SUMMARY

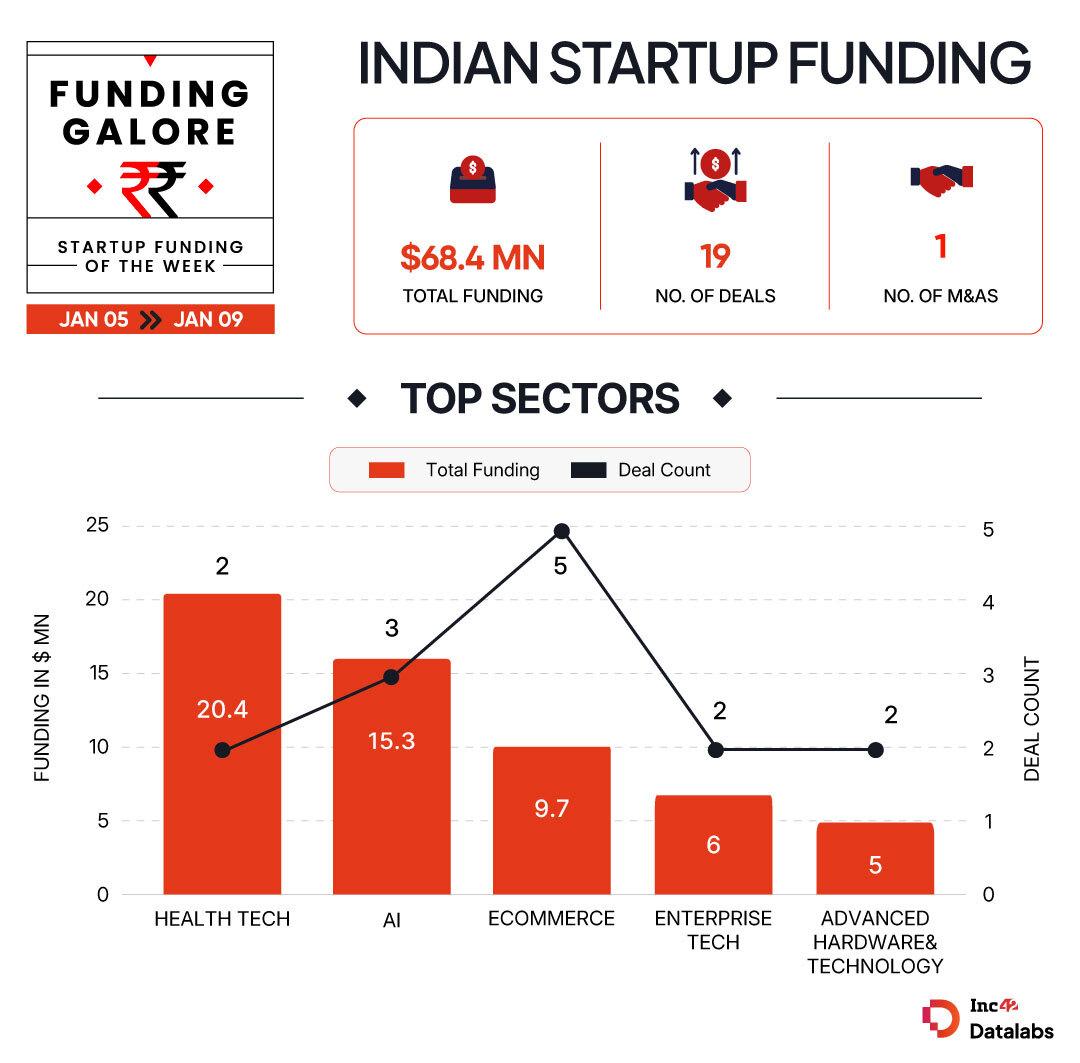

Between Jan 5 and 9, 19 startups managed to secure a fresh capital of $68.4 Mn, representing a near 34% declined from the $104.2 Mn bagged by two startups in the preceding week

With Even Healthcare bagging the largest cheque of $20 Mn, healthtech sector topped the weekly funding charts. Two startups from the space secured $20.4 Mn during the week

Ecommerce sector continued to dominate funding deal trends this week, with five D2C startups raising $9.7 Mn

After attaining relative stability in the year 2025, Indian startup funding trends were rather muted in the first week of 2026. Between Jan 5 and 9, 19 startups managed to secure a fresh capital of $68.4 Mn, representing a near 34% declined from the $104.2 Mn bagged by Arya.ag and Knight Fintech in the preceding week.

Funding Galore: Indian Startup Funding Of The Week [ Jan 5 – 9 ]

Note: Only disclosed funding rounds have been included been included

Key Startup Funding Highlights Of The Week

- With Even Healthcare bagging the largest cheque of $20 Mn, healthtech sector topped the weekly funding charts. Two startups from the space secured $20.4 Mn during the week.

- Ecommerce sector continued to dominate funding deal trends this week, with five D2C startups raising $9.7 Mn.

- A large chunk of the capital deployed during the week was concentrated around B2C startups, with these startups lapping up 70% of the overall weekly funds.

- Seed staged startups secured $16.8 Mn in fresh capital across six funding deals this week.

Other Developments Of The Week

- After filing its RHP on Thursday, Amagi is now set to become the first new-age tech company to go public in 2026. The media SaaS giant has trimmed the fresh issue size by 25% to INR 816 Cr along with trimming the OFS component by 22% to 2.69 Cr shares.

- One of the biggest edtech mergers between upGrad and Unacademy has failed to materialise as both parties pulled the plug on discussions after failing to reach a consensus on the valuation.

- In what could potentially lead to one of the largest Indian fintech startup IPOs, Razorpay is said to have roped in merchant bankers including Kotak Mahindra and Axis Capital to helm the IPO filing process. The IPO is likely to comprise a fresh issue of shares worth INR 4,500 Cr.

- Tamil Nadu CM MK Stalin launched a dedicated startup policy with an outlay of INR 100 Cr to foster deeptech startups in the state.

]]>