- Wondering if USA Rare Earth is a hidden value gem or just another materials stock trading on hype? You are not alone, as many investors are looking closely at the company’s recent run.

- After gaining 9.9% in the last week but still down 31.7% over the past month, USA Rare Earth’s stock price has seen some dramatic swings. Both growth potential and risk remain top of mind for investors.

- Recent headlines spotlight the company’s strategic moves in securing domestic supply chains, as well as policy shifts that have drawn attention to rare earths and their critical role in tech and defense production. These factors have contributed to the stock’s volatility and have piqued interest across the market.

- Currently, USA Rare Earth scores a 2 out of 6 on our valuation checks, suggesting there is room for improvement compared to peers. Next, we will break down which valuation methods matter most. Stick around, because the best way to size up value might surprise you at the end of this article.

USA Rare Earth scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: USA Rare Earth Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and then discounting them back to their present value. The goal is to determine what those future dollars are worth today, based on reasonable expectations for growth and risk.

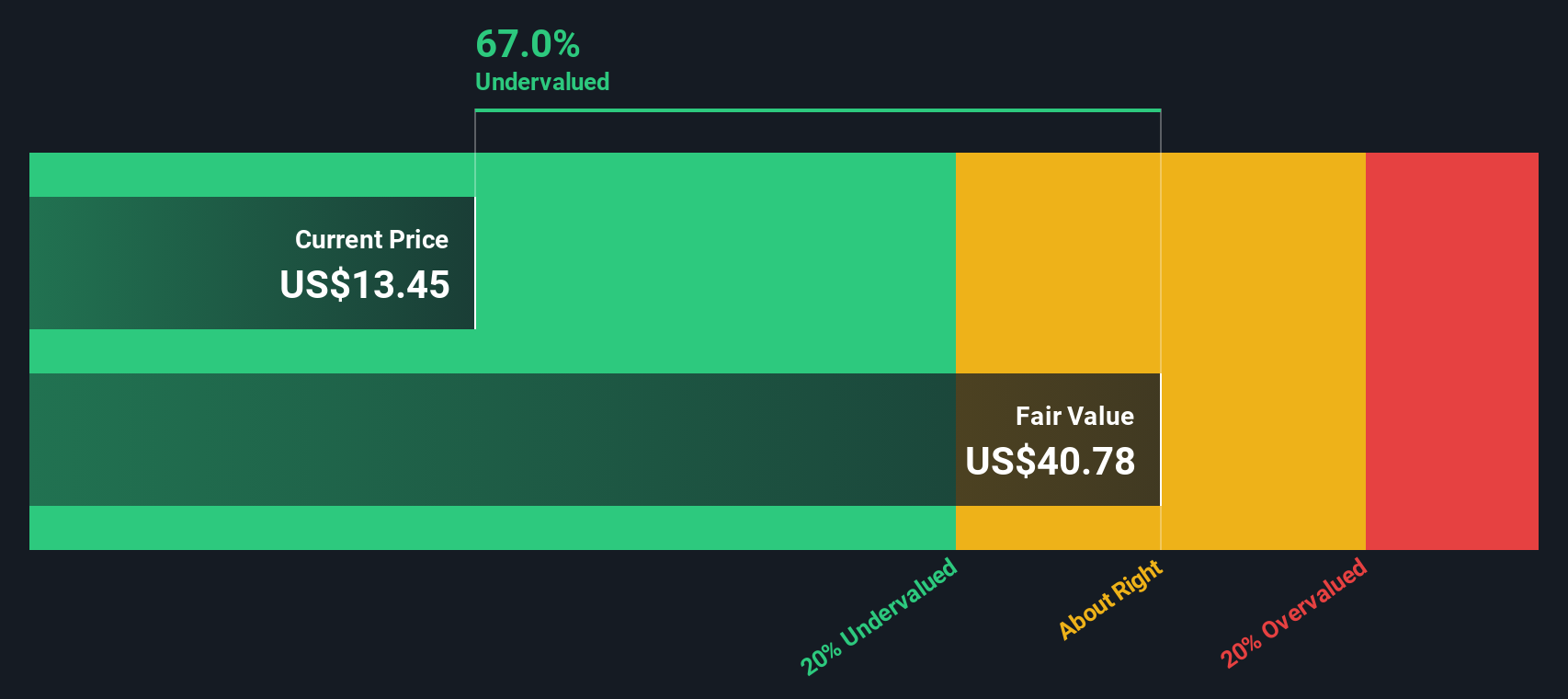

For USA Rare Earth, the company’s latest trailing twelve month Free Cash Flow (FCF) stands at a negative $39.0 million, highlighting its current investment phase. Analyst forecasts expect FCF to turn positive and rise sharply, with projections reaching $124.8 million by the end of 2029 and a further $438.5 million by 2035 (projected by Simply Wall St). This substantial swing from negative to strong positive cash flows forms the basis for the DCF valuation.

Using the 2 Stage Free Cash Flow to Equity model, the DCF methodology values USA Rare Earth at an intrinsic fair value of $40.78 per share. This valuation implies that the stock is currently trading at a 67.0% discount to its fair value, signaling strong undervaluation based on future cash flow potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests USA Rare Earth is undervalued by 67.0%. Track this in your watchlist or portfolio, or discover 914 more undervalued stocks based on cash flows.

USAR Discounted Cash Flow as at Nov 2025

USAR Discounted Cash Flow as at Nov 2025

Approach 2: USA Rare Earth Price vs Book

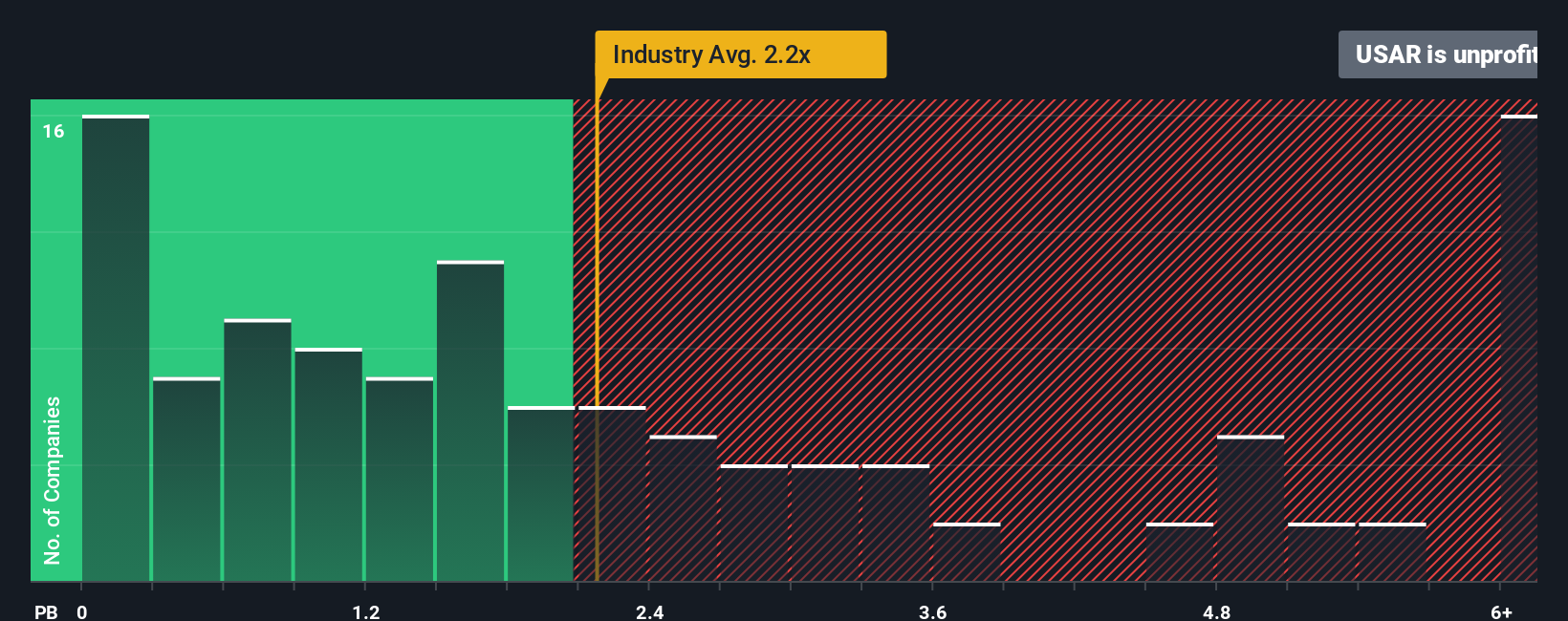

For many profitable companies, the Price-to-Book (P/B) ratio is a popular valuation tool that highlights how much investors are willing to pay for each dollar of net assets. This metric is especially relevant in capital-intensive industries like mining, where tangible assets are a significant driver of value. The P/B ratio allows investors to assess whether the company is trading below or above the true worth of its assets.

Market expectations for growth and risk play a big part in shaping what is considered a “normal” or “fair” P/B ratio. Companies with high growth prospects or lower perceived risk generally command higher multiples, while those with less favorable outlooks or greater risk trade at a discount.

USA Rare Earth currently trades at a Price-to-Book ratio of -29.46x, which is not only negative, but starkly contrasts the Metals and Mining industry average of 2.17x, and the peer average of 6.52x. A negative P/B ratio signals the market values the business below its stated net assets, usually due to ongoing losses or concerns about future profitability.

Simply Wall St’s “Fair Ratio” is designed to provide a more nuanced benchmark than simply using industry or peer averages. This proprietary measure accounts for USA Rare Earth’s specific growth projections, profit margins, risk profile, and market capitalization. It offers a tailored assessment of fair value for this stock.

Comparing the Fair Ratio to the company’s actual P/B multiple tells us more than just how it stacks up to industry peers. In the case of USA Rare Earth, since its P/B is significantly below both the peer and fair value benchmarks, this deep discount underscores potential undervaluation. However, large negative ratios often point to operational risks and investor skepticism, so caution is warranted.

Result: UNDERVALUED

NasdaqGM:USAR PB Ratio as at Nov 2025

NasdaqGM:USAR PB Ratio as at Nov 2025

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1437 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your USA Rare Earth Narrative

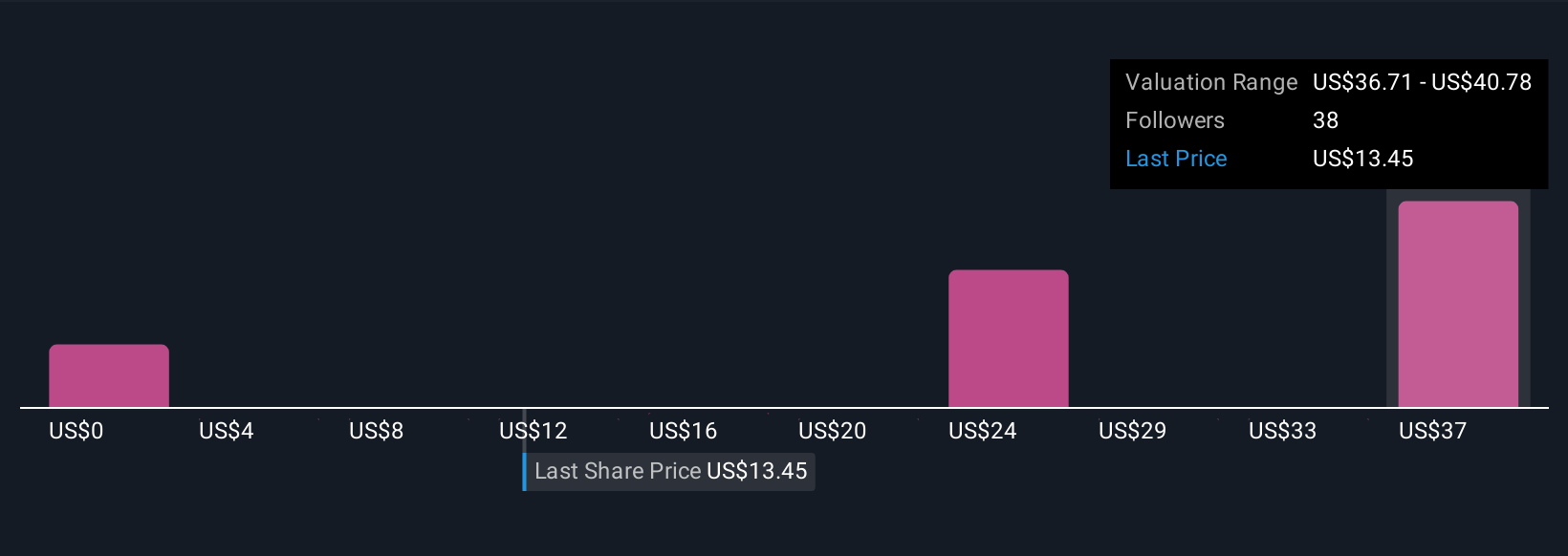

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. Narratives are a simple yet powerful tool that lets you tell your story behind a company’s numbers by setting your own assumptions on future revenue, margins, and fair value. Instead of relying solely on traditional ratios or forecasts, you connect the company’s business story with real financial expectations, shaping a personalized view of what the business is truly worth.

Available right now on Simply Wall St’s Community page, Narratives make it easy for millions of investors to map out their investment ideas and instantly see how their story compares to the current stock price. They also help you decide between different options by comparing your Fair Value with today’s market price. Narratives update automatically when new information arrives, so your perspective stays relevant as the market changes.

For example, one USA Rare Earth Narrative might see fair value above $50 based on aggressive growth, while another pegs it closer to $20 using more conservative assumptions. This gives you the flexibility to choose the story and numbers that fit your view.

Do you think there’s more to the story for USA Rare Earth? Head over to our Community to see what others are saying!

NasdaqGM:USAR Community Fair Values as at Nov 2025

NasdaqGM:USAR Community Fair Values as at Nov 2025

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com