Train fare revenue for Great Britain’s rail network increased by 8% to GBP 11.5 billion between April 2024 and March 2025, according to new figures from the Office of Rail and Road (ORR). The rise reflects continuing recovery in passenger demand, with 1.7 billion journeys made across the network. However, fare income remains 12% below pre-pandemic levels, despite journeys returning to figures last seen in 2019.

Regional operators recorded the strongest revenue growth at 11%, followed by increases of 8% in London and the South East and almost 8% on long-distance services. Average fares rose marginally to GBP 6.65 per journey, although this remains GBP 0.82 lower than before the pandemic.

Government funding falls as passenger income strengthens

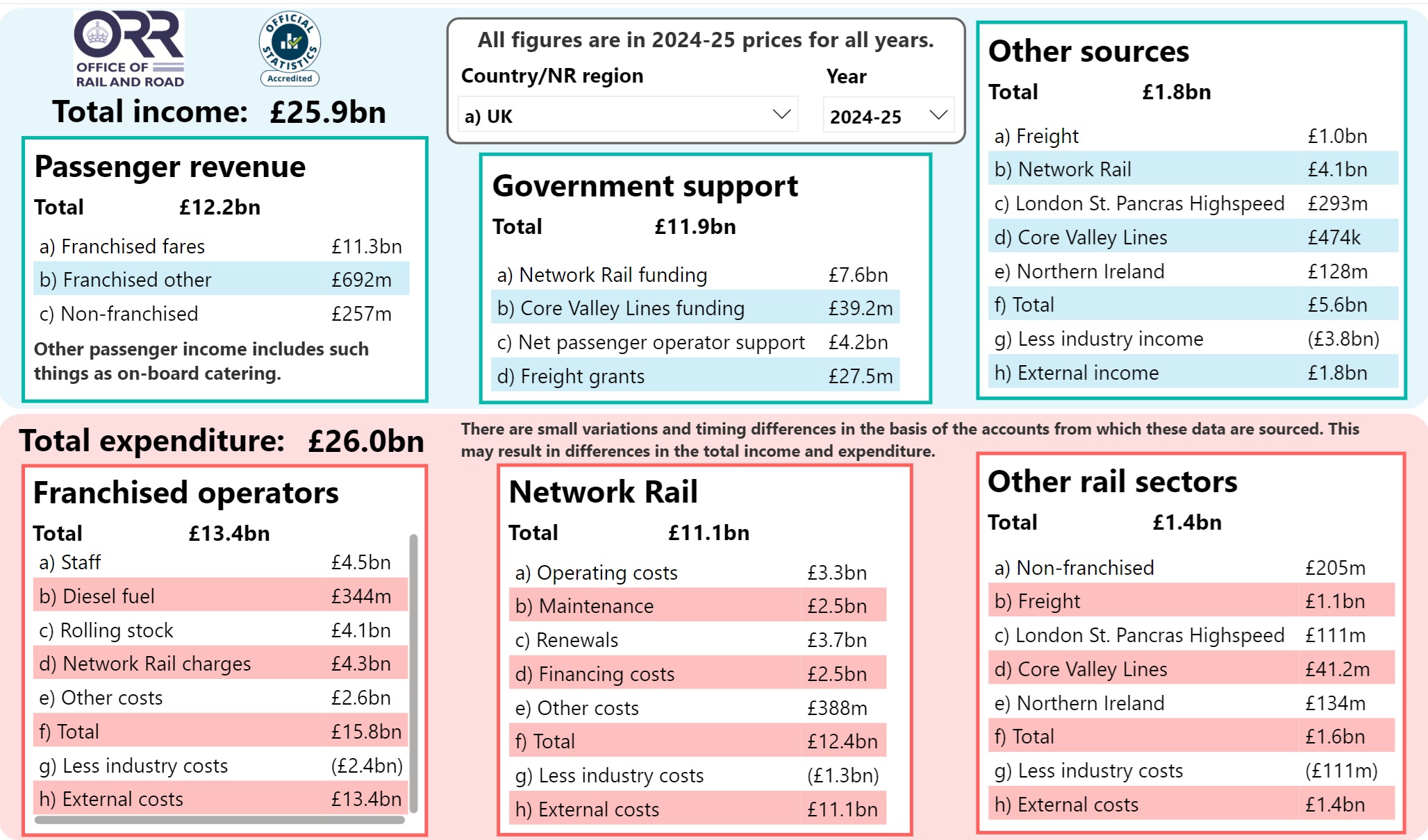

Higher fare income contributed to a reduction in government funding for the day-to-day operation of the railway, which fell by GBP 0.9 billion year-on-year to GBP 11.9 billion. Despite this, state support still accounts for nearly half of operational railway income and remains significantly above pre-COVID levels.

Passengers in Scotland received the highest subsidy per passenger kilometre, at 34 pence, compared with 16 pence in Southern and Eastern England. In Wales, the figure reached 45 pence.

Will Godfrey, Director of Economics, Finance and Markets at ORR, said:

“Taking stock of the national rail finances in our annual report, we welcome the continued recovery in fares income in the last year. But cost pressures and a lagged recovery in industry income compared to passenger journeys, explains why the reduction in government funding still leaves the overall subsidy substantially above pre-pandemic levels.”

Total industry income decreases slightly

Despite higher fares, overall industry income declined by 1% to GBP 25.9 billion. While fares accounted for GBP 11.5 billion, other sources contributed GBP 1.8 billion and non-fares operator income reached GBP 0.7 billion.

Network Rail property income fell sharply, down 32% to GBP 286 million, mainly due to a slowdown in asset sales compared with the previous year.

Operational expenditure continues to rise

Operational rail industry expenditure increased by 1% to GBP 26.0 billion. Costs for franchised passenger operators rose by 4.6% to GBP 13.4 billion, driven by a 6.1% increase in staff expenditure and higher rolling stock and operating costs. Staff numbers grew 4.6% compared with the previous year.

Network Rail spent GBP 8.6 billion on operations, maintenance and renewals, a 1.4% decrease, partly due to lower renewals expenditure following the reprioritisation of signalling projects, including ETCS upgrades. Financing costs also fell by 5.5% as inflation eased.

Investment in HS2 dominates capital spending

Spending on rail infrastructure enhancements and rolling stock fell by 4% to GBP 10.3 billion, with GBP 7.1 billion directed to HS2. Funding for HS2 decreased slightly due to programme restructuring and scope changes.

Network Rail enhancements accounted for GBP 2.1 billion, while private investment increased by 27% to GBP 756 million. Most private sector spending — GBP 525 million — went into new or upgraded rolling stock.

Dividends and rolling stock leasing

Ten of the twenty franchised operators were expected to pay dividends in the latest year, totalling GBP 164 million, a slight decrease on the previous year and around half the level recorded before the pandemic.

Rolling stock leasing companies saw net profit margins fall to 19%, while dividend payments to shareholders dropped by 19% to GBP 275 million.