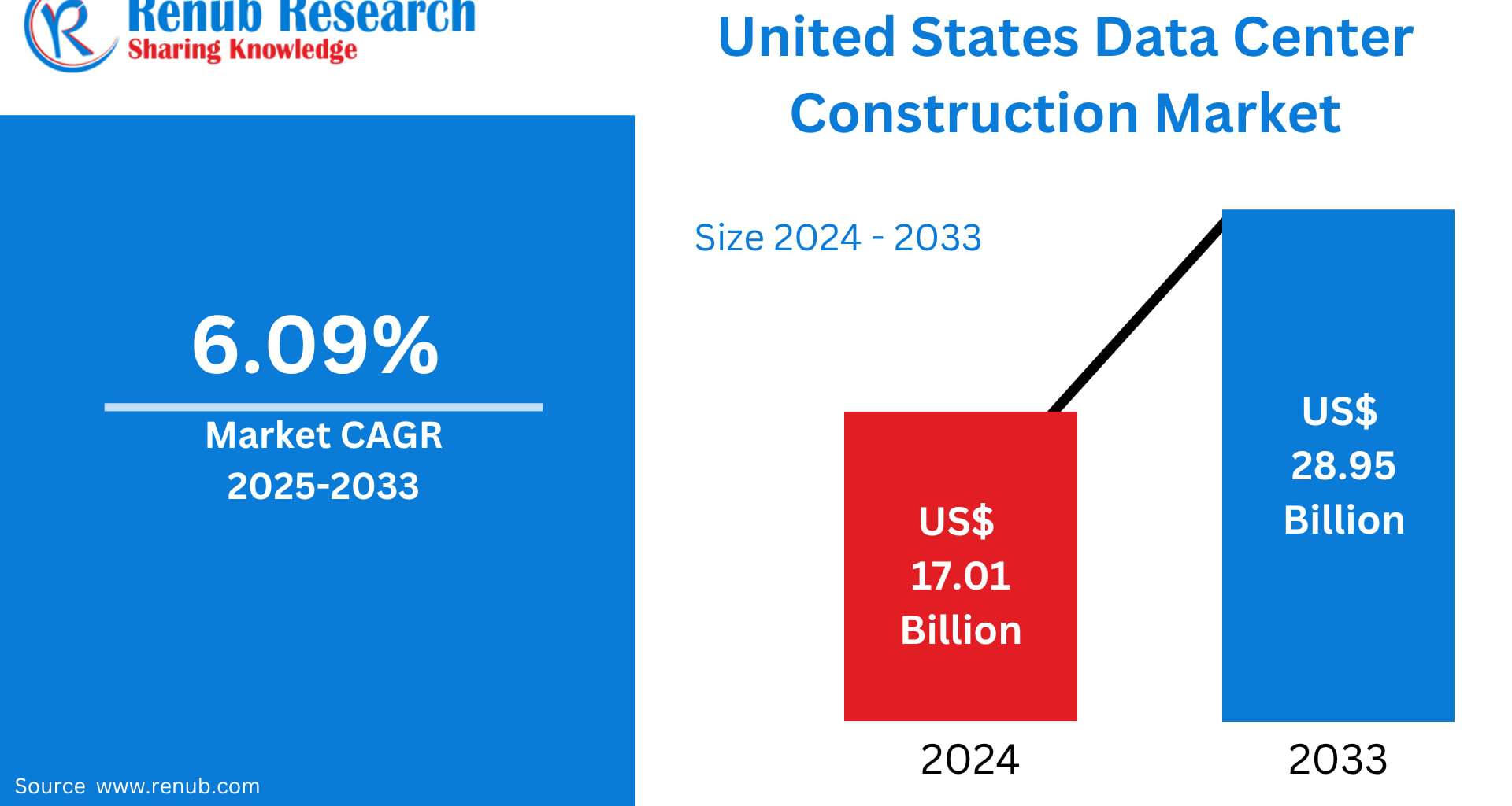

The United States Data Center Construction Market is entering an unprecedented phase of expansion, powered by the rapid shift toward cloud computing, artificial intelligence, IoT, and digital-first business operations. According to Renub Research, the market is projected to reach US$ 28.95 billion by 2033, rising from US$ 17.01 billion in 2024, at a CAGR of 6.09% during 2025–2033. As enterprises, hyperscalers, and governments accelerate investments in high-capacity digital infrastructure, the U.S. continues to dominate global data center construction with its technology clusters, advanced engineering expertise, and strong ecosystem of cloud service providers.

Today, data centers form the foundation of digital America—enabling everything from smart cities and 5G networks to AI-powered applications and real-time financial systems. This decade marks a historical transition: the U.S. is no longer just adopting digital systems—it’s building a massive, AI-driven infrastructure layer that will define global competitiveness for years to come.

United States Data Center Construction Industry Overview

The U.S. data center construction market is being reshaped by surging cloud demand, big data integration, remote work proliferation, and the explosive development of AI and machine learning. Companies across every industry—finance, healthcare, government, retail, and manufacturing—are pushing to expand digital capacity, prompting hyperscalers like Amazon Web Services, Microsoft Azure, and Google Cloud to invest in larger, more energy-efficient infrastructure.

The growing need for low-latency processing, high-density servers, and hyper-scalable environments has intensified collaboration between technology firms, engineering companies, construction giants, and energy solution providers. Modern data centers are now built with:

High-performance computing (HPC) capabilities

Renewable-powered systems

Liquid and free-air cooling

Modular and prefabricated designs

AI-driven energy management

Sustainability is becoming a defining feature. Operators increasingly adopt green building standards, solar and wind energy, and innovative cooling methods to comply with environmental benchmarks and control rising energy costs.

The rise of modular data centers—which allow quicker deployment and reduced on-site labor—is transforming how enterprises expand capacity, particularly in remote and edge locations.

Key Factors Driving Market Growth

1. Explosive Cloud Dependency & Surging Data Consumption

The U.S. is witnessing record-breaking data usage. According to the CTIA Wireless Industry Survey (2024), wireless networks processed 100.1 trillion MB of data in 2023, up 89% since 2021. This exponential rise demands more storage, computing power, and secure data routing—directly intensifying data center construction across the country.

The transition to hybrid and multi-cloud environments among enterprises is another major catalyst. As businesses migrate mission-critical workloads to the cloud, they require:

Advanced colocation facilities

Scalable cloud data centers

Secure, high-capacity server farms

This demand will continue to climb as cloud-native applications dominate every sector.

2. Industry Investments, Remote Work Surge & Sustainability Push

The U.S. is experiencing a wave of remote and hybrid work adoption. Approximately:

22 million Americans now work remotely full-time

68% of tech workers operate off-site

This demands resilient cloud infrastructure and real-time collaboration systems.

Meanwhile, sustainability is shaping construction strategies. Data center operators increasingly adopt renewable energy solutions, precision cooling, and carbon-reduction technologies. Federal and state-level incentives encourage:

Energy-efficient facilities

Reduced-emission equipment

Water-efficient cooling

Renewable-powered systems

This shift is accelerating investment in future-ready, sustainable data centers.

3. The Rise of AI, IoT, Machine Learning & 5G Connectivity

Perhaps the greatest growth driver is the U.S. race to dominate artificial intelligence infrastructure. AI demands enormous computing power. This reality has triggered some of the largest investments in digital infrastructure in American history.

In January 2025, OpenAI, Oracle, and SoftBank announced an AI megaproject called Stargate—a US$100 billion venture (potentially expanding to US$500 billion) to build 10 next-generation data centers across the U.S. Each will span 500,000 sq ft, purpose-built for AI workloads.

Additionally:

The explosion of IoT devices

National 5G expansion

Growth of edge computing

…require real-time processing hubs closer to end users. This is pushing companies to build decentralized micro-data centers nationwide.

Challenges Facing the U.S. Data Center Construction Market

1. High Capital & Operational Costs

Data center construction is capital-intensive. Modern facilities include:

Sophisticated cooling

Power distribution units

Cyber-secure environments

Redundant power systems

Fire suppression and monitoring systems

Combined with high energy consumption and skilled labor shortages, operational expenses also rise. Smaller companies struggle to compete with hyperscalers who command large financing and low-cost power agreements.

2. Complex Regulatory & Compliance Frameworks

Data center developers must navigate:

State renewable mandates

Federal cybersecurity standards

Zoning and land-use regulations

Environmental impact assessments

States like California impose some of the strictest energy-efficiency standards. Permitting delays and compliance costs can significantly extend project timelines. Ensuring privacy and infrastructure security requires substantial investments, adding to the financial burden.

United States Data Center Construction Market Overview by States

California

California remains the U.S. epicenter for data center construction thanks to:

Silicon Valley’s technology ecosystem

Strong connectivity infrastructure

High concentration of hyperscale cloud providers

The state incentivizes sustainable practices, including renewable energy usage and energy-efficient cooling. However, challenges such as high land prices, energy constraints, and strict regulatory rules slow down expansion. Yet, innovation in modular construction and cooling methods keeps California at the forefront of digital infrastructure development.

Texas

Texas is one of the fastest-growing hubs due to:

Business-friendly tax policies

Affordable land

Strong energy availability

Central U.S. connectivity

Dallas-Fort Worth, Houston, and Austin lead expansion. While grid reliability and extreme weather events pose concerns, renewable-integrated designs and government-backed technology investments continue fueling growth. Texas is emerging as a preferred destination for hyperscale deployments.

New York

New York’s dominance as a global financial center fuels high demand for secure, high-capacity data centers. Enterprises in finance, media, and professional services require resilient digital infrastructure and low-latency connectivity.

Challenges include:

High real estate costs

Regulatory complexity

Energy constraints

Despite these factors, New York remains a crucial strategic location due to its East Coast connectivity and its role in global financial systems.

Florida

Florida is rapidly becoming a major player due to:

Strategic position connecting Latin America

Rising digital adoption

Attractive tax incentives

Miami and Orlando lead new investments. However, hurricane exposure and humidity create design challenges—leading to innovations in disaster-resilient infrastructure and robust backup systems. With growing enterprise demand and strong regional connectivity, Florida’s role continues to expand.

Recent Developments in the U.S. Data Center Construction Market

June 2025 – Sika launched next-gen construction solutions aimed at supporting a global investment pipeline of CHF 400 billion by 2028, focusing on sustainability, cooling efficiency, and high-performance infrastructure.

June 2025 – Amazon announced a US$10 billion expansion of its North Carolina data center campus as part of a larger US$100 billion AI-focused capital plan, adding 20 buildings and 500 jobs.

January 2025 – EDGNEX Data Centers by DAMAC unveiled a US$20 billion expansion targeting 2,000MW capacity across the U.S., particularly to support hyperscalers and AI-driven applications.

Market Segmentations

By Tier Type

Tier 1

Tier 2

Tier 3

Tier 4

By Infrastructure

IT Infrastructure

Miscellaneous Infrastructure

Power, Distribution & Cooling (PD&C)

By Vertical

IT & Telecom

BFSI

Healthcare

Government & Defense

Energy

Others

By States

All major U.S. states covered, including:

California, Texas, New York, Florida, Illinois, Ohio, Pennsylvania, Georgia, North Carolina, Virginia, Washington, New Jersey, and others.

Key Players Covered

AECOM

Whiting-Turner Contracting Company

Turner Construction Co.

Jacobs Solutions Inc.

DPR Construction

Skanska USA

Balfour Beatty US

Hensel Phelps

Company Overview & SWOT Insights (Summary)

AECOM

Strengths: Global engineering expertise, large-scale project execution

Weaknesses: High project costs

Opportunities: Growing hyperscale and green construction demand

Threats: Rising competition from modular solution providers

Jacobs Solutions Inc.

Strengths: Strong technology consulting and engineering integration

Opportunities: AI and HPC-focused facility design

Threats: Complex regulatory pressures in key states

DPR Construction

Strengths: Leader in modular data center buildouts

Opportunities: Expansion in Texas and Virginia

Threats: Supply chain volatility

Turner Construction

Strengths: Strong project portfolio and innovation in cooling systems

Opportunities: Increasing investment from public and private cloud operators

Final Thoughts

The United States is entering a transformative era in data center infrastructure. With AI, IoT, 5G, and cloud computing defining the future of business and government operations, the nation is witnessing one of the largest construction booms in digital infrastructure history. Backed by billions in public and private investments, ambitious hyperscale expansions, and a strong push toward sustainable design, the U.S. data center construction market will play a pivotal role in shaping the global digital economy through 2033.

As enterprises chase computational power and low-latency environments, and as AI demands modernized, energy-efficient facilities, the U.S. stands at the forefront of next-generation digital transformation—building the backbone of the technologically advanced economy that lies ahead.