Nov 1, 2025

IndexBox has just published a new report: United Kingdom – Crude Coconut (Copra) Oil – Market Analysis, Forecast, Size, Trends And Insights.

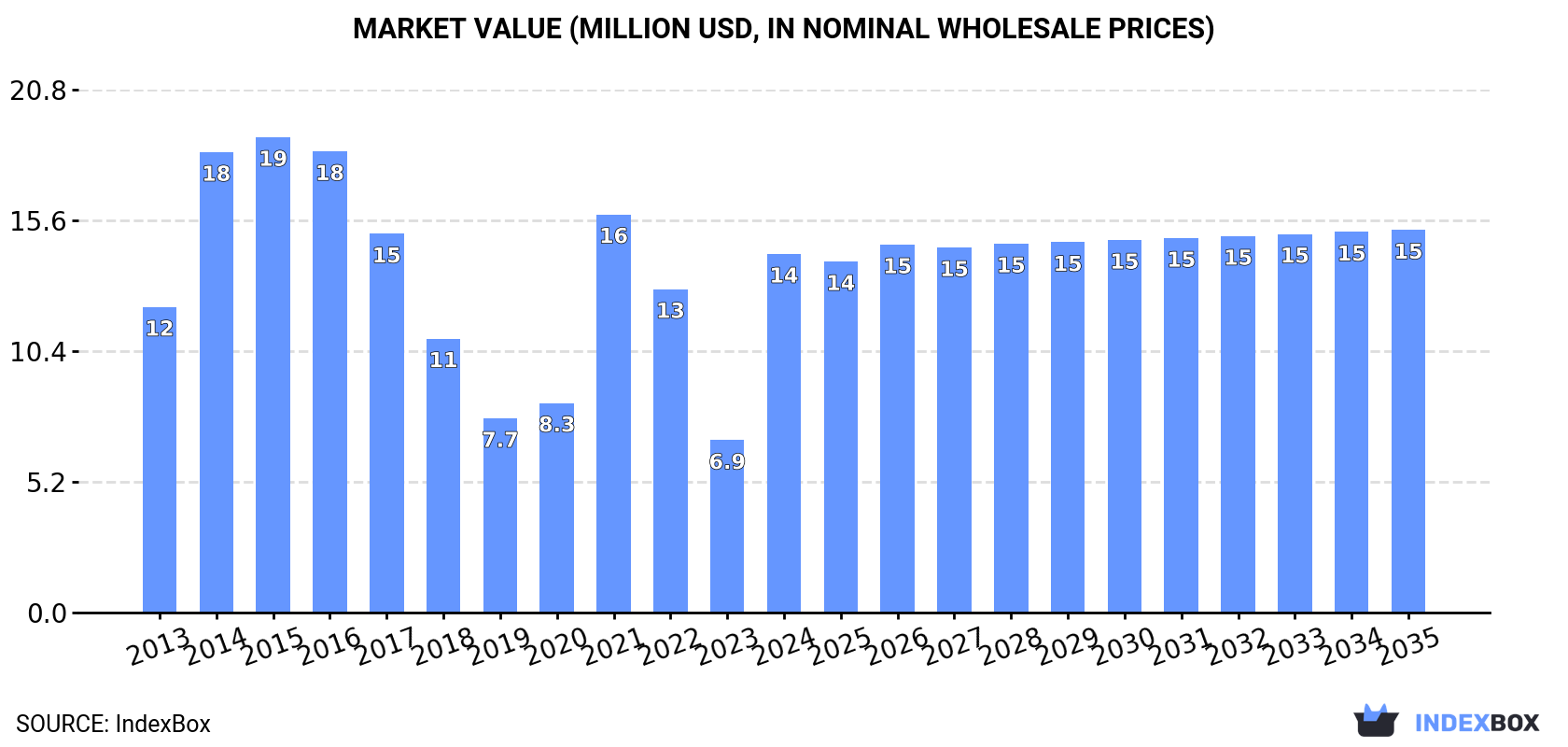

The UK’s crude coconut oil market is forecast for modest growth, with a projected CAGR of +0.6% in both volume and value from 2024 to 2035, reaching 6.4K tons and $15M respectively. After a two-year decline, 2024 saw a rebound in consumption to 6.1K tons and imports to 6.2K tons, though both remain below their 2014 peaks. Indonesia and the Philippines are the dominant import sources, while Ireland is the leading export destination. The average import price fell to $2,506 per ton in 2024, while the export price saw a slight increase to $4,604 per ton.

Key Findings

- Market forecast to grow at a CAGR of +0.6%, reaching 6.4K tons and $15M by 2035

- Consumption and imports rebounded in 2024 after a two-year decline but remain below 2014 peaks

- Indonesia and the Philippines are the primary import sources, together accounting for the majority of volume

- Export volume plummeted by -50.6% in 2024, with Ireland as the key destination by value

- Significant price disparity exists, with the US having the highest import price and Indonesia the lowest

Market Forecast

Driven by rising demand for crude coconut oil in the UK, the market is expected to start an upward consumption trend over the next decade. The performance of the market is forecast to increase slightly, with an anticipated CAGR of +0.6% for the period from 2024 to 2035, which is projected to bring the market volume to 6.4K tons by the end of 2035.

In value terms, the market is forecast to increase with an anticipated CAGR of +0.6% for the period from 2024 to 2035, which is projected to bring the market value to $15M (in nominal wholesale prices) by the end of 2035.

ConsumptionUnited Kingdom’s Consumption of Crude Coconut (Copra) Oil

ConsumptionUnited Kingdom’s Consumption of Crude Coconut (Copra) Oil

In 2024, consumption of crude coconut (copra) oil was finally on the rise to reach 6.1K tons after two years of decline. Overall, consumption, however, recorded a mild contraction. Over the period under review, consumption reached the peak volume at 8.5K tons in 2014; however, from 2015 to 2024, consumption stood at a somewhat lower figure.

The revenue of the crude coconut oil market in the UK surged to $14M in 2024, increasing by 108% against the previous year. This figure reflects the total revenues of producers and importers (excluding logistics costs, retail marketing costs, and retailers’ margins, which will be included in the final consumer price). In general, consumption saw mild growth. Over the period under review, the market hit record highs at $19M in 2015; however, from 2016 to 2024, consumption failed to regain momentum.

ImportsUnited Kingdom’s Imports of Crude Coconut (Copra) Oil

In 2024, overseas purchases of crude coconut (copra) oil were finally on the rise to reach 6.2K tons for the first time since 2021, thus ending a two-year declining trend. In general, imports, however, saw a mild shrinkage. Over the period under review, imports hit record highs at 8.6K tons in 2014; however, from 2015 to 2024, imports remained at a lower figure.

In value terms, crude coconut oil imports skyrocketed to $15M in 2024. Over the period under review, imports continue to indicate pronounced growth. Over the period under review, imports reached the peak figure at $23M in 2015; however, from 2016 to 2024, imports remained at a lower figure.

Imports By Country

Indonesia (2.5K tons), the Philippines (2.1K tons) and the Netherlands (629 tons) were the main suppliers of crude coconut oil imports to the UK, with a combined 84% share of total imports. Slovenia, Sri Lanka, Vietnam, Germany and the United States lagged somewhat behind, together accounting for a further 15%.

From 2013 to 2024, the most notable rate of growth in terms of purchases, amongst the main suppliers, was attained by Vietnam (with a CAGR of +71.1%), while imports for the other leaders experienced more modest paces of growth.

In value terms, the largest crude coconut oil suppliers to the UK were the Philippines ($5.1M), Indonesia ($3.4M) and Slovenia ($2.3M), together comprising 70% of total imports. Sri Lanka, the Netherlands, Vietnam, Germany and the United States lagged somewhat behind, together accounting for a further 28%.

Vietnam, with a CAGR of +66.4%, saw the highest rates of growth with regard to the value of imports, among the main suppliers over the period under review, while purchases for the other leaders experienced more modest paces of growth.

Import Prices By Country

The average crude coconut oil import price stood at $2,506 per ton in 2024, falling by -14.1% against the previous year. In general, import price indicated a resilient increase from 2013 to 2024: its price increased at an average annual rate of +5.7% over the last eleven-year period. The trend pattern, however, indicated some noticeable fluctuations being recorded throughout the analyzed period. The most prominent rate of growth was recorded in 2014 an increase of 60% against the previous year. The import price peaked at $3,001 per ton in 2019; however, from 2020 to 2024, import prices stood at a somewhat lower figure.

There were significant differences in the average prices amongst the major supplying countries. In 2024, amid the top importers, the country with the highest price was the United States ($17,673 per ton), while the price for Indonesia ($1,359 per ton) was amongst the lowest.

From 2013 to 2024, the most notable rate of growth in terms of prices was attained by Malaysia (+53.6%), while the prices for the other major suppliers experienced more modest paces of growth.

ExportsUnited Kingdom’s Exports of Crude Coconut (Copra) Oil

In 2024, shipments abroad of crude coconut (copra) oil decreased by -50.6% to 101 tons for the first time since 2021, thus ending a two-year rising trend. Over the period under review, exports recorded a abrupt slump. The pace of growth appeared the most rapid in 2015 with an increase of 382%. As a result, the exports reached the peak of 780 tons. From 2016 to 2024, the growth of the exports remained at a lower figure.

In value terms, crude coconut oil exports plummeted to $464K in 2024. In general, exports showed a abrupt contraction. The pace of growth appeared the most rapid in 2015 with an increase of 214%. As a result, the exports attained the peak of $4.3M. From 2016 to 2024, the growth of the exports remained at a somewhat lower figure.

Exports By Country

Ireland (19 tons), Saudi Arabia (15 tons) and Sri Lanka (13 tons) were the main destinations of crude coconut oil exports from the UK, together comprising 46% of total exports.

From 2013 to 2024, the most notable rate of growth in terms of shipments, amongst the main countries of destination, was attained by Saudi Arabia (with a CAGR of +44.5%), while the other leaders experienced more modest paces of growth.

In value terms, Ireland ($101K) remains the key foreign market for crude coconut (copra) oil exports from the UK, comprising 22% of total exports. The second position in the ranking was taken by Saudi Arabia ($46K), with a 10% share of total exports. It was followed by Lebanon, with an 8.1% share.

From 2013 to 2024, the average annual growth rate of value to Ireland totaled -9.1%. Exports to the other major destinations recorded the following average annual rates of exports growth: Saudi Arabia (+29.1% per year) and Lebanon (+8.2% per year).

Export Prices By Country

The average crude coconut oil export price stood at $4,604 per ton in 2024, picking up by 13% against the previous year. Over the period under review, the export price, however, saw a deep contraction. The pace of growth appeared the most rapid in 2021 an increase of 183% against the previous year. As a result, the export price reached the peak level of $13,769 per ton. From 2022 to 2024, the average export prices remained at a somewhat lower figure.

There were significant differences in the average prices for the major export markets. In 2024, amid the top suppliers, the country with the highest price was the Netherlands ($10,764 per ton), while the average price for exports to Cyprus ($1,187 per ton) was amongst the lowest.

From 2013 to 2024, the most notable rate of growth in terms of prices was recorded for supplies to the Netherlands (+3.1%), while the prices for the other major destinations experienced mixed trend patterns.

Source: IndexBox Market Intelligence Platform