Flights and hotels, weddings, al fresco dinners… Summer is wonderful, but it’s not cheap!

With endless demands on our bank accounts at this time of the year, it’s no wonder many of us are feeling the pinch.

Against this backdrop, it’s easy to see why there’s lots of interest in tools that can help us save more and spend less.

One of these is Plum, a smart money app that’s free to download on the App Store or Google Play, with more than 2.2 million people already on board.

So, what’s all the fuss about? Below, we put the app to the test by breaking down its features one by one.

Could an app help make you better with money? Read on to find out!

This is not financial advice. Plum is not a bank.

Could an app help make you better with money? Read on to find out!

Getting started

Finance apps aren’t always easy for new users to navigate, but fortunately, Plum keeps things simple.

First, you download the app and follow the instructions to create your account.

You’ll then be asked to link the app to your bank account – an important step, as we’ll explain later.

Plum has lots of clever features, but its two fantastic key functions are that it:

1. Automates the process of saving money from your bank account using intelligent rules known as ‘Auto Savers’;

2. Grows your savings by offering competitive returns on various accounts and tax-wrappers, like Cash ISAs.

We’ll now look at both of these in turn.

What are Auto Savers, and how do they work?

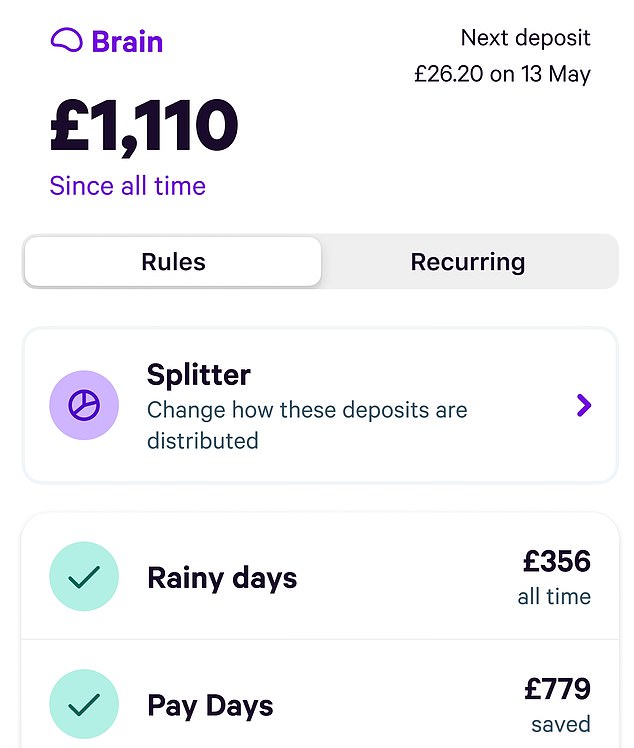

A screenshot of Plum’s Brain with two Auto Savers enabled. Rainy Days transfers money every day it rains in your area, while Pay Days does so when you get paid

Automatic saving is at the heart of Plum, and its Auto Savers control how this process works.

When you turn on the main rule, ‘Automatic’, the app’s AI peers into your bank account and scans your incomings and outgoings to calculate what you can afford to spare each week, before setting it aside on your behalf.

At this point, you might ask why this automation is necessary when you could simply make manual transfers yourself.

What else can Plum do?

Before you start thinking Plum is only about saving and investing, let’s take a look at what else it can do too.

Remember reading how its AI scans your bank account to understand your income and spending habits?

This is incredibly useful for budgeting, as it enables the app to generate a monthly overview of your upcoming payments – detailing all your bills and subscriptions for the month ahead.

Plum would answer by saying it’s about ease and effectiveness.

Ease, because remembering to make regular manual transfers is a hassle.

And effectiveness, because by moving money on your behalf into your ring-fenced savings, Plum removes the temptation to spend it.

This way, the app helps you build a regular, consistent savings habit – a proven way of saving more money over time.

Plum’s other Auto Savers range from the practical, like Weekly Depositor – which transfers a set amount each week – to funkier savings challenges.

These include the 52-Week Challenge, which saves £1 in the first week of the year before increasing this by £1 each time until you get to £1,378 by the end.

If you’re ambitious, you can enable all nine Auto Savers at once, although some require a paid subscription.

Lots of users who’ve never automated their savings before are amazed at how much they manage to save in a relatively short period.

Many Plum users are left surprised by how much they’re able to save

Where your money ends up

Plum lets you transfer your savings into a range of different accounts.

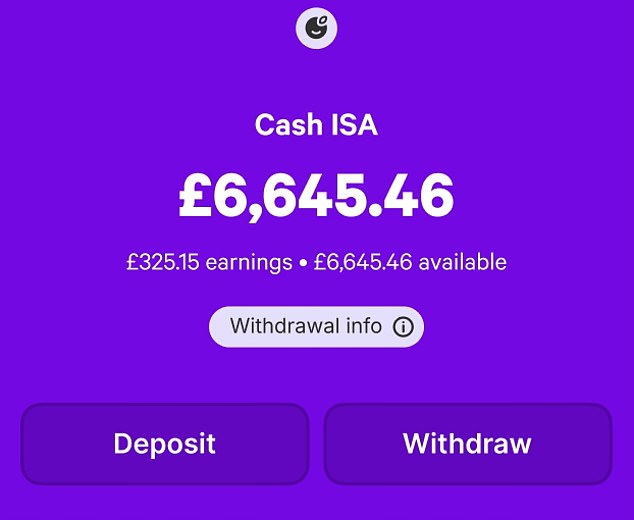

While these are the same as those offered by many banking apps, Plum stands out by offering highly competitive interest rates.

This includes 4.41% AER (variable)* on Cash ISAs – which let you save up to £20,000 a year tax free – and 4.10% AER (variable) on Lifetime ISAs (rate as at 13/08/2025 – terms apply).

Plum also offers access to a range of professionally managed investment funds through a Stocks and Shares ISA or self-invested personal pension (SIPP). Keep in mind, as with all investing, your capital is at risk.

So, depending on where you’re at with your finances, it covers most of the account types you may need.

Plum stands out by offering highly competitive interest rates on products like Cash ISAs (ISA rules apply)

Is Plum safe?

Some people may feel squeamish about handing over control of their money to an app.

Plum supports fingerprint and face ID

But with Plum, you always remain in control, with the ability to withdraw your money or change the size of your automatic deposits at any time.

The app prioritises safety and privacy by using 256-bit TLS encryption and supporting face and fingerprint ID verification.

Plum is authorised and regulated by the UK’s Financial Conduct Authority (FCA).

And if you ever need help, a friendly customer support team is available seven days a week.

Money protection

Plum protects your money in several ways, depending on the product you use. Funds in interest pockets, ISAs, and certain savings accounts are held with FSCS‑protected banks, offering cover of up to £85,000 per person, per bank. You can read the full details here.

Conclusion: Does Plum deliver?

Well done, you’ve got to the end of our review! Now for the question we started with: is Plum really the answer to making you better with money this summer?

For two key reasons, we think it is.

By automating saving, Plum helps you save more money without even noticing.

And because it keeps your savings with competitive interest options outside your bank account, there’s less temptation to raid them.

It’s up to you whether you want to invest any of your money. But if you do, Plum makes the process simpler and more accessible.

All in all, we’d say that’s a pretty ‘Plum’ deal!

Start saving today! Download Plum via the App Store or Google Play.

*Rate includes a Plum bonus of 1.37% AER (variable) if kept for 12 consecutive months and is for new customers only. The interest rate for ISA transfers is 3.04% AER (variable). Interest on our Cash ISA varies.