- Data shows service industry shrank as consumer confidence weakened in April

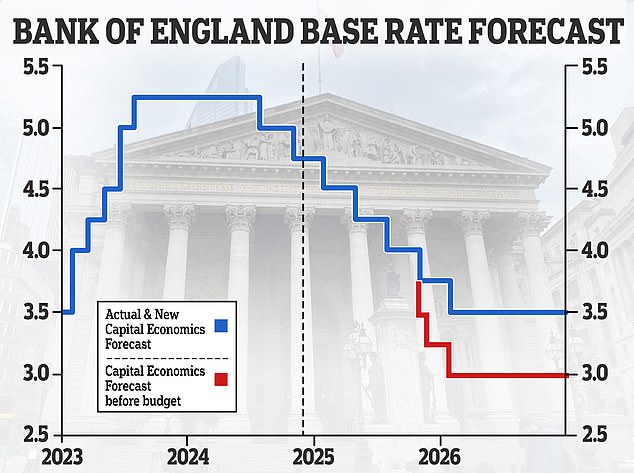

- Markets expect the bank to cut base rate from 4.5% to 4.25%

Financial markets expect the Bank of England to cut interest rates on Thursday after fresh data showed further deterioration in the health of the economy.

Britain’s crucial services sector, which plays an outsized role in the overall economy, shrank in April for the first time since October 2023 and at the fastest pace in more than two years, according to S&P Global data.

The S&P Global UK Services Purchasing Managers Index dropped to 49 last month from March’s 52.5, the steepest pace of decline since January 2023, as both new orders and employment fell sharply and cost pressures increased.

Britain’s services sector, which is responsible for more than 80 per cent of the country’s economic output and employment, cited growing labour costs associated with the Autumn Budget after cutting back on hiring for the seventh consecutive month.

Economics director at S&P Global Market Intelligence Tim Moore also noted ‘heightened business uncertainty’ and ‘the impact of global financial market turbulence in the wake of US tariff announcements’.

The reading cemented investors bets on another BoE base rate cut of 25 basis points later this week, taking the rate from 4.5 to 4.25 per cent, as the bank is forced to respond to waning economic strength.

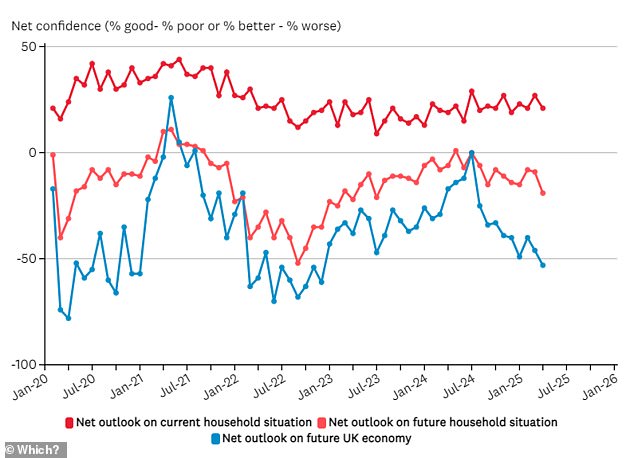

Downbeat: Consumer confidence weakened in April, according to Which? data, as the services sector also shrank in April for the first time since October 2023

It came as separate data from Which? showed consumer confidence in the future of the UK economy plummeted to its weakest level since the height of the cost-of-living crisis.

The Which? Consumer Insight Tracker reveals 64 per cent of consumers now believe the economy will get worse before it gets better.

It follows a PMI survey last week that showed British manufacturers saw export orders fall at the sharpest pace since May 2020, in April.

The International Monetary Fund last month cut its forecast for British economic growth in 2025 to 1.1 per cent from a previous estimate of 1.6 per cent.

The BoE is expected to respond to slowing economic output with more rate cuts, despite inflation remaining above its 2 per cent target at 2.6 per cent in March.

Developed markets economist, UK, at ING, James Smith expects services inflation, which remains well above target at 4.7 per cent, ‘should start to come noticeably lower later this quarter’.

He said: ‘That should enable the Bank to become more relaxed about inflation by the Autumn. At the end of last year, our view was that this would enable the Bank to speed up the pace of cuts, just as markets are starting to price.

‘The messaging from officials so far this year has made us less convinced of that, and instead, we think the path of least resistance is for the Bank to keep cutting rates once per quarter.

‘That process could, however, continue for longer than markets are now pricing. We think bank rate will fall to 3.25 per cent by mid-2026 and possibly even a little lower than that.’

How far do forecasters think the BoE will cut base rate this cycle?

DIY INVESTING PLATFORMS AJ Bell

AJ Bell AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine InvestEngine

InvestEngine

Account and trading fee-free ETF investing

![]() Trading 212

Trading 212![]() Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

Compare the best investing account for you

Share or comment on this article:

Interest rates set to be cut this week as economy continues to show weakness