Introduction: Retail sales rise, lifted by warm weather and gold demand

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

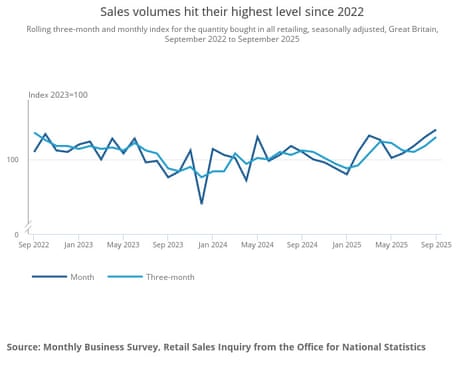

Retail sales across Great Britain have risen, in a sign that consumer spending is holding up despite the pressure from inflation.

New data from the Office for National Statistics this morning shows that retail sales volumes increased by 0.5% in September, and were 1.5% higher than a year earlier. Economists had expected a 0.2% monthly drop.

The ONS reports that sales grew strongly at non-food stores, including computer and telecommunications retailers.

A “notable contributor to this rise was online jewellers reporting a strong demand for gold”, the ONS says – as some consumers have flocked to bullion as its price rose to record highs this year.

Overall, sales volumes hit to their highest level since 2022 in September – although they are still 1.6% below their levels in February 2020 before the first Covid-19 lockdown.

A chart showing how GB Sales volumes hit their highest level since 2022 Photograph: ONS

A chart showing how GB Sales volumes hit their highest level since 2022 Photograph: ONS

Sales volumes are also their highest since 2022 over the last three months. In the quarter to September, sales volumes rose by 0.9% with the hot weather in July and August boosting clothing sales.

ONS senior statistician Hannah Finselbach says:

“Retail sales rose quite strongly in the latest quarter and were at their highest level since summer 2022. Although food stores saw very little growth, good weather in July and August boosted sales of clothing, while online retailing also did well.

“Retail sales also grew over the month of September, with tech stores seeing a notable rise in sales, while online jewellers reported strong demand for gold.”

Also coming up today

Hopes of a breakthrough in US-Canada relations have taken a blow, after Donald Trump has said he is ending “all trade negotiations” with his northern neighbour after the release of a television ad opposing US tariffs.

The US president accused Canada of “egregious behavior” aimed at influencing US court decisions.

And after weeks of disruption caused by the government shutdown, investors will finally be shown some official US economic data today!

The Bureau of Labor Statistics is expected to publish its September inflation report today, which is expected to show the CPI index rose by around 3.1% over the last year, above the Federal Reserve’s 2% target.

The agenda

-

7am BST: Great Britain retail sales report

-

9am BST: Flash eurozone PMI report

-

9.30am BST: Flash UK PMI report

-

1.30pm BST: US inflation report for September

-

3pm BST: University of Michigan US consumer confidence report

Updated at 02.36 EDT

Key events

Show key events only

Please turn on JavaScript to use this feature

Canadian dollar weakens as Trump terminates trade talks

The Canadian dollar has weakened slightly after Donald Trump blew up the US-Canada trade talks overnight.

The Canadian currency has dropped by 0.2%, to 1.4018 to the $.

In a post on his Truth Social site, Trump accused Canada of fraudulently using a “FAKE” advertisement featuring Ronald Reagan speaking negatively about tariffs, to sway a decision from America’s highest federal court on the legality of US levies on imports.

Trump declared:

They only did this to interfere with the decision of the U.S. Supreme Court, and other courts. TARIFFS ARE VERY IMPORTANT TO THE NATIONAL SECURITY, AND ECONOMY, OF THE U.S.A. Based on their egregious behavior, ALL TRADE NEGOTIATIONS WITH CANADA ARE HEREBY TERMINATED.

Updated at 02.47 EDT

Introduction: Retail sales rise, lifted by warm weather and gold demand

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Retail sales across Great Britain have risen, in a sign that consumer spending is holding up despite the pressure from inflation.

New data from the Office for National Statistics this morning shows that retail sales volumes increased by 0.5% in September, and were 1.5% higher than a year earlier. Economists had expected a 0.2% monthly drop.

The ONS reports that sales grew strongly at non-food stores, including computer and telecommunications retailers.

A “notable contributor to this rise was online jewellers reporting a strong demand for gold”, the ONS says – as some consumers have flocked to bullion as its price rose to record highs this year.

Overall, sales volumes hit to their highest level since 2022 in September – although they are still 1.6% below their levels in February 2020 before the first Covid-19 lockdown.

A chart showing how GB Sales volumes hit their highest level since 2022 Photograph: ONS

Sales volumes are also their highest since 2022 over the last three months. In the quarter to September, sales volumes rose by 0.9% with the hot weather in July and August boosting clothing sales.

ONS senior statistician Hannah Finselbach says:

“Retail sales rose quite strongly in the latest quarter and were at their highest level since summer 2022. Although food stores saw very little growth, good weather in July and August boosted sales of clothing, while online retailing also did well.

“Retail sales also grew over the month of September, with tech stores seeing a notable rise in sales, while online jewellers reported strong demand for gold.”

Also coming up today

Hopes of a breakthrough in US-Canada relations have taken a blow, after Donald Trump has said he is ending “all trade negotiations” with his northern neighbour after the release of a television ad opposing US tariffs.

The US president accused Canada of “egregious behavior” aimed at influencing US court decisions.

And after weeks of disruption caused by the government shutdown, investors will finally be shown some official US economic data today!

The Bureau of Labor Statistics is expected to publish its September inflation report today, which is expected to show the CPI index rose by around 3.1% over the last year, above the Federal Reserve’s 2% target.

The agenda

-

7am BST: Great Britain retail sales report

-

9am BST: Flash eurozone PMI report

-

9.30am BST: Flash UK PMI report

-

1.30pm BST: US inflation report for September

-

3pm BST: University of Michigan US consumer confidence report

Updated at 02.36 EDT