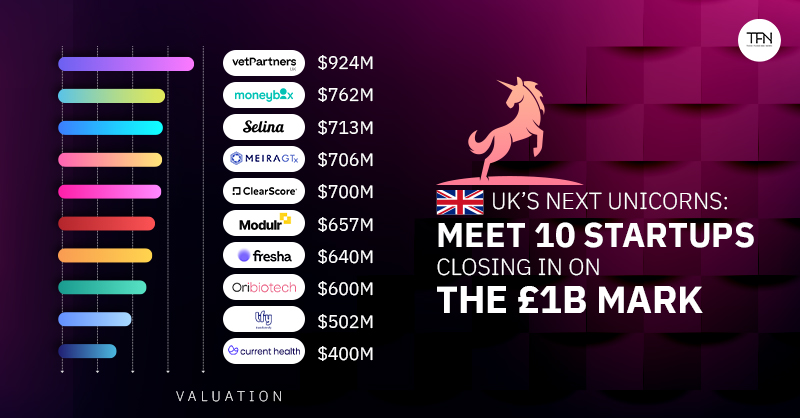

Britain’s startup ecosystem is entering an exciting phase as a new generation of soonicorns edges closer to the £1 billion valuation mark. While the pace of unicorn creation has slowed, film streaming platform Mubi is the UK’s only new unicorn in 2025. There is growing anticipation around the next set of high-growth companies ready to break through.

Recent reports have highlighted a dozen rising stars with the scale, funding, and market momentum to join the billion-pound club. The investment climate is proving supportive.

From fintech and healthtech to enterprise software and energy solutions, these soonicorns represent the most ambitious and fast-moving businesses in the country. Below, we have curated a list of 10 homegrown contenders racing toward unicorn status.

VetPartners

Founder/s: Jo Malone

Founded year: 2015

Valuation: $924M

Founded by a veterinarian, VetPartners offers a group of veterinary practices, including small-animal, equine, farm, mixed, and referral services. These services emphasise compassionate, vet-led care with a supportive family ethos. It offers each clinic extensive central support across operations, HR, finance, marketing, IT, and professional development, ensuring clinicians focus on delivering outstanding care.

In August 2018, VetPartners was acquired by private equity firm BC Partners for approximately £700 million, enabling further expansion and consolidation across the UK veterinary sector.

Moneybox

Founder/s: Ben Stanway, Charlie Mortimer

Founded year: 2016

Valuation: $726M

Fintech platform Moneybox offers a simple, mobile-first app for saving, investing, home-buying, and retirement planning, all in one place. It enables users to open tax-efficient accounts like Cash and Stocks & Shares ISAs, Lifetime ISAs, pensions, and more, starting with as little as £1. The platform’s intuitive features, such as round-ups that invest spare change, have made it the UK’s largest Lifetime ISA provider, supporting over a million customers in building wealth with confidence.

In October 2024, Moneybox completed a £70 million secondary share sale. Existing investors sold 10–15% of share capital, enabling crowdfunding, customer, and employee shareholders to realize partial gains. New backers in the deal included Apis Global Growth Fund III and Amundi, who joined the company’s existing investors to help fuel its next phase of growth.

Selina

Founder/s: Rafael Museri, Daniel Rudasevski

Founded year: 2014

Valuation: $713M

Selina is a hospitality brand crafted for millennial and Gen Z travellers, offering more than just places to stay. It blends beautifully designed lodgings with coworking spaces, recreation, wellness activities, and local cultural experiences. Each location is brought to life through partnerships with local artists and creators, transforming interesting buildings from urban settings to remote jungles and beaches into vibrant, versatile destinations that support both travel and work.

In April last year, Selina amended a $12 million subscription agreement with Osprey International. Osprey agreed to accelerate the remaining $6 million investment, disbursing it in four monthly installments of $1.5 million through August 2024, instead of the original schedule ending in December 2024. These funds are earmarked for marketing, commercial initiatives, and capital upgrades to maintain properties.

MeiraGTX

Founder/s: Alexandria Forbes, Joel Marcus

Founded year: 2015

Valuation: $706M

Clinical-stage genetic medicines company MeiraGTx develops therapies for both inherited and acquired conditions, with a focus on diseases of the eye, central nervous system and salivary glands. Its approach employs precise delivery of tiny doses of genetic material, using optimised viral vectors and an integrated internal manufacturing capability to support development through commercialisation.

In March this year, MeiraGTx entered into a strategic collaboration that brings $200 million in immediate funding and access to up to another $230 million in committed capital via a new joint venture, fully funding its Parkinson’s disease therapy through late-stage development and commercialisation.

ClearScore

Founder/s: Justin Basini, Nigel Morris, Dan Cobley

Founded year: 2015

Valuation: $700M

Yet another London-based fintech startup in this list is ClearScore. It is a financial marketplace that lets people check their credit score and report for free. It helps users discover credit cards, loans, car finance and other financial products tailored to their needs. Operating in the UK and countries such as Australia, Canada, New Zealand and South Africa, ClearScore partners with over 150 financial institutions to match users with relevant offers based on their profile.

Earlier this year, ClearScore secured £30 million in debt financing from HSBC Innovation Banking UK. This funding continues a long-standing partnership and will support the company’s expansion into new markets, broaden its product range and strengthen its ability to deliver services to more users.

Modulr

Founder/s: Myles Stephenson, Manoj Kumar Bithal, Manoj Kumar Badale, Ritesh Tendulkar

Founded year: 2016

Valuation: $657M

Modulr, an embedded payments provider, helps digital companies integrate payment capabilities directly into their platforms through a flexible Payments-as-a-Service API. Its modern FinOps hub simplifies complicated infrastructure and compliance, so organisations can control money flow, issue accounts, make pay-ins and payouts, and issue cards without becoming licenced themselves. Now, the company handles over £100 billion in annualised transactions across the UK and Europe.

In 2022, Modulr raised $108 million in a Series C funding round led by growth equity firm General Atlantic, with participation from returning backers such as Blenheim Chalcot, Frog Capital, Highland Europe, and PayPal Ventures. The funding will help the company expand across more verticals and geographic markets across Europe.

Fresha

Founder/s: William Zeqiri, Nicholas Miller

Founded year: 2015

Valuation: $640M

Fresha is a beauty and wellness platform that helps salons, spas, barbershops, and clinics manage operations and reach customers more effectively. Consumers can discover, book, and pay for appointments through its marketplace, while professionals benefit from free business software and financial tools. The platform offers appointment scheduling, POS, customer management, marketing automation, loyalty programs, inventory tracking, and team management. With integrations across social media, and mobile apps, Fresha drives online bookings and revenue growth, empowering businesses to operate independently and scale seamlessly.

Last year, Fresha landed a $31 million venture debt facility from JP Morgan. This new relationship with JP Morgan will further fuel its ambitions to revolutionise the beauty and wellness space.

Ori Biotech

Founder/s: Chris Mason, Farlan Veraitch

Founded year: 2015

Valuation: $600M

Ori Biotech is a manufacturing technology company focused on cell and gene therapies (CGT). It has created a proprietary full-stack platform that closes, automates, and standardises CGT manufacturing. By integrating hardware, software, data, and analytics, Ori enables developers to scale production, improve quality, and reduce costs. Its platform is designed to seamlessly translate therapies from process discovery to commercialisation, supporting faster, more efficient, and reliable delivery of advanced therapeutics to patients at commercial scale.

In 2022, Ori Biotech raised over $100 million in an oversubscribed Series B led by Novalis LifeSciences with new backers Puhua Capital and Chimera Abu Dhabi. The funds will support team expansion and accelerate pre-commercialisation towards launching its innovative CGT manufacturing platform, strengthening its global growth trajectory.

Transformity (TFY)

Founder/s: Lilia Stoyanov, Desislav Kamenov

Founded year: 2015

Valuation: $502M

Workforce management platform Transformify simplifies hiring, managing, and paying remote teams, freelancers, and contingent workers. Acting as an Agent on Record (AOR), it streamlines onboarding, compliance, billing, and secure payments across global talent pools, ideal for mid-sized organisations.

Since its debut, Transformify has sustained high profitability while embedding social impact into its operations, offering charities and NGOs free access to its applicant tracking system to help them recruit volunteers. Its mission also includes creating remote jobs in war and post-war zones through its “Rebuild Lives” programme.

Current Health

Founder/s: Christopher McCann, Stewart Whiting, Chris McGhee

Founded year: 2015

Valuation: $400M

Current Health delivers a remote care-at-home platform that brings advanced healthcare into patients’ homes. Its solution, built around an FDA-cleared wearable, continuously tracks vital signs with ICU-level accuracy, integrates third-party devices, enables telehealth communication, and ties into electronic health records. Coupled with patient engagement tools and clinical dashboards, it helps care teams spot early signs of decline and coordinate in-home care effectively. Serving hospital-at-home and oncology programs, it supports proactive, lower-cost healthcare delivery outside traditional settings.

In 2021, Best Buy acquired Current Health for about $400 million to boost its at-home healthcare offerings. In mid-2025, Current Health was divested back to its co-founder, Christopher McGhee, who resumed the role of CEO.