Solar Media’s UK & Ireland portfolio lead analyst Josh Cornes charts the capacity likely to come online by 2030 following grid connection reform in the UK.

The rush to bring projects online in order to contribute to the government’s Clean Power 2030 target is well underway.

Developers have submitted their projects to the National Energy System Operator (NESO) in hopes of securing coveted Gate 2 grid connection offers, after spending months demonstrating ‘strategic alignment’ with the UK’s clean energy plans as set out by NESO in November 2024.

Although there is a feeling amongst the community that grid connection reform may have been rushed, with numerous oversights along the way, it was obvious a grid overhaul was required for the market to move forward.

The previous system saw some projects given grid connection dates up to 12 years after entering the planning system; developers are hoping to get such connection offers brought forward by as much as 10 years under the new process.

Planning is one of the most crucial things when proving strategic alignment, as this is the best way to highlight project readiness and that construction will begin within the foreseeable future.

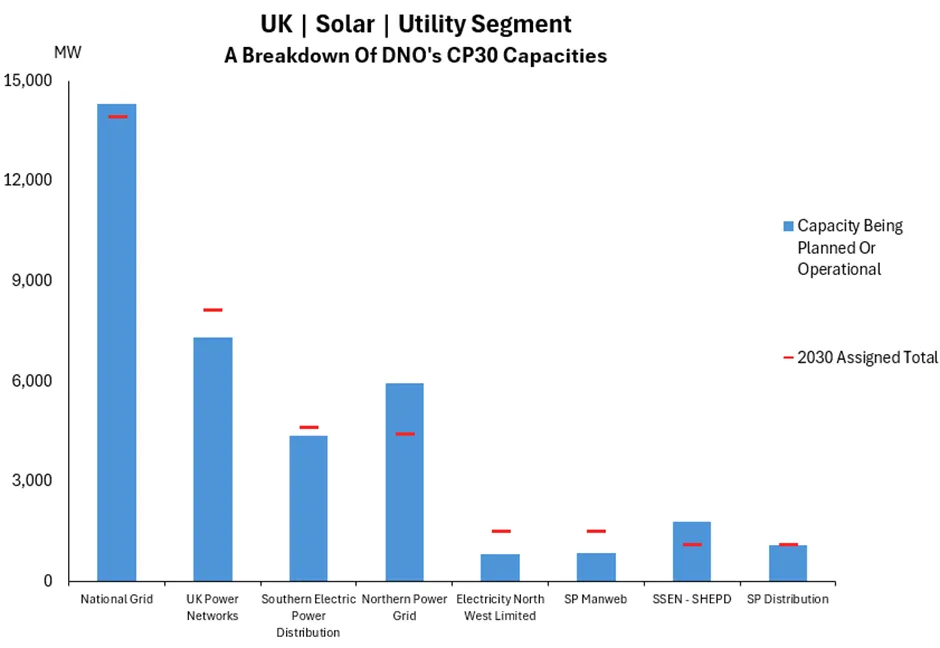

Figure 1: Export capacity being scoped, in planning or operational compared to the Clean Power 2030 assigned totals per DNO, according to Solar Media’s Utility-Scale Solar: UK Pipeline Database.

Figure 1 outlines the capacities assigned by NESO per DNO, against the projects that are currently being scoped or progressed.

This is what I will be counting as the “queue” below, excluding the projects that have grid connections but are yet to progress in any way. Such projects may be too early-stage to be feasible or have been mothballed (referred to as ‘zombie projects’).

The first thing we notice is the over-subscription in some regions compared to the headroom seen in others.

Take Northern Power Grid as an example, where NESO allocated 4.4GW. According to Solar Media’s Market Research there is currently 600MW connected, with a further 5.3GW either being scoped, in planning or under construction. This is far beyond the assigned 4.4GW, giving developers with projects at very early stages little hope of getting gate 2 offers.

Conversely, UK Power Networks (UKPN) has the largest headroom, with 8.1GW assigned and only 7.3GW currently scoped or further progressed.

A reason for the significant target in this area is the size of the population, leading to increased demand. There does however seem to be a lack of infrastructure, with almost all the 7.3GW shown in Figure 1 currently contracted to connect to only 20 different Grid Supply Points (GSPs). This includes Bramford, which has the largest queue (over 1GW) of any GSP in the UK. Walpole, which has the third largest queue (800MW), is also in this region.

Similarly, lack of infrastructure is concerning in East Sussex and Kent. Both have a huge amount of green space, with a complete lack of GSPs. Across these two counties, just 1GW of projects are at scoping or futher, less than the capacity at Bramford alone.

As mentioned above, these figures do not include the projects that are yet to progress in any way. When we throw these in it tells a slightly different story, with over 13GW of solar having a contract with UKPN.

This implies 6GW of these projects are yet to be scoped or hit the UK planning system. Figure 1 does show there is hope for some of these projects, however these developers will have to move swiftly if they wish to secure pre-2030 grid connections.

Scotland has longest connection queue as UK-wide planning picks up

Scotland has only been assigned up to 3.7GW, just over one tenth of the distribution capacity assigned by NESO for the grid reform.

This comes as no surprise, with barely 400MW operational in the region. The pipeline has grown significantly, however, with 1.2GWp being submitted in 2025, more than any other year prior.

Although Scottish Electric has the lowest solar target in the UK, and the lowest operational capacity, it has the largest queue, with over 800MW approved and 140MW under construction.

You can take the above sentiments and apply them to each DNO to paint a picture of the queue per DNO.

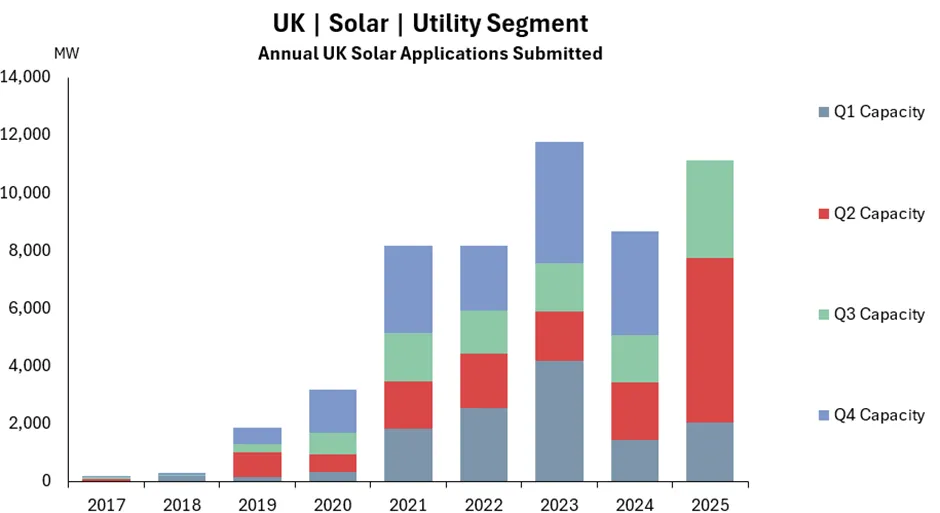

Projects entering the planning system, as expected, have been at an all-time high. Figure 2 emphasises the impact of the deadlines set by NESO, specifically the Gate 2 submission window that was originally expected to close at the end of July.

Figure 2: UK solar planning submissions over the last 8 years broken down by quarter, with 2025 almost surpassing all years in the first 8 months.

July had the highest capacity submitted in history, topping just over 3GWp, a huge number seeing as only 2 months prior to this had topped 2GW, December 2024, and June 2025, also both very important months in the context of CP30.

All the data and analysis shown above are taken from Solar Media Market Research’s analysis, which can be accessed here.

To view the in-depth data used in Figure 1, reach out to [email protected].