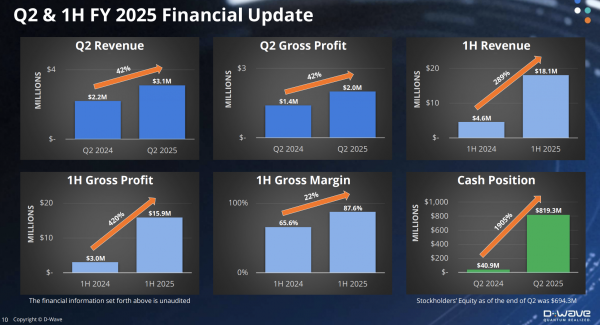

D-Wave Quantum (NYSE: QBTS), the long-time champion of quantum annealing-based quantum computing, is on a roll. While its stock price dipped yesterday after second quarter earnings fell short of expectations, it still hovers up nearly 80% YTD. Even more significant, D-Wave has built a roughly $800 war chest. CFO John Markovich noted that’s a 1900% increase from FY 2024 second quarter.

What’s D-Wave going to do with all that cash?

That’s a good question and one that analysts raised on D-Wave’s earning call yesterday. No doubt D-Wave has many non-M&A needs, and CEO Alan Baratz spent a good deal of the yesterday’s analyst call describing recent technical and market advances, and cited areas requiring increased investment. But M&A activity is on the list.

He said, “We have not disclosed our strategy and plans for M&A other than to say that with $800 million in the bank, it has now become a strategic priority for the company. That [being] said we have been spending a fair amount of time developing a strategy and a plan, and it falls into a number of key areas…[T]hink about it as really accelerating our R&D and product development.”

Asked about the timing of deals, Baratz said, “It’s hard for me to predict, but what I would say is our goal would be to start being able to announce acquisitions this year. However, it takes two to tango, and so we’ll just have to see how that plays out.”

In addition to strategic acquisitions, Markovich cited specific R&D and sales investment:

- “We are investing in superconducting bond process, to support our multi-chip processor program on our path towards a 100,000 qubit annealing system,” he said. This process will also support D-Wave’s cryogenic control of fluxonium based gate model technology.

- The company will be upgrading its superconducting printed circuit board, advanced packaging manufacturing operation, and increasing the number and frequency of our wafer fabrication runs to support building Advantage Three prototypes, said Markovich.

- “We will be expanding the size and geographical footprint of our professional services organization to support growing demand for quantum optimization customer engagements across both commercial and government sectors, including US defense.

- “Lastly, in the area of G&A, we will be making further investments in our cybersecurity personnel and infrastructure,” said Markovich.

These are certainly heady days for the 20-plus-year-old company.

Analyst Bob Sorensen, Hyperion Research’s SVP of Research, noted, “$800 million is indeed a nicely sized war chest although of late some of the investments flowing in QC companies has been equally impressive. In the study I did for the QED-C earlier this year, we discovered that the majority of QC suppliers—83% to be exact –were engaged in partnerships with other QC suppliers. The key drivers cited were gaining access to QC-related technical expertise, access to larger customer bases with key verticals/sectors, and access to financial resources. So it is no surprise that any QC company with the financial wherewithal should be moving to make any such arrangements more formal.

“Currently, there are a great number of smaller QC companies spread across the entire QC stack that could bring value to a more financially endowed partner. The key here is making the right choices: spending the money will be the easy part, spending the money wisely will be a bit more complicated. Those that can accurately assess what internal gaps they can address through an M&A and then find the right partners to address those gaps will do well. Those that don’t, not so much it. Either way, expect this trend increase significantly in the next few years.”

Practically speaking, D-Wave has been pushing ahead non-stop. Introducing widespread availability of its Advantage 2 system is a big step. Last week’s introduction of new tool aimed at easing development of Quantum-AI capabilities is another. Collaboration with NASA Jet Propulsion Lab on bump bonding promises to help enable chip-to-chip connectivity and D-Wave’s just announce cryogenic packaging initiative is key to scaling.

These effort are also not inexpensive. (For a full rundown of D-Wave’s advancing technology efforts, financial results, and bookings, see the official earnings release on HPCwire.)

On the analyst call, Baratz again sought to clearly distinguish quantum annealing from gate-based systems, again arguing that D-Wave’s quantum annealing approach is the better tool for optimization problems, and that gate-based are still years away.

Baratz said: “To characterize annealing quantum computing as niche is misleading and ill informed. Both annealing and gate model quantum computers can solve a broad range of problems, and each has its limitations with problems it cannot efficiently solve.

“Annealing quantum computing is very good at solving optimization problems which cannot be efficiently solved by gate model. Gate model quantum computers, once commercialized, are expected to be very good at quantum chemistry and 3D fluid dynamics, which cannot be efficiently solved by annealing. Both systems can tackle linear algebra and factorization, meaning problems related to AI machine learning and cryptography.

“We believe that organizations will need both annealing and gate model systems in order to address their full problem sets. This is why D-Wave is building both types of quantum computers for our customers,” said Baratz.

When asked about DARPA’s Quantum Benchmarking Initiative program (QBI), which excludes quantum annealing, Baratz responded as fiery as ever:

“You really know how to push my buttons,” he said. “The DARPA QBI program is totally focused on gate model, and I think that is a huge mistake on the part of DARPA and the US government. I think that by focusing on gate model, they are totally missing the fact that annealing is the most capable approach to quantum for many of the important problems that the government needs to address whether it’s in the area of defense, for things like missile defense, or troop resupply, or in the area of transportation.”

“I think DARPA has made a huge mistake, and I would encourage them to maybe not add annealing to the QBI program, but maybe create a second quantum program for non-gate model approaches to ensure that the US government is focused on all the approaches to quantum computing.”

The fact is that D-Wave and quantum annealing have fought (and are still fighting) a long, weary battle for acceptance. The market will be the final arbiter. Against this backdrop, D-Wave has shown resilience and determination and concrete progress.

It will be interesting to watch how D-Wave deploys its cash. It knows well that not all investments go as hoped. Its investment in the failed AI/quantum software specialist Zapata AI is a good example.

While reviewing the financials, Markovich noted, “We fully recovered the $1 million investment plus accrued interest that we made in Zapata AI in February of 2024 through a convertible note instrument that we wrote off later that year when Zapata became insolvent.

Lots of folks will be watching how D-Wave invests going forward.

Link D-Wave 2nd quarter earnings results, https://www.hpcwire.com/off-the-wire/d-wave-reports-second-quarter-2025-results/