By Cara Hene, News Digital Editor

We were confused too. So, we spoke to an expert and made a guide just for you.

Epigram recruited Dr Peter Spittal, an expert in labour and public economics at Bristol University, and Research Fellow at the Institute for Fiscal studies. Here’s how the 2025 Autumn budget will impact you, as a University of Bristol student:

1. Uber and Bolt to pay more VAT

You might have to forgo that late-night Uber home from City Centre.

£3 could be added onto a £12 Uber fare, according to The Sun | Epigram / Ellen Reynolds

£3 could be added onto a £12 Uber fare, according to The Sun | Epigram / Ellen Reynolds

From January 2026, Uber and Bolt will be charged 20% VAT on the full trip fare, rather than just the profit, no longer benefitting from a loophole intended for tour operators.

Due to specific regulations in the capital, this may impact taxis in London more than in Bristol. Either way, this will mean more expensive Uber rides across the country.

But hey, maybe you’ll get the Bristol bum out of it.

2. Student loan repayment threshold frozen

The salary threshold of £29,385, (the point at which you’ll start paying back your student loan) has been frozen for three years.

This applies to you if your course started between September 2012 and July 2023.

Because wages tend to rise over time, your student loan will now start coming out of your pay sooner, effectively reducing your pay.

In effect, this raises the cost much more for degrees that graduates have not tended to pay back, such as communications, psychology, and design.

3. Minimum wage increase

This is huge news for university students.

The government has increased the minimum wage significantly compared to previous British governments.

From April 2026, the minimum wage for 18-20 year-olds will rise from £10.00 to £10.85 per hour. That’s a 8.5% increase – we’d generally expect a 5-6% rise.

Part-time hospitality jobs are common for students | Epigram / Sophie Maclaren

Over-21s will get 50p more, a 4.1% increase to £12.71 per hour.

This is really important for students; in July, Bristol SU found 35% of University of Bristol students had skipped classes for part-time work.

From next year, you’ll be able to work less for the same amount of money, meaning more time for studying or seeing mates.

4. Income tax thresholds frozen

Income tax rates did not rise.

Instead, the Chancellor froze income tax thresholds until 2030-31, three years longer than originally planned.

Again, on average, wages tend to rise over time. Therefore, more people will be pushed into a higher tax bracket when they get a pay rise.

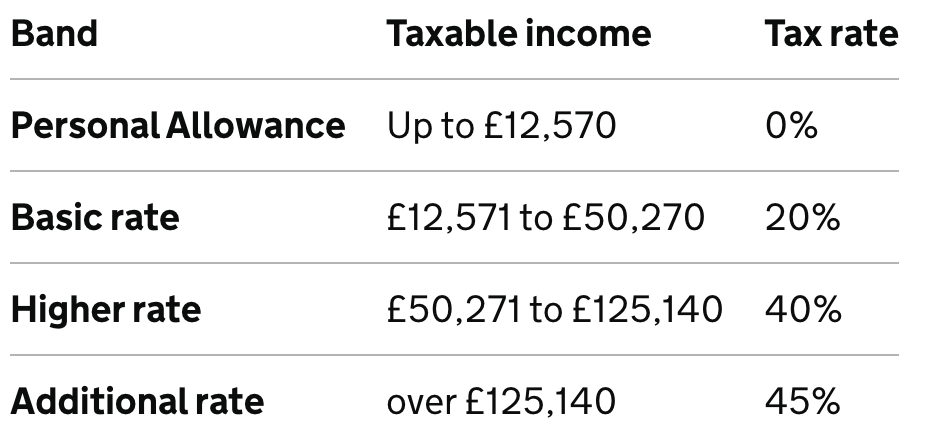

These income tax brackets for England will remain unchanged | ‘Income Tax rates and Personal Allowances’, Gov.uk

These income tax brackets for England will remain unchanged | ‘Income Tax rates and Personal Allowances’, Gov.uk

This will especially impact recent graduates, who are relatively high earners at the start of their career.

5. Rail fares frozen

This is great news if you take the train to get home from Bristol to a major city in England.

A 2024 University of Bristol report found over half of students take the train or public transport to get to University | Epigram / Hannah Corcoran

A 2024 University of Bristol report found over half of students take the train or public transport to get to University | Epigram / Hannah Corcoran

For the first time in 30 years, ‘regulated’ rail prices in England won’t rise for two years, until March 2027.

This includes travel between major cities, season tickets, day singles and returns, and some flexible fares around urban centres. Last year, these fares were increased by 4.1%.

However, the freeze won’t apply to Scotland, Wales, or non-English rail operators such as ScotRail, which runs trains from Bristol to Edinburgh.

6. ‘Salary sacrifice’ pension contribution tax

A ‘salary sacrifice’ pension contribution is when some of your salary goes toward your pension. Previously, this was beneficial because you didn’t have to pay a National Insurance Contribution, or NIC (a type of tax).

Now, from April 2029, only the first £2000 of your contribution will be tax free. Both you and your employer will have to pay NIC on anything more.

33% of private sector and 9% of public sector employees currently use this contribution scheme | Epigram / Sophie Maclaren

This will come out of your pay packet when you start work, particularly impacting young people who’ll be affected by this change far longer than their older colleagues.

Say you earn £34,000 straight out of university (the median graduate starting salary) and you want to put 10% of your salary towards your pension – that’s £3400.

Now, you’ll need to pay employee NIC on £1400 of that £3400 contribution. Your NIC rate will be 8% because you earn between £24,000 and £49,000.

8% of £1400 is £112. Therefore, you’ll be £112 out of pocket.

Before this budget, this number would have been £0.

7. The ‘latte tax’

Don’t worry! You won’t have to pay more for your Mocha Mocha vanilla oat latte.

The sugar tax is now being extended to pre-packaged ‘milky drinks’, which will include lattes, protein shakes, and even sweetened plant-based milks.

The sugar tax was originally introduced in 2018 to tackle child obesity | Epigram / Ellen Reynolds

The sugar tax was originally introduced in 2018 to tackle child obesity | Epigram / Ellen Reynolds

This won’t apply to lattes in cafés (thank god), but you’ll have to pay a bit more in supermarkets, or they might taste less sweet.

8. Maintenance grants re-introduced

A levy on international students will fund maintenance grants from 2028-29 for university students from low-income backgrounds on ‘high priority’ courses.

It’s currently unclear which courses will count as ‘high priority‘ | Epigram / Sophie Maclaren

If your parents earn £25,000 or less, you’ll get £1,000 in first and second year, and £750 in third year.

If your parents earn between £25,000 and £30,000 you’ll get between £500 and £1000 in first and second year, and between £375 and £750 in your third.

Altogether, maintenance grants funded by a levy on international students favours domestic students. It will make international students less financially attractive, and give money to disadvantaged home students.

9. International student levy

Universities in England will pay £945 for each international student from August 1 2028, which will fund the re-introduction of maintenance grants.

This will likely result in fewer international university students, and may ‘make things worse’ for universities already in a funding crisis, according to Spittal.

35% of University of Bristol students are international, according to 2023/24 figures | Epigram / Sophie Maclaren

However, forcing a move away from the international student model might put universities in England on a ‘more stable footing’ for the future, Dr Spittal says.

Featured imaged: Epigram / Sophie Maclaren

What do you think of the budget? Let us know! Email us on editor.epigram@gmail.com, or dm us on Instagram (@epigrampaper_)