Amazon.com Inc. is deepening its bet on quantum computing, taking a $36.7 million equity stake in IonQ Inc., a move that underscores the tech giant’s interest in emerging technologies beyond artificial intelligence’s current chip-and-algorithm boom.

The investment—announced this week—ties IonQ more closely to Amazon Web Services, the company’s cloud-computing arm, and adds another layer to the competition among hyperscalers to secure quantum capabilities. IonQ already counts AWS and Microsoft Corp.’s Azure as customers, positioning it in the middle of a high-stakes race to commercialize quantum solutions for cloud clients.

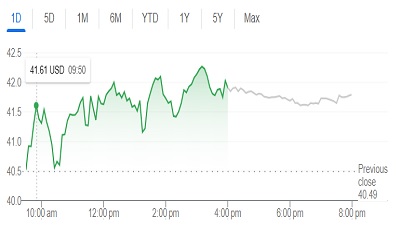

Shares of IonQ (NYSE: IONQ) rose 3.5% Friday to $41.90. The stock has traded between $6.54 and $54.74 over the past 12 months, and Wall Street’s average price target sits at $45. Institutional interest has been building; one analyst has reiterated a bullish call on the stock, citing “massive upside” potential.

Quantum computing—still years from mainstream adoption—promises exponential improvements in processing power over classical systems. That potential has drawn attention from major cloud players, which see quantum as both a differentiator for enterprise customers and a long-term growth engine.

While Microsoft and other rivals have explored their own partnerships, Amazon’s equity stake signals a willingness to tie capital directly to its strategic ambitions. For investors, the move may be less about near-term earnings and more about identifying the companies likely to control the infrastructure of a quantum-enabled economy.