While a rise in the basic rate of income tax appears to have been dispensed with, there could be other forms of taxation in a wide variety of areas.

Here, the Belfast Telegraph breaks down what people in Northern Ireland should be looking out for as a result of the rumoured policy announcements.

Minimum wage increases

The minimum wage is set to go up in the Budget

As announced on Tuesday, both the national minimum wage and the national living wage will be increased, in a move that will extend to Northern Ireland.

The upshot is £1,500 more a year for workers on the minimum wage, and £900 extra annually for those on the living wage.

Child benefit boost

The budget is expected to see a removal of the two-child cap on child tax credits and and universal credit, in a boost to families with three or more children.

According to the most recent census figures from Northern Ireland, there are over 51,000 households in Northern Ireland that could benefit from the two-child cap being scrapped.

A heftier price for a pre-made latte

Pre-packaged milkshakes and lattes will come under the sugar tax (Alamy/PA)

The Government is set to add a range of milk-based beverages to the soft drinks industry levy, sometimes referred to as the “sugar tax”. This is a tax on pre-packaged drinks, like cans or bottles, that was introduced in 2018.

The new move, announced on Tuesday by Health Secretary Wes Streeting, will see pre-packaged milk drinks, like bottled lattes and milkshakes, now come under the tax having previously been exempt from it.

The upshot is that fans of a bottled latte or yogurt drink can expect to see a few extra percentage points of cost added onto the price of a purchase.

Mixed news for electric car drivers

Electric vehicle owners facing mixed news in the Budget

Policy towards EVs is set to change, as the Government seeks to balance increasing the number of people moving to electric-powered cars with gathering income from them.

The Chancellor is said to be considering a 3p per mile tax on EVs, as she looks to make up for revenues lost on fuel duty as people shift from petrol and diesel cars.

Rachel Reeves will deliver her Budget on Wednesday (PA)

News Catch Up – Monday 24 November

However, she is also said to be adding £1.3bn to the EV buyer subsidy, a scheme which can save buyers of electric vehicles up to £3,750 on their purchase.

So those buying an electric car can expect to see the initial cost helped by the Government, but the cost of running their battery-powered vehicles may well be going up.

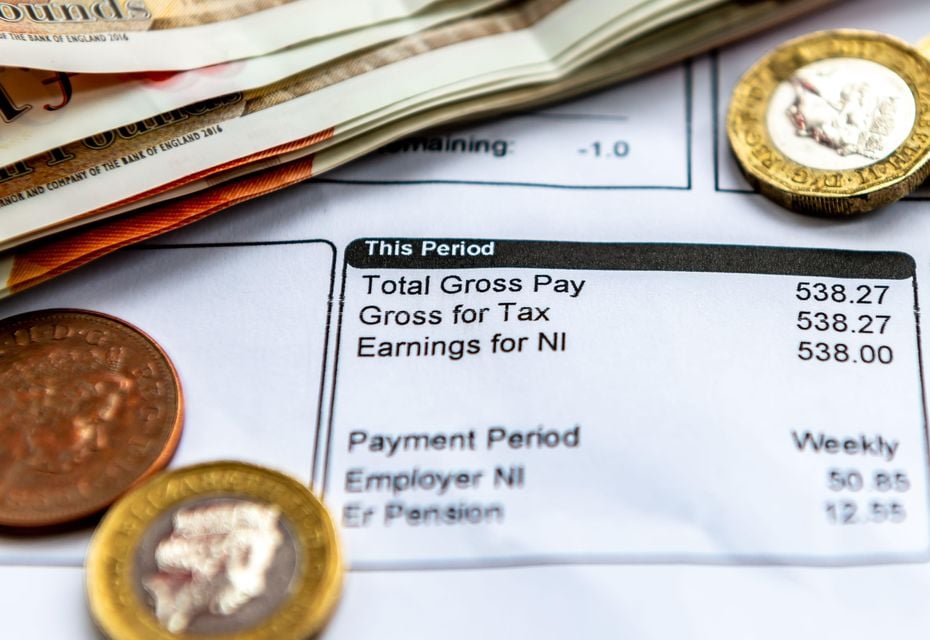

Tax threshold freezes

Income tax return. Photo: Getty

While the Chancellor appears to have backed away from a much-mooted rise in income tax rates, the money people pay may still increase.

This is because she may well freeze income tax thresholds at their current rates for a number of years, which would bring people into higher tax brackets as their wages increase in line with inflation.

The effect is known as “fiscal drag” and could provide the Government with more revenue without breaking their manifesto promises on tax.