- Wondering if Comfort Systems USA is currently trading at a bargain or getting too pricey? You’re not alone. With the stock attracting plenty of investor attention, it’s worth digging into what really drives its value.

- The stock has surged 128.0% year-to-date and boasts an impressive 98.8% gain over the past year, signaling strong growth momentum and perhaps shifting risk perceptions on Wall Street.

- Recent announcements about large-scale project wins and a surge in demand for energy-efficient building solutions have sparked renewed optimism. These developments add important context to the stock’s recent price run and have many investors reevaluating their long-term expectations.

- Comfort Systems USA currently lands a valuation score of 4 out of 6, reflecting solid, but not perfect, undervaluation across our key checks. Next, we break down exactly how we arrive at that score and discuss a way to spot value before the broader market takes notice.

Approach 1: Comfort Systems USA Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to today’s dollars. This method gives investors a way to assess what a business is truly worth based on expected cash generation, rather than just market sentiment or headline numbers.

According to the latest data, Comfort Systems USA currently generates a Free Cash Flow of $798.7 Million. Analyst estimates suggest notable growth over the next five years, with FCF projected to reach $2.415 Billion by 2029. After this period, Simply Wall St continues projections further out. However, the confidence in these forecasts typically declines beyond the analyst consensus range. All cash flows are calculated in USD for consistency.

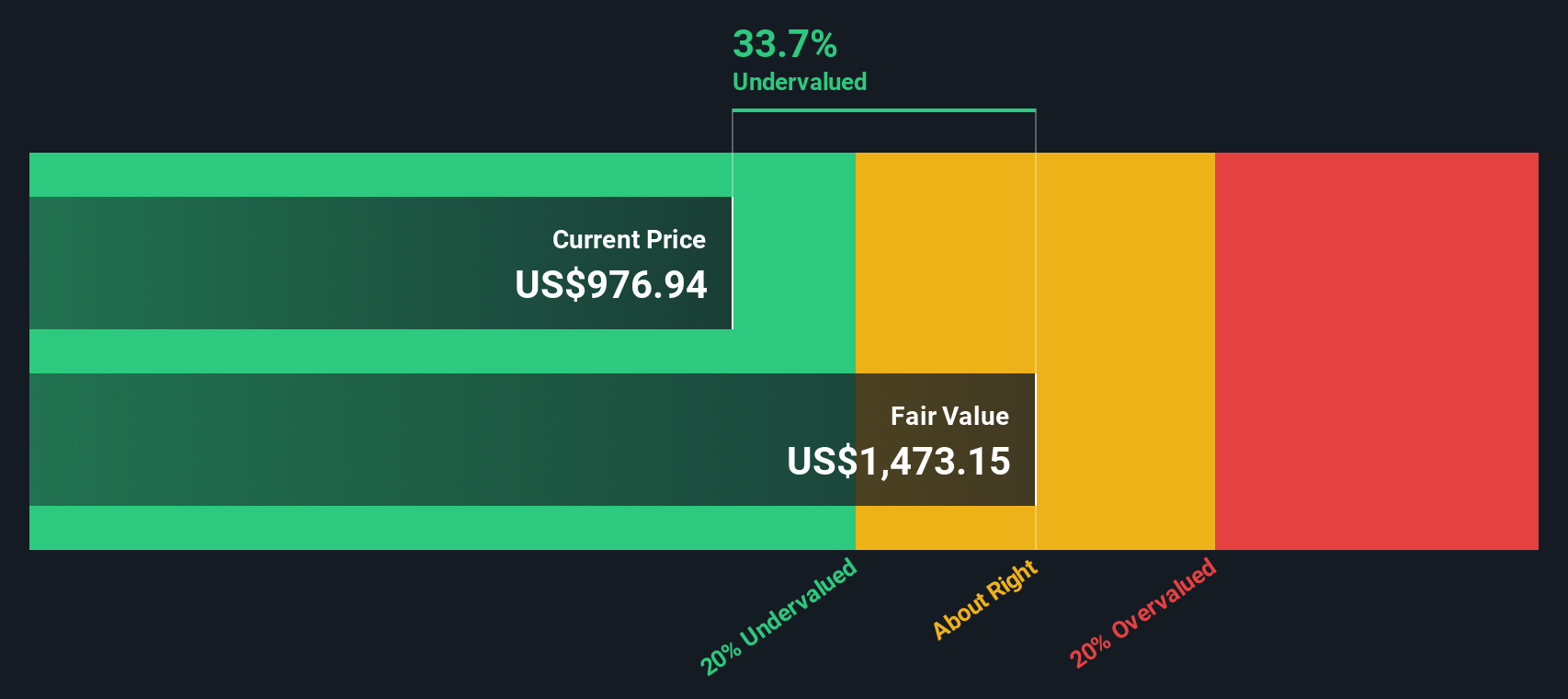

Using the 2 Stage Free Cash Flow to Equity DCF model, the intrinsic value for Comfort Systems USA is estimated at $1,473.15 per share based on these forward-looking cash flows. With this approach, the analysis shows the stock trading at a 33.7% discount compared to its intrinsic value, which may indicate significant undervaluation at current market prices.

If DCF assumptions hold true, Comfort Systems USA shares may present one of the more appealing value opportunities in the sector at this time.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Comfort Systems USA is undervalued by 33.7%. Track this in your watchlist or portfolio, or discover 919 more undervalued stocks based on cash flows.

FIX Discounted Cash Flow as at Nov 2025

FIX Discounted Cash Flow as at Nov 2025

Approach 2: Comfort Systems USA Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is widely regarded as a go-to metric for valuing profitable companies, as it directly compares a company’s market value to its actual earnings. This allows investors to gauge how much they are paying for every dollar of profit the business generates.

Growth expectations and perceived risks play a big role in determining what a “fair” PE ratio should be. Companies with higher growth prospects or lower risk profiles typically command higher PE multiples because investors are willing to pay more for future profits. Conversely, slower-growing or riskier firms tend to trade at lower multiples.

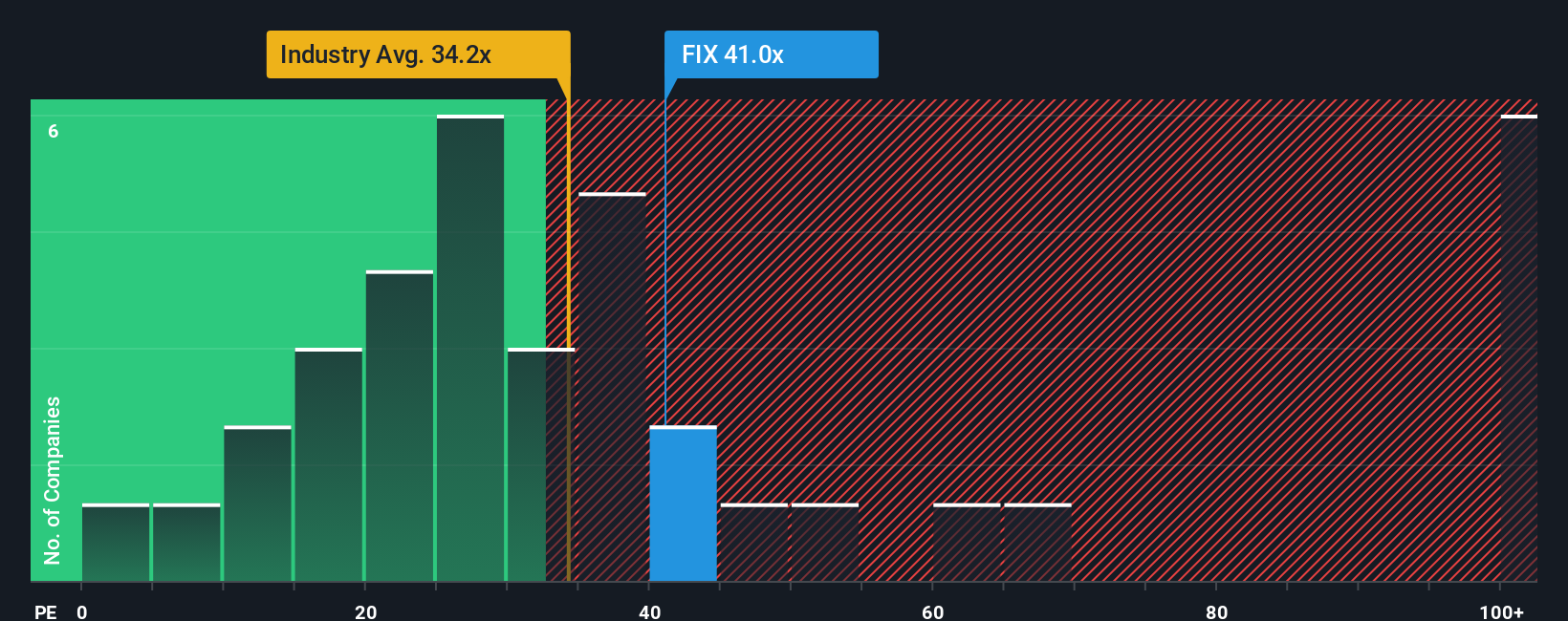

Comfort Systems USA currently trades at a PE ratio of 41.05x. This is above the Construction industry average of 34.15x but below its immediate peer group average of 62.02x. Simply Wall St’s proprietary “Fair Ratio” for Comfort Systems USA is 46.77x. This figure reflects a balanced assessment of the company’s earnings growth, profit margins, scale, industry position, and perceived business risks.

The Fair Ratio is especially useful because it moves beyond simple comparisons to peers or sector averages. It integrates a holistic view of the company’s unique characteristics, ensuring that the valuation is adjusted for factors like growth and financial stability. This makes it more relevant to Comfort Systems USA’s actual performance than broad benchmarks.

Comparing the current PE of 41.05x to the Fair Ratio of 46.77x suggests the stock remains undervalued on this basis, with room to potentially rerate higher if growth and profitability continue to meet expectations.

Result: UNDERVALUED

NYSE:FIX PE Ratio as at Nov 2025

NYSE:FIX PE Ratio as at Nov 2025

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1439 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Comfort Systems USA Narrative

Earlier we mentioned that there’s an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your unique story and outlook on a company, making it easy to link what you believe about Comfort Systems USA’s business, from project backlogs and industry shifts to future profit margins, to your own revenue or earnings forecasts and an estimated fair value.

Unlike static metrics, Narratives put you in control by letting you connect your ideas and expectations with the numbers. This helps you see instantly if the stock price aligns with your view of fair value. The magic of Narratives is that they are dynamic: as new news or earnings reports come out, your forecast and fair value automatically update, so your investment thesis always reflects the latest developments.

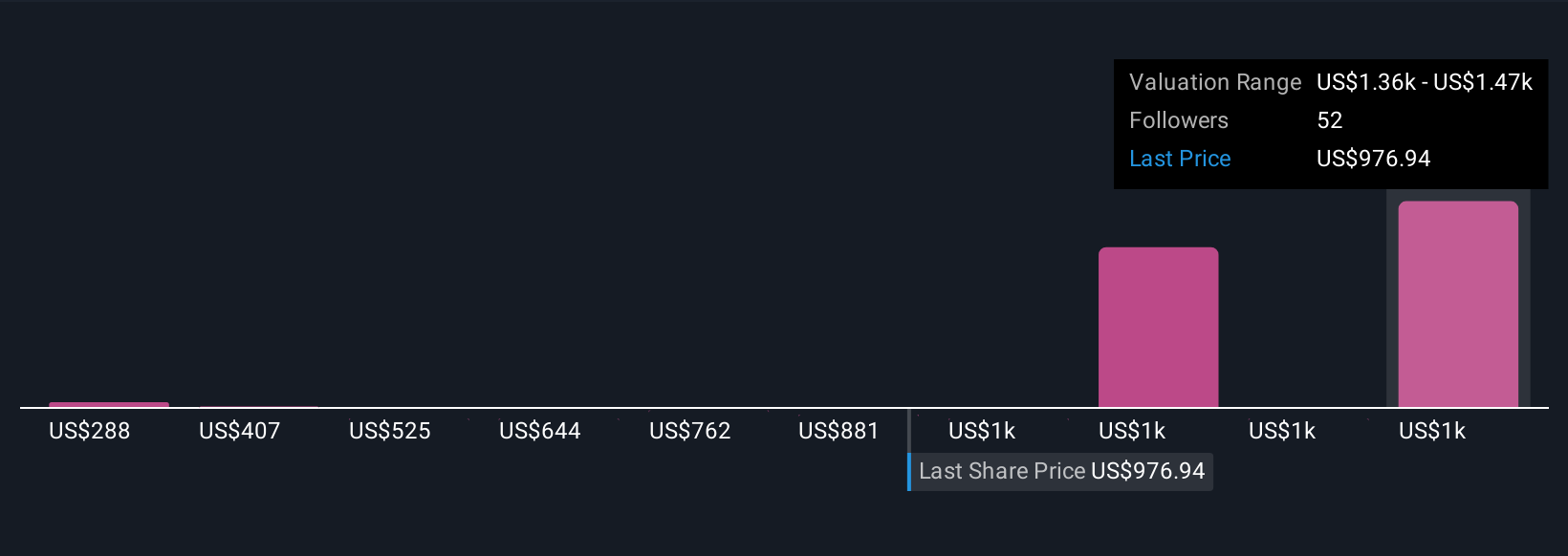

On Simply Wall St’s Community page, millions of investors are already using Narratives to track their thinking and spot the best moments to buy or sell, whether they are bullish based on record project backlogs or more cautious due to sector risk and cost pressures. For example, the highest user narrative for Comfort Systems USA forecasts robust growth and fair value above $1,130, while the lowest takes a more reserved outlook, valuing the company much lower based on margin pressures or cyclical risks.

This approach empowers you to make smarter, more personalized investment decisions, knowing exactly why you are buying, holding, or selling.

Do you think there’s more to the story for Comfort Systems USA? Head over to our Community to see what others are saying!

NYSE:FIX Community Fair Values as at Nov 2025

NYSE:FIX Community Fair Values as at Nov 2025

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com