ONS reveals error with its seasonally adjusted retail sales

Newsflash: Britain’s blundering statistics body has revealed another mistake with the data it produces to track the UK economy.

The Office for National Statistics has admitted that it has dicovered an error in the way it produces seasonally adjusted British retail sales data.

The blunder relates to the treatment of “calendar effects”, such as the timing of Easter (which moves between March and April), and to the way that its default data collection periods are aligned to calendar months.

[The ONS uses default data collection periods on a four-week, four-week, five-week cycle, which then need to be aligned to calendar months].

ONS basically say the reason for the issues with quality assurance was seasonal adjustment by calendar month rather than trading month (the 4-4-5 split). ONS say they will switch to calendar month collection at the end of 2026.

— Harvir Dhillon (@HarvirDhillon) September 5, 2025

This error forced the ONS to delay the release of the retail sales data – they were initially due two weeks ago.

The ONS, which insists seasonal adjustment is important, reveals tha the tratement of these holiday effects and “phase shift” effects were not properly accounted for between January and May this year.

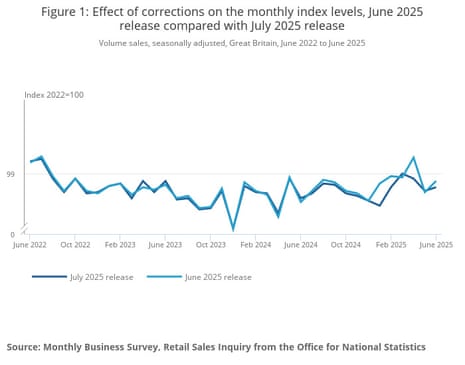

The corrections mean that retail sales were actually lower than previously recorded in January, February, April and June, this chart from the ONS shows:

Photograph: ONS

Photograph: ONS

These errors are another embarrassment to the Office for National Statistics; back in June, a report exposed “deep-seated” issues at the statistics body, which has been struggling to produce data on the state of the labour market too.

Today’s data also shows that the volume of goods bought by shoppers fell by 0.6% in the three months to July 2025 when compared with the three months to April 2025.

But in July alone, retail sales volumes are estimated to have risen by 0.6% in July 2025, following an increase of 0.3% in June 2025.

Updated at 02.46 EDT

Key events

Show key events only

Please turn on JavaScript to use this feature

Halifax: house prices at record high

UK house prices have hit a new record high, lender Halifax has reported this morning.

Halifax’s house price index shows that prices rose by 0.3% in August, the third monthly rise in a row.

That lifted the average property price to £299,331, a new record high.

Amanda Bryden, head of mortgages at Halifax, says:

“The story of the housing market in 2025 has been one of stability. Since January, prices have risen by less than £600, underlining how steady the market has been despite wider economic pressures.

Affordability remains a challenge, but there are signs of improvement. Interest rates have been on a gradual downward path for nearly two years, and many of the most competitive fixed-rate mortgage deals now offer rates below 4%.

Combined with strong wage growth – which has outpaced house price inflation for nearly three years – this is giving more prospective buyers the confidence to take the next step. Summer is typically a quieter period for the market, so the recent rise in mortgage approvals to a six-month high is an encouraging sign of underlying demand.”

However, rival lender Nationwide reported earlier this week that house prices fell in August, as high mortgage costs dampened activity, so the picture isn’t entirely clear….

ShareONS reveals error with its seasonally adjusted retail sales

Newsflash: Britain’s blundering statistics body has revealed another mistake with the data it produces to track the UK economy.

The Office for National Statistics has admitted that it has dicovered an error in the way it produces seasonally adjusted British retail sales data.

The blunder relates to the treatment of “calendar effects”, such as the timing of Easter (which moves between March and April), and to the way that its default data collection periods are aligned to calendar months.

[The ONS uses default data collection periods on a four-week, four-week, five-week cycle, which then need to be aligned to calendar months].

ONS basically say the reason for the issues with quality assurance was seasonal adjustment by calendar month rather than trading month (the 4-4-5 split). ONS say they will switch to calendar month collection at the end of 2026.

— Harvir Dhillon (@HarvirDhillon) September 5, 2025

This error forced the ONS to delay the release of the retail sales data – they were initially due two weeks ago.

The ONS, which insists seasonal adjustment is important, reveals tha the tratement of these holiday effects and “phase shift” effects were not properly accounted for between January and May this year.

The corrections mean that retail sales were actually lower than previously recorded in January, February, April and June, this chart from the ONS shows:

Photograph: ONS

These errors are another embarrassment to the Office for National Statistics; back in June, a report exposed “deep-seated” issues at the statistics body, which has been struggling to produce data on the state of the labour market too.

Today’s data also shows that the volume of goods bought by shoppers fell by 0.6% in the three months to July 2025 when compared with the three months to April 2025.

But in July alone, retail sales volumes are estimated to have risen by 0.6% in July 2025, following an increase of 0.3% in June 2025.

Updated at 02.46 EDT

Introduction: US jobs report in focus

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

All eyes will be on the US employment market later today, for signs that America’s jobs market is cooling.

The latest non-farm payroll data is expected to show a slowdown in hiring – economists predict a rise of 75,000 in August. That would be slightly higher than the disappointing 73,000 increase reported in July – which spurred Donald Trump to fire the head of the Bureau of Labor Statistics

The US unemployment rate is set to tick up to 4.3%, from 4.2%

Another weak jobs report would harden fears that the US economy stumbled over the summer, as Trump’s trade war created confusion and drove up costs.

That would make investors even more confident that the US Federal Reserve will cut interest rates next week.

So the markets could be volatile at 1.30pm UK time today.

Chris Weston of brokerage Pepperstone explains:

We know the Fed has placed weight on the NFP outcome, so naturally market players are fixated on it too. This suggests the period around payrolls will be messy from a price action perspective, with algos reacting immediately to the numbers and liquidity thinning out.

How markets ultimately react is tough to plan for — the first move may not be the final move. The clear tactical play is to hold out and put money to work in trades once the collective has had some time to truly digest the data, assess its implications for Fed policy, and consider whether it possibly fuels concerns that the Fed is behind the curve or even that the labour market is perhaps more resilient than feared…

The agenda

-

7am BST: Halifax house price index for August

-

7am BST: US retail sales data for July

-

9am BST: UN FAO‘s food price index

-

1.30pm BST: US non-farm payroll jobs report