Buying shares in companies that lead the way in cutting edge technology such as AI is both exciting and financially rewarding – as investors in the Magnificent Seven stocks have discovered in recent years.

Yet it’s not without risk, as evidenced by increasing concerns that the share prices of some of these US companies – Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla – are being driven into bubble territory as a result of the market’s euphoria over AI.

Although many fund managers have responded by trimming some (not all) of their holdings in these tech giants, a majority believe that investors should not shut their eyes to some of the key themes that will shape our future.

Opportunities, they say, abound for astute investors as specific companies blossom in areas such as robotics, medical procedures and testing, secure software updating and ‘smart barcodes’.

It’s an argument that Daegal Tsang, a fund manager with Swiss-based Pictet Asset Management, is keen to expound. Tsang is part of a four-strong management team that runs the £8.7 billion investment fund Pictet Robotics.

Over the past ten years, the fund has generated average annual returns of 18.7 per cent by investing in companies involved in robotics and enabling technologies for use, for example, in factories, the home and hospitals.

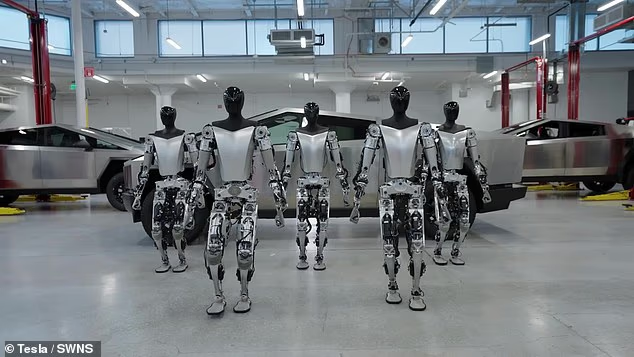

Tsang says: ‘Is the robotics investment story running out of steam? My answer is an emphatic no. I believe we are still at an early stage in terms of what robots can and cannot do.’

Daegal Tsang, a fund manager with Swiss-based Pictet Asset Management, believes we are still at an early stage in terms of what robots can and cannot do

He points to the fact that last year Amazon installed its millionth robot. For perspective, it has 1.5 million human employees.

He adds: ‘The latest global data indicates that there are 177 robots for every 10,000 workers, a penetration rate of less than 2 per cent, compared to 40 per cent for Amazon. This suggests the robotic journey has a long way to go, especially as it expands into other areas such as the home and hospitals.’

Magnificent Seven stocks Alphabet and Nvidia remain among the top ten holdings of Pictet Robotics.

Tsang’s view on robotics is shared by other experts.

Christopher Rossbach is chief investment officer of wealth manager J Stern & Co and runs the £335 million World Stars Global Equity Fund. Top ten holdings include Amazon and Nvidia.

‘Amazon remains a compelling investment right now, as it adds more robotics to its operations, enabling the company to deliver orders faster, cut costs and use less energy,’ says Rossbach. ‘It is also seeing renewed growth for its cloud platform, AWS.

‘We also like Nvidia for its clear lead in AI computing and the key role it will play in providing the data required for accelerating the adoption of robotics.’

While Rossbach is excited by robotics in surgical procedures, humanoid robots, and some of the Asian-based robotic companies, he has yet to make investments in these areas. But he is adamant that robotics ‘is here to stay’.

Ben Kumar, head of equity strategy at Seven Investment Management, agrees. He says robotics are moving from factories into settings that are part of daily life. ‘Surgeons are now using robots in operations, while in Japan and South Korea some robots are assisting in care homes.’

So which cutting edge companies are worth contemplating investing in? And if shares are not to your liking, which funds?

SHARES TO CONSIDER

Those keen to invest in companies leading the robotics charge will need to look outside the UK.

In the robot-assisted surgery space, leading firms are US-listed Intuitive Surgical and Medtronic. Their respective one-year results are losses of 6.7 per cent and gains of 15.9 per cent.

‘These two companies are at the forefront of robotic-assisted surgery, which is still in its early stages of adoption,’ says Rossbach.

Pictet Robotics has Intuitive Surgical in its top-ten holdings. Tsang also likes US firms Teradyne (a manufacturer of advanced robotics systems) and cloud-based platform Salesforce. Respective one-year returns are 68.8 per cent and losses of 27.3 per cent.

Jamie Mills O’Brien manages funds for Aberdeen Investments, which invest in some of the world’s most innovative companies.

He recently identified four best-in-class innovators.

Three were American: Procept BioRobotics (a pioneer in the treatment of enlarged prostates); JFrog (a global software company) and Impinj which makes tiny chips and readers that enable retailers and logistics firms to track individual items using radio tags. The fourth was UK-listed Oxford Nanopore, which is making portable DNA and RNA (ribonucleic acid) sequencers that can read genetic information on the spot.

Jamie Mills O’Brien manages funds for Aberdeen Investments, which invest in some of the world’s most innovative companies

Its devices, says Mills O’Brien, will drive growth in sales as hospitals and drug companies start using them more.

Shares in all of the companies mentioned can be bought through leading investing platforms.

THE FUND ROUTE

Investors who prefer funds could opt for Pictet Robotics or Robocap, both actively managed.

Alternatively, they could choose an exchange-traded fund such as L&G Global Robotics and Automation, which tracks the performance of a basket of companies involved in robotics, automation and AI.

Both Kumar and Jason Hollands of investment platform Bestinvest say this is the best route for investors thanks to broad exposure and low annual charges (cheaper than both Pictet and Robocap).

Hollands says: ‘It tracks 77 stocks, has no exposure to the Magnificent Seven, and nearly a third of its portfolio is invested in Asian robotics companies.’

Other exchange-traded funds include ARK Artificial Intelligence & Robotics, Global X Robotics & Artificial Intelligence, and iShares Automation and Robotics.

BUYER BEWARE

According to Hollands, many cutting edge investment themes such as robotics and automation are ‘very hot’, and ‘heavily intertwined with excitement about AI’.

As a result, he warns investors to tread carefully, spreading any purchase over a matter of months. Investors should also check if they already have sufficient exposure to the high risk, high reward tech sector through global funds that have shares in the Magnificent Seven.