Despite tariffs, trade wars, market volatility, and economic uncertainty, the International Monetary Fund (IMF) forecasts that the global economy will grow a healthy 3.2% this year.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The latest outlook is only slightly lower than the IMF’s previous forecast for 2025 that was issued a year ago. However, despite signs of resiliency, the IMF warns that it would be “premature and incorrect” to conclude that tariffs haven’t hurt global growth. The special agency of the United Nations now forecasts global growth of 3.1% in 2026, down from pre-pandemic growth of 3.7%.

IMF Chief Economist Pierre-Olivier Gourinchas stresses in the latest outlook that it is too early to gauge the full impact of tariffs on the global economy, noting that there’s no guarantee that trade agreements that have been negotiated to date will remain in place.

Offsetting Impacts

The IMF states in its latest report that there have been many offsets that have blunted the full and initial impacts of U.S. President Donald Trump’s tariff policies. Companies front-loaded purchases before tariffs went into effect and made changes to minimize the initial damage. At the same time, many countries negotiated lower tariff rates than feared and many of the tariffs didn’t go into effect until this August.

The IMF says the impact of tariffs is so far falling on U.S. importers. But some of those importers are starting to pass the added costs onto American consumers, which is likely to hurt the U.S. economy in 2026. Additionally, trade is being rerouted in many instances, a development that could alter the global economy moving forward.

Is the SPDR S&P 500 ETF Trust a Buy?

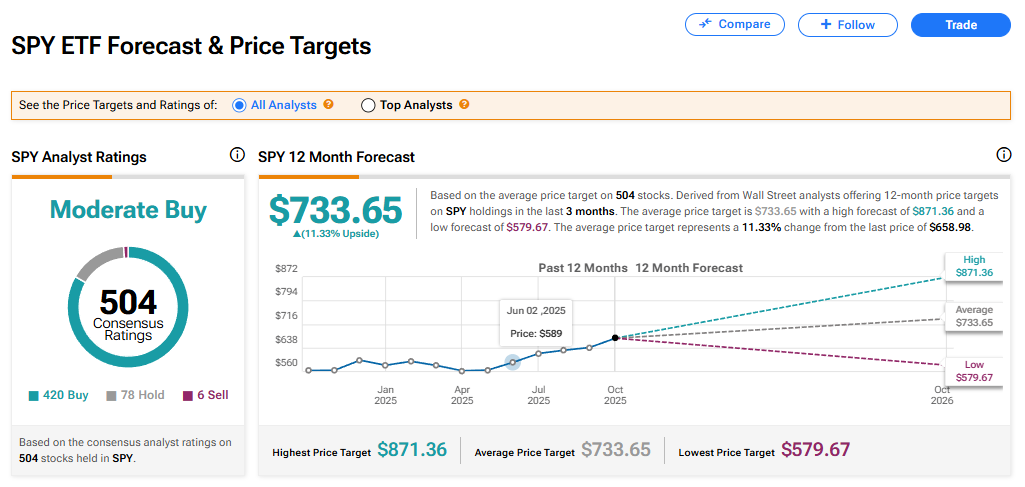

The SPDR S&P 500 ETF Trust (SPY) currently has a Moderate Buy rating among 504 Wall Street analysts. That rating is based on 420 Buy, 78 Hold, and six Sell recommendations issued in the last three months. The average SPY price target of $733.65 implies 11.33% upside from current levels.

Read more analyst ratings on the SPY ETF

Disclaimer & DisclosureReport an Issue