Global wheat prices eased last week (25 Jul–1 Aug), pressured by strong supply prospects, harvest progress, currency movements and lacklustre export demand.

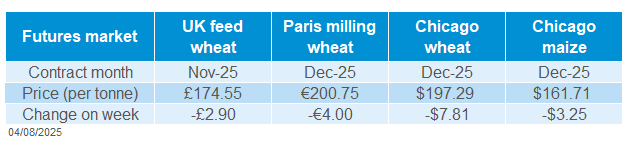

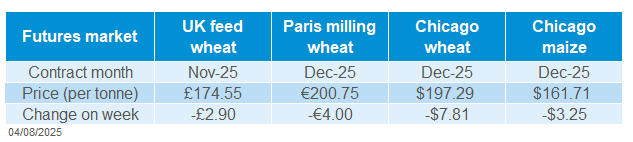

Nov-25 UK feed wheat futures fell by £2.90/t (–1.6%) to close at £174.55/t, tracking declines on global markets. Paris milling wheat and Chicago wheat futures (Dec-25) dropped 2.0% and 3.8%, respectively. The larger fall in Chicago was driven by a stronger US dollar after the Federal Reserve held interest rates steady.

Harvest progress is weighing on markets amid expectations of ample global supply. In the US, 80% of the winter wheat crop had been harvested by 27 July, with spring wheat harvesting underway in some regions. However, forecasted rainfall across the Midwest may cause delays. In France, 89% of the soft wheat crop had been harvested by 28 July, up from 86% the previous week and well ahead of 63% at the same time last year. Meanwhile, persistent rainfall in Germany and Poland is disrupting harvest and raising concern over crop quality.

Recent rainfall has enhanced soil moisture levels across Argentina, supporting the 2025/26 wheat crop as planting nears completion. According to the Buenos Aires Grain Exchange, nearly all sown areas are now in normal to optimal condition.

In the Black Sea region, SovEcon has trimmed Russia’s 2025 wheat crop forecast to 83.3 Mt (USDA: 83.5 Mt) from 83.6 Mt, due to weaker yields in the south. Despite this, the export projection remains steady at 43.3 Mt. Meanwhile Ukraine’s wheat exports are off to a slow start, with only 487 Kt shipped so far this season, compared to 1.4 Mt at the same point last year.

Export demand remains subdued. Weekly US wheat export sales totalled 592.1 Kt for the week ending 24 July, down 17% on the previous week, though still broadly in line with recent averages. EU soft wheat exports also continue to lag behind last year’s pace. However, renewed interest from Jordan, Bangladesh and Egypt offered a modest lift to market sentiment.