Performance indicators and sentiment in the European hospitality sector are steady and reveal optimism for the future, according to Booking.com’s Accommodation Barometer report for the region in 2025.

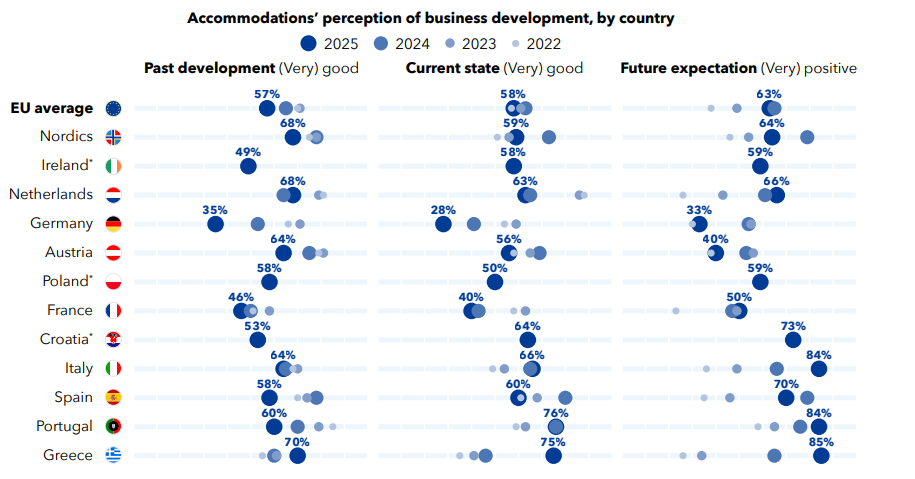

Similarly to 2024, almost two-thirds of hoteliers (63%) expect continued improvement in the coming season, a 25% increase on 2022’s low point – a sign, the booking giant says, of “resilience and strength”. Croatia (73%), Greece (85%), Italy (84%), Portugal (84%), and Spain (70%) all show “very positive” future expectations, while Austria (40%), France (50%), and Germany (33%) are all at only 50% or below.

There has been a slight year-on-year softening of good and very good perceptions of past and present business development, (57% and 58% respectively rating them as good or very good), but the report notes that “negative sentiment remains minimal”, with fewer than one in ten respondents view current conditions poorly.

© Booking.com | Statista

Rooms, occupancy, capital and investment

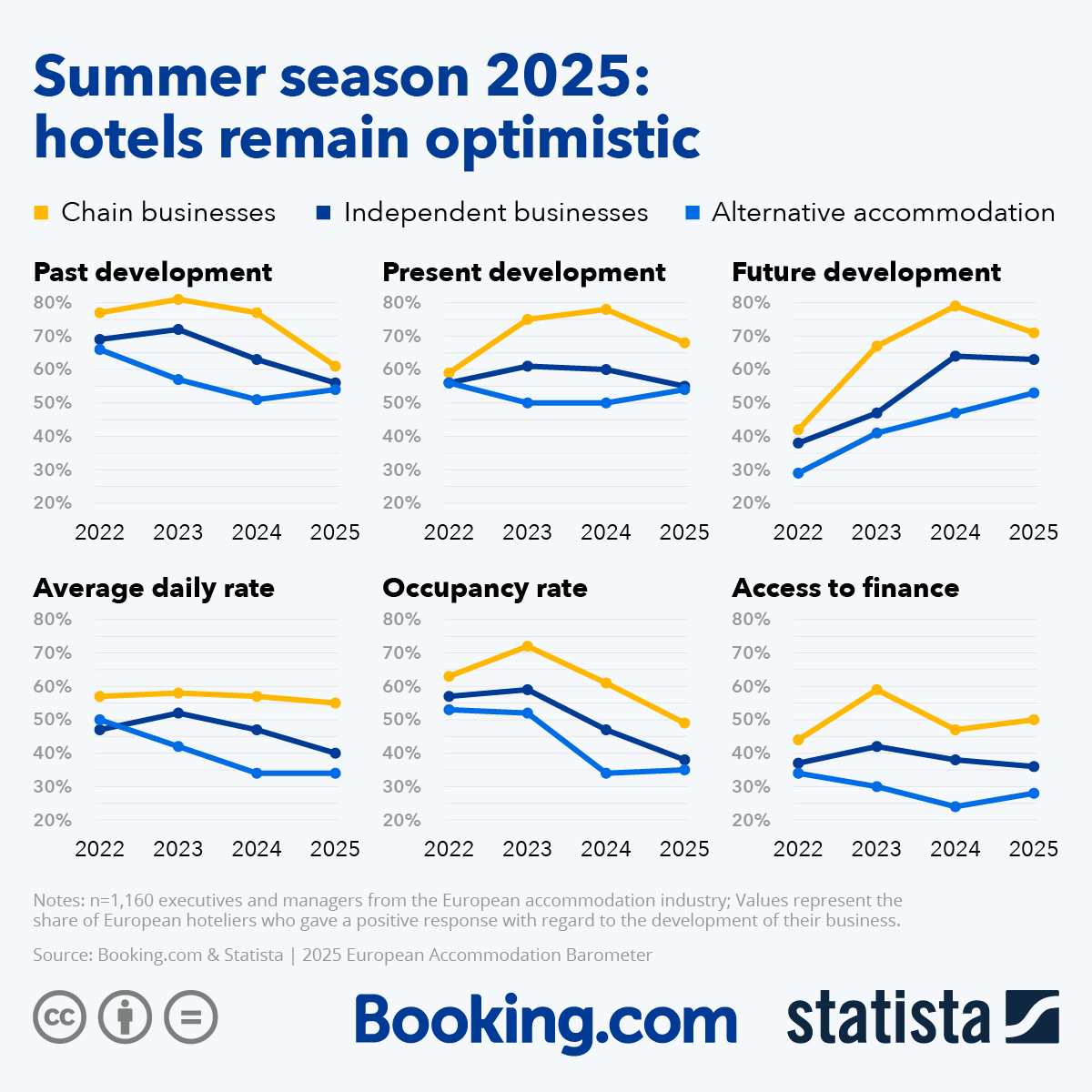

In terms of room and occupancy rates, 43% and 40% respectively, say they have improved but there is a confidence gap between countries. Greece and Italy show “consistently strong sentiment across metrics,” while Germany and France show “greater caution”. Nonetheless the “broader European outlook remains anchored in durable optimism heading into the 2025 season.”

Access to capital and investment intentions are also “holding steady”, with no difficulty experienced by 39% of respondents and 62% planning to maintain current levels. Although 19% encountered “some challenges” and around the same percentage say they will reduce their financial commitments, Booking.com believes these figures show “confidence in continued demand” even though the post-COVID-19 “revenge travel” boom is starting to wain.

© Booking.com | Statista

© Booking.com | Statista

Chains, large properties, and high-star-ratings make a difference

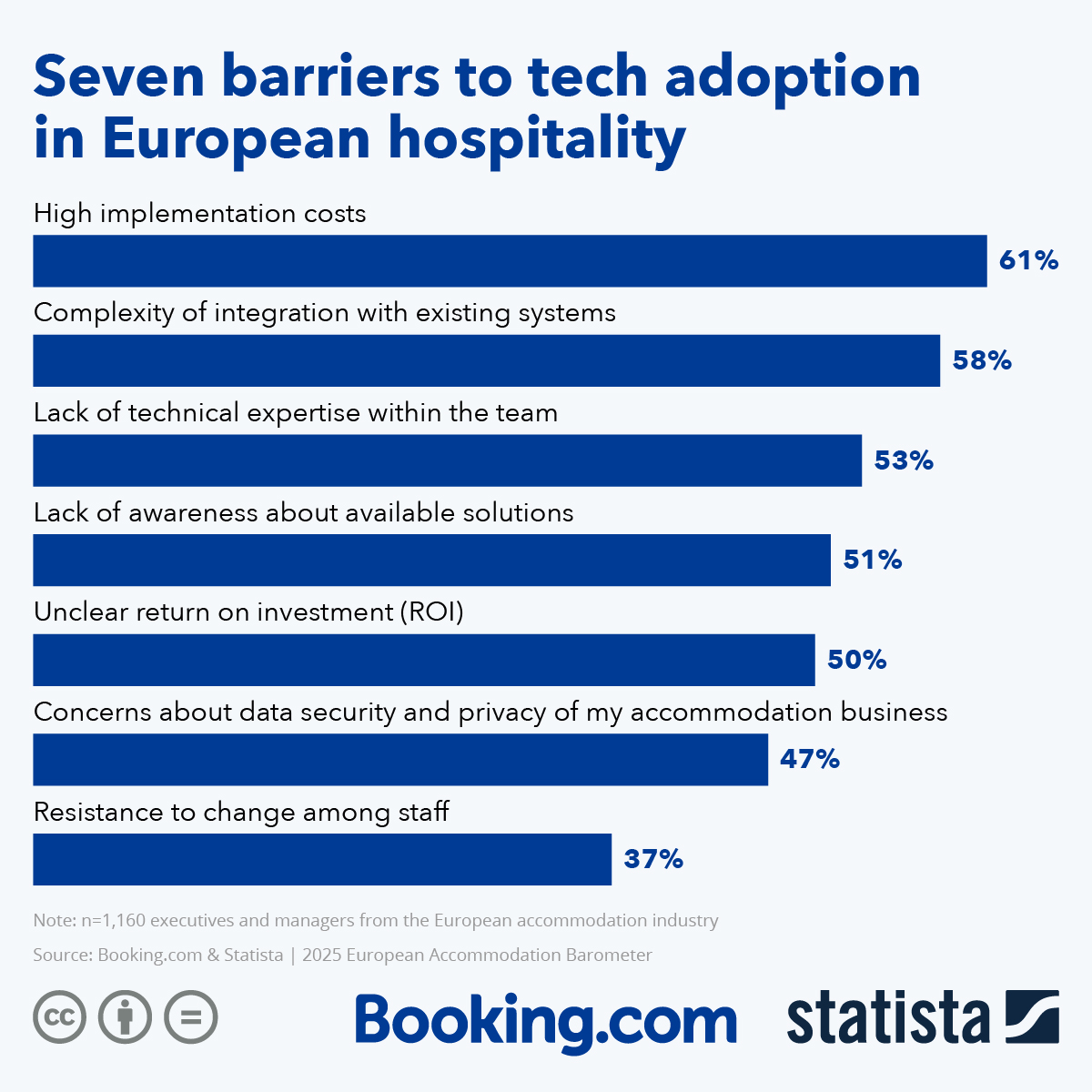

Chains and larger properties are at a “structural advantage”, the report finds, compared to smaller and independent accommodation providers, thanks to their favourable access to financing, proactive investments including in in-house staff training and adoption of tech and AI tools, particularly for marketing and customer service.

Reflecting remarks earlier this month from the Advantage Travel Partnership, which has noted consumers’ growing appetite for all-inclusive holidays and luxury upgrades, Booking.com also sees higher-star-rated hotels outperforming lower-star ones. In fact, the gap between larger chains of 250 employees or more, and smaller, independent, alternative accommodations is one of the “most consistent” in the survey.

© Booking.com | Statista

© Booking.com | Statista

Staffing remains a key issue, with 47% of European accommodations struggling to find and hire skilled and experienced candidates especially in the fields of management, sales, marketing, and spa and recreation. On average, European hotels are planning to hire 3.59 employees in the next 12 months, with Greece at the top of the hiring foodchain, needing an average of 7.45 employees per hotel. In contrast, and reflecting the lowest business development confidence in Europe, their German counterparts only plan on hiring 1.43 staff members.