Triple lock benefits richer pensioners the most and makes the public finances unpredictable, warn experts

Rachel Reeves should scrap the state pension triple lock and replace it with a link to workers’ wages, Britain’s leading economic think-tank has said.

The Institute for Fiscal Studies (IFS) said the triple lock made it harder to plan public finances – and benefited better-off pensioners far more than the poorest.

Under the policy, which took effect in 2011, the state pension increases each year in line with consumer price inflation (CPI), growth in average earnings, or 2.5 per cent – whichever is the highest.

New FeatureIn ShortQuick Stories. Same trusted journalism.

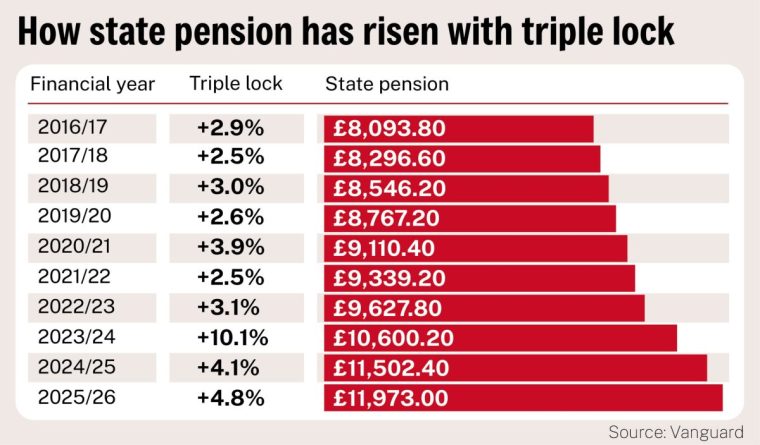

CPI figures to be published on Wednesday are almost certain to confirm that the increase in the state pension from April 2026 will be 4.8 per cent. This was the level of wage growth from May to July this year – the window used to calculate the triple lock.

The mechanism means that over time, the state pension is likely to grow more rapidly than both workers’ income and inflation. The full new state pension is now £30 a week – 14 per cent – higher than it would have been if linked only to earnings.

How the state pension has risen with the triple lock

How the state pension has risen with the triple lock

A new research note from the IFS has warned that the Government is spending an additional £12bn each year as a result of the triple lock.

Its author, Heidi Karjalainen, said: “Spending on the state pension is expected to rise by around £80bn in today’s terms by the 2070s.

“More than half of this increase is projected to come from the triple lock, but because the triple lock ratchets up the value of the state pension in a very unpredictable way, that figure could actually be much higher.

“Maintaining the triple lock over the long term will have to mean either higher taxes and/or lower spending elsewhere.

“And this spending pressure would, if left unchecked, come on top of increasing pressure for more spending on health and social care.”

She added that because better-off people tend to have greater life expectancy than those who are poorer, the advantages of a higher state pension accrue disproportionately to them.

The IFS suggested that the best way to fix pensions policy in the long run would be to introduce a “smoothed earnings link”, with the Government setting a target that the state pension should match a certain percentage of average earnings.

Each year the pension would increase at the same pace as wages, except in years when workers’ pay lags behind inflation – in which case the pension would go up in line with prices for as long as it took for earnings to catch up again.

The Chancellor has pledged to keep the triple lock in place at least until the next general election, and other parties are also currently committed to the policy, which is hugely popular with voters.