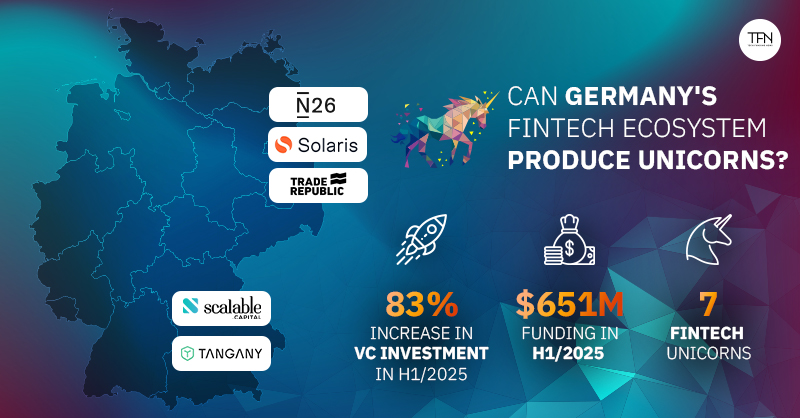

After a challenging year in 2024, the German fintech market showed clear signs of recovery in the first half of 2025. According to the KPMG report, Pulse of Fintech H1/2025, financing rounds totalling $651M were completed in Germany in H1 2025, a 44% decline from H2 2024.

Anna Bosch, Principal at b2b ventures, tells TFN, “2024 marked a turning point, with fintech revenues growing 21% year-over-year and EBITDA margins of public fintechs rising by 25%. Notably, 69% of public fintechs are now profitable, up from less than half in 2023.”

Alexander Emeshev, co-founder at Vivid Money, adds, “Funding clearly slowed in the second half of 2024. The mix of weak markets and political uncertainty ahead of the 2025 elections made investors more cautious. After the elections, confidence returned, but investors remained selective. The focus has shifted from hype to health: Investors now back B2B Fintechs with strong fundamentals, clear path to profitability, and impact technologies like AI and defence.”

As Richard Würl of Redstone VC notes, “It is definitely a mature ecosystem. Several companies are preparing for IPOs, including Trade Republic, Raisin, Scalable, and SumUp, with profitable business models. A promising group of Scaleups, including Finanzguru, Pliant, Liqid, Upvest, Banxware, and Taktile. And various early-stage fintechs innovating along the entire value chain of financial services.”

Indeed, fintech companies now lead with sustainable, profitable models, and are rumoured to be plotting IPOs. In fact, Scalable Capital’s recent €155 million round, the country’s largest in 2025, signals that German scale-ups can draw global capital and top-tier backers.

The timing of this maturation is notable. Gustas Germanavičius, CEO of InRento, Europe’s largest buy-to-let crowdfunding platform, observes that investor appetite has shifted cyclically: “Yes, the volumes always grow in the second half of the year, this is mainly due to the reason that, during H1, investors and consumers are more focused on administrative tasks such as tax reporting or, in the case of entities, annual accounts and audits. In the second half of the year, people have a better understanding of their finances, and they are more eager to place investments.”

The scale-up gap: Why unicorns are scarce

The same KPMG report shows that VC investments increased by 83 % compared to the previous six months. Corporate venture capital, i.e., investments by companies in start-ups, is developing particularly dynamically: it has almost tripled to $451 million.

Yet, essential questions remain: does the market have the ambition, capital, and policy alignment to mint breakout global unicorns at the pace of the UK or France? Or does the ecosystem risk stall just shy of greatness?

Sebastian Schäfer, CEO of House of Finance and Tech, Berlin’s central hub for Fintech and Banking, explains to TFN, “The real challenge for Germany isn’t a bubble – it’s that we’re missing the large-ticket deals in the €20 to €50 million range. We have fantastic seed activity, but we struggle to scale into the mega-growth rounds that UK and French fintechs are closing. So it’s a maturation process. The companies that survive will be profitable, sustainable businesses.”

Yet this gap is closing. “We look for winners irrespective of the geography and strongly believe Europe can produce global leaders,” says Kaushik Subramanian, Partner at EQT Ventures, whose firm recently backed Berlin-based Payrails.

Regulatory paradox and talent flywheel

Germany’s rigid regulatory frameworks are often described as both a barrier and a moat. As Miriam Wohlfart, Founder & co-CEO at Banxware, observes, even as banks still hold a strong position, “banks are realising they cannot build everything by themselves — they’re just too slow. If you look at the evolving technology, two and a half years ago, nobody knew ChatGPT. For big banks, they don’t have the speed anymore to adapt to new technology.”

She predicts, “We will see a lot more cooperation between banks and fintechs in the future,” with the latter focusing on customer-facing innovation.

In a conversation with TFN, Barbod Namini, General Partner at HV Capital, notes, “More often than not, fintech companies require a substantial front-loaded investment. This is so they can operate in a strongly regulated environment that leaves little room for error. The companies that make it past the initial phase tend to build a substantial moat and have very sticky and profitable customer bases.”

Securing a BaFin license, as Trade Republic did in 2025, now signals operational resilience and opens doors for cross-border growth. “The regulatory environment is quite restrictive, and we need to remove the barriers that prevent companies from scaling…The creation of a single pan-European entity (such as EU-Inc, which is currently being proposed) would be a huge tailwind in ensuring not only the success of German but also the success of the European tech ecosystem in general,” adds Subramanian.

Crucially, Germany’s unique assets lie in its technical talent, operator quality, and a savings-rich, digitally engaged population. Bosch highlights vertical winners like SumUp, which serves small merchants globally, and Nelly, a Klarna-founded fintech now powering healthcare platforms across Europe. Payrails and the region’s agentic AI pioneers, in Bosch’s words, “are already seeing the impact: from improved KYC and automation to higher margins and better customer outcomes.”

Any signs of a unicorn surge in 2026?

There are real signs that 2025 and 2026 could see a unicorn wave. “The ecosystem is maturing fast. We’re past the hype cycle. Founders are sharper, capital is smarter, and 2025 will reward real products with real economics, not just good slides,” Emeshev says. Corporate and growth VC activity is surging, and mega-scale rounds are becoming more routine.

“The past few years have separated hype from substance. What’s left are founders who truly understand both finance and technology, and that’s where we’re doubling down,” reflects Michael Hock of Motive Ventures. But as Schäfer cautions: “Efficiency doesn’t create unicorns. We need more ambition – and the capital to fund it.”

Carolin Wais, Partner at Plug and Play, states, “Looking ahead, we are particularly bullish on WealthTech. Demographic shifts, generational wealth transfer, and the rise of alternative asset classes are creating a new wave of demand, and AI is enabling regulated distribution at scale. We expect the next generation of €1B+ European fintech successes to emerge from exactly these areas, and we are doubling down accordingly”

The bottom line

Germany’s fintech market is coming of age. It has shed excess, matured its talent base, and built a solid foundation of profitability. The challenge ahead is scaling, moving from efficient, well-run companies to ambitious category-defining unicorns. As Bosch puts it, “Future winners will need to show what the best fintechs already do: clear profitability paths, capital efficiency, and strategic focus.”

If 2025’s momentum holds, Germany could finally deliver a cohort of fintech unicorns worthy of international acclaim. The stage is set, and the outcome now rests on whether Germany can match ambition with opportunity, and scale with vision.

Wohlfarth concludes, “It’s a big ride, but the ecosystem is stronger for having weathered tough years, and fintechs that keep innovating, especially in embedded finance and UX, will shape the next wave”