The consensus expects nonfarm payrolls for September to come in at 50,000, and I think that is too pessimistic. The charts below with incoming daily and weekly data for September show that:

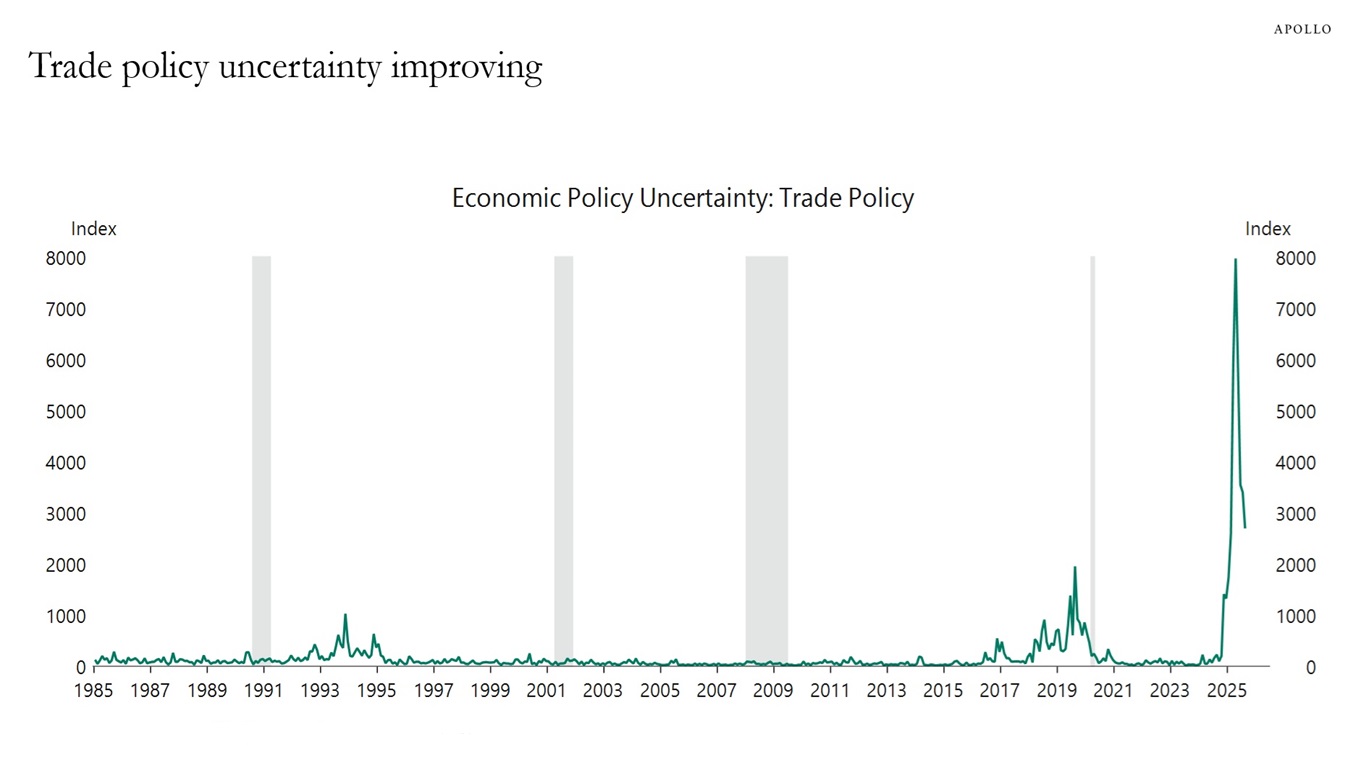

1) Trade policy uncertainty is improving

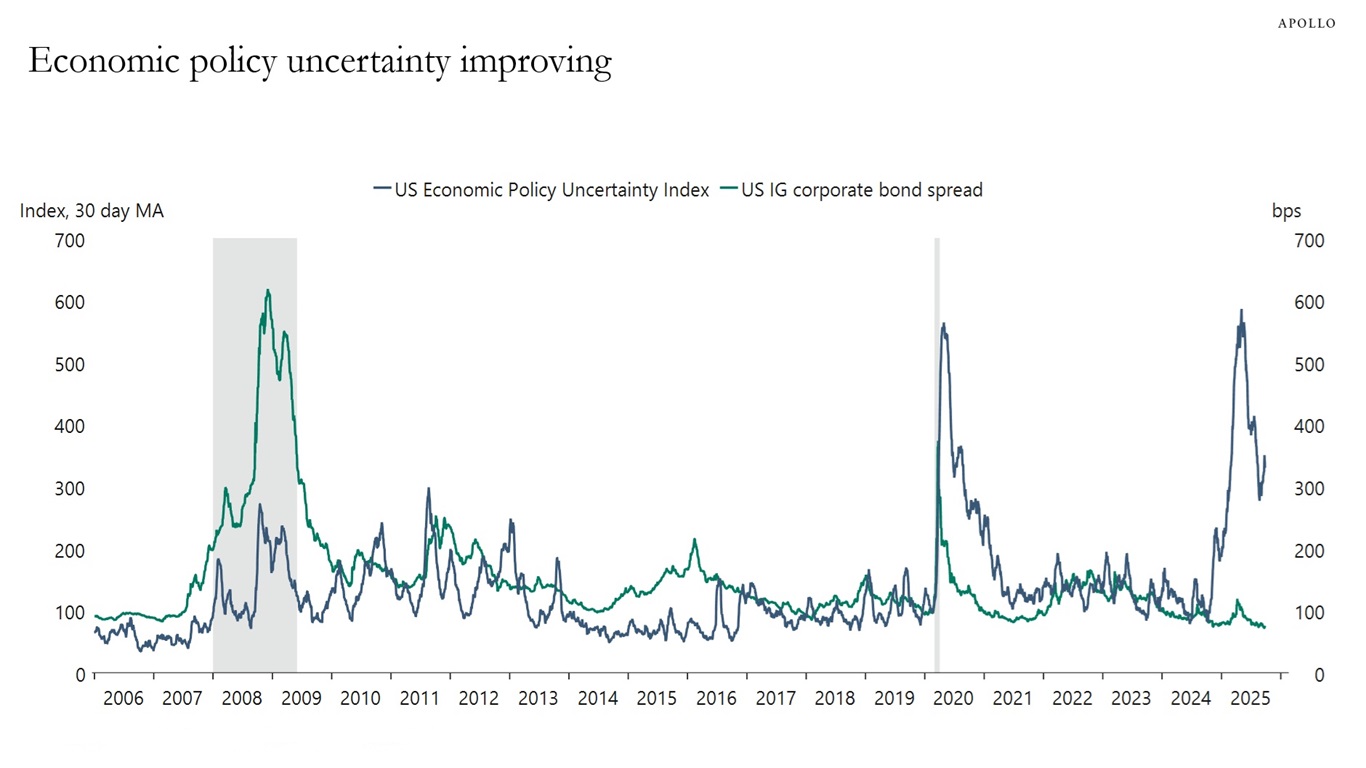

2) Economic policy uncertainty is improving

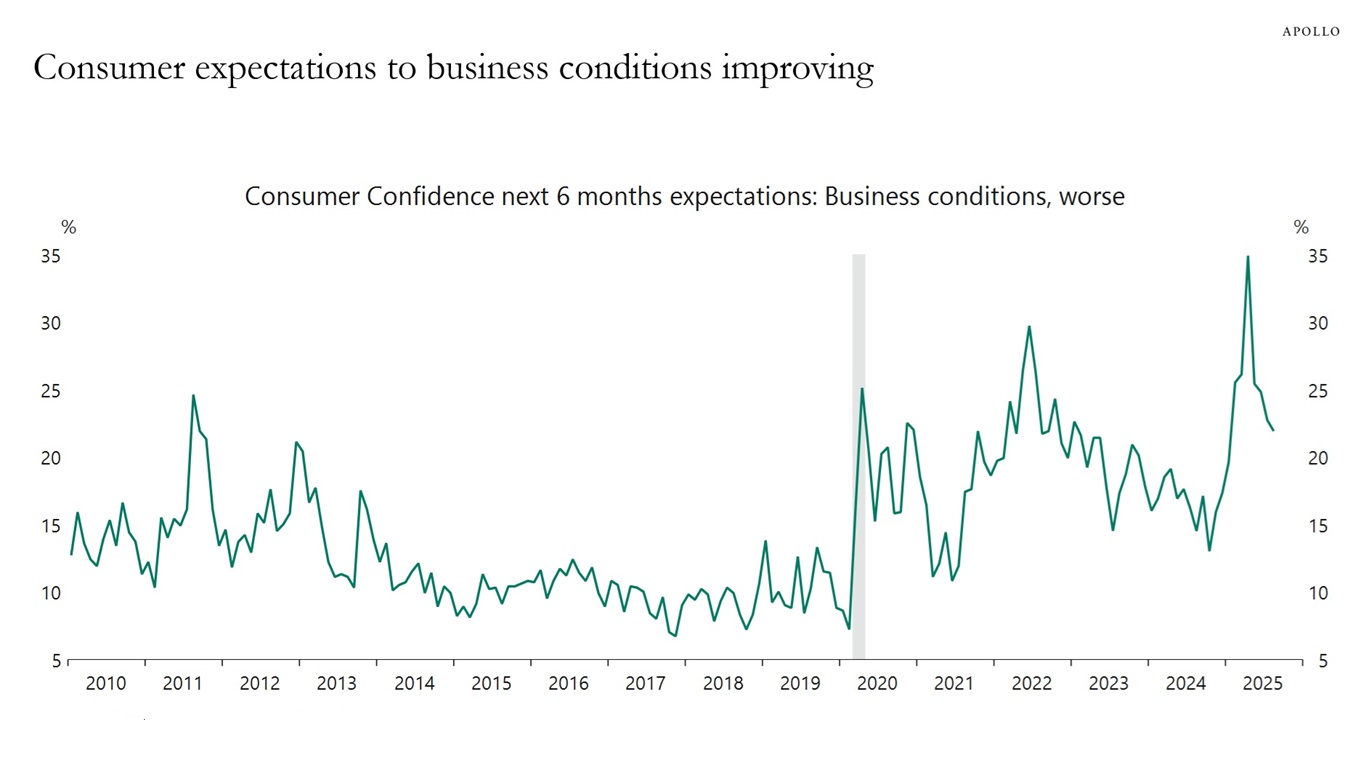

3) Consumer expectations to business conditions are improving

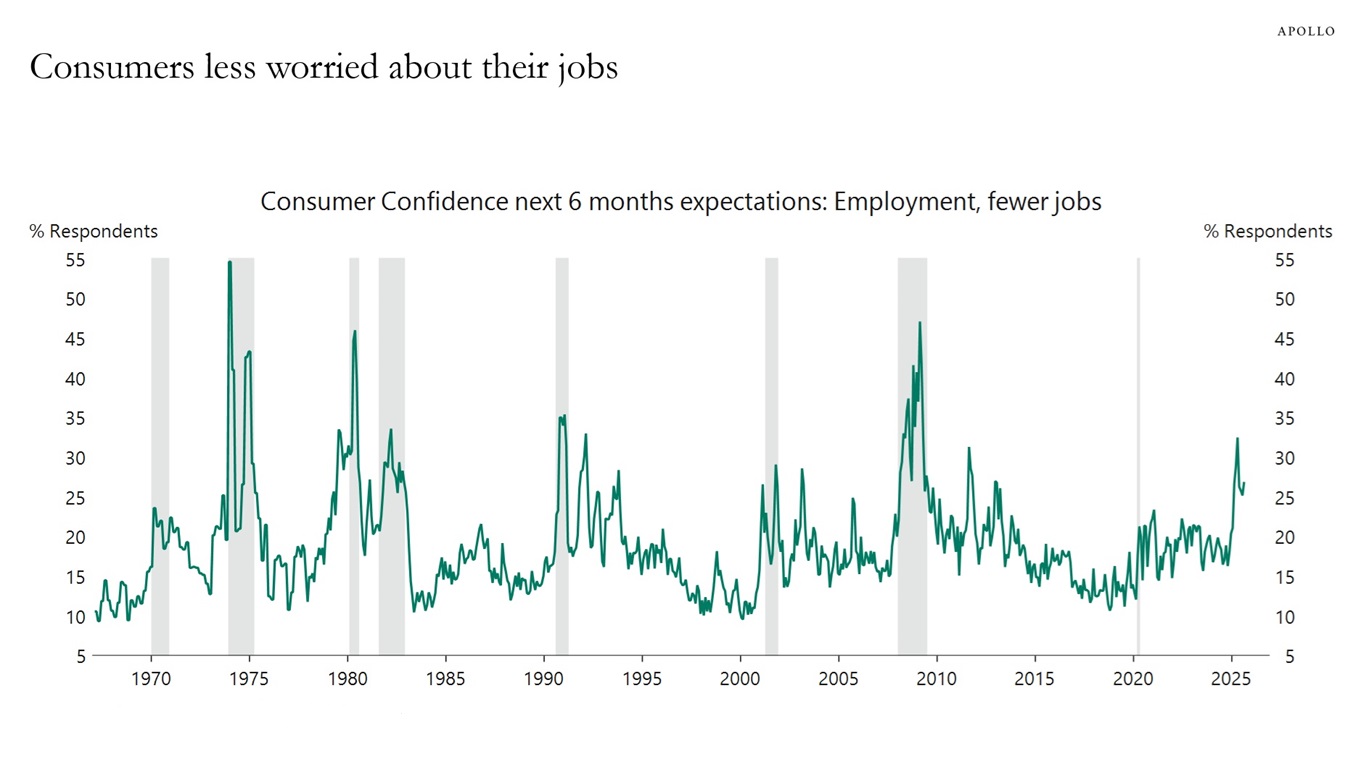

4) Consumers are less worried about losing their jobs

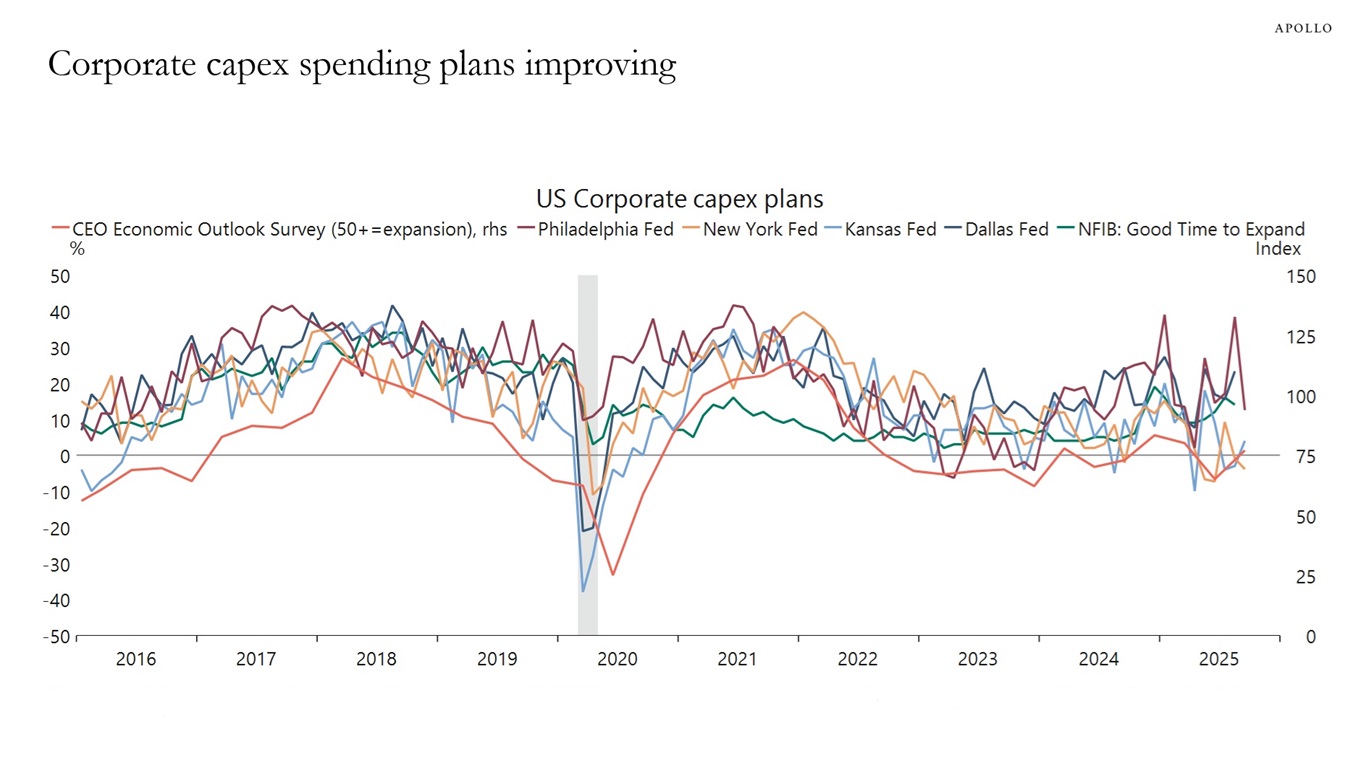

5) Corporate capex plans are improving, and jobless claims are still low

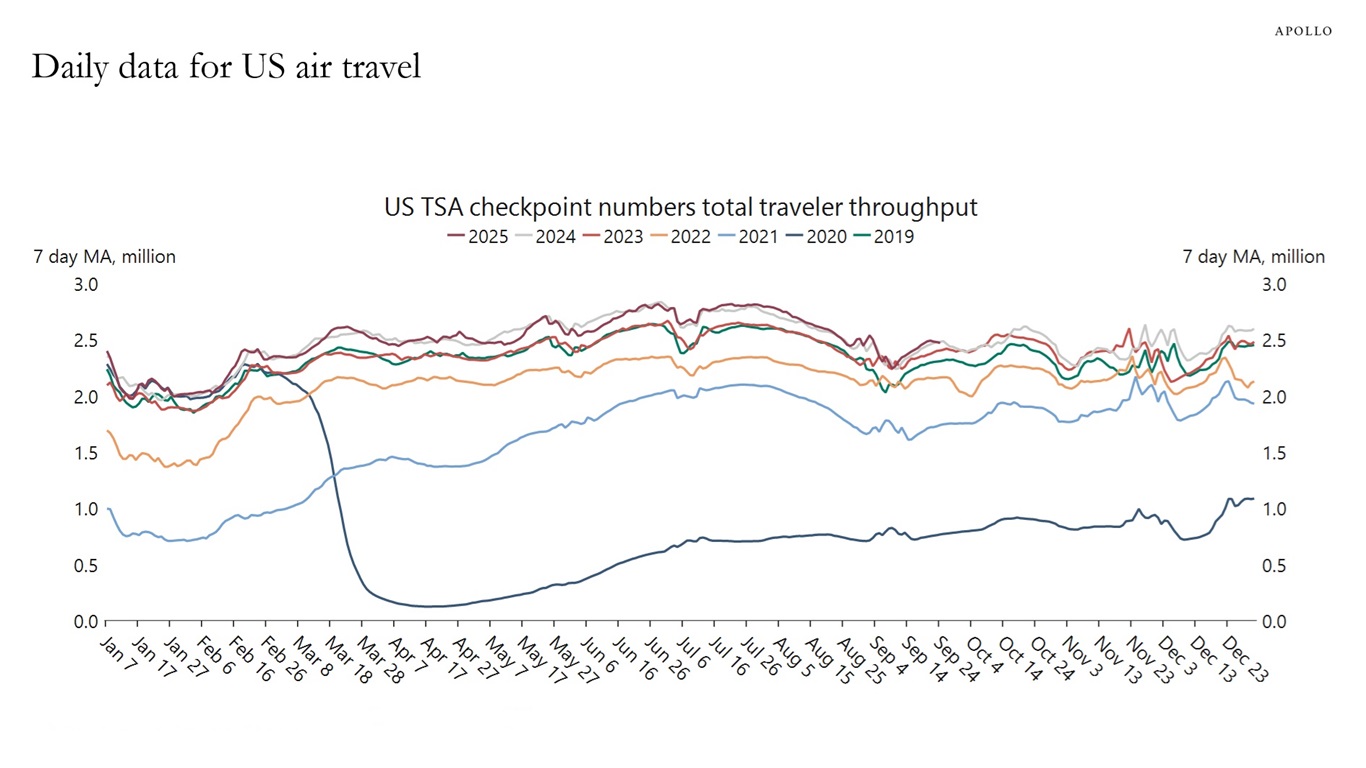

6) The daily TSA data for the number of people traveling on airplanes is strong

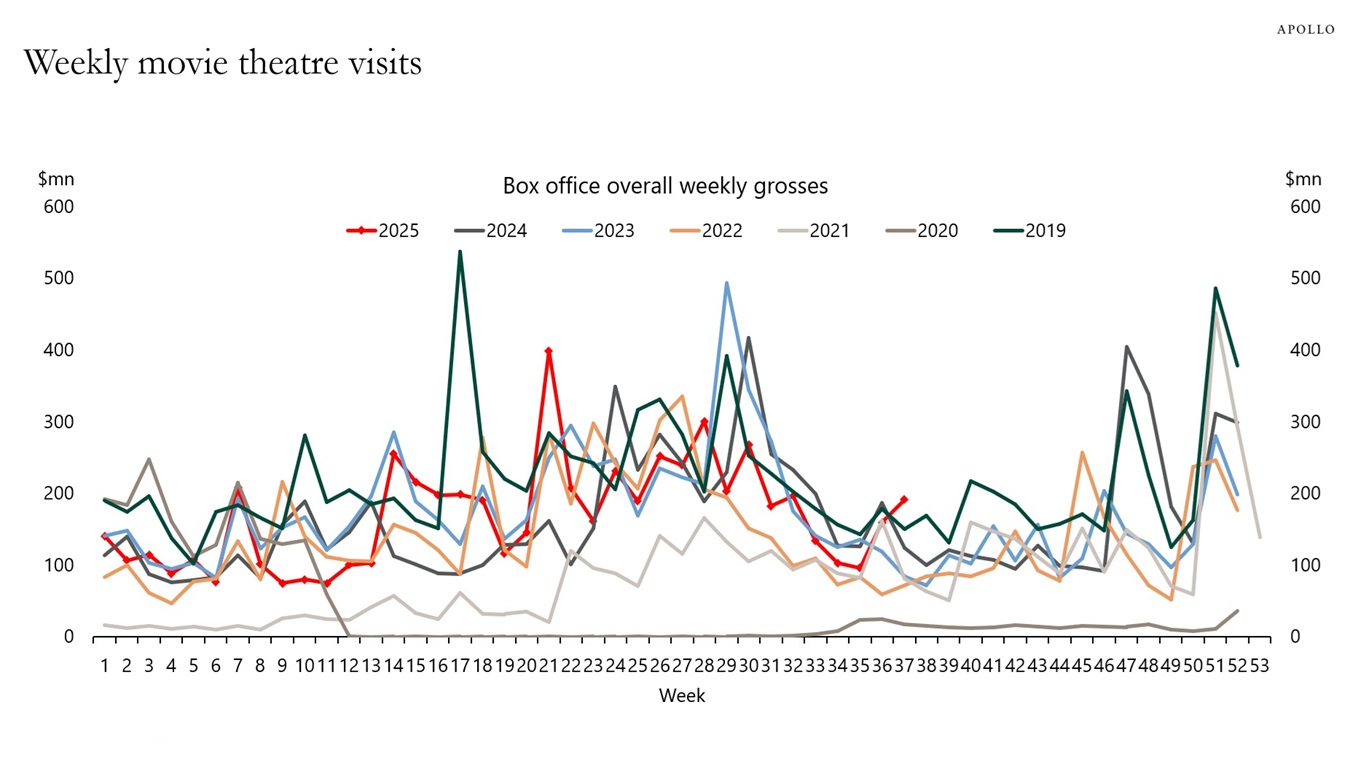

7) Data for the number of people going to Broadway shows, the movies and visiting the Statue of Liberty is strong

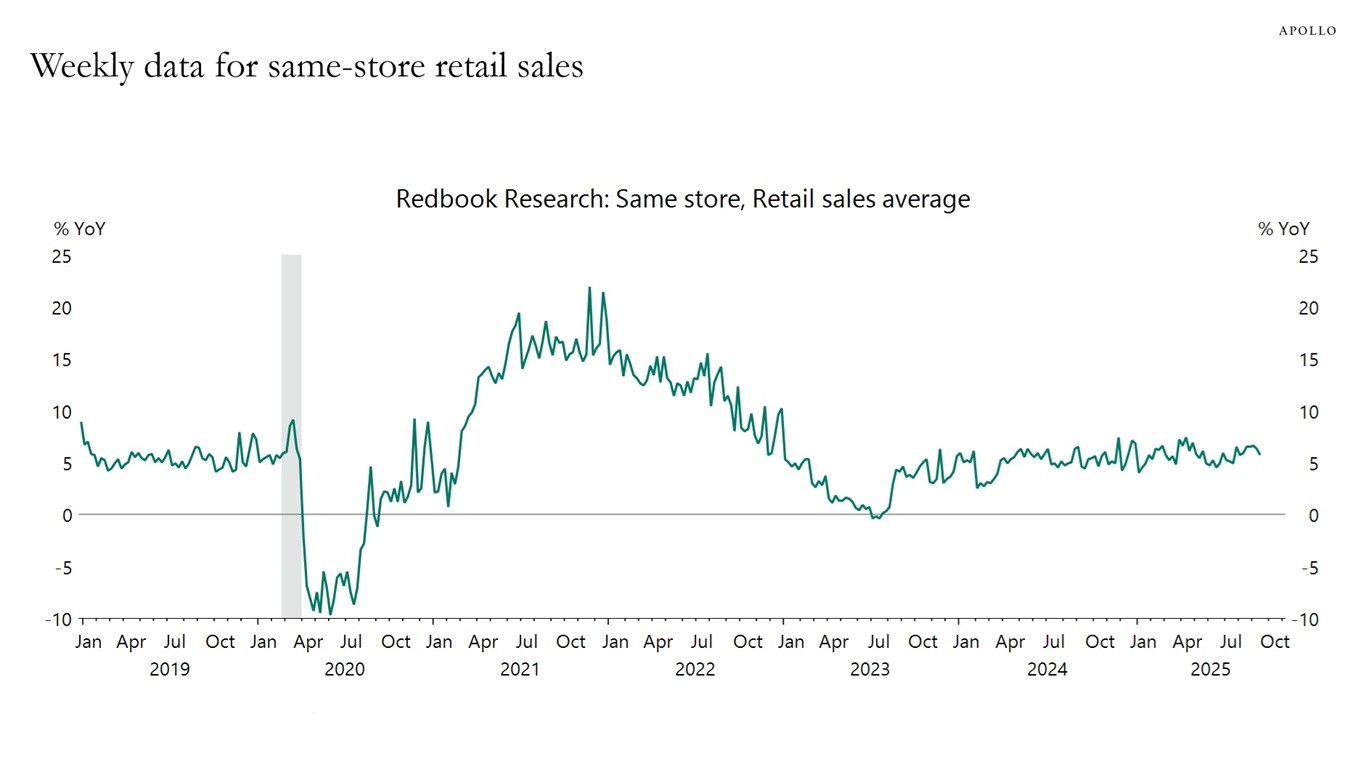

8) Weekly data for same-store retail sales is strong

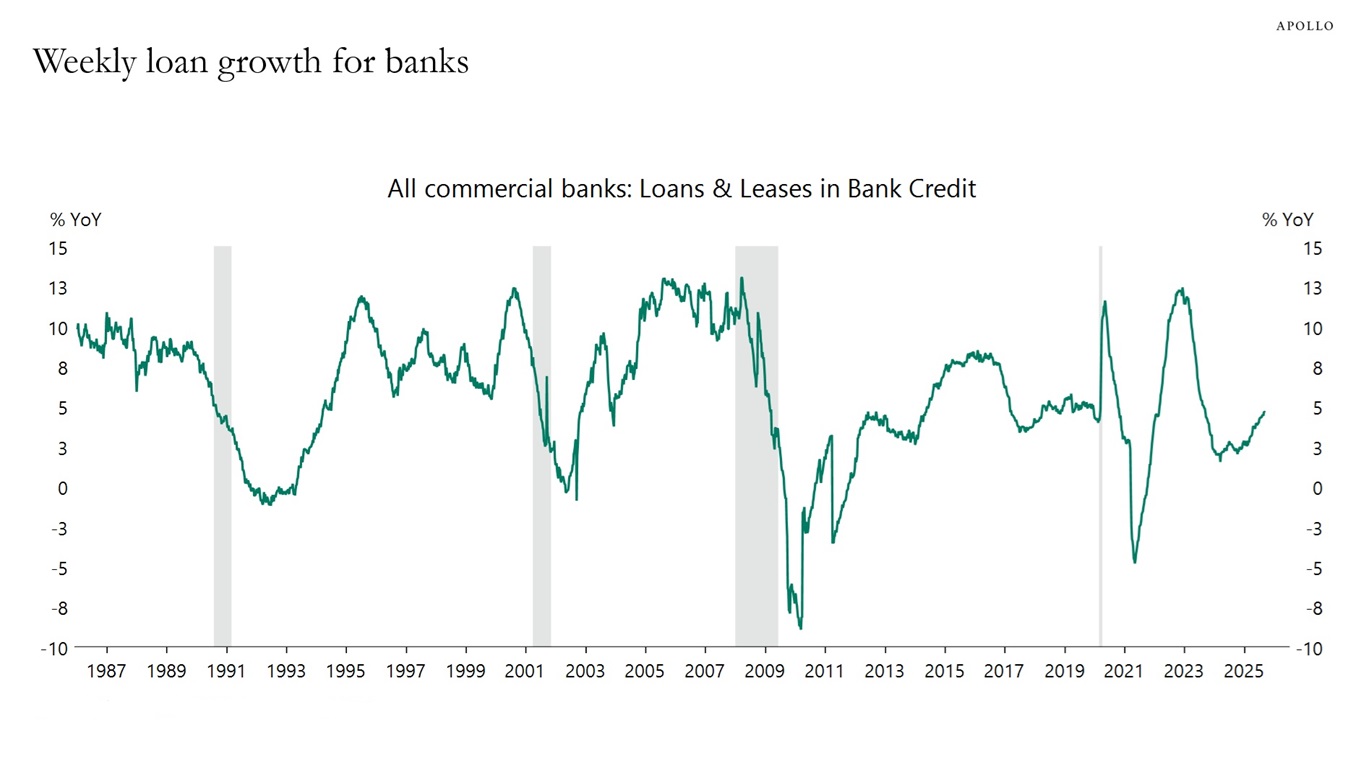

9) Weekly data for bank lending is accelerating

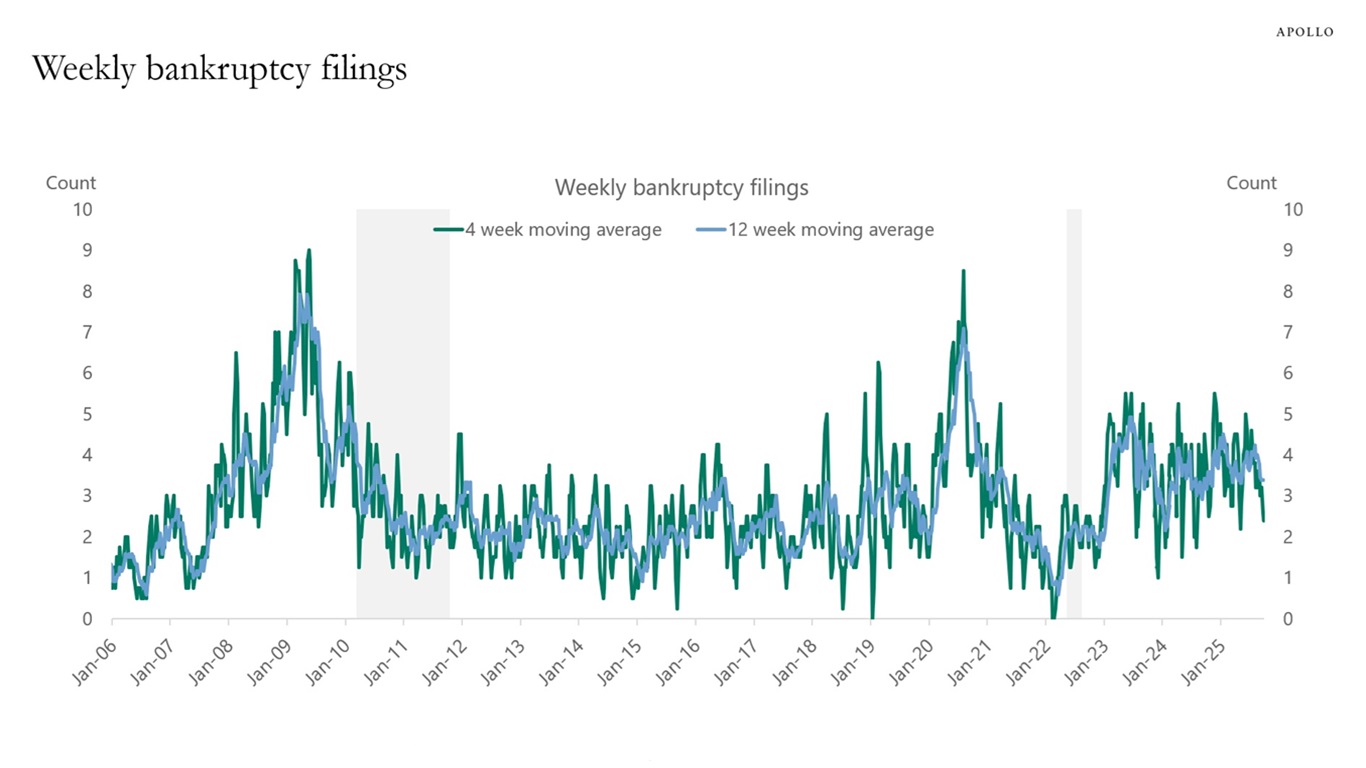

10) Weekly bankruptcy filings are starting to trend lower

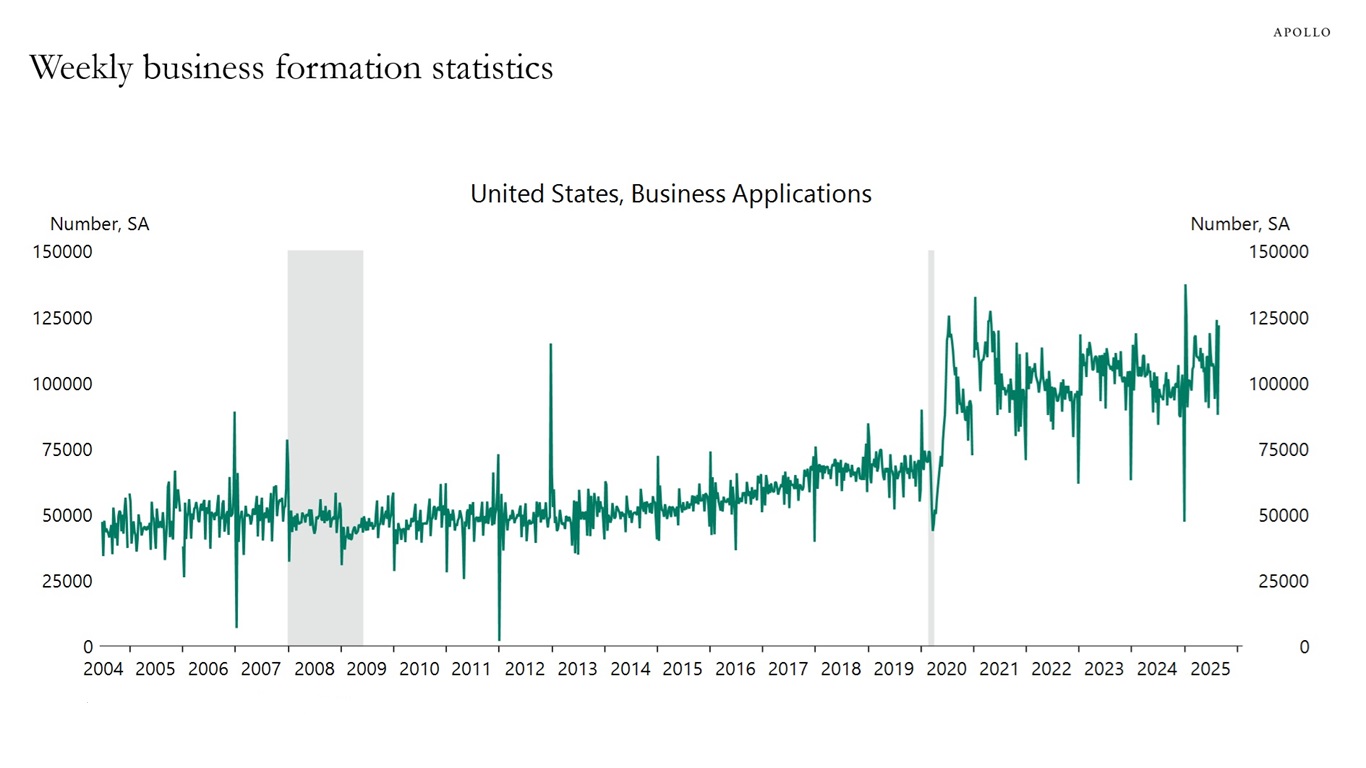

11) Weekly data for business formation is still strong

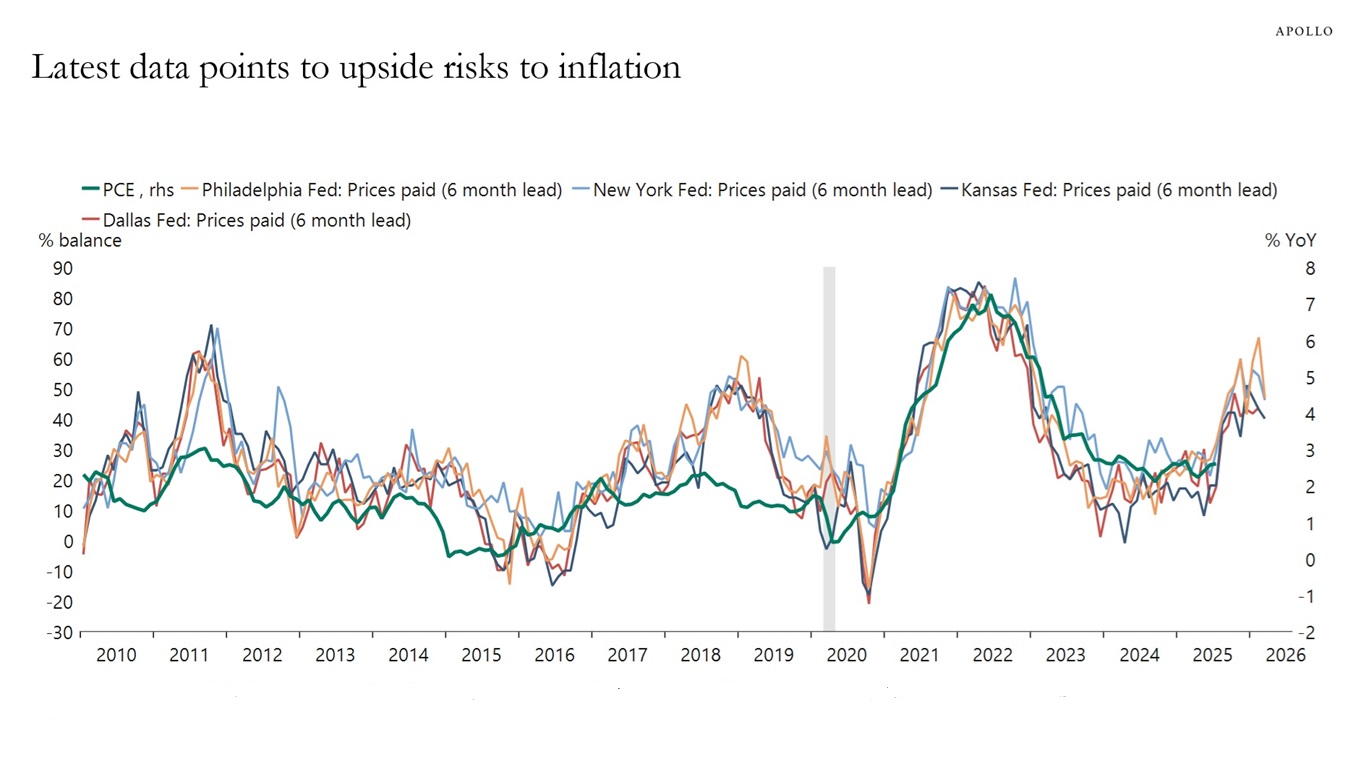

12) There are significant upside risks to inflation in the regional Fed surveys and in ISM services price paid

Combined with the Atlanta Fed expecting GDP growth in the third quarter at 3.9%, the bottom line is that the economy continues to do better than the consensus expects, and the labor market has likely weakened because of lower immigration and perhaps also AI implementation.

With continued strong growth and upside pressures on inflation from tariffs, immigration restrictions, and the declining dollar, the FOMC should really be talking about rate hikes rather than rate cuts.

Our chart book with high-frequency indicators for the US economy is available here.

Sources: Economic Policy Uncertainty, Macrobond, Apollo Chief Economist

Sources: Economic Policy Uncertainty, Macrobond, Apollo Chief Economist

Sources: Economic Policy Uncertainty, Macrobond, Apollo Chief Economist

Sources: Economic Policy Uncertainty, Macrobond, Apollo Chief Economist

Sources: Conference Board, Macrobond, Apollo Chief Economist

Sources: Conference Board, Macrobond, Apollo Chief Economist

Sources: Conference Board, Macrobond, Apollo Chief Economist

Sources: Conference Board, Macrobond, Apollo Chief Economist

Sources: National Federation of Independent Business, Federal Reserve Bank of Dallas, Federal Reserve Bank of Kansas City, Federal Reserve Bank of New York, Federal Reserve Bank of Philadelphia, Business Roundtable, Macrobond, Apollo Chief Economist

Sources: National Federation of Independent Business, Federal Reserve Bank of Dallas, Federal Reserve Bank of Kansas City, Federal Reserve Bank of New York, Federal Reserve Bank of Philadelphia, Business Roundtable, Macrobond, Apollo Chief Economist

Sources: US Dept of Homeland Security, Macrobond, Apollo Chief Economist

Sources: US Dept of Homeland Security, Macrobond, Apollo Chief Economist

Sources: Boxofficemojo.com, Apollo Chief Economist

Sources: Boxofficemojo.com, Apollo Chief Economist

Sources: Redbook Research Inc., Macrobond, Apollo Chief Economist

Sources: Redbook Research Inc., Macrobond, Apollo Chief Economist

Sources: Federal Reserve, Macrobond, Apollo Chief Economist

Sources: Federal Reserve, Macrobond, Apollo Chief Economist

Note: Filings are for companies with more than $50 million in liabilities. For week ending on September 26, 2025. Sources: Bloomberg, Apollo Chief Economist

Note: Filings are for companies with more than $50 million in liabilities. For week ending on September 26, 2025. Sources: Bloomberg, Apollo Chief Economist

Sources: US Census Bureau, Macrobond, Apollo Chief Economist

Sources: US Census Bureau, Macrobond, Apollo Chief Economist

Sources: Federal Reserve Bank of Dallas, Federal Reserve Bank of Kansas City, Federal Reserve Bank of New York, Federal Reserve Bank of Philadelphia, US Bureau of Economic Analysis (BEA), Macrobond, Apollo Chief Economist

Sources: Federal Reserve Bank of Dallas, Federal Reserve Bank of Kansas City, Federal Reserve Bank of New York, Federal Reserve Bank of Philadelphia, US Bureau of Economic Analysis (BEA), Macrobond, Apollo Chief Economist