The latest tariff announcement coming out of the White House is about a key piece of technology: chips.

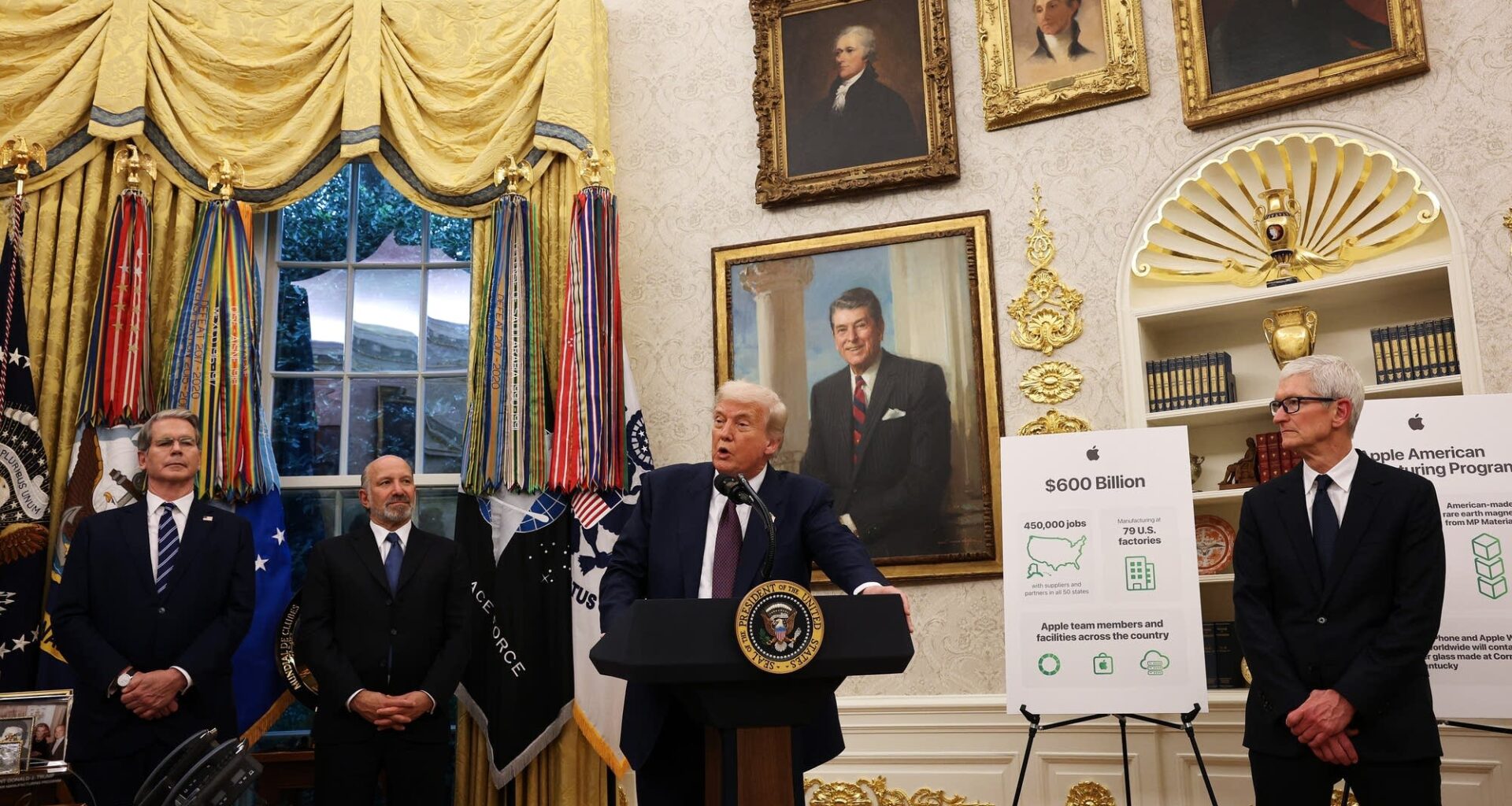

During an Oval Office meeting with Apple CEO Tim Cook on Wednesday, President Donald Trump said the U.S. would impose a whopping 100% tariff on imported semiconductors and computer chips. But not for companies “building in the U.S.”

There are a lot of details that still need to be filled in, but the idea here is to use tariffs to pressure companies to create production here. The U.S. has tried plenty of strategies to accomplish this goal before.

For more than a decade, the U.S. has been focused on bringing semiconductor production back to the U.S., and it’s cycled through different tactics.

“One is to just have the government pay some of the bill,” said Gregory Allen, a senior adviser at the Center for Strategic and International Studies.

The government can subsidize chip plant construction with grants or tax credits — that’s what Congress did under the Biden administration with the bipartisan CHIPS and Science Act.

“The Trump administration also wants that increased construction, but they want the incentive to take the form of making it more expensive to build anywhere else, not making it cheaper to build in the United States,” Allen said.

One hundred percent tariffs would for sure make it more expensive to build outside the U.S. But they also risk making products in the U.S. more expensive. Still, this was the approach in the first Trump administration and under Biden too — both placed tariffs on Chinese-made chips in particular.

“What Trump’s doing though is a major dramatic expansion of that effort,” said Chris Miller, an economic historian and author of “Chip War: The Fight for the World’s Most Critical Technology.”

“Both because the tariff rate is going to go higher, and because it’s going to apply not just on chips from China, but on chips from other countries, too,” Miller said.

One way for companies to get out of the tariff is if they commit to building production in the U.S.

Although details there are not spelled out yet, Vivek Arya, research analyst with Bank of America, said a 100% tariff should be convincing enough, “to at least commit to enough production to serve, at a minimum, their U.S. customer base.”

Many already have, from Samsung to Intel, on the back of the CHIPS Act and in the years after.

“With the $39 billion of manufacturing incentives in terms of grants, it attracted somewhere north of $400 billion of announced projects in the United States. And that has increased even further with this administration,” said Dan Kim, chief economist for the CHIPs program under President Biden and chief strategy officer at TechInsights.

He agreed the latest tariff approach has the potential to build on that. “This can be complementary, or it can be counterproductive,” Kim said.

But a lot is unclear. For example, to get out of tariffs, does the chipmaker need to build here, or the phone maker who uses chips? And down the line, what will this mean for prices? Devil … meet details.

Related Topics