The focus on fiscal “headroom”, the gap between what the Office for Budget Responsibility (OBR) expects the government to raise in tax over five years and how much it plans to spend, has dominated the UK’s economic and political landscape for 15 years.

Jack Barnett, Economics Correspondent, looks at way that its, what is meant by fiscal holes, and the economic factors that can erode this headroom.

Workers’ rights bill is about power, says Badenoch

The Conservative leader, Kemi Badenoch

YUI MOK/PA

The government’s Employment Rights Bill is “not about fairness but about power”, putting unions in charge of workplaces while businesses pay the cost, the Conservative leader told the CBI annual conference.

Kemi Badenoch said the bill was causing the most anxiety for businesses. She described it as an “assault on flexible working” and promised to repeal its measures, which included restrictions on “fire and rehire” practices and zero-hour contracts.

The government estimated the legislation could add £5 billion a year to business costs. The business secretary, Peter Kyle, said he would “listen to both sides” to ensure the law did not pit employers against employees.

Novo Nordisk pill fails to slow Alzheimer’s

Novo Nordisk said an older oral version of its semaglutide drug failed to meet its main goal in late-stage trials testing whether it could slow cognitive decline in Alzheimer’s patients. Its shares fell 9 per cent to 277 Danish kroner.

The trial has been closely watched because Alzheimer’s represents a potential market for GLP‑1 medicines after semaglutide’s success in obesity and diabetes, where treatment options are limited.

The chief scientific officer, Martin Holst Lange, said: “While semaglutide did not demonstrate efficacy in slowing the progression of Alzheimer’s disease, the extensive body of evidence supporting semaglutide continues to provide benefits for individuals with type 2 diabetes, obesity and related co-morbidities.”

The setback does not affect its established uses in metabolic diseases.

S4 Capital shares hit new low

Shares in Sir Martin Sorrell’s advertising group S4 Capital have fallen to a fresh low after warning revenue would be less than expected due to “lower project-based revenue, cautious client spending, and slower-than-expected ramp-up of new business wins”.

S4 said in a trading update that cost actions taken this year had helped mitigate the effects but the combination of slower new business growth and cautious client activity continued to weigh on profitability, prompting the downward revision to Ebitda and revenue guidance for the full year.

The shares fell 7 per cent, or 1¼p, to 16½p this morning, down 96 per cent over the past five years.

UK ‘turning a corner’ in delivering growth, says Kyle

Peter Kyle, the business secretary, addressed business leaders in London

DAN KITWOOD/GETTY IMAGES

Britain remains in the grip of an economic “growth emergency”, the business secretary has told the CBI conference.

Addressing business leaders in London, Peter Kyle said it was the “singular challenge of our time” and he would bring a “relentlessness” in working with business to help grow the economy.

He insisted the Labour government was “slowly but surely turning a corner” in delivering this.

“I am relentless. I’ve never accepted no for an answer.”

He added: “We will be a pro-business, pro-wealth creation government. This week’s budget will take the fair and necessary choices. We will not repeat the mistakes of previous governments by losing control of public spending and uncontrolled borrowing.”

Revolut has cemented its status as the crown jewel of Britain’s financial technology industry with a share sale that has valued the company at $75 billion and delivered windfalls for staff.

The artificial intelligence chipmaker Nvidia has become a shareholder in the London-based fintech group through the deal, which was led by investors Coatue, Greenoaks, Dragoneer, and American asset management company Fidelity.

The price-tag clinched by Revolut represents a big increase on the $45 billion valuation placed on the privately-owned business in August last year. It is the fifth time that the fintech company has allowed its employees to sell shares, allowing staff to cash in on Revolut’s spiralling valuation, which has risen despite its struggles to start a banking business in Britain, its home market.

Revolut secured a provisional banking licence from City regulators in July last year after a three-year wait. It has yet to be granted a full licence, however, meaning it cannot start its own lending operations in Britain.

Fiscal watchdog said to downgrade growth forecasts

The Office for Budget Responsibility (OBR) will downgrade its economic growth forecasts for 2026 and for the remaining years of the current parliament alongside the budget, according Sam Coates, the deputy political editor at Sky News.

He tweeted from the daily podcast he co-hosted with Politico’s Anne McElvoy, Politics At Sam And Anne’s podcast that the “OBR will say growth is lower in 2026 and every year of Pt on Wednesday”.

Please enable cookies and other technologies to view this content. You can update your cookies preferences any time using privacy manager.

Enable cookiesAllow cookies onceInvestor revolt over HICL-Trig merger intensifies

HICL focuses on infrastructure in hospitals, schools and the transportation industry

The revolt against plans for a merger between HICL and The Renewables Infrastructure Group (Trig) to create a giant £5.3 billion investment trust has gathered pace, with shareholders speaking for about 9.3 per cent of one of the merging companies now condemning the proposal.

Eleven institutional investors in HICL Infrastructure have signed a letter calling on the company to abandon the plan, saying they intend to vote against it if it goes ahead in its current form.

The new rebels comprise wealth managers looking after the savings of tens of thousands of retail clients, including TrinityBridge, which owns a 3.8 per cent stake in HICL and is the largest shareholder so far to come out against the deal.

HICL shares edged up 0.18 per cent to 112p, and Trig shares slid 0.7 per cent to 75p.

• Read in full: Investors rebel against giant infrastructure merger

What small traders want in the budget

The team at Blake Henry’s family butchers in Pudsey

TIMES PHOTOGRAPHER JAMES GLOSSOP

After months of non-stop leaks and speculation about what measures the budget will contain, the one thing companies wanted was certainty — and that small businesses would not be regarded as “easy pickings” for tax rises, as they felt they had been in last October’s budget.

“I don’t think they thought through the unintended consequences of those changes,” said Zulfi Hussain, who runs the Deeva Indian restaurants in the village of Farsley and the Leeds suburbs of Headingley and Chapel Allerton.

Not put off by the tough trading environment or the tax hits in the past budget was Adrian Thorp, who opened his butcher’s shop in Pudsey in March this year, along with his son Nathan.

As a first-time business owner, “it’s all still new and exciting” and the 54 year old does not feel weighed down by the burden of tax and regulation. “You can’t have a free NHS and not pay taxes, it’s as simple as that,” he said.

• Read in full: Business owners in Rachel Reeves’s patch have their say

M+C Saatchi shares tumble

M&C Saatchi shares fell as much as 18 per cent this morning to their lowest level since 2021 after the Aim-listed advertising group warned full-year profits would be lower than expected due to the United States government shutdown.

The shutdown, the longest in American history, hit trading in the second half, particularly affecting the company’s Issues business, which handles communications on political and social matters such as climate, health, human rights and social justice. The unit accounted for about a quarter of like-for-like sales last year.

M&C Saatchi now expected operating profit of £26 million to £28 million, down from a previous guidance of £35.2 million and in line with last year’s results. Analysts had forecast profits of £33.4 million.

Government borrowing costs fall, FTSE rises

Government borrowing costs have fallen across the curve while the FTSE 100 and the more UK-focused FTSE 250 have risen.

Investors are buying bonds before the budget on Wednesday, putting up prices and pushing down yields. The yield on the ten-year gilt, a proxy for government borrowing cost, slid 2 basis points to 4.53 per cent, and the yield on the 30-year bond was 5.35 per cent, down 2 basis points.

The pound was flat against the dollar at $1.3101 and dipped 0.02 per cent against the euro to €1.359.

London’s leading share indexes have risen with miners, property and financial shares higher. Although Anglo American shares were flat after BHP walked away from reviving its bid for the company. The FTSE 100 was up 0.5 per cent, or 47 points, at 9,586.06. The mid-cap index was up 0.48 per cent, or 101 points, at 21,465.15.

Defence stocks were down on reports that Ukraine peace talks were advancing. Retail and energy shares were lower.

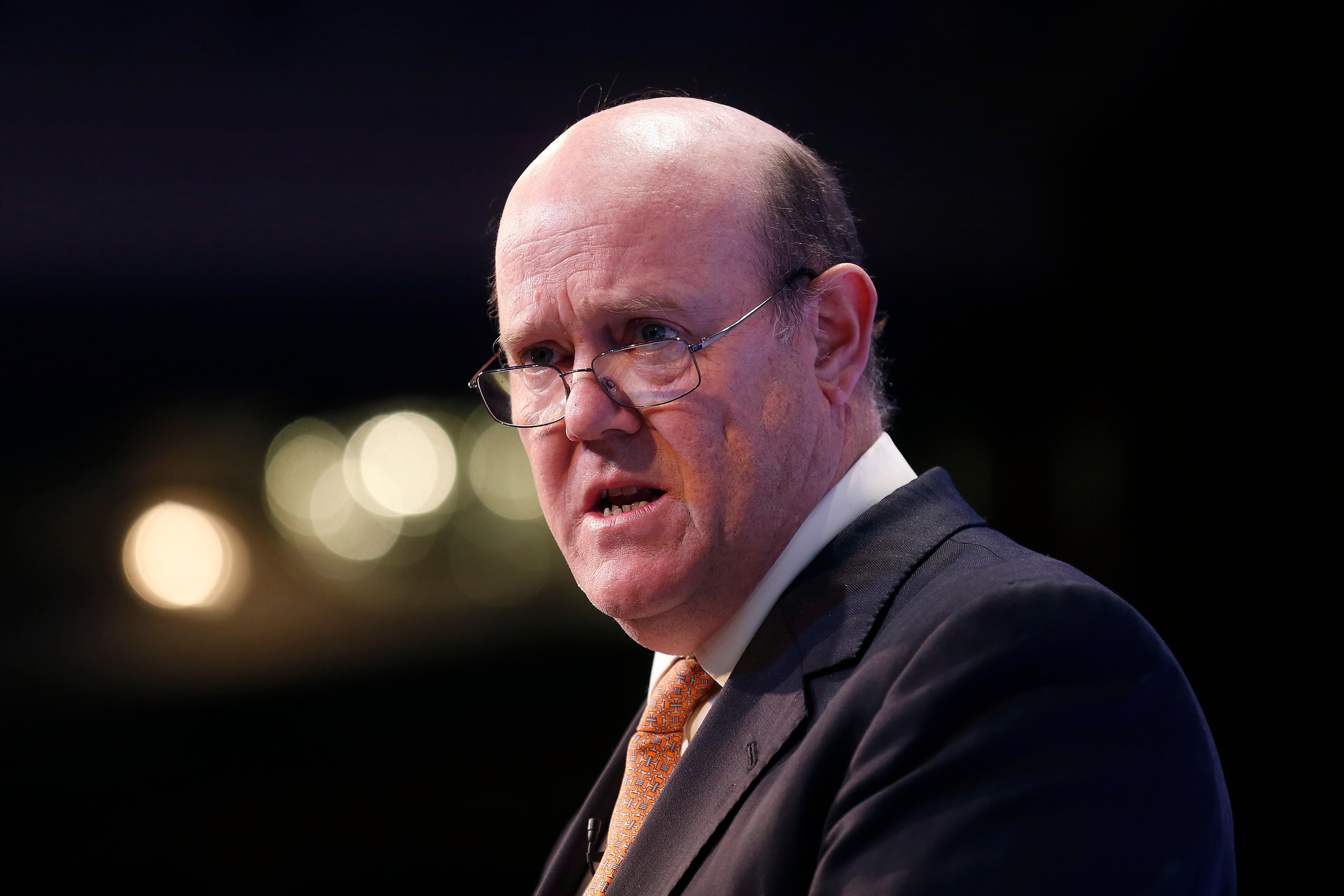

Budget anticipation has confused businesses, says CBI chair

Rupert Soames, the CBI chair

SIMON DAWSON/BLOOMBERG/GETTY IMAGES

Rupert Soames, chair of the Confederation of British Industry, criticised the “shambolic” and “unnecessary” run-up to this year’s budget, saying the constant “pitch rolling” of ideas being inflated, withdrawn, and reintroduced has confused businesses.

Speaking to Times Radio before the body’s annual conference, the grandson of Sir Winston Churchill said: “We’ve only got another two days of pitch-rolling hell to go and then we’ll know what’s in it.”

Soames warned that the Employment Rights Bill “will be seriously damaging to the willingness of employers to take on new staff, particularly young people”, and stressed the need for a stable environment to allow businesses to plan. He described government policy as incoherent, highlighting the contradiction between efforts to increase workforce participation and rising employment costs.

Despite his concerns, Soames acknowledged positive steps on trade, infrastructure and deregulation but said slow delivery and conflicting policies risked hampering economic growth and undermining confidence in the government’s approach.

CBI says workers’ rights bill will hit growth

Rain Newton-Smith, the chief executive of the Confederation of British Industry

STEFAN ROUSSEAU/PA

The Confederation of British Industry will press the government to change tack on its “damaging” workers’ rights bill or risk putting a brake on growth.

The lobby group’s boss, Rain Newton-Smith, will say the government has not yet listened to the concerns of companies over the Employment Rights Bill, which will give workers stronger rights over unfair dismissal and bring guaranteed working hours.

The group wants the legislation to be amended to allow employers and trade unions to find a compromise over key reforms. Companies also want clarity on changes to workers’ rights, gig economy rules and protections for employees and contractors in the bill.

What could be in Reeves’s budget?

Rachel Reeves has abandoned plans for major income tax rises on November 26, despite having paved the way for Labour to break one of its main manifesto pledges at the budget.

The chancellor has been handed news that was better than expected from the Office for Budget Responsibility about the state of the public finances and is now expected not to raise either the basic or higher rate of income tax, which would have generated tens of billions of pounds for the Treasury.

The reversal, which has spooked bond markets, comes after Reeves warned this month that everyone would have to do their “bit for the security of our country and the brightness of its future”.

• Read in full: What could the chancellor announce?

Warnings from S4 Capital and M&C Saatchi

It is an unhappy start to the week for advertisers:

S4 Capital Sir Martin Sorrell’s advertising group warned that its full-year profit would fall below market expectations, hit by cautious spending by clients and a slow ramp-up of new business wins. The group said it now expected annual operational earnings before interest, taxes, depreciation and amortisation of about £75 million. Analysts had forecast £81.6 million.

M&C Saatchi The troubled Aim-listed advertising group has warned that full-year profits will be lower than expected after the United States government shutdown hit trading. The group said it now expected operating profit in the range of £26 million to £28 million, having previously guided to profits of £35.2 million, in line with last year’s results. City analysts had forecast profits of £33.4 million.

IMI sells Truflo Marine for £225m

IMI has agreed to sell Truflo Marine, which supplies valves and actuators for naval submarine programmes worldwide, to Fairbanks Morse Defense for £225 million.

The engineer, a specialist in fluid and motion control, said the sale was part of its push to streamline its portfolio around the faster growth sectors of energy, automation and healthcare.

The deal, advised by Lazard and Addleshaw Goddard, is subject to regulatory approvals and is expected to complete by mid-2026.

AstraZeneca invests $2bn in US manufacturing

GRAEME SLOAN/BLOOMBERG/GETTY IMAGES

AstraZeneca will invest $2 billion to expand manufacturing in Maryland, including enlarging its Frederick site and building a Gaithersburg facility to develop and produce innovative molecules for clinical trials.

The company decided in September to pause a planned £200 million investment in its Cambridge research site, which had been expected to create 1,000 jobs and was seen as another setback for Britain’s life sciences strategy.

The decision heightened concerns about AstraZeneca’s long-term commitment to Britain amid industry frustration over high costs tied to an NHS sales scheme and reports that the chief executive, Sir Pascal Soriot, had privately discussed the possibility of moving the company’s listing to the United States.

Focus on Anglo American after BHP walks away

Anglo American’s Sishen iron ore mine in the Northern Cape, South Africa

NADINE HUTTON/BLOOMBERG/GETTY IMAGES

The mining company Anglo American shares are set to move after its Australian rival BHP abandoned a last-minute approach just two weeks before Anglo shareholders vote on a $60 billion tie-up with the Canadian Teck Resources.

BHP ruled out a bid late last night, hours after Bloomberg reported that it had made overtures to Anglo, reviving interest after last year’s failed £39 billion all-share offer.

Under British rules, BHP’s withdrawal bars it from making another bid for six months unless a rival offer emerges or Anglo seeks a waiver.

Andy Forster of Argo Investments said the move was “the last throw of the dice”, adding that he was surprised BHP felt able to return.

Anglo shares are up more than 30 per cent this year, while BHP’s are flat.

CBI fears a repeat of last year’s budget

Rachel Reeves, the chancellor

JUSTIN TALLIS/REUTERS

The chancellor, Rachel Reeves, must avoid another Groundhog Day budget and a “stop-start economy,” the CBI chief executive will tell business leaders today.

Rain Newton-Smith will urge the government to “work with business to fix what’s broken”, make “hard choices” after welfare and tax reversals, warn against “death by a thousand taxes” and press for more fiscal headroom.

Reeves will deliver her budget on Wednesday, aimed at filling a major fiscal gap and reviving weak growth. Business leaders, frustrated by policy instability and last year’s rise in employer national insurance, fear a repeat performance.

Newton-Smith will say: “A year on from a budget that turned to business to plug a hole, loading on £24 billion per year in extra costs, pushing the tax burden to a 25-year high, the government is once more grappling with a new fiscal gap, billions of pounds wide.

“It feels less like we’re on the move. And more like we’re stuck in Groundhog Day.”

Speakers include Peter Kyle, the business secretary, Kemi Badenoch, the Conservative leader, and Reform UK’s Zia Yusuf.

• ‘Damaging’ workers’ rights bill will stall growth, Reeves told

Global stock markets rise

The Korea Composite Stock Price Index (Kospi) rose today

AHN YOUNG-JOON/AP

Asian stocks rose this morning on renewed hopes of a Federal Reserve rate cut in December and optimism about a possible Ukraine peace deal, reversing last week’s declines driven by concerns over stretched AI tech valuations.

Markets also awaited delayed United States data, with retail sales and producer prices due later in the week, as the chancellor, Rachel Reeves, prepared her autumn budget to be delivered on Wednesday.

With Japan closed for a holiday, trading was thin but China, Australia, South Korea and Taiwan all gained. European equities were set to open higher, with FTSE 100 futures up 0.5 per cent, while the Nasdaq and S&P 500 futures rose after the Federal policymaker John Williams said rates could fall “in the near term”.

The Goldman Sachs chief economist, Jan Hatzius, expected a cut in December, followed by two more in March and June 2026 to take the funds rate to 3–3.25 per cent.