management and ensures continued market access in key European countries.

This development has encouraged other fisheries to invest in better monitoring, gear technology, and selective harvesting methods. With large retailers and foodservice brands prioritizing certified sustainable seafood in their sourcing policies, sustainability is no longer optional; it’s a market imperative. As awareness grows, demand is shifting toward MSC-labeled haddock, reshaping global trade dynamics in favor of eco-certified suppliers.

Haddock Market Growth Factor

Rising seafood consumption

The growing global appetite for seafood is significantly driving the demand for haddock. Consumers are increasingly opting for healthier protein sources, and seafood, particularly lean fish like this, is gaining popularity due to its low-fat content and high nutritional value.

- According to the FAO, in 2022, global production of aquatic animal protein reached 185 million tonnes (live weight equivalent), with nearly 164.6 million tonnes, around 89%, allocated for human consumption. This translates to an average per capita intake of approximately 20.7 kilograms annually. Notably, average global fish consumption has more than doubled since the 1960s, increasing from around 9 kilograms per person to 20.7 kilograms by 2022.

As seafood continues to play a larger role in global diets, the demand for versatile species like this fish is expected to rise.

Market Restraint

Overfishing and stock depletion

One of the primary restraints facing the global market is overfishing and the subsequent depletion of fish stocks. Haddock populations, particularly in the North Atlantic, have experienced significant pressure due to unsustainable fishing practices over the past decades. As a result, regulatory bodies like the International Council for the Exploration of the Sea (ICES) have imposed stricter fishing quotas and seasonal restrictions to ensure sustainability.

These limitations directly impact the volume of this fish available for commercial distribution, leading to supply shortages and price fluctuations. Furthermore, environmental groups and eco-conscious consumers increasingly demand responsibly sourced seafood, further challenging suppliers reliant on overexploited stocks to maintain market share.

Market Opportunity

Product diversification

Product diversification is creating new growth avenues in the global market as consumers increasingly seek convenient, healthy, and ethically sourced seafood options. Brands are moving beyond plain fillets to offer ready-to-eat, seasoned, or oven-ready haddock products that align with modern lifestyles.

- For instance, in April 2023, New England Seafood International expanded its Fish Said Fred OvenReady range, introducing a cheesy smoked haddock meal exclusively at Tesco. Certified MSC and ASC, this added-value product caters to rising consumer demand for convenient, responsible seafood options priced around £6 per unit.

Such innovations not only improve accessibility and affordability but also enhance product appeal in mainstream retail. The trend allows companies to reach new consumer segments while increasing product turnover, ultimately driving market growth through differentiation and improved shelf visibility.

![]()

If you have a specific query, feel free to ask our experts.

Regional Analysis

Europe holds a mature and prominent share in the market, largely driven by strong seafood consumption culture and longstanding fishing traditions. The region has adopted stringent sustainability standards, which have led to higher demand for MSC-certified haddock. Smoked and breaded haddock are popular choices across the retail and hospitality sectors. Expansion of premium seafood offerings in supermarkets and gourmet outlets supports market growth. Additionally, consumer interest in clean-label and locally sourced fish further strengthens demand. Innovations in packaging and ready-to-eat haddock meals are also gaining significant traction in the region.

- The UK haddock industry remains robust, driven by traditional dishes like fish and chips, where haddock is a preferred choice. According to Seafish UK, haddock is among the top five most consumed fish species in the country. British retailers such as Tesco and Sainsbury’s offer a wide range of frozen and fresh haddock products, and MSC-certified sustainable sourcing is gaining traction among environmentally conscious consumers.

- The Norwegian market is anchored by the country’s strong seafood export infrastructure. Norway is a major supplier of wild-caught haddock from the Barents Sea, with the Norwegian Seafood Council reporting increased exports to markets like the UK and the EU. Companies like Lerøy and Norway Seafoods are expanding their processed haddock product lines, including skinless fillets and smoked portions, to meet rising global demand for premium seafood.

Asia-Pacific Haddock Market Trends

Asia Pacific is witnessing rapid growth in the market fueled by urbanization, changing dietary patterns, and rising income levels. With a growing appetite for Western cuisines and high-protein diets, this fish is gaining popularity among middle-class consumers. The region is also investing in advanced cold storage and seafood import infrastructure, facilitating broader distribution. Online seafood delivery platforms are expanding rapidly, offering convenience and variety. As health consciousness grows, demand for low-fat white fish like this is expected to surge, especially in metro cities and high-growth urban clusters.

- The Chinese haddock sector is witnessing growth due to the rising demand for protein-rich diets and the influence of Western cuisine. Urban consumers are increasingly purchasing imported frozen haddock through platforms like JD.com and Tmall. Additionally, the Chinese government’s focus on diversifying seafood imports post-COVID has opened opportunities for European exporters, especially from Norway and the UK, to expand their haddock trade into high-income cities such as Beijing and Shanghai.

- The Indian market for haddock remains niche but is gradually expanding, driven by rising health consciousness and growing acceptance of international seafood varieties. Premium retail chains like Nature’s Basket and online platforms such as Licious and FreshToHome are introducing frozen haddock fillets in metro cities. With increasing demand for high-protein alternatives and exposure to global cuisines, India shows potential for growth in value-added haddock products, particularly among the urban middle class.

North America Haddock Market Trends

The market in North America is growing steadily due to rising demand for healthy protein sources and increased awareness of omega-3 benefits. Consumers are shifting toward sustainable and wild-caught seafood, driving interest in traceable haddock products. The retail sector is expanding its offerings with frozen fillets, smoked haddock, and meal kits. Additionally, a thriving foodservice industry is incorporating haddock into menus, especially in coastal areas. Technological advancements in cold chain logistics are also improving product availability and shelf life across the region, boosting overall consumption.

- The U.S. market benefits from rising demand in northeastern states, particularly for dishes like fish and chips. The Boston and New England regions rely heavily on imports from Canada and Iceland. Retailers such as Whole Foods and Costco promote wild-caught haddock through their sustainable seafood programs. Additionally, the growing trend of protein-rich diets has increased the inclusion of haddock in meal kits and frozen food segments.

- Canada’s haddock market is driven by strong consumer demand for sustainably sourced seafood. Nova Scotia and Newfoundland are key contributors to the domestic haddock supply. Retailers like Sobeys and Loblaws increasingly offer MSC-certified frozen haddock products. Moreover, the popularity of traditional dishes like fish and brewis supports consistent domestic consumption, while exports to Europe and Asia further boost market dynamics.

Need a Custom Report?

We can customize every report – free of charge – including purchasing stand-alone sections or country-level reports

Product Type Insights

Fresh haddock holds a dominant position in the global market due to its high demand among consumers seeking quality and flavor. Preferred for its flaky texture and mild taste, fresh fish is widely used in traditional dishes like fish and chips, particularly in Europe and North America. The segment benefits from increased consumption of freshly sourced seafood driven by health-conscious consumers. Improved cold chain logistics and the expansion of local fish markets further support its growth. Additionally, the preference for chemical-free, minimally processed fish enhances the appeal of fresh fish among both households and foodservice providers.

End-user Insights

The household/retail consumers segment is a key contributor to the market growth, driven by rising awareness of healthy dietary choices. Consumers increasingly prefer haddock for home cooking due to its low fat and high protein content. The growing popularity of cooking shows, online recipes, and food delivery of raw ingredients has also encouraged at-home seafood preparation. Urbanization, coupled with better access to cold storage facilities in homes, further supports fresh and frozen haddock purchases. This segment’s growth is bolstered by the availability of packaged portions and value-added products, which offer convenience and ease of preparation for busy lifestyles.

Distribution Channel Insights

Supermarkets and hypermarkets lead the distribution channel due to their wide reach, product variety, and enhanced cold storage infrastructure. These retail formats offer consumers access to fresh, frozen, and value-added products under one roof, promoting convenience and trust. In-store promotions, attractive packaging, and seafood counters with expert advice contribute to higher purchase rates. Major retail chains also support traceable and sustainably sourced haddock, appealing to environmentally conscious buyers. With rising urban footfall and expansion of organized retail, this segment plays a crucial role in making this fish accessible to both budget-conscious and premium seafood consumers globally.

Market Size By Product Type

Fresh Haddock

Frozen Haddock

Smoked Haddock

Canned Haddock

Dried & Salted Haddock

Value-added Products (e.g., fish fingers, patties, fillets)

Company Market Share

Companies in the haddock market are focusing on expanding their processing capabilities, enhancing cold chain logistics, and investing in sustainable fishing certifications to gain consumer trust. Efforts are also directed toward product innovation, including ready-to-eat and smoked haddock varieties, to meet evolving dietary preferences. Additionally, strategic collaborations with retailers and foodservice providers, along with the adoption of digital sales channels, are helping companies increase their market reach and share.

Young’s Seafood Ltd.

Young’s Seafood Ltd., founded in 1805 and headquartered in Grimsby, England, is a leading British producer and distributor of chilled, frozen, and fresh seafood, including haddock, supplying about 40 % of all fish consumed in the UK annually. Formed in 1999 through the merger of Young’s and Bluecrest, the company operates some 12 production sites, employs over 3,000 staff, and generates around £600 million in annual revenue. Owned by Karro Food Group, part of CapVest/Sofina Foods, it emphasizes sustainable sourcing and innovation in seafood offerings.

- In April 2025, Young’s launched Extra Large Haddock Fillets across UK stores, including Iceland. These large, haddock-based fillets are coated in the brand’s signature crispy “bubbly batter,” enabling a takeaway-quality fish-and-chips experience at home. The expansion follows strong performance in cod variants and taps into increasing demand for haddock in regions like Scotland and northern England.

Recent Developments

- June 2025- Channel Fish Processing secured a U.S. Department of Agriculture (USDA) contract, valued at approximately USD 358,200, to supply 900 cases of frozen haddock fillets for child nutrition and domestic food distribution programs, deliveries scheduled between July and October 2025.

Haddock Market Segmentations

By Product Type (2021-2033)

- Fresh Haddock

- Frozen Haddock

- Smoked Haddock

- Canned Haddock

- Dried & Salted Haddock

- Value-added Products (e.g., fish fingers, patties, fillets)

By End-Use (2021-2033)

- Household/Retail Consumers

- Food Processing Industry

- HoReCa (Hotels, Restaurants, Cafés)

- Others

By Distribution Channel (2021-2033)

- Supermarkets & Hypermarkets

- Specialty Seafood Stores

- Online Retail

- Convenience Stores

- Others

By Region (2021-2033)

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

The global haddock market size was worth USD 715.98 million in 2024.

Top industry players are High Liner Foods Inc., Lerøy Seafood Group, Marine Harvest ASA, Young’s Seafood Ltd., Clearwater Seafoods, Pacific Seafood Group, Trident Seafoods Corporation, Ocean Choice International, Nordic Seafood A/S, Austevoll Seafood ASA

Europe has the highest growth in the global market.

The global market growth rate growing at a 4.57% from 2025 to 2033.

Product diversification is the opportunity for the market.