Aug 28, 2025

IndexBox has just published a new report: United Kingdom – Crude Sunflower-Seed And Safflower Oil – Market Analysis, Forecast, Size, Trends And Insights.

Driven by growing demand, the UK market for crude sunflower-seed and safflower oil is expected to see significant growth in both volume and value over the next decade. With a projected CAGR of +2.7% for volume and +3.0% for value, the market is poised to expand and reach 166K tons in volume and $189M in value by 2035.

Market Forecast

Driven by increasing demand for crude sunflower-seed and safflower oil in the UK, the market is expected to continue an upward consumption trend over the next decade. Market performance is forecast to accelerate, expanding with an anticipated CAGR of +2.7% for the period from 2024 to 2035, which is projected to bring the market volume to 166K tons by the end of 2035.

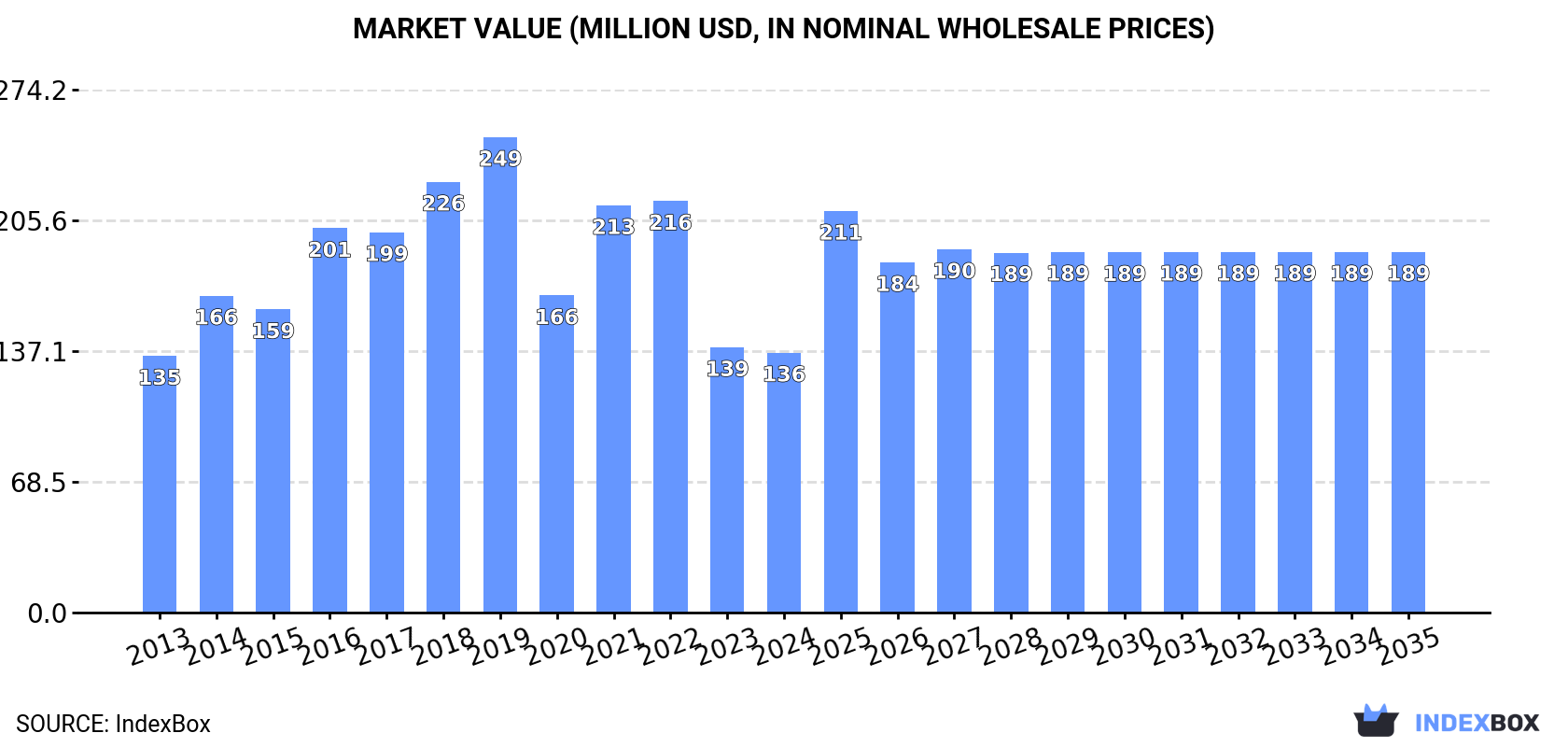

In value terms, the market is forecast to increase with an anticipated CAGR of +3.0% for the period from 2024 to 2035, which is projected to bring the market value to $189M (in nominal wholesale prices) by the end of 2035.

ConsumptionUnited Kingdom’s Consumption of Crude Sunflower-Seed And Safflower Oil

ConsumptionUnited Kingdom’s Consumption of Crude Sunflower-Seed And Safflower Oil

After two years of decline, consumption of crude sunflower-seed and safflower oil increased by 9.8% to 124K tons in 2024. Overall, consumption saw a mild increase. Crude sunflower-seed and safflower oil consumption peaked at 254K tons in 2019; however, from 2020 to 2024, consumption failed to regain momentum.

The revenue of the market for crude sunflower-seed and safflower oil in the UK declined slightly to $136M in 2024, dropping by -2% against the previous year. This figure reflects the total revenues of producers and importers (excluding logistics costs, retail marketing costs, and retailers’ margins, which will be included in the final consumer price). In general, consumption continues to indicate a relatively flat trend pattern. Over the period under review, the market reached the peak level at $249M in 2019; however, from 2020 to 2024, consumption remained at a lower figure.

ImportsUnited Kingdom’s Imports of Crude Sunflower-Seed And Safflower Oil

In 2024, supplies from abroad of crude sunflower-seed and safflower oil increased by 8.2% to 124K tons for the first time since 2019, thus ending a four-year declining trend. In general, imports recorded a relatively flat trend pattern. The pace of growth was the most pronounced in 2016 with an increase of 36% against the previous year. Imports peaked at 258K tons in 2019; however, from 2020 to 2024, imports failed to regain momentum.

In value terms, crude sunflower-seed and safflower oil imports dropped to $134M in 2024. Overall, imports, however, recorded a relatively flat trend pattern. The most prominent rate of growth was recorded in 2021 when imports increased by 45%. Over the period under review, imports hit record highs at $252M in 2022; however, from 2023 to 2024, imports remained at a lower figure.

Imports By Country

In 2024, Ukraine (74K tons) constituted the largest crude sunflower-seed and safflower oil supplier to the UK, accounting for a 60% share of total imports. Moreover, crude sunflower-seed and safflower oil imports from Ukraine exceeded the figures recorded by the second-largest supplier, France (31K tons), twofold. The third position in this ranking was taken by Bulgaria (9.7K tons), with a 7.8% share.

From 2013 to 2024, the average annual rate of growth in terms of volume from Ukraine amounted to +1.7%. The remaining supplying countries recorded the following average annual rates of imports growth: France (+0.1% per year) and Bulgaria (+4.7% per year).

In value terms, Ukraine ($76M) constituted the largest supplier of crude sunflower-seed and safflower oil to the UK, comprising 57% of total imports. The second position in the ranking was taken by France ($36M), with a 27% share of total imports. It was followed by Bulgaria, with a 7.5% share.

From 2013 to 2024, the average annual growth rate of value from Ukraine was relatively modest. The remaining supplying countries recorded the following average annual rates of imports growth: France (-1.2% per year) and Bulgaria (+7.0% per year).

Import Prices By Country

The average import price for crude sunflower-seed and safflower oil stood at $1,081 per ton in 2024, shrinking by -15.7% against the previous year. In general, the import price continues to indicate a mild curtailment. The most prominent rate of growth was recorded in 2021 an increase of 45%. Over the period under review, average import prices reached the peak figure at $1,946 per ton in 2022; however, from 2023 to 2024, import prices remained at a lower figure.

Average prices varied noticeably amongst the major supplying countries. In 2024, amid the top importers, the countries with the highest prices were the Netherlands ($1,192 per ton) and France ($1,159 per ton), while the price for Ukraine ($1,030 per ton) and Bulgaria ($1,040 per ton) were amongst the lowest.

From 2013 to 2024, the most notable rate of growth in terms of prices was attained by Bulgaria (+2.2%), while the prices for the other major suppliers experienced a decline.

ExportsUnited Kingdom’s Exports of Crude Sunflower-Seed And Safflower Oil

In 2024, crude sunflower-seed and safflower oil exports from the UK contracted dramatically to 118 tons, falling by -93% against 2023. Over the period under review, exports faced a abrupt downturn. The most prominent rate of growth was recorded in 2017 when exports increased by 351%. As a result, the exports reached the peak of 19K tons. From 2018 to 2024, the growth of the exports remained at a somewhat lower figure.

In value terms, crude sunflower-seed and safflower oil exports dropped significantly to $344K in 2024. Overall, exports recorded a abrupt curtailment. The most prominent rate of growth was recorded in 2017 when exports increased by 303% against the previous year. As a result, the exports attained the peak of $21M. From 2018 to 2024, the growth of the exports failed to regain momentum.

Exports By Country

Norway (24 tons), France (18 tons) and Nigeria (17 tons) were the main destinations of crude sunflower-seed and safflower oil exports from the UK, together comprising 49% of total exports.

From 2013 to 2024, the biggest increases were recorded for Nigeria (with a CAGR of +25.6%), while shipments for the other leaders experienced more modest paces of growth.

In value terms, the United States ($81K), Hong Kong SAR ($61K) and Norway ($39K) were the largest markets for crude sunflower-seed and safflower oil exported from the UK worldwide, together comprising 53% of total exports.

Hong Kong SAR, with a CAGR of +25.7%, recorded the highest growth rate of the value of exports, among the main countries of destination over the period under review, while shipments for the other leaders experienced more modest paces of growth.

Export Prices By Country

In 2024, the average export price for crude sunflower-seed and safflower oil amounted to $2,910 per ton, growing by 66% against the previous year. Over the period under review, the export price posted a pronounced increase. As a result, the export price reached the peak level and is likely to continue growth in the immediate term.

Prices varied noticeably by country of destination: amid the top suppliers, the country with the highest price was Hong Kong SAR ($10,630 per ton), while the average price for exports to Norway ($1,601 per ton) was amongst the lowest.

From 2013 to 2024, the most notable rate of growth in terms of prices was recorded for supplies to Hong Kong SAR (+6.1%), while the prices for the other major destinations experienced more modest paces of growth.

Source: IndexBox Market Intelligence Platform