The era of Germany acting as a security freeloader is ending. Berlin is considering voluntary conscription, enacting spending levels not seen since the days when Soviet tanks were plowed into Prague and rearming on a grand scale.

Few countries epitomize the changes in Europe’s wider security landscape better than Germany, which has scrambled to transform itself from a security laggard to a leading force in NATO and a champion of European defense industrial autonomy. The latest update to Germany’s profile in Aviation Week’s Defense Market Analyzer (DMA) illustrates this process of adaptation. Germany fell short of meeting a target of spending 2% of GDP on defense when the previous edition of the profile was published in August 2024. It has now reached 2.15% of GDP, with Berlin striving to bring that to 3.5% by 2029.

Multiple factors are driving the shift—principally, Russia’s full-scale invasion of Ukraine in February 2022 and the return of President Donald Trump, who has made clear he is looking to end the U.S. role as security guarantor to Europe. Those events have led to a $169 billion rise in the defense budgets of 19 European countries tracked by DMA, from a collective $369 billion in 2021 to $538 billion in 2025. They have also prompted European governments to reevaluate how they carry out defense procurement.

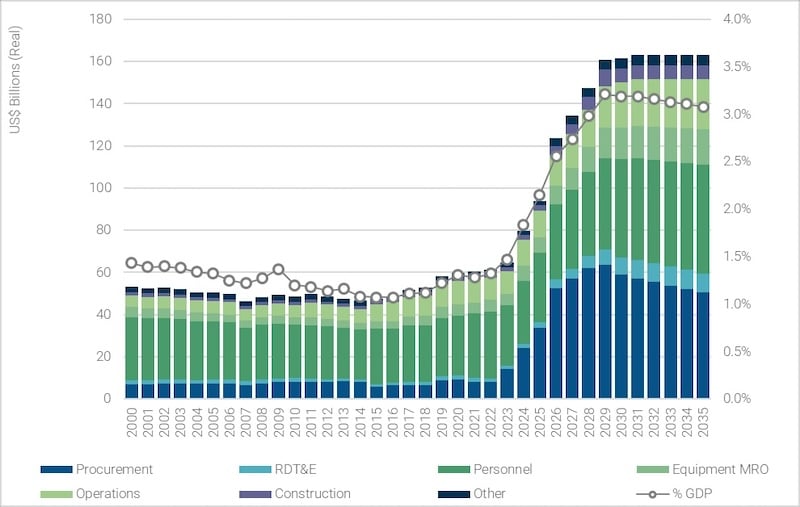

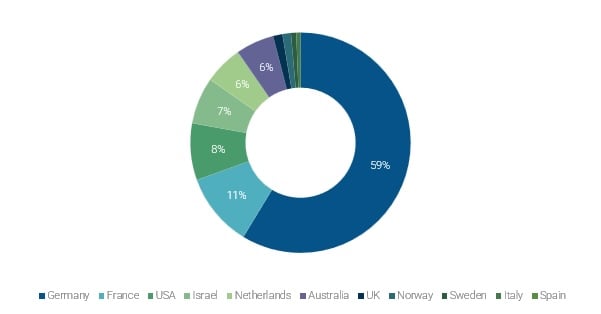

Graph 1: Germany’s Overall Defense Spend In Real Terms, 2000-25

Since 2022, Germany has rapidly increased its defense spending to beyond 2.0% of GDP, with an increasing proportion of this spending going towards procurement.

DMA defense budget data shows that between 2014 and 2022, Germany’s defense spending averaged 1.29% of GDP, meaning that it consistently fell far short of the then 2% of GDP target adopted by NATO in 2014.

This trajectory changed in 2022, when then-Chancellor Olaf Scholz announced what he termed a Zeitenwende or turning point in the country’s security posture. The government would increase defense spending to 2% of GDP and set aside €100 billion ($117 billion) through a budget for rearmament.

New Chancellor Friedrich Merz has added to this spending surge. Before Merz even took power, legislators this year exempted German defense spending over 1.0% of GDP from the country’s strict constitutional debt limits, opening the way for an increase to spending 3.5% of GDP on defense. At the NATO summit in June 2025, Germany supported the adoption of a target for NATO members to spend 5% of their GDP on defense and security-related investments by 2035. DMA budget data projects an approximately 45% increase in Germany’s core defense budget by 2028 to maintain such spending levels in relation to GDP.

Berlin has paired the expenditure influx with a spending shift on equipment. Procurement expenditure, which represented 25% of defense spending in 2023, has gone to 37% in 2025.

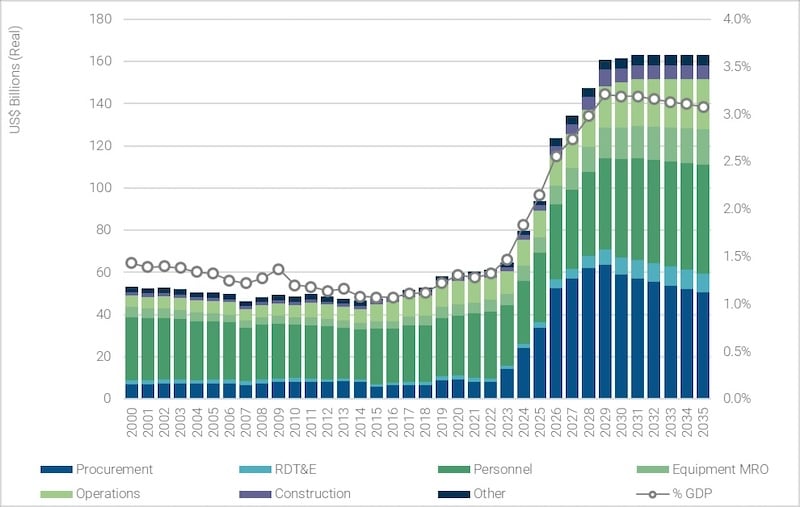

Graph 2: Value Of German Defense Contracts By Supplier, 2023-25

Since 2022, imports have accounted for more than 40% of the value of German defense contracts captured by DMA’s contracts database, with France, Israel and the U.S. among its main suppliers.

To ensure that this larger budget can be effectively and efficiently translated into capability uplift, Germany has reformed procurement procedures through two so-called Acceleration Acts. One is aimed at simplifying procurements and removing regulatory hurdles for the procurement of military equipment and related services, so contracts are awarded faster. This could, for instance, give officials more freedom to bypass competitive tendering through off-the-shelf purchasing.

The second measure, officially known as the Bundeswehr Planning and Procurement Acceleration Act, is expected to come into effect in early 2026. It extends the streamlining to any contract signed by the armed forces. It also expands the definition of essential national security interests to anything that contributes to NATO and European defense readiness, making it easier for officials to directly award contracts without running time-consuming competitions.

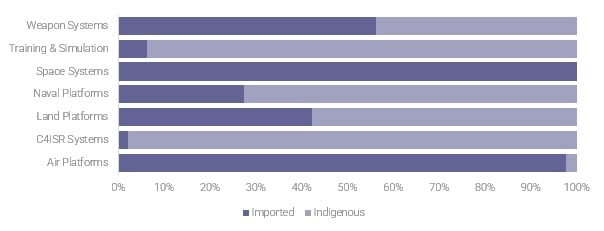

Graph 3: Comparison Of The Value Of German Imported And Indigenous Defense Contracts By Sector, 2023-24 (USD millions)

Germany procures most of its equipment from domestic suppliers in areas where it has an established industrial presence, but it is more dependent on imports in the air platforms, space systems and weapons systems sectors.

Like other European countries, Germany wants as to spend much of this procurement money domestically to reduce reliance on foreign companies and strengthen its defense industrial autonomy.

To this end, Germany published a National Security and Defense Industry Strategy in December 2024. It urges the government to protect sectors where Germany has strong national capability, such as armored fighting vehicles, sensors, shipbuilding and electronic warfare, while at the same time being open to collaboration in sectors where it is weaker, such as aircraft.

But even as Berlin’s policies illustrate the wider European push to become less reliant on foreign defense equipment, it also showcases the challenges of such an approach at a time governments are scrambling to rapidly address capability shortfalls.

Germany, for instance, has opted to buy the Israeli Arrow 3 ballistic missile defense rather than wait to pursue a lengthy European development program. In July 2025, Germany sent a letter of request to the U.S. Defense Department to buy Typhon ground-launched long-range strike systems as a gap filler until a solution emerges from the European Long-Range Strike Approach initiative, German Defense Minister Boris Pistorius said at the time.

This briefing was put together using data and analysis from Aviation Week Intelligence Network’s Defense Market Analyzer tool. To find out more, contact your customer representative or .