According to a new study from the European Audiovisual Observatory, authored by Nicolas Edmery, the global theatrical animation industry has recovered from the COVID-19 pandemic, although some markets have shown greater improvement than others.

Behind the optimistic headline, however, the report – a comprehensive statistical review of theatrical animation from 2017 to 2024 across 49 markets – uncovers structural imbalances, particularly in Europe, which, despite strong production activity and critical/festival success, remains largely sidelined when it comes to audience impact.

The Global Picture

The Observatory’s report confirms that by 2024, global admissions to theatrical animated films had reached 882 million, essentially matching pre-pandemic levels. That recovery was not seen across all theatrical films, marking animation as one of the few sectors to achieve a full recovery. Live-action fiction, for example, remains below pre-pandemic attendance levels.

Animation’s recovery has been driven largely by U.S. studios. While only 10% of animated titles released globally came from the States, those films routinely account for over 70% of global admissions. Major franchises and family-friendly IPs continue to dominate the box office worldwide.

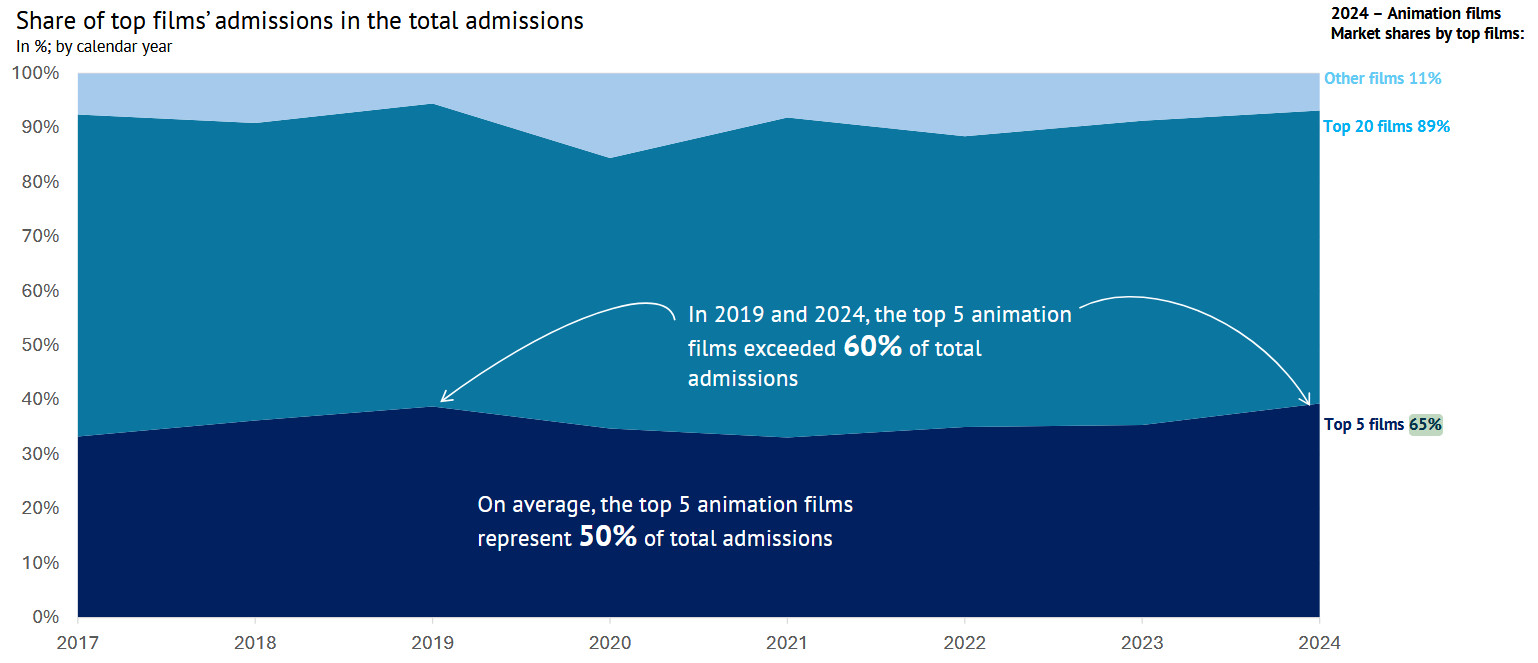

The disconnect between volume and visibility is critical, the report notes. On average, 199 animated features are produced worldwide each year, yet a relatively small group of U.S. titles disproportionately draws mainstream audiences. In 2024, the top five animation films alone accounted for 65% of all global animation admissions.

It’s worth noting that these Hollywood-driven figures are expected to undergo significant changes this year, as Chinese animation emerges on the global stage while also dominating domestically in one of the world’s largest box office territories. Ne Zha 2’s $2.2 billion box office haul could be either a historic outlier or the harbinger of a significant shift. Only time will tell.

The European Dilemma

Europe continues to play a significant role in global animation production. European countries were responsible for 25% of all theatrical animation titles produced and 36% of those released globally during the study period. But the region’s share of the global animation box office is just 5%.

This discrepancy reflects a larger issue: despite the European sector’s creative vitality and robust co-production activity, its films are struggling to break through at the box office. Between 2022 and 2024, European animation films averaged 33 million admissions annually, down from 42 million before the pandemic.

More troubling, their market share in Europe itself is shrinking. In 2024, US films accounted for 84% of animation admissions in Europe, leaving European productions with just 11%, a stark contrast to the European live-action sector, where domestic films usually command around 35% market share.

European Animation Travels Better

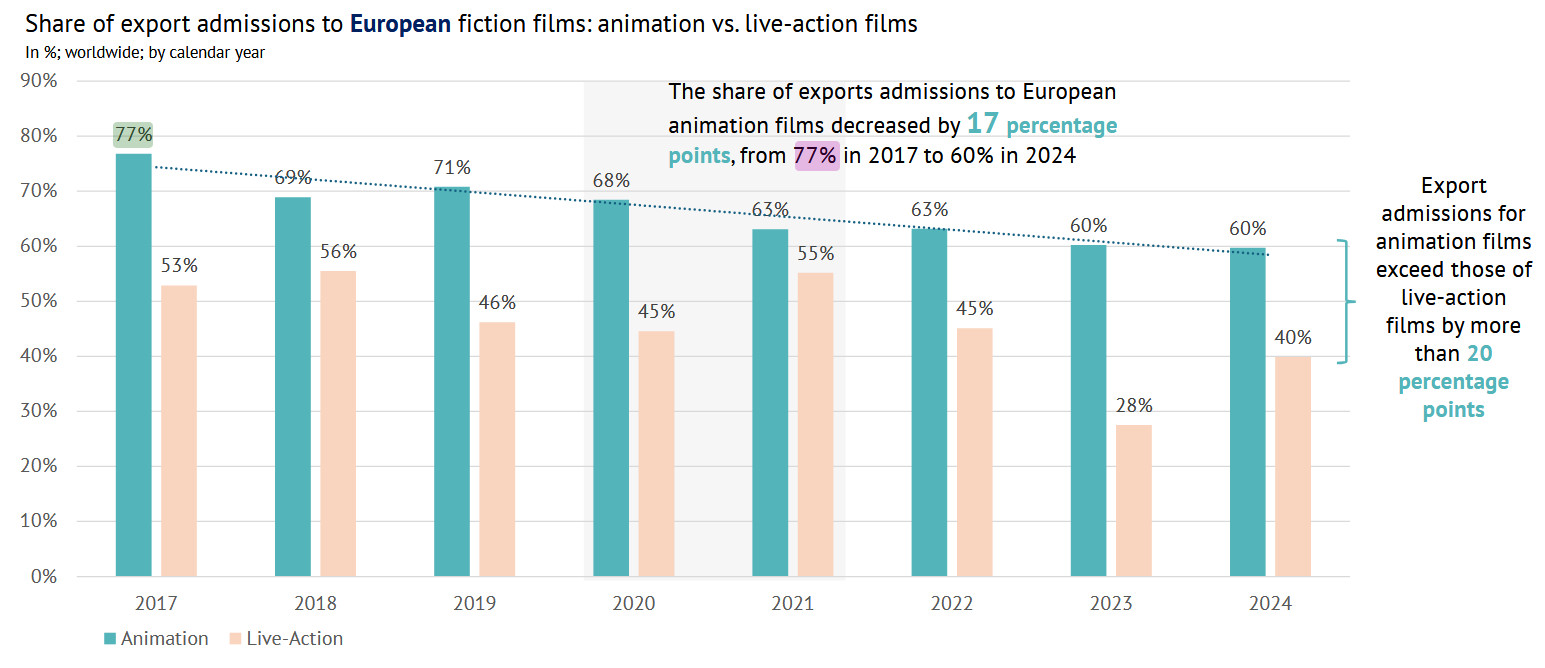

One bright spot: European animated films travel far better than their live-action counterparts. The average European animated feature is released in 11 markets, compared to just five for live-action films, and 67% of their admissions come from export markets.

But even this strength is eroding. In 2017, 77% of admissions to European animated films came from outside their country of origin. By 2024, that had dropped to 60%. This is especially significant given that animation, unlike live action, is traditionally seen as a more exportable format due to its visual universality and appeal across age groups.

Production Budgets: Bigger Isn’t Always Better

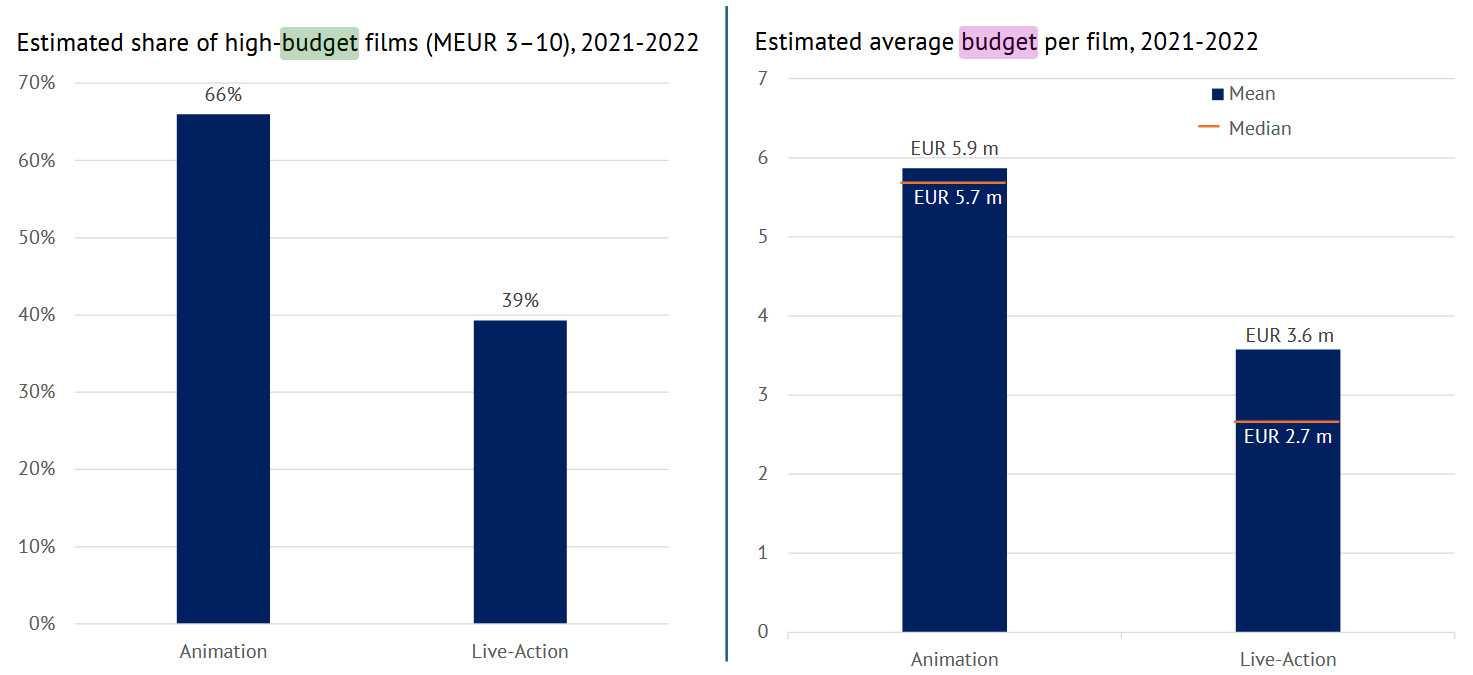

Another insight from the report is that European animated films are more expensive to produce than live-action fiction. Based on 2021–2022 data, the average budget for an animated feature was €5.9 million ($6.9 million), compared to €3.6 million ($4.2 million) for live-action. Median budgets reveal a similar disparity, with animation at €5.7 million ($6.7 million) compared to live action at €2.7 million ($3.2 million).

High budgets imply higher financial risk, the study points out. Yet the return on investment, at least in theatrical terms, remains comparatively low, particularly when the same films struggle to generate ticket sales.

The Co-Production Factor: A Double-Edged Sword?

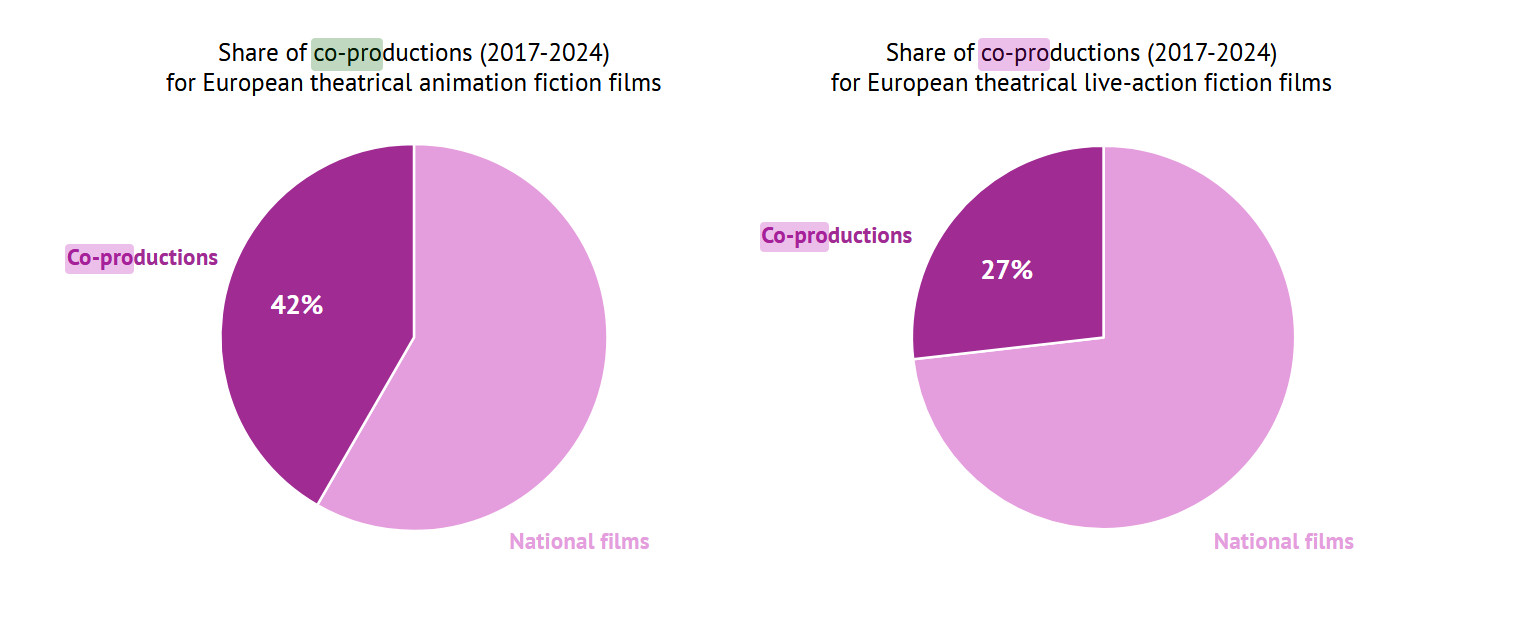

Co-productions are central to the sustainability of European animation. 42% of European animated features are co-productions, nearly double the rate for live-action films (27%). Countries like Belgium, France, and the Netherlands rely heavily on cross-border collaboration.

This model enables the pooling of talent, funding, and distribution access while limiting individual risk, but it also presents challenges. Creative compromises, complex rights structures, and varying audience expectations across territories can complicate both the production and the marketing of these films.

Can European Animation Compete?

The report stops short of offering potential solutions to Europe’s current woes, but its findings raise poignant questions for the continent’s industry players:

- Is Europe’s emphasis on co-productions and festival circuit prestige limiting its commercial potential?

- Can national agencies do more to support international marketing and distribution?

- Should European animation pivot more aggressively toward younger audiences and established IPs to reclaim theatrical ground?

While animation as a medium has emerged relatively unscathed from the pandemic, the benefits of that recovery are far from equal across the global industry. For now, American studios continue to dictate the theatrical animation landscape, leaving Europe with the task of turning production strength into market presence. Meanwhile, the rising popularity of Asian animation, particularly that from Japan and China, looks likely to create further shifts. Will this rising tide lift all boats? Or will major franchises and shifting audience tastes cause further erosion in Europe’s global box office presence?