A new report from PYMNTS Intelligence reveals a nuanced landscape of consumer shopping and payment habits, challenging some long-held assumptions about generational digital divides and highlighting the distinct influences of shopping channels on consumer choice.

The “How People Pay: Payment Choice Depends on Shopping Channel” report, based on a November 2024 survey of 2,722 U.S. consumers, indicates that while younger generations are deeply engaged online, the gap in eCommerce adoption for retail and travel purchases is surprisingly narrow across age groups.

Online shopping for categories such as grocery, restaurant, retail and travel has stabilized over the past year, with consumers maintaining consistent online purchase rates from November 2023 to November 2024. However, this cross-generational consistency does not extend to all categories, as Gen Z and millennials remain significantly more inclined to make online restaurant and grocery purchases than older consumers. The study underscores that payment preferences vary considerably between online and physical environments: credit cards and digital wallets are favored in online spaces, while debit cards maintain their dominance in brick-and-mortar stores. These differences are attributed to factors such as perceived security, budgeting priorities and the unique demands of each shopping channel.

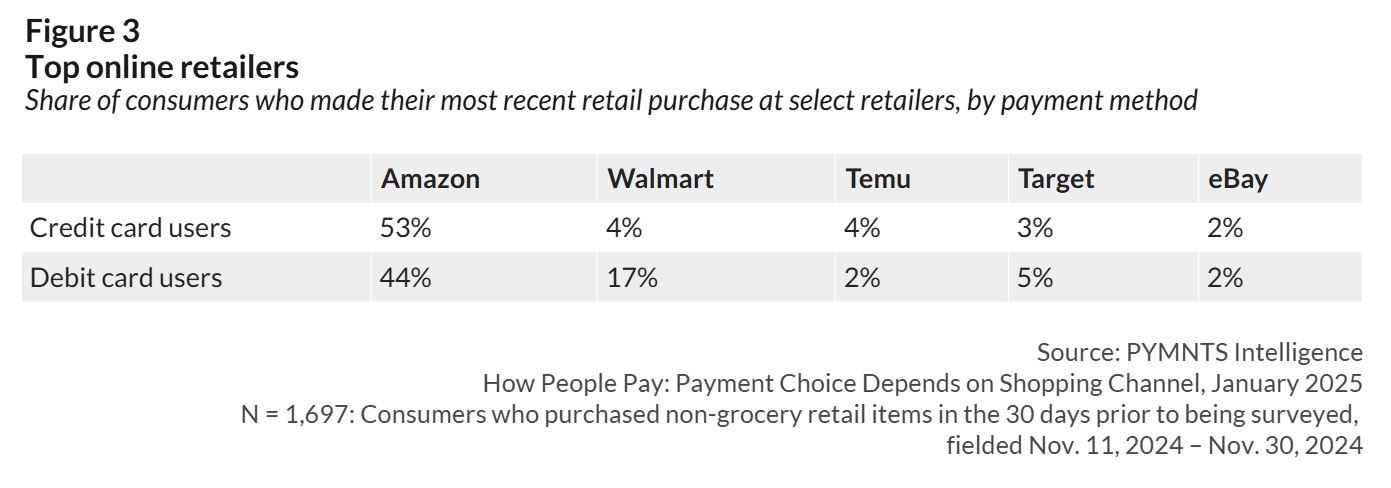

Merchant preferences similarly diverge based on the shopping channel and payment method, with Amazon holding a commanding lead in eCommerce and Walmart dominating brick-and-mortar sales. The report highlights a clear relationship between a consumer’s chosen payment method and their overall purchasing priorities, particularly noting that debit card users often gravitate toward value-focused retailers. This suggests that financial considerations, such as budgeting, play a significant role in both payment choice and retailer selection for a segment of the consumer base.

Key data points from the report include:

- Payment method preference shift: For online retail transactions, consumers are 27% more likely to use credit cards than debit cards, whereas in physical retail locations, they are 50% more likely to use debit cards than credit cards.

- Digital wallet usage: Consumers are twice as likely to use digital wallets for online retail purchases (16%) compared to in-store retail purchases (8%).

- Merchant dominance and payment type: Amazon captures 53% of online credit card users and 44% of online debit card users for their last retail transaction. Meanwhile, Walmart reigns supreme in brick-and-mortar, capturing 23% of in-store debit shoppers and 15% of in-store credit shoppers.

The report also covers the nuances of specific merchant choices, such as online debit shoppers being four times more likely to purchase from Walmart than online credit users when not choosing Amazon, and credit card users being twice as likely to shop at Temu. It also highlights how discount retailers like dollar stores draw in-store debit shoppers, while Target serves as the second-most popular destination for in-store credit users. This rich dataset provides essential insights for understanding evolving consumer behaviors across the digital economy.