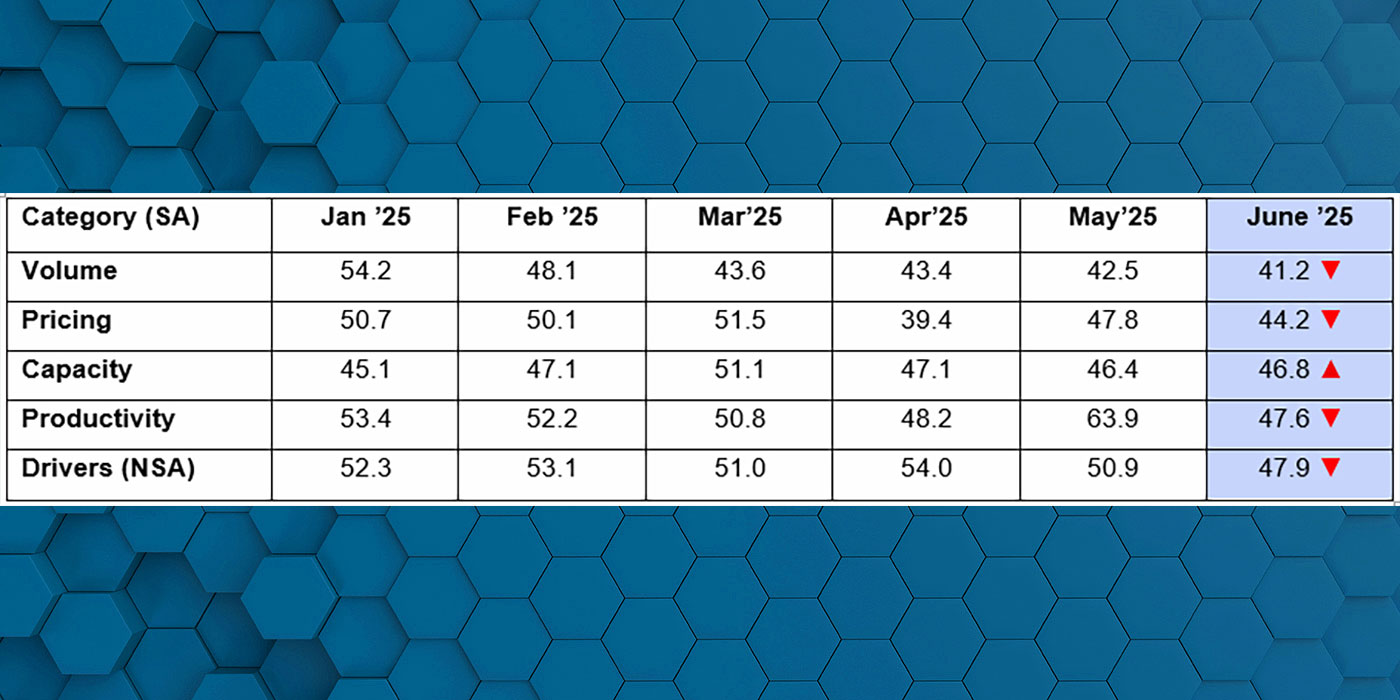

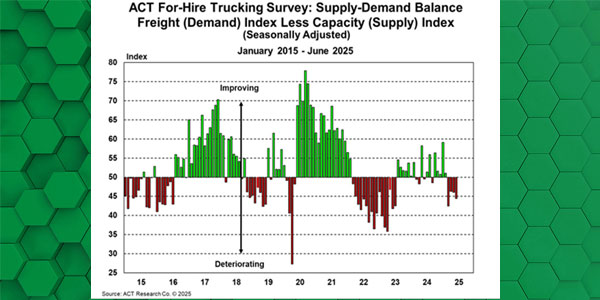

ACT Research’s June For-Hire Trucking Index reveals continued market softness. The supply-demand balance fell to 44.4 (seasonally adjusted), down from 46.1 in May, as freight volumes declined, and capacity increased.

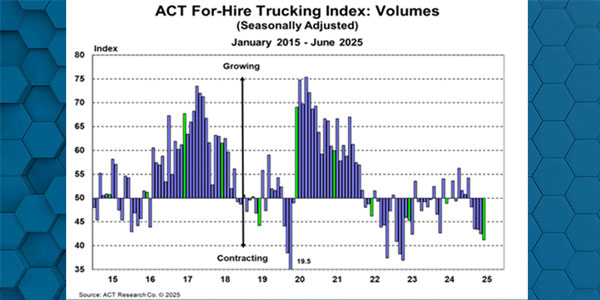

Freight Volumes Drop for Fourth Month

The Volume Index fell to 41.5 (SA) in June, following a reading of 42.5 in May. ACT attributes the decline to early-April tariff disruptions, some of which were reversed, and persistent overcapacity in the market.

Carter Vieth, research analyst at ACT Research, said, “Volumes should improve in July and August following the tariff reprieve, but the pull-forwards in freight demand in the first half of the year will result in paybacks.”

Vieth noted that goods spending outpaced real income growth in early 2025, creating a temporary boost supported by consumer credit. “After surging 7.7% year-over-year in April, goods spending slowed to 3.7% in May, indicating the beginning of the post-pull-forward decline.”

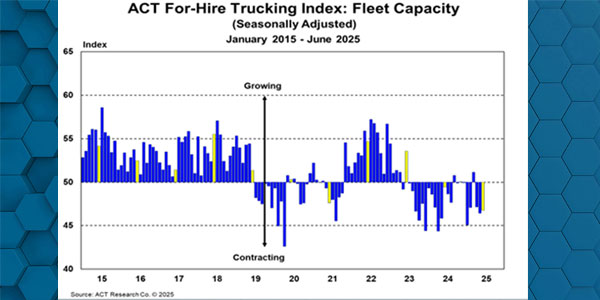

Capacity Grows Slightly, But Pressures Mount

The Capacity Index rose to 46.8 in June, up from 46.4 in May. Although growth was modest, total fleet capacity remains on a downward trend. Rising costs tied to steel, aluminum, and parts tariffs continue to weigh on the industry.

“Publicly traded TL carriers’ profit margins remain near the lowest levels since 2009,” Vieth said. “Due to challenging operating conditions, trade and economic uncertainty, and equipment cost increases, many fleets are significantly reducing capital spending in 2025.”

Outlook: June For-Hire Trucking Index Signals a Loose Market

The June for-hire trucking index underscores an unbalanced freight market. Vieth said the demand dip “created a looser market balance,” and even with short-term improvement likely, a freight slowdown is expected.

“Even with modest pass-through, the tariff’s inflationary effects may lead to softer goods demand in the coming months,” he added. ACT expects the index to remain at or below 50 in the near term, as demand weakens faster than capacity contracts.