I’ve tried the 1p savings challenge over two years, and in 2026, I’ll be making a simple but important change

Ketsuda Phoutinane Spare Time Content Editor

10:53, 03 Jan 2026

I learned about the 1p challenge a few years ago from Martin Lewis’ Money Saving Expert newsletter(Image: ITV)

I learned about the 1p challenge a few years ago from Martin Lewis’ Money Saving Expert newsletter(Image: ITV)

December’s paycheque has a lot of ground to cover. Between buying presents (including some for myself), seeing friends, parties, and the big food shop, the Christmas spending spree is not a pleasant way to end the year – financially at least.

Starting the year feeling skint isn’t ideal either, which is why the 1p savings challenge seemed a brilliant way to cushion the blow. The idea was introduced to me through Martin Lewis‘ Money Saving Expert newsletter.

The site’s lengthy weekly emails are a treasure trove of advice, tips, and deals. Just from bank switch offers alone, I’ve managed to get hundreds of pounds thanks to what I’ve learned that land in my inbox every Tuesday.

What is the 1p saving challenge?

The 1p challenge is a simple way to save little and often. On the first day, you put away 1p, 2p the day after, and so on for 365 days. Another way is to contribute more at the start, beginning with £3.65 on the first day, £3.64 the next, down to 1p on the final day of the year.

2026 will be my third time doing the 1p saving challenge(Image: Getty)

2026 will be my third time doing the 1p saving challenge(Image: Getty)

By the end, you end up saving a £667.95 pot of money. It’s a relatively pain-free way to accumulate a decent amount of savings for whatever you need, be it a rainy day fund, holidays or a home deposit.

How I’ve done the 1p challenge over two years

2025 marked my second go at the challenge which proved better than the first. In practice, the problem wasn’t parting with a small amount of money daily, but remembering to transfer it into my savings each and every day.

I ended up downloading the challenge tracker PDF from the Money Savings Expert website. Marking off each day’s sums – or several, when I forgot – was a faff and I gave up halfway through 2024.

Thankfully, the task became significantly easier last year. Monzo, where I already held an account, was the first UK bank to automate the process. They will shift the designated money every day into what they dub a Challenge Pot, which should be noted is not a savings account.

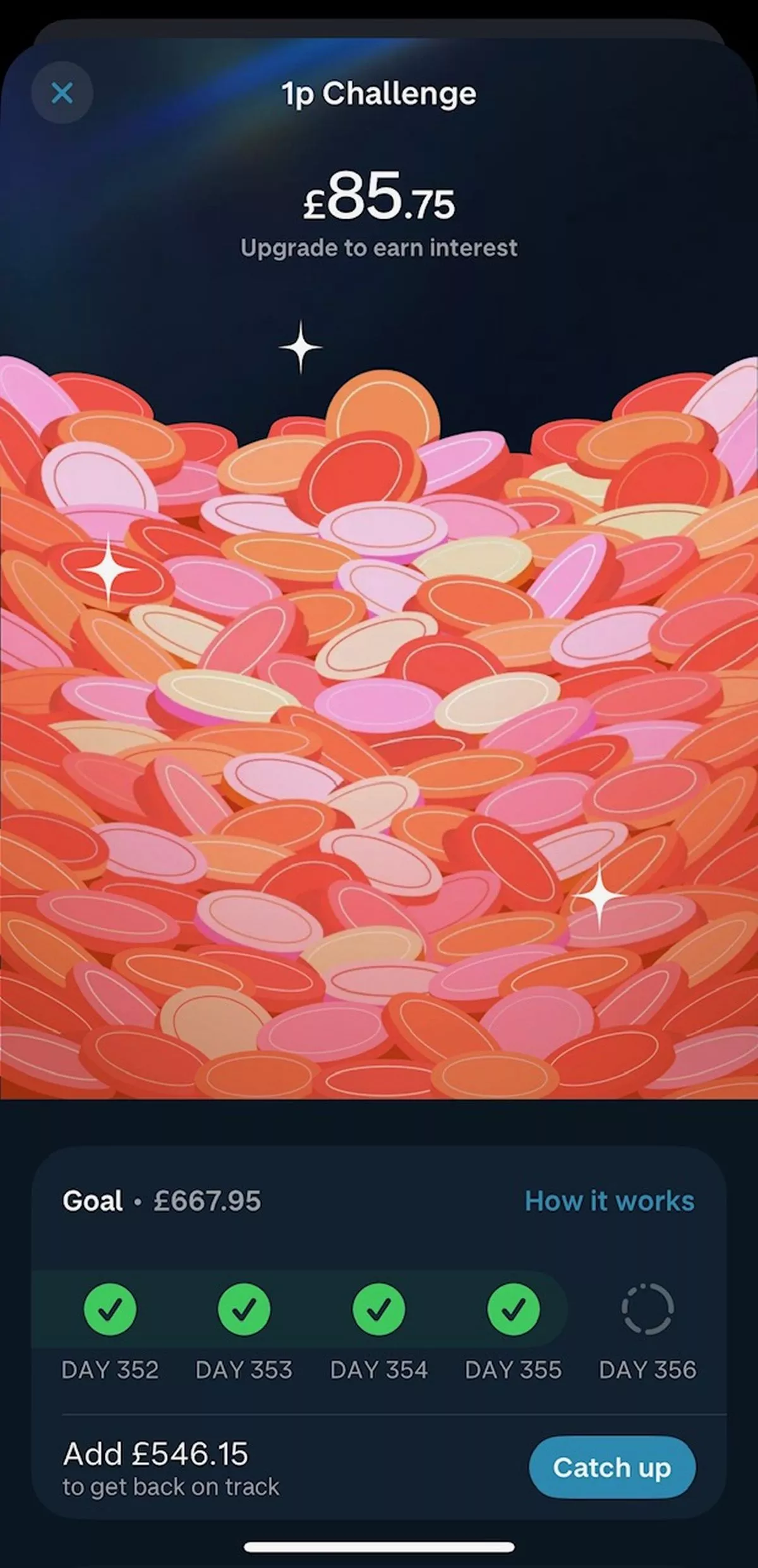

A screenshot of the Monzo app’s Challenge Pot(Image: Ketsuda Phoutinane)

A screenshot of the Monzo app’s Challenge Pot(Image: Ketsuda Phoutinane)

Only Monzo members who have subscribed to an Extra, Perks or Max account are eligible to earn 5% interest on a Challenge Pot and stand a chance to win in monthly £100 prize draws.

These accounts cost £3 a month, which I refuse to pay. As you’re granted the flexibility to pause, stop or withdraw funds from the pot, I sporadically emptied the Challenge Pot into an existing savings account. In retrospect, I would have saved a bit more money if I had done this more regularly.

Final thoughts

Having Monzo automate the process was incredibly handy. The nature of the savings plan means £3 or more is taken from your account in December, which I didn’t love, but was unavoidable.

Another approach to frequent, small savings is through round ups. This automated savings tool offered by many banks rounds up purchases to the nearest pound and transfers the spare change into a savings account. You can boost it further at some banks by doubling or even tripling this amount.

It builds up over time like the 1p challenge. I’ve opted for round ups at various banks, but on average, the amount I’ve saved doesn’t touch the challenge’s £670.95 sum. The total round ups from my most frequently used account have only surpassed £400 after several years.

The 1p challenge is a simple method to save, particularly if you can automate it. It’s helped relieve the strain of Christmas and even unexpected home repairs.

It might not be the most thrilling New Year’s resolution, but in 2026, I’m aiming to be better at earning interest on my challenge money.

I’ve saved hundreds from skimming Martin Lewis’ Money Saving Expert newsletter (Image: ITV)

I’ve saved hundreds from skimming Martin Lewis’ Money Saving Expert newsletter (Image: ITV) You end up with £667.95 in savings by the end of the year(Image: johan10 via Getty Images)

You end up with £667.95 in savings by the end of the year(Image: johan10 via Getty Images) The savings challenge money starts with just a penny(Image: Catherine Falls Commercial via Getty Images)

The savings challenge money starts with just a penny(Image: Catherine Falls Commercial via Getty Images)