Britain’s national debt soared by an eye-watering £186billion during Labour‘s first year in power, an analysis has shown.

From the end of July 2024 to the end of last month, the UK’s national debt rocketed from £2.53trillion to £2.71trillion, the study of official figures found.

It means the Labour Government put Britain into the red by an extra £186.2billion in just 12 months.

The TaxPayers’ Alliance analysis of newly-published figures by the Office for National Statistics (ONS) found this represented a £6,510 increase in debt per household.

It was also a £5,880 increase in debt per taxpayer over 12 months, and a £2,726 increase in debt per person.

If the extra debt taken on over 12 months represented spending by a Government department, it would be the third largest in terms of total spending.

This would be after the Department for Work and Pensions and the Department for Health and Social Care.

A ‘debt clock’ launched by the campaign group currently shows the national debt increasing by £4,956 per second and £428million per day.

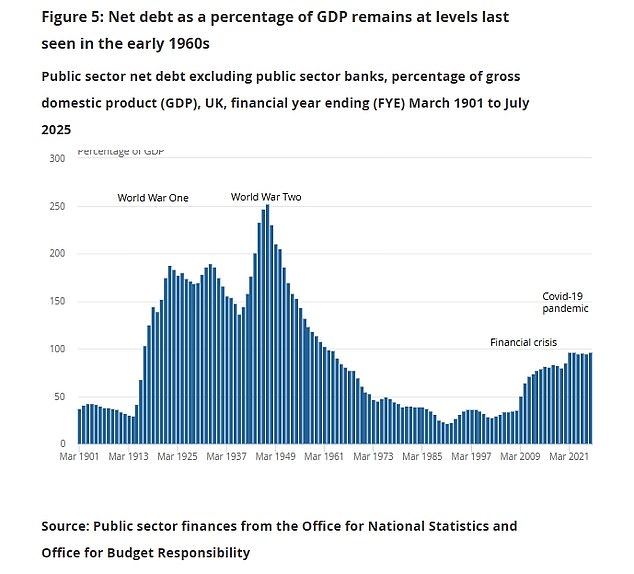

The ONS estimated public sector net debt, excluding public sector banks, at 96.1 per cent of GDP at the end of last month. This remains at levels last seen in the early 1960s

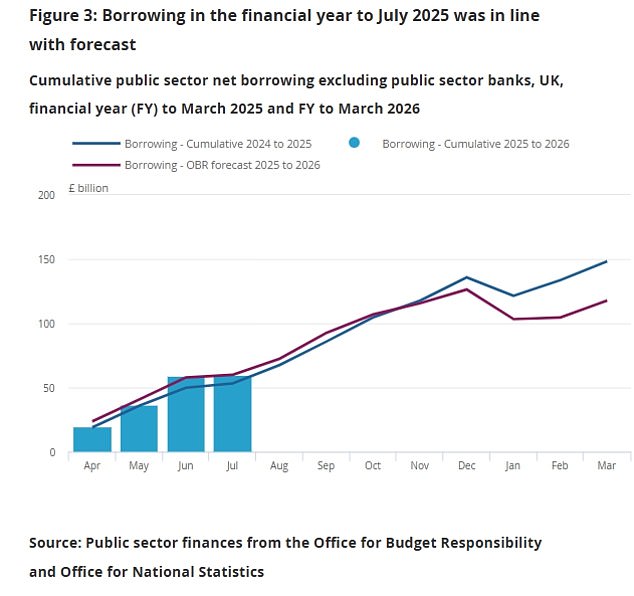

Borrowing for the first four months of this financial year stood at £60billion, £6.7billion more than during the same period last year

Chancellor Rachel Reeves is estimated to be facing a £51billion black hole in the public finances ahead of her next Budget in the autumn

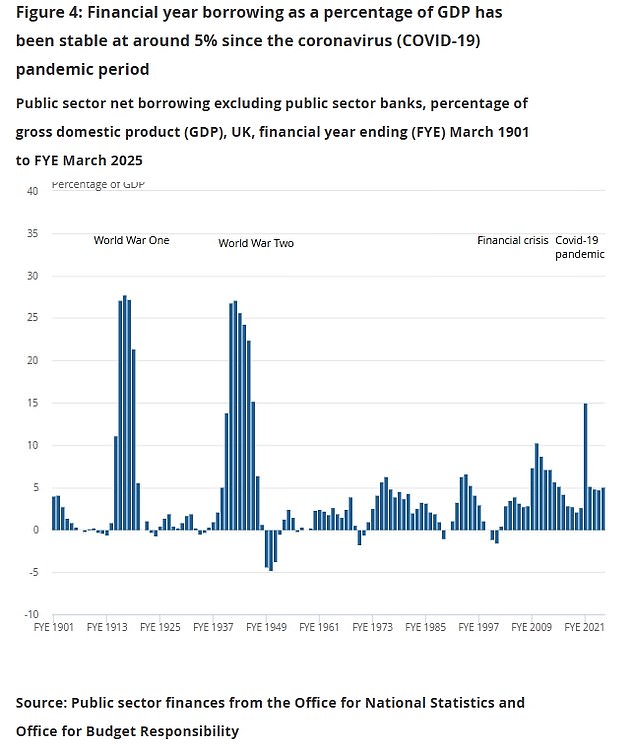

But there was some relief for Chancellor Rachel Reeves as ONS figures showed Government borrowing slowed to a lower-than-expected £1.1billion last month.

This was the lowest July borrowing figure for three years and £2.3billion less than July 2024.

It came after a rise in self-assessed income tax and national insurance payments helped increase tax receipts for the month.

July borrowing was lower than the £2billion figure predicted by a consensus of economists.

Yet borrowing for the first four months of this financial year stood at £60billion, £6.7billion more than during the same period last year.

The ONS estimated public sector net debt, excluding public sector banks, at 96.1 per cent of GDP at the end of last month.

This was 0.5 percentage points more than at the end of July 2024 and remains at levels last seen in the early 1960s.

Ms Reeves is estimated to be facing a £51billion black hole in the public finances ahead of her next Budget in the autumn.

In a recent report, the National Institute of Economic and Social Research found that the ‘wafer thin’ headroom of £9.9billion Ms Reeves left herself last year has been wiped out, and there is now a budget deficit of £41.2billion.

To fill the hole and maintain the buffer, the Chancellor will have to find £51billion annually in higher taxes or lower spending by 2029/30, the think tank said.

The dire warnings about the state of the public finances has increased expectations that Ms Reeves will hike taxes once again this autumn.

She is said to be considering new property levies, including the removal of the capital gains tax exemption for the sale of higher-value homes, as well as a replacing stamp duty with an annual charge.

Treasury officials are also said to be eyeing an inheritance tax raid, while economists have also predicted there could be further ‘stealth’ and ‘sin’ taxes.

The Chancellor has ruled out increasing income tax, employees’ national insurance contributions and VAT.

The TaxPayers’ Alliance said Britain ‘has a borrowing problem because politicians have a chronic spending addiction’

Darwin Friend, head of research of the TaxPayers’ Alliance, said: ‘The fundamental truth is that Britain has a borrowing problem because politicians have a chronic spending addiction.

‘In just one year, Labour have splurged hundreds of billions they don’t have, piling yet more debt onto taxpayers’ backs.

‘Ministers must slam the brakes on this reckless debt binge because if the Government doesn’t get Britain’s financial house in order it will be ordinary taxpayers that suffer.’

Elliott Jordan-Doak, senior UK economist at Pantheon Macroeconomics, said: ‘The Chancellor will still have to raise taxes in October despite borrowing matching official forecasts.

‘The big picture remains that the public finances are in chronically weak condition.

‘We think the Chancellor will need to resort to ‘sin’ and ‘stealth’ tax hikes, duty increases, and a pensions tax raid in order to meet her fiscal rules if she wants to meet her pledge of keeping headline tax rates unchanged.’

ONS deputy director for public sector finances Rob Doody said: ‘Borrowing this July was £2.3 billion down on the same month last year and was the lowest July figure for three years.

‘This reflects strong increases in tax and national insurance receipts.

‘However, in the first four months of the financial year as a whole, borrowing was over £6 billion higher than in the same period in 2024.’

Treasury minister Darren Jones said: ‘We’re investing in our public services and modernising the state, to improve outcomes and reduce costs in the medium term.

‘Far too much taxpayer money is spent on interest payments for the longstanding national debt.

‘That’s why we’re driving down government borrowing over the course of the parliament – so working people don’t have to foot the bill and we can invest in better schools, hospitals and services for working families.’