In August, European tech companies secured €3.2 billion

across 189 deals, reflecting a 66 per cent drop in investment volume and 47 per

cent fewer deals compared to July 2025.

Despite this month-on-month slowdown, the market showed far

greater strength than a year earlier, with investment levels up nearly 70 per

cent year-on-year from €1.9 billion in August 2024, even though deal count fell

slightly from 203 to 189.

The UK led the way with €907.9 million in investments,

followed by Italy (€504.8 million), Switzerland (€467.9 million), Germany

(€331.1 million), and Sweden (€202.2 million), highlighting both the UK’s

continued dominance and the growing role of other European hubs.

By industry, energy (€746.9 million), software (€633.1

million), and healthtech (€514 million) stood out as the strongest sectors,

underscoring investor appetite for long-term, transformative technologies.

Simone Lavizzari, Investment manager at Join Capital,

commented on the August numbers within the European tech investment landscape

in our August Tech.eu Pulse, a compact version of the monthly report:

Europe is bursting with talent, ideas, and the ability to

lure back those who once left.

But if we want real scale-ups and true category leaders, we

need more than talent and capital. We need bold structural change: a true

single market, and a single stock exchange.

Until then, Europe will keep producing brilliance, just not

enough breakthroughs.

For his more detailed review and more in-depth analyses of

the European tech ecosystem, including industry and country performance, exit

activities, and more, check out our August report.

Here are the 10 largest tech deals in Europe from August,

accounting for approximately 59 per cent of the month’s total funding.

1

Bending Spoons (Italy)

Amount raised: €500M

Bending Spoons is a Milan-based technology powerhouse that develops and operates a portfolio of widely acclaimed mobile apps, including Evernote, komoot, Meetup, Remini, StreamYard, and WeTransfer, used by hundreds of millions worldwide.

The company combines design excellence with strong engineering, leveraging proprietary technologies and a highly data-driven, creative mindset to power its products.

Bending Spoons secured over €500 million in debt financing to accelerate its acquisition strategy and strengthen its position in the technology, media, and telecommunications (TMT) sector.

2

Energy Vault (Switzerland)

Amount raised: $300M

Energy Vault pioneers long-duration, utility-scale energy storage using gravity- and kinetic-based systems. Their flagship “gravity battery” harnesses the potential energy stored in towering stacks of heavy composite blocks, releasing electricity when needed via reversible cranes.

Their solutions span multiple technologies, from proprietary gravity storage and traditional batteries to hybrid configurations involving hydrogen, supported by advanced orchestration software to optimise performance across both operational and commercial metrics.

Energy Vault raised $300 million to launch Asset Vault, a new subsidiary focused on building and operating energy storage assets.

3

Pulse Clean Energy (UK)

Amount raised: £220M

Pulse Clean Energy is a UK-based leader in energy storage solutions, focused on stabilising and optimising clean energy networks through ethical and sustainable practices.

Their innovations help overcome renewable energy’s inherent variability by advancing energy storage and grid optimisation. Notably, they developed the UK Storage Asset Emissions Impact Calculator, an open-source tool enabling real-time tracking and certification of battery storage systems’ carbon impact.

Pulse Clean Energy secured £220 million in green financing to fuel the construction of six new ready-to-build BESS sites.

4

Ortivity (Germany)

Amount raised: €200M

Ortivity is a German outpatient orthopaedic care platform, a physician-led network dedicated to revolutionising non-surgical orthopaedic treatments.

Operating over 100 sites across three regional clusters (Bavaria, North Rhine-Westphalia, and Baden-Württemberg), Ortivity unites top-tier practices under a shared philosophy of medical excellence, seamless patient experience, and operational innovation.

By pooling resources across its network, Ortivity enables clinics to access cutting-edge equipment, advanced treatment methods, and digital tools, creating a unified ecosystem that enhances patient access, elevates treatment standards, and fosters sustainable growth.

Ortivity closed €200 million funding round to scale its integrated outpatient model across Germany.

5

Aira (Sweden)

Amount raised: €150M

Aira is a Swedish clean energy technology company on a mission to decarbonise homes across Europe one at a time.

With a vertically integrated model, from R&D and manufacturing in Sweden and Poland to end-to-end installation and service in markets like the UK, Germany, and Italy, Aira makes intelligent heat pumps accessible via affordable monthly plans with no upfront cost.

Its solutions can reduce household heating bills by up to 40 per cent and cut CO₂ emissions by up to 75 per cent, supporting the transition off gas toward a cleaner, smarter energy future.

Aira secured a €150 million investment to accelerate its operations and expand its intelligent clean energy technology offering.

6

Greenvolt Group (Portugal)

Amount raised: €150M

Greenvolt Group is a Portuguese renewable energy company that generates power from forest residues, wind, and solar.

Listed on Portugal’s PSI-20, it develops and operates projects across Europe, North America, and Asia, with activities structured around three business areas: Sustainable Biomass, Distributed Generation, and Utility-Scale projects.

Greenvolt Group has raised €150 million to fuel its growth strategy, with a focus on expanding large-scale battery energy storage systems (BESS).

7

GoFibre (UK)

Amount raised: £125M

GoFibre is an independent broadband provider dedicated to bridging the rural digital divide across Scotland and northern England.

By investing millions in state-of-the-art full-fibre infrastructure, the company delivers ultra-fast, reliable broadband, up to 1 Gbps, to underserved towns and villages.

Driven by local teams and communities, GoFibre combines swift installations, UK-based customer support, and a commitment to environmental sustainability and community development.

GoFibre has raised £125 million to support the rollout of two Project Gigabit contracts in South and North East Scotland.

8

Oculis (Switzerland)

Amount raised: €106.2M

Oculis is a biopharmaceutical company dedicated to “rethinking ophthalmology to save sight and improve eye care.”

Its pipeline includes innovative, non-invasive eye drop treatments for conditions such as diabetic macular oedema (OCS-01), dry eye disease (OCS-02), and acute optic neuritis (OCS-05), all built upon its proprietary OPTIREACH® drug delivery technology and designed to address stubborn unmet needs in eye health.

Oculis has expanded its loan facility to provide up to €106.2 million in flexible financing, intended to support regulatory activities and late-stage clinical trials for its three core ophthalmic and neuro-ophthalmic asset candidates.

9

CuspAI (UK)

Amount raised: $100M

CuspAI is a UK-based frontier AI startup transforming materials science with its “search engine for materials.”

The company harnesses generative AI, deep learning, and molecular simulation to discover breakthrough materials in months instead of decades, drastically accelerating innovations in sectors like carbon capture, clean energy, and advanced manufacturing.

CuspAI has raised $100 million to drive growth, expand its platform, build partnerships, and scale hiring, paving the way for breakthroughs in material science.

10

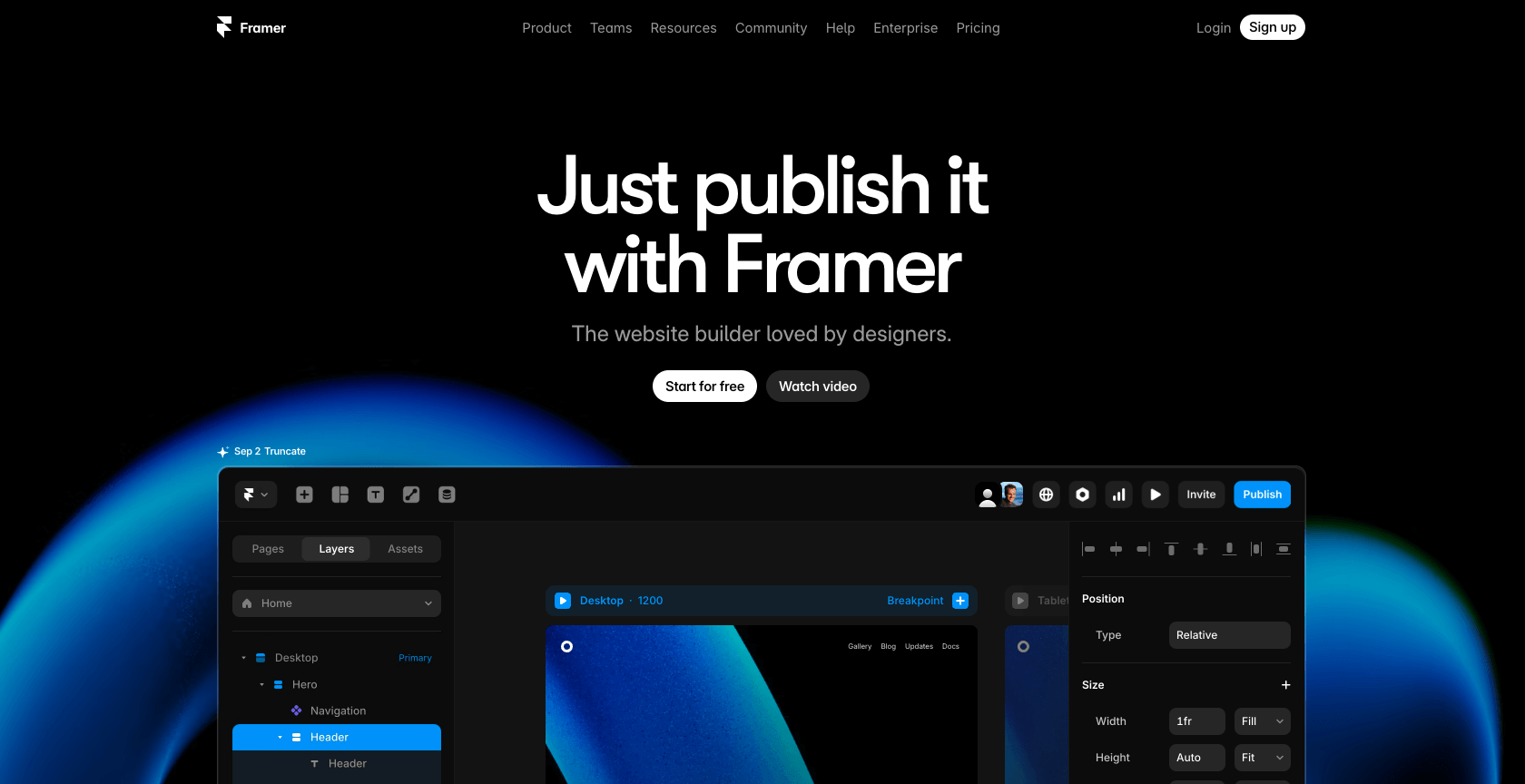

Framer (Netherlands)

Amount raised: $100M

Framer is a no-code website design and publishing platform that combines a fully flexible visual design canvas with built-in CMS, animations, SEO, A/B testing, analytics, and enterprise-grade security.

Trusted by designers and high-performance teams, it makes it easy to create, collaborate on, and launch complex, high-traffic websites without writing code.

Framer has closed a $100 million Series D, boosting its valuation to $2 billion and raising total funding to over $160 million.