Report: US sports rights spend stalls in Europe | Advanced Television

Report: US sports rights spend stalls in Europe

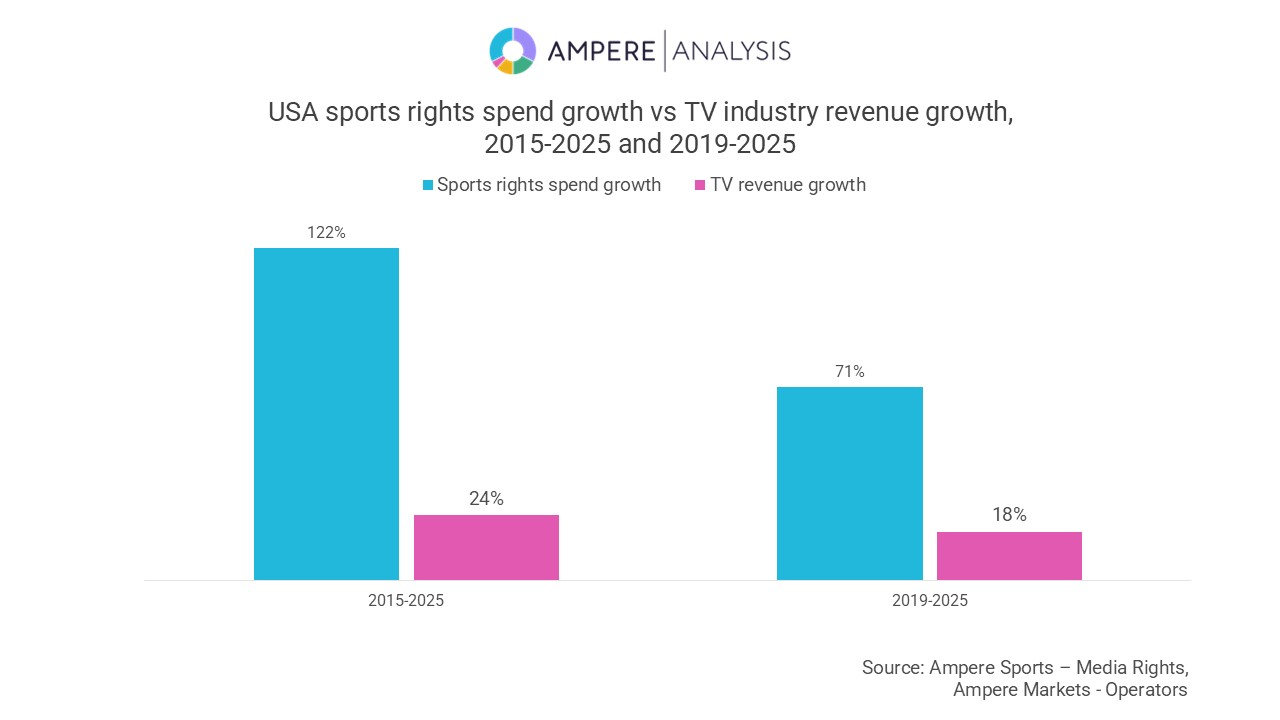

Spending on US sports rights has surged 122 per cent over the past decade according to insight from Ampere Analysis.

Over the same period, total TV industry revenues increased by just 24 per cent, meaning investment in rights has grown five times faster than the broader market. Sports rights now account for 14 per cent of total TV revenue, underlining the premium value of live sport as broadcasters battle for subscribers and viewer loyalty in an increasingly fragmented media landscape.

Key findings: US sports rights spend soars:

- Sports rights spending in the US grew 122 per cent between 2015 and 2025, up from $13.8 billion to $30.5 billion.

- By contrast, combined revenues from broadcast, cable and streaming rose 24 per cent in the decade, from $172 billion to $213 billion.

- The share of US TV revenue which is spent on sports rights has climbed from 8 per cent in 2015 to 14 per cent in 2025.

- Landmark deals have fuelled growth, including new long-term NFL contracts signed in 2023 and NBA rights renewals beginning in the 2025–26 season.

- The extent of the spending increases reflects the value of live sport to broadcasters as a subscription driver and retention play, as well as a lever for audience and ad dollar growth.

Europe tells a different story:

- In the UK, sports rights spend has grown at twice the rate of TV revenues since 2015, and 1.6 times as fast in Spain. But in France and Germany, the growth of rights has largely stalled.

- Between 2019 and 2025, TV revenue growth outpaced sports rights spend across all of Europe’s ‘big five’ markets. The US trend was the reverse, with rights spend rising at four times the rate of TV market growth.

- European broadcasters have taken a more cautious stance, reflecting declining viewership and ongoing challenges in driving subscriber revenue growth.

Daniel Harraghy, Research Manager at Ampere Analysis, commented: “As TV markets slow, sports rights inflation continues. The huge hikes in NFL and NBA deals demonstrate how live sports continue to deliver unique value as a driver of audience reach and retention. By contrast, the more restrained approach in Europe reflects the tough economics of rights investment. Market differences are being driven by several factors, including longer-term rights contracts in the US, business models that place greater emphasis on affiliate fees and advertising rather than subscriptions, and a more competitive rights market.”

Copyright © 2001-2025. Advanced Television Ltd.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Ok