Animal Blood Bank Market Summary

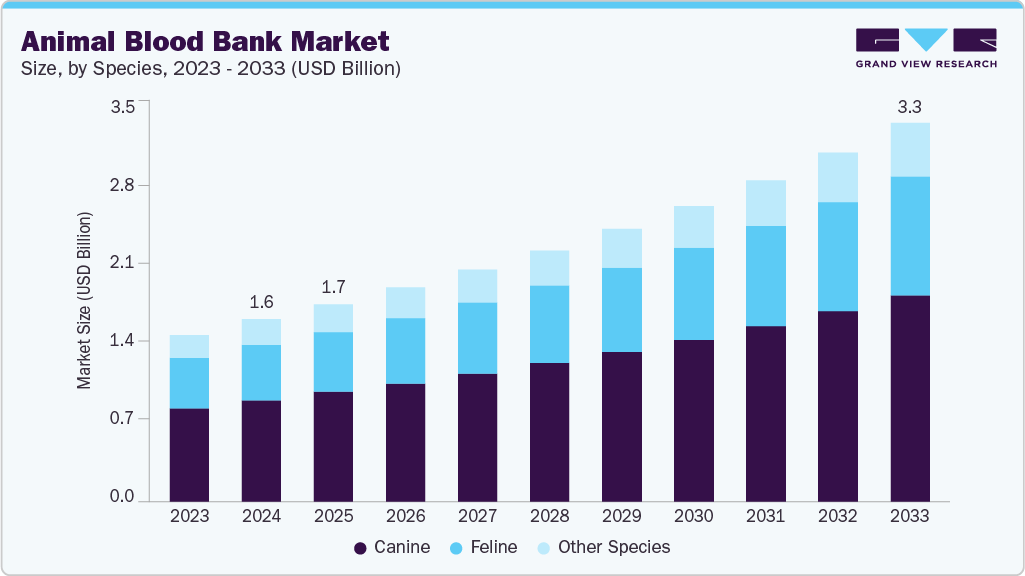

The global animal blood bank market size was estimated at USD 1.56 billion in 2024 and is projected to reach USD 3.25 billion by 2033, growing at a CAGR of 8.5% from 2025 to 2033. The primary factor driving the market is the rising demand for animal blood products, fueled by increased use of transfusions in emergency and specialty veterinary care, expanding blood banking infrastructure, and greater pet owner participation in donor programs.

Key Market Trends & Insights

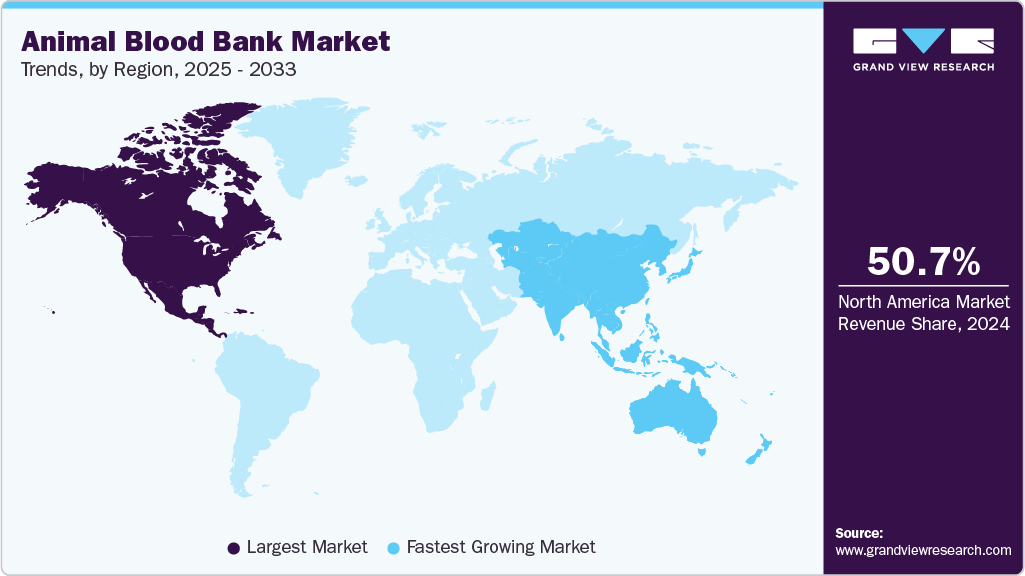

- North America animal blood bank market held the largest share of 50.7% of the global market in 2024.

- The animal blood bank industry in India is expected to grow at the fastest rate over the forecast period.

- By product, the packed red blood cells segment held the largest global market share in 2024.

- By species, the canine segment accounted for the largest revenue share in 2024.

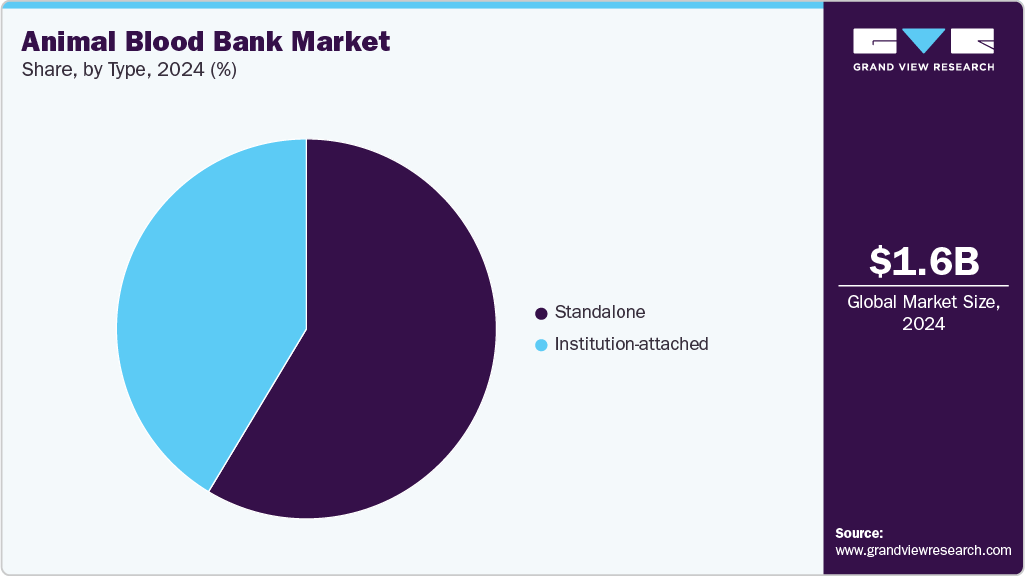

- Based on type, the standalone segment holds the largest share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.56 Billion

- 2033 Projected Market Size: USD 3.25 Billion

- CAGR (2025-2033): 8.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

A rising demand for animal blood products is driving the industry. Advances in veterinary care and changing pet owner expectations have made blood transfusions an increasingly essential component of treatment protocols in emergency and specialty settings.

Clinical cases highlight this trend. At leading veterinary institutions, transfusions are no longer rare interventions but critical, often repeated procedures that can determine survival outcomes. One such case involved a canine patient at Tufts University. In June 2025, the canine patients required multiple units of blood products, including whole blood, red blood cells, and plasma, to recover from severe internal hemorrhage. Such examples highlight how access to readily available blood supplies is becoming indispensable in modern veterinary medicine.

However, the demand has begun to surpass the supply. Veterinary practitioners consistently report shortages of blood products, driven by several factors such as the growing prevalence of advanced interventions, the expanding availability of specialty and emergency services, and the increasing willingness of pet owners to invest in life-saving treatments. As a result, clinics are turning to structured blood banking systems rather than relying solely on external suppliers. Many hospitals are now working to establish internal donor programs, with some aiming to source a substantial proportion of their transfusion needs from within their networks.

Awareness and donor participation remain critical to meeting this demand. While many pet owners are unaware that dogs and cats can be blood donors, studies show that most express willingness once informed. This has led to increased emphasis on outreach initiatives, owner education, and donor incentive programs, all of which are expected to strengthen the donor base and reduce supply gaps.

Growing clinical need, expanding blood banking infrastructure, and increased donor participation significantly support the market’s rising trajectory. The rising demand for animal blood products is anticipated to continue to be a major factor in the sector’s steady expansion as transfusions are increasingly incorporated into routine veterinary care.

National Guidelines/SOPs for Animal Blood Transfusion and Blood Banks, India – Key Highlights

Factor

Description

Purpose

Establish a national framework for veterinary transfusion medicine in India

Infrastructure

State-regulated veterinary blood banks with biosafety-compliant facilities

Donor Selection

Eligibility criteria based on health, vaccination status, age, weight, and disease screening

Blood Compatibility

Mandatory blood typing and cross-matching to prevent incompatibility reactions

Donation Ethics

Emphasis on voluntary, non-remunerated donations; informed consent; Donor Rights Charter

Zoonotic Risk Management

Integration of One Health principles to manage zoonotic risks

SOP Standardization

Uniform SOPs, forms, and checklists for donor registration, transfusion monitoring, and adverse reaction reporting

Network Development

Roadmap for National Veterinary Blood Bank Network (N-VBBN) with digital registries, real-time inventories, emergency helpline

Education & Training

Incorporation of transfusion medicine training into BVSc & AH curriculum, postgraduate education, and Continuing Veterinary Education

Innovations & Future Outlook

Mobile blood collection units, cryopreservation of rare blood types, mobile applications for donor-recipient matching, advanced transfusion research

Sector Significance

Addresses needs of 537 million livestock and 125 million companion animals contributing to national GDP and public health

Document Nature

Advisory, non-statutory, dynamic framework evolving with science, field experience, and stakeholder feedback

Source: Press Information Bureau of India (PIB)

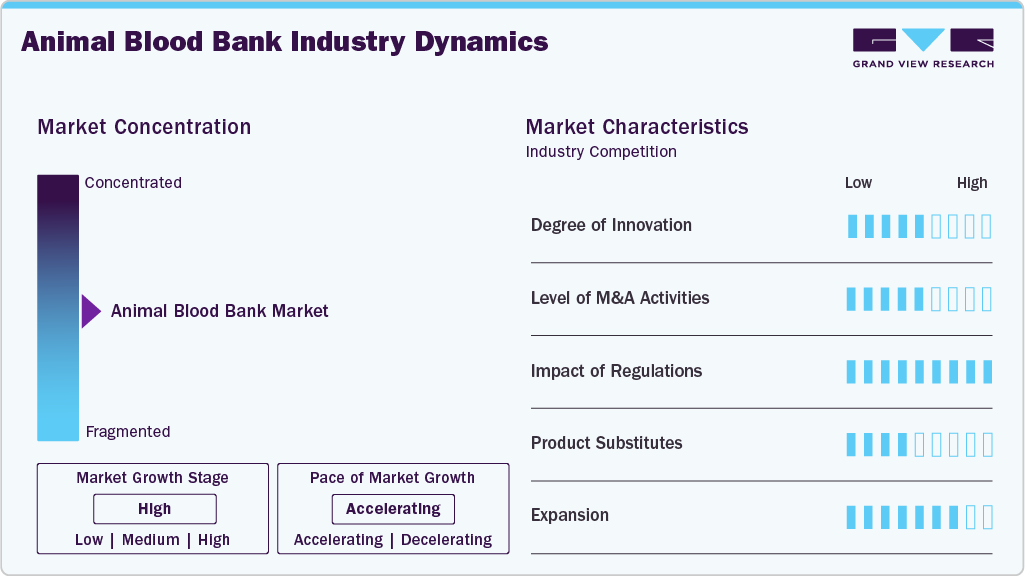

Market Concentration & Characteristics

The animal blood bank market demonstrates a moderate to high degree of innovation, with advancements in blood storage, component separation, cross-matching, and pathogen screening improving safety and efficiency. Emerging technologies such as cryopreservation and synthetic substitutes are also being explored, though adoption is still in early stages. Innovation increasingly focuses on standardizing protocols and expanding donor recruitment systems to meet rising clinical demand.

Considering its niche and still-eveloping nature, M&A activity in this market remain limited when compared to larger veterinary sectors. Yet, trends towards consolidation are becoming prominent as diagnostic companies and associations of veterinary hospitals indicate interest in integrating blood banking services to their networks. This signifies a gradual move towards collaborations and acquisitions to expand clinical offerings, guarantee supply security, and improve geographic reach.

The regulatory landscape is significantly shaping the growth of the animal blood bank market. For instance, in August 2025, the Department of Animal Husbandry & Dairying (DAHD), India, introduced comprehensive guidelines for animal blood transfusion and blood banks, emphasizing biosafety, standardized protocols, and ethical donor practices. These guidelines mandate blood typing, cross-matching, and establishing state-regulated blood banks with digital registries and real-time inventories. Furthermore, the government’s plan to create a National Veterinary Blood Bank Network (N-VBBN) aims to unify practices, ensure quality control, and address the increasing demand for blood products across species.

The sector’s product alternatives are a handful but expanding and primarily comprise oxygen-carrying solutions, synthetic blood components, and plasma expanders. Although such substitutes may offer critical patients with short-term support, they cannot completely replace the functions of whole blood or certain blood components. As a result, traditional animal blood products remain the preferred option, especially for complex transfusions and life-saving interventions.

The establishment of new blood banks, hospital-based donor programs, and national networks is driving expansion in the animal blood bank market. Increased availability can be made feasible by investments in infrastructure, storage, and logistics, and geographic coverage is growing, particularly in urban areas with cutting-edge veterinary facilities. Furthermore, improving veterinary professionals’ and pet owners’ awareness promotes growth of services to satisfy growing clinical demand.

Product Insights

The packed red blood cells segment held the largest revenue share of more than 46% in 2024, due to their critical role in treating anemia, trauma, and surgical blood loss in pets and other animals. PRBCs provide targeted oxygen-carrying capacity without the volume overload associated with whole blood, making them safer and more efficient for clinical use. Increased availability becomes attainable by investments in infrastructure, storage, and logistics, and geographic coverage is growing, particularly in urban areas with cutting-edge veterinary facilities. Furthermore, improving veterinary professionals’ and pet owners’ awareness promotes growth of services to satisfy growing clinical demand.

The plasma segment is expected to grow at a significant CAGR of 8.8% over the forecast period. This can be attributed to its increasing use in treating clotting disorders, immune deficiencies, and shock in animals. Plasma products, including fresh frozen and hyperimmune plasma, are critical for emergency and specialized therapies, driving clinical demand. Advances in fractionation, storage, and transfusion protocols have improved safety and efficacy, encouraging broader adoption. Additionally, rising awareness among veterinarians and pet owners about the therapeutic benefits of plasma is contributing to its projected CAGR.

Species Insights

The canine segment accounted for the largest revenue share in 2024. This is because dogs are the most common companion animals and often require blood transfusions for emergencies, surgeries, or chronic illnesses. Structured canine donor programs make blood collection reliable and consistent, while standardized blood typing and cross-matching protocols ensure safe transfusions. In contrast, adoption in felines and other species remains limited due to smaller donor pools, higher risk of transfusion reactions, and less-developed blood banking infrastructure. These challenges, combined with lower overall transfusion demand in cats, horses, and production animals, result in dogs accounting for the largest share of the market.

The feline segment is projected to exhibit the fastest growth rate over the forecast period. This can be due to increasing pet cat ownership and rising awareness of life-saving transfusions for conditions like anemia, kidney disease, and hemolytic disorders. Advances in feline blood typing and cross-matching have improved transfusion safety, encouraging broader clinical adoption. Furthermore, more structured feline donor programs have been developed by veterinary clinics and hospitals, and pet owners are becoming more eager to take part. All of these factors combine to promote the sharp rise in demand for feline blood products.

End-use Insights

The hospitals/ clinics segment led the market with the largest revenue share in 2024 and is expected to showcase the fastest growth rate. This can be due to the high demand for transfusions in emergency care, surgeries, and chronic disease management. Their direct access to patients ensures frequent utilization of blood products, driving revenue. Additionally, establishing in-house donor programs and expanded veterinary services has accelerated adoption. The segment’s rapid growth is further supported by increasing pet ownership and greater awareness among veterinarians and owners about the benefits of timely transfusions.

The academic & research institutions represent the second-largest market sharebecause they combine clinical services with training and research, creating consistent demand for blood products. These institutions often operate hospital-attached blood banks supporting patient care and experimental studies. Their involvement in veterinary education, clinical trials, and protocol development drives utilization and innovation in blood banking practices. This dual role ensures steady revenue and a significant presence in the market.

Type Insights

The standalone segment holds the largest share in 2024 and is expected to grow at the fastest rate over the forecast period. This dominance can be attributed to their ability to serve multiple veterinary hospitals and clinics, offering a centralized and scalable supply of blood products. Unlike institute-attached banks, they are not limited to a single facility, allowing for higher collection volumes and broader distribution. Their dedicated infrastructure, specialized staff, and advanced storage capabilities enhance reliability and efficiency. Additionally, standalone banks can implement standardized protocols and maintain larger donor pools, making them the preferred choice for a consistent and high-quality blood supply.

Through their integration with clinical and educational settings, the institution-attached blood bank category that is linked with academic, research, and hospital facilities maintains an important presence. They give the institution quick accessibility to blood products for research, surgeries, and emergency care. Timely transfusions are ensured by their close collaboration with veterinary teams, and research and training initiatives aid in the development of blood banking procedures. Despite having a smaller reach than independent banks, they are still essential for providing specialized, superior healthcare.

Regional Insights

North America’s animal blood bank market, which held the largest market share of 50.7% in 2024, is experiencing robust growth, driven by increasing demand for veterinary blood products. In Canada, for instance, in January 2025, the Nova Scotia SPCA initiated a program to encourage dog blood donations, highlighting the need for a sustainable blood supply to support animal health services. Similarly, in the U.S., veterinary professionals emphasize the importance of pet blood donations to save patient lives, underscoring the critical role of blood banks in emergency and specialty care.

U.S. Animal Blood Bank Market Trends

In the U.S., the demand for animal blood products is escalating, particularly in emergency and specialty veterinary care. Academic and research institutions are highlighting the life-saving impact of animal blood donors and showcasing the essential role of blood banks in treating critically ill animals. Furthermore, veterinary hospitals are increasingly establishing in-house blood donation programs to meet the growing need for blood products, ensuring a timely and adequate supply for patient care.

Europe Animal Blood Bank Market Trends

The Europe animal blood bank market is witnessing significant developments, with initiatives to improve blood donation and transfusion practices. In the UK, organizations are advancing blood banking practices to enhance the availability and safety of blood products for pets, reflecting a commitment to improving animal healthcare standards. These efforts are supported by increasing awareness and collaboration among regional veterinary professionals.

The animal blood bank market in the UKis evolving, focusing on enhancing blood donation systems and practices. The June 2025 BBC reports on initiatives encouraging dog blood donations, addressing the critical need for blood products in veterinary care. Additionally, media outlets like WRAL, in February 2025, highlighted the challenges posed by pet blood shortages, emphasizing the importance of donor programs and public awareness in ensuring a steady supply of blood for animal patients.

Asia Pacific Animal Blood Bank Market Trends

The Asia Pacific region is experiencing the fastest growth in the animal blood bank market, driven by increasing pet ownership and advancements in veterinary care. Countries in this region are developing infrastructure and protocols to support blood donation and transfusion services, aiming to meet the rising demand for animal blood products. Collaborations between veterinary institutions and blood banks foster improvements in service delivery and animal health outcomes.

India animal blood bank market in India is growing fastest globally. The sector is undergoing a significant transformation with the introduction of national guidelines for veterinary blood transfusion services. The DAHD, India has issued comprehensive Standard Operating Procedures (SOPs) to establish a structured, ethical animal blood banking network nationwide. These guidelines aim to improve animal welfare, ensure biosafety, and integrate One Health principles, benefiting livestock and companion animals. Moreover, initiatives in cities like Chennai and Mangaluru are promoting canine blood donation programs to address local blood supply needs.

Latin America Animal Blood Bank Market Trends

The animal blood bank market in Latin America is gradually growing alongside increasing awareness of animal welfare and veterinary care. Incidents highlighting the need for ethical treatment and better veterinary support have spurred initiatives for improved healthcare infrastructure. This has created opportunities for developing blood banking systems to support companion and rescue animals in the region.

Brazil animal blood bank marketis expanding as veterinary institutions and rescue centers focus on providing comprehensive care for pets and wildlife. Efforts to rehabilitate trafficked animals and the growing emphasis on cruelty-free practices have increased attention on veterinary support services. These trends drive the establishment of blood banks and donor programs to ensure an adequate blood supply for needy animals.

Middle East & Africa Animal Blood Bank Market Trends

The market in the Middle East & Africa is developing steadily, driven by rising pet ownership and increasing awareness of life-saving transfusions. Initiatives in countries like the UAE, including painless pet blood donation programs and advocacy for blood banks, encourage broader adoption. This has led to a gradual expansion of veterinary blood banking infrastructure across the region.

South Africa animal blood bank market is strengthening due to growing demand for veterinary transfusions and specialized animal care. Institutions like the Onderstepoort Blood Bank are leading in donor recruitment and the use of advanced blood collection and storage techniques. These developments are enhancing the availability of safe and reliable blood products for both companion and research animals.

Key Animal Blood Bank Company Insights

The animal blood bank market comprises specialized standalone blood banks, veterinary hospitals with in-house blood programs, and academic or research institution-attached banks. Major players emphasize on establishing donor networks, enhancing processing and storage capabilities, and offering an array of blood products, such as plasma, pRBCs, and whole blood. Because of their adaptable business models and capacity to serve multiple institutions, standalone banks and large networks of veterinary hospitals hold a dominant market share. Due to their association with clinical services and training programs, academic and research institutions retain a significant presence regardless of their smaller distribution. By ensuring a consistent supply of blood and enhancing transfusion techniques, these organizations and businesses work together to propel market expansion.

Key Animal Blood Bank Companies:

The following are the leading companies in the animal blood bank market. These companies collectively hold the largest market share and dictate industry trends.

- Plassvac

- NVABB, LLC

- Pet Blood Bank UK

- HemoLife

- Animal Blood Resources International

- Canadian Animal Blood Bank

- VEG ER

- GADVASU Blood Bank

- Tufts University

- Mount Vets Veterinary Hospital

- DoveLewis

- MAX PETZ HOSPITALS PRIVATE LIMITED

Recent Developments

-

In August 2025,the Indian government unveiled plans to establish a National Veterinary Blood Bank Network (N-VBBN) under the Department of Animal Husbandry and Dairying (DAHD). This initiative aims to provide standardized protocols for animal blood transfusion, define donor animal criteria, and build infrastructure for veterinary blood banks nationwide.

-

In August 2025, the Department of Animal Husbandry & Dairying (DAHD) in India released comprehensive guidelines for animal blood transfusion and blood banks. These guidelines aim to establish state-regulated veterinary blood banks, emphasizing biosafety and future-ready innovations in animal blood transfusion.

-

In May 2025, in Chennai, India, an animal welfare organization, Hope for Critters, launched a canine blood donor program to create a database of canine blood donors to address the blood shortage for pets in need. This initiative aims to connect potential donors with veterinary hospitals to ensure timely blood transfusions.

-

In April 2025, an umbrella cockatoo bird regained sight after cataract surgery at North Carolina State University’s Veterinary Hospital. The procedure was performed by a team of veterinary ophthalmologists and exotic animal specialists, marking a significant achievement in avian eye care. This surgery highlighted the advanced capabilities of veterinary medicine in treating exotic species

Animal Blood Bank Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.69 billion

Revenue forecast in 2033

USD 3.25 billion

Growth rate

CAGR of 8.5% from 2025 to 2033

Actual data

2021 – 2024

Forecast period

2025 – 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, species, type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait; Qatar; Oman

Key companies profiled

Plassvac; NVABB LLC; Pet Blood Bank UK; HemoLife; Animal Blood Resources International; Canadian Animal Blood Bank; VEG ER; GADVASU Blood Bank; Tufts University; Mount Vets Veterinary Hospital; DoveLewis; MAX PETZ HOSPITALS PRIVATE LIMITED

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Animal Blood Bank Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global animal blood bank market report based on product, species, type, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2021 – 2033)

-

Packed Red Blood Cells

-

Whole Blood

-

Plasma

-

Other Products

-

-

Species Outlook (Revenue, USD Million, 2021 – 2033)

-

Canine

-

Feline

-

Other Species

-

-

Type Outlook (Revenue, USD Million, 2021 – 2033)

-

Standalone

-

Institution-attached

-

-

End-use Outlook (Revenue, USD Million, 2021 – 2033)

-

Regional Outlook (Revenue, USD Million, 2021 – 2033)