United States Soup Market Overview

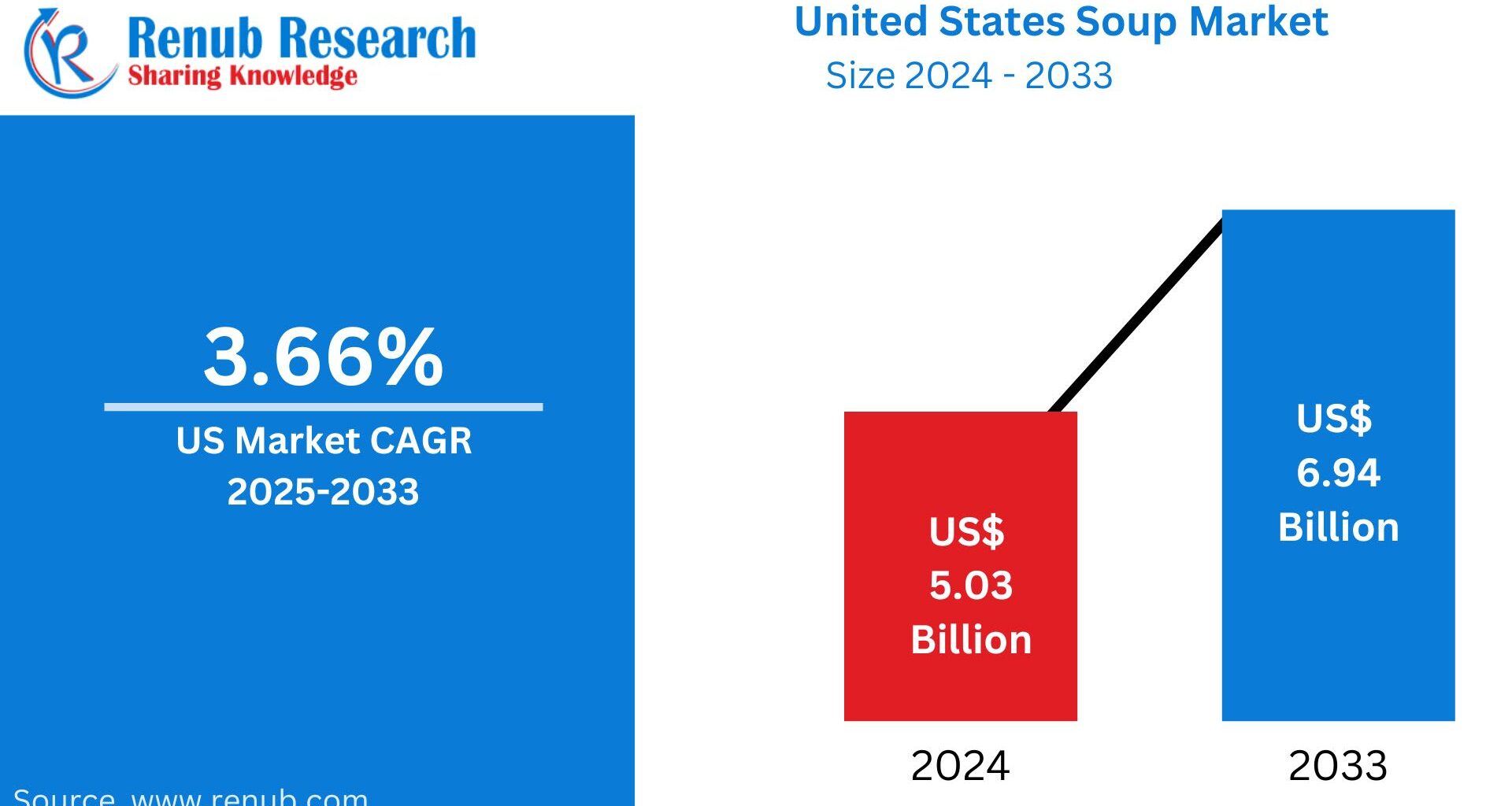

The United States soup market continues to be a resilient and evolving segment of the packaged and foodservice food industry, blending tradition with modern consumer demands. According to Renub Research, the U.S. soup market stood at approximately US$ 5.03 billion in 2024 and is forecast to reach around US$ 6.64 billion by 2033, expanding at a compound annual growth rate (CAGR) of 3.66% between 2025 and 2033.

The growing demand for convenient, nutritious, and ready-to-eat meals is a key factor supporting steady market growth. As consumers seek faster meal solutions without compromising health or taste, soup continues to maintain its relevance in both retail and foodservice channels.

Market Size and Growth Outlook

Renub Research estimates indicate that the United States soup market will witness consistent expansion through 2033. Growth is driven by:

Rising consumption of ready-to-eat and single-serve soups

Increasing demand for clean-label, organic, and low-sodium products

Expansion of plant-based and functional soup offerings

Greater penetration of soups through online retail and foodservice channels

Despite competition from alternative meal options such as meal kits and protein snacks, soup remains a preferred choice due to its versatility as a light meal, appetizer, or comfort food.

Key Drivers of Growth in the United States Soup Market

Rising Demand for Healthy and Convenient Meal Solutions

Modern American consumers are increasingly balancing busy schedules with health-conscious eating habits. This has accelerated demand for ready-to-eat (RTE) soups, microwaveable bowls, and portion-controlled packaging. These formats eliminate lengthy preparation while offering warmth, satiety, and perceived nutritional benefits.

Health-focused consumers are also pushing brands to reduce sodium levels, eliminate artificial preservatives, and use recognizable ingredients. Organic, gluten-free, and non-GMO soups are no longer niche offerings but have become mainstream in major grocery chains.

A notable example of innovation in this space occurred in December 2024, when Panera Bread introduced a limited-release holiday soup cup collection, featuring new seasonal offerings alongside established favorites. With more than 140 million servings served annually, such initiatives reflect how major players continue to invest in innovation to meet evolving consumer needs.

Growing Popularity of Premium and Functional Soups

The U.S. soup market is witnessing a shift away from basic canned varieties toward premium, gourmet, and functional soups. Consumers are increasingly willing to pay more for soups that deliver restaurant-quality taste and added health benefits.

Functional soups containing bone broth, collagen, protein, turmeric, ginger, and superfoods have gained strong traction, particularly among wellness-focused consumers. Additionally, global-inspired flavors—Thai coconut, Korean spicy broths, and Mediterranean vegetable blends—are expanding shelf appeal.

In January 2022, Zoup! expanded its portfolio with gourmet, shelf-stable soups under the “Good, Really Good®” brand, showcasing how premium positioning and convenience can coexist successfully.

Expansion of Plant-Based and Vegan Soup Options

The rapid growth of plant-based eating habits in the U.S. has significantly influenced soup innovation. Lentil, chickpea, bean-based, and vegetable-forward soups are now common across retail shelves and restaurant menus.

Dairy-free creamy soups and vegetable-based broths appeal to vegans, flexitarians, and lactose-intolerant consumers. Sustainability concerns further reinforce demand for soups made with ethically sourced ingredients and eco-friendly packaging.

In November 2024, Amy’s Kitchen, a leader in organic and natural foods, launched five new soups inspired by international cuisines and Southern comfort foods, all crafted using organic ingredients. Such launches highlight how plant-based soups are becoming a key growth engine for the overall market.

Challenges Facing the United States Soup Market

Declining Appeal of Traditional Canned Soups

Traditional canned soups face declining popularity, particularly among younger consumers who associate them with high sodium levels, preservatives, and artificial ingredients. While convenience remains a strength, perceptions around health have forced legacy brands to reformulate recipes, redesign packaging, and emphasize transparency.

Although canned soup continues to hold market share, growth has slowed compared to refrigerated, frozen, and fresh alternatives.

Competition from Alternative Meal Options

Soups now compete with a wide range of alternative meal solutions, including meal kits, ready-made salads, smoothies, and protein shakes. As consumers seek variety, soup brands must work harder to position products as complete, nutritious, and satisfying meals rather than side dishes.

This competitive landscape requires continuous innovation in flavors, formats, and nutritional profiles to maintain relevance.

United States Soup Market by Product Type

Ready-to-Eat (RTE) Wet Soups

RTE wet soups are among the fastest-growing segments in the market. Refrigerated and microwaveable soups offer a fresh, homemade taste while maintaining convenience. Brands such as Campbell’s Fresh Reserve and Panera Bread have capitalized on this trend with premium, clean-label offerings.

Advancements in packaging technology have extended shelf life without compromising quality, making RTE soups increasingly popular among urban and working consumers.

Dry Soup Market

Dry soups, including instant mixes and dehydrated varieties, remain popular due to their affordability, portability, and long shelf life. Technological advancements such as freeze-drying have improved flavor retention and nutritional value.

Health-conscious brands are now introducing organic and low-sodium dry soups, expanding their appeal beyond budget-focused consumers to wellness-oriented buyers.

Frozen and Refrigerated Soups

Frozen and refrigerated soups are gaining momentum as consumers seek minimally processed alternatives. These products are often perceived as healthier and closer to home-cooked meals. Frozen soups offer extended shelf life without preservatives, while refrigerated soups attract premium shoppers looking for freshness and flavor authenticity.

United States Soup Market by Distribution Channel

Food Service Channel

Soups play a vital role in restaurants, cafés, and quick-service establishments due to their versatility and profitability. Seasonal soups, locally inspired recipes, and rotating menus help foodservice operators attract repeat customers.

Convenience stores and gas stations are also expanding grab-and-go soup offerings, further supporting market growth.

Retail Channel

Retail remains the dominant distribution channel for soups in the U.S. Supermarkets are expanding shelf space for premium, refrigerated, and plant-based soups. Private-label offerings are gaining popularity, offering quality products at competitive prices.

E-commerce has also contributed to retail growth, enabling consumers to access specialty and international soups not always available in physical stores.

Regional Insights into the United States Soup Market

East United States

The Eastern U.S. exhibits strong soup demand, driven by colder climates and rich culinary traditions. New England clam chowder, lobster bisque, and Manhattan-style soups remain regional favorites. The area’s cultural diversity also fuels demand for international soup varieties.

West United States

Western states, particularly California, lead in demand for organic, vegan, and clean-label soups. Consumers favor fresh, refrigerated, and locally sourced products, with sustainability and transparency playing a major role in purchasing decisions.

North United States

The Northern U.S. records high soup consumption during long winter seasons. Hearty soups such as beef stew, chicken noodle, and split pea are widely preferred. Convenience-focused formats like frozen and RTE soups dominate this region.

United States Soup Market Segmentation

By Product:

Ready-to-Eat Wet Soups

Condensed Wet Soups

Dry Soups

Frozen/Refrigerated Soups

Wet Broths and Stocks

By Distribution Channel:

Food Service

Retail

Online Stores

By Region:

East

West

North

South

Competitive Landscape and Company Analysis

The U.S. soup market is moderately consolidated, with both global food giants and specialized brands competing on innovation, quality, and branding. Key players analyzed from four perspectives—overview, key personnel, recent developments, and revenue—include:

The Campbell’s Company

Kellanova

PepsiCo

Nestlé

General Mills Inc.

The Kraft Heinz Company

Hain Celestial Group

Cargill Incorporated

Conagra Brands, Inc.

Greencore

These companies continue to invest in product reformulation, premiumization, and sustainability to maintain market leadership.

Final Thoughts

The United States soup market is evolving steadily, balancing tradition with innovation. With a projected value of US$ 6.64 billion by 2033, the industry’s future lies in health-focused formulations, plant-based offerings, premium flavors, and convenient formats.

While challenges such as competition from alternative meals and declining canned soup demand persist, ongoing innovation and changing consumer preferences are opening new growth avenues. For brands that prioritize quality, transparency, and convenience, the U.S. soup market will remain a warm and rewarding opportunity well into the next decade.