Report Overview

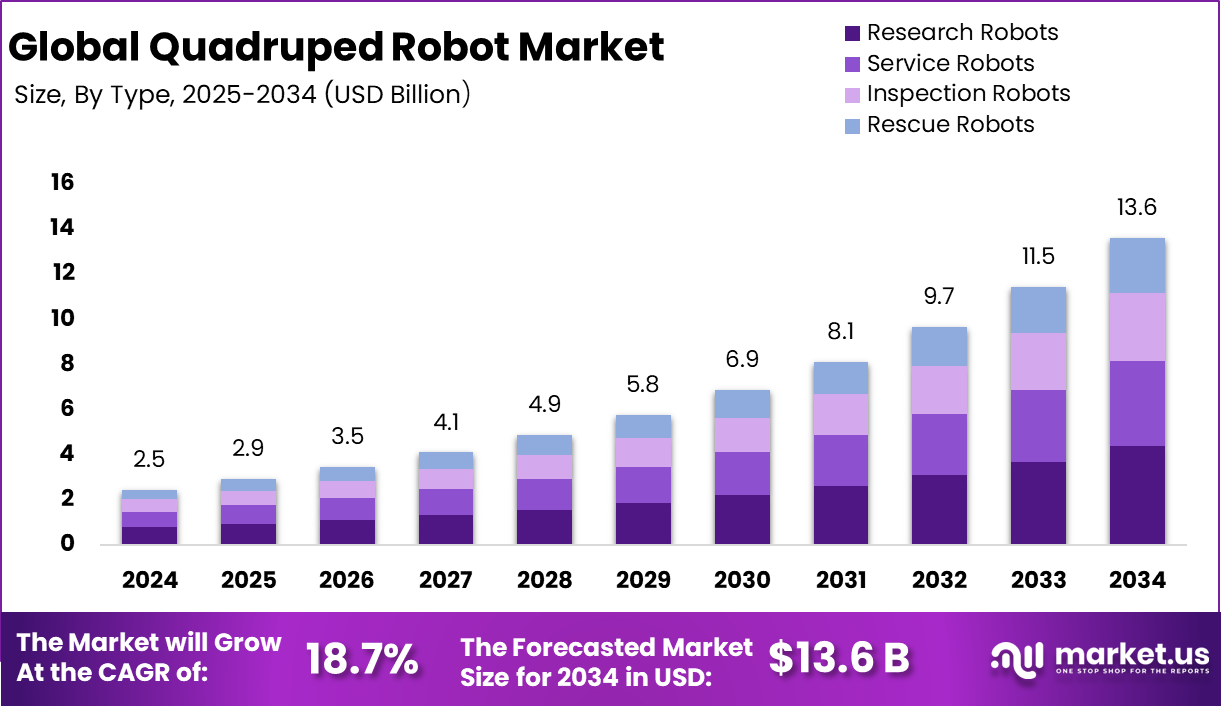

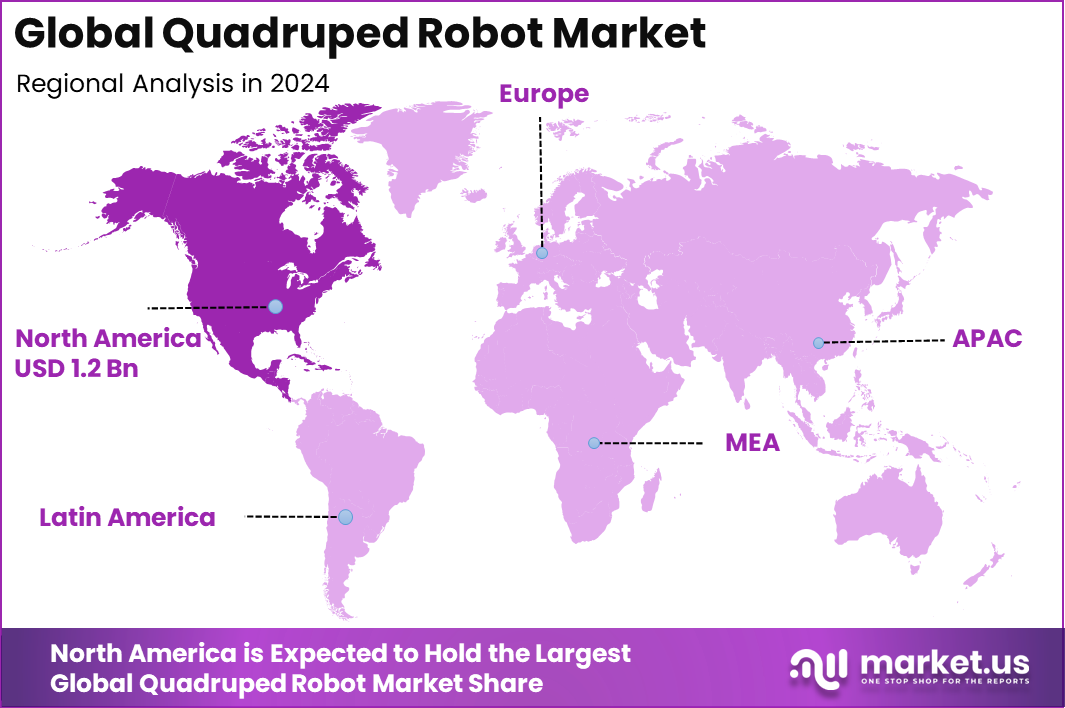

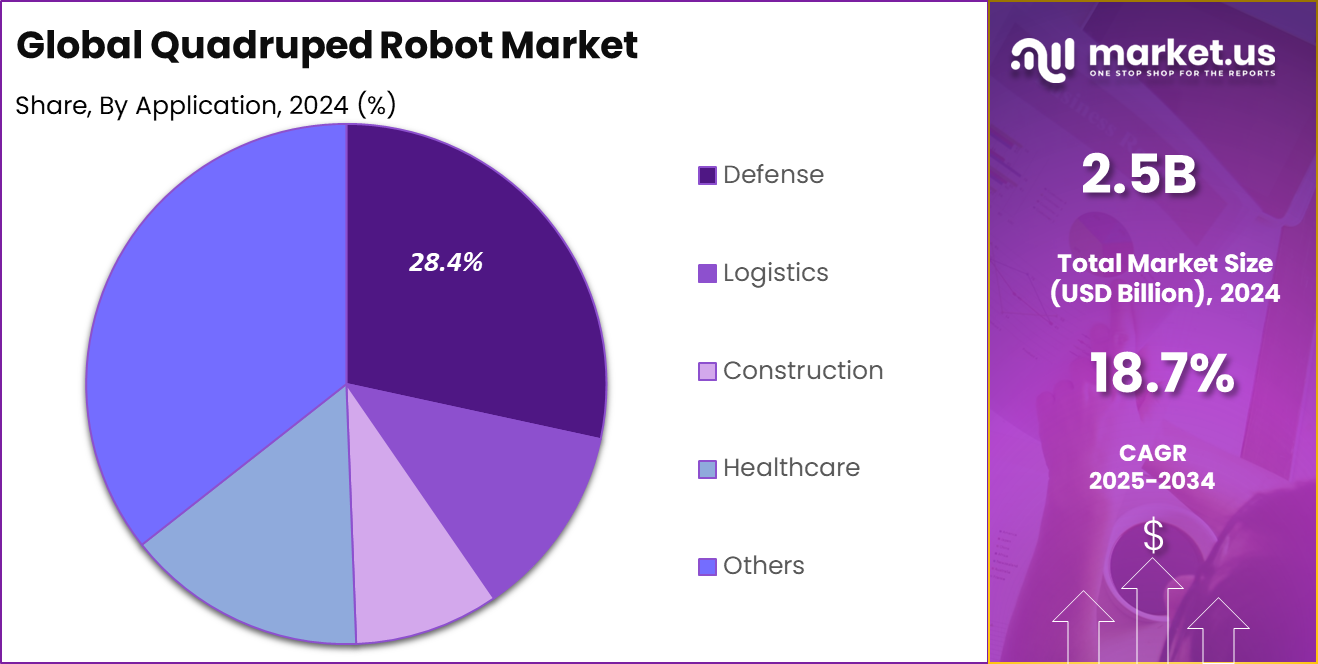

The Global Quadruped Robot Market size is expected to be worth around USD 13.6 Billion by 2034, from USD 2.5 Billion in 2024, growing at a CAGR of 18.7% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 47.2% share, holding USD 1.2 Billion revenue.

The quadruped robot market represents an emerging segment of robotics in which four‑legged robotic platforms are deployed across sectors such as inspection, agriculture, search & rescue, defense, and industrial applications. These robots deliver superior terrain navigation and stability in conditions unfavourable to wheeled or humanoid robots.

The growth of the market has been underpinned by continuous advancements in robotics engineering, sensor integration, and AI‑driven autonomy. Top driving factors include the increasing global demand for automation across industries. Quadruped robots are valued for their ability to perform routine and hazardous tasks, reducing labour costs and enhancing operational safety and efficiency.

Market Size and Growth

Technologies driving increased adoption include AI and machine learning integration, sensor and actuator improvements, lightweight materials, battery technology, and autonomy‑enhanced control systems. These technologies support unmanned navigation, environment mapping, and decision‑making capabilities that justify higher investment and operational value.

According to Market.us, The Smart Robots Market has been witnessing a remarkable transformation driven by advancements in AI, sensor technologies, and autonomous systems. In 2023, the market stood at USD 12.5 Billion, and it is projected to reach approximately USD 128.1 Billion by 2033, registering a strong CAGR of 26.2% during the period from 2024 to 2033.

Meanwhile, the Generative AI in Robotics Market is emerging as a transformative force within the automation landscape. Valued at USD 1,161.0 Million in 2023, it is forecasted to grow significantly and reach USD 23,343.7 Million by 2033, expanding at a compelling CAGR of 35% over the same forecast period.

Key Takeaway

- The Research Robots segment led the market with a 32.1% share, driven by rising deployment of quadrupeds in academic, industrial, and AI research settings for testing mobility, autonomy, and sensor fusion.

- Autonomous Navigation held the dominant functional share at 46.7%, highlighting growing investment in fully self-guided robots capable of terrain adaptation, route planning, and real-time obstacle avoidance.

- The Defense sector captured 28.4% of the market, as military organizations adopt quadrupeds for surveillance, logistics, reconnaissance, and hazardous missions where human presence is risky.

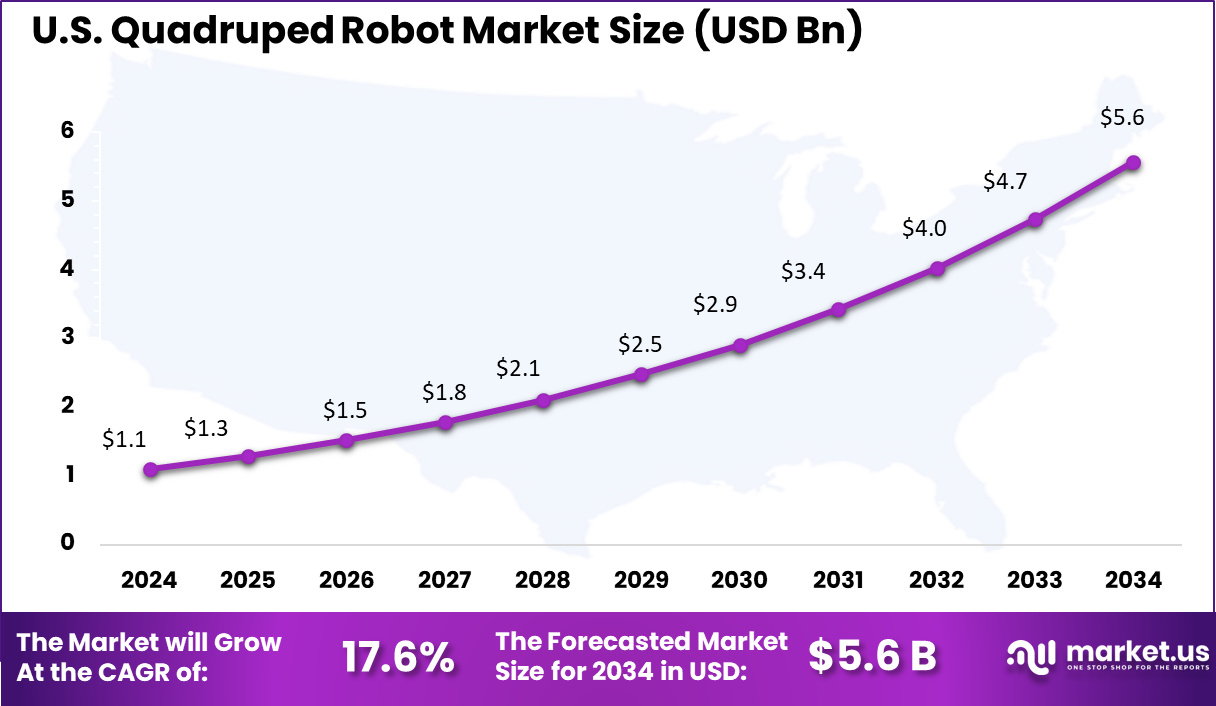

- The U.S. market was valued at USD 1.1 billion in 2024, supported by a strong CAGR of 17.6%, reflecting increased spending in robotics research, defense modernization, and field operations automation.

- North America dominated globally with a 47.2% share, fueled by innovation hubs, government contracts, and early adoption across defense, disaster response, and R&D.

Role of AI

U.S. Market Size

The U.S. Quadruped Robot Market was valued at USD 1.1 Billion in 2024 and is anticipated to reach approximately USD 5.6 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 17.6% during the forecast period from 2025 to 2034. This sustained growth is being driven by rising adoption across defense, industrial inspection, public safety, and research sectors.

Quadruped robots are increasingly valued for their agility, stability in rough terrains, and ability to perform autonomous tasks in hazardous or inaccessible environments. Continued investments in AI mobility, sensor integration, and edge computing are expected to further accelerate U.S. market leadership.

In 2024, North America held a dominant market position, capturing more than a 47.2% share, holding USD 1.2 Billion in revenue in the global quadruped robot market. This leadership has been driven by the region’s rapid deployment of robotic systems in defense, public safety, and industrial automation.

Government agencies and military organizations in the U.S. have shown strong interest in autonomous ground vehicles for surveillance, patrolling, and logistics. The Department of Defense and Homeland Security have actively tested quadruped robots for harsh terrains and border operations, increasing demand and funding for domestic R&D initiatives.

Additionally, the region benefits from a mature ecosystem of robotics startups, universities, and AI research institutions that have accelerated the commercial readiness of advanced quadruped systems. The presence of well-established technology hubs, coupled with rising demand from sectors such as mining, construction, and oil & gas, has reinforced North America’s position in early-stage adoption.

Growth Factors

Emerging Trends

Type Analysis

In 2024, the Research Robots segment led the market under the type classification, representing roughly 32.1 % of the quadruped robot market. This segment’s prominence is rooted in its pivotal role in advancing foundational robotics science.

Research platforms are engineered for experimentation in locomotion, sensor integration, control algorithms, and AI-based navigation. Their modular architecture and open design conventions enable academic institutions and laboratories to iterate rapidly and contribute to next‑generation innovations.

Furthermore, this leadership reflects sustained investment in university and government research programs that prioritize agility and flexibility over commercial viability. Research robots often serve as benchmarks for prototype validation, allowing researchers to assess gait dynamics, terrain adaptation, and autonomous decision‑making. The high share underscores the importance of such platforms in driving the broader development of quadruped robotics capabilities.

Technology Analysis

In 2024, the Autonomous Navigation segment dominated the technological classification with an approximate 46.7 % share of the market. The elevated position of this technology is attributable to its capacity to enable quadruped robots to operate independently in complex environments.

Autonomous navigation systems integrate sensors, machine learning, and real‑time mapping to allow robots to traverse uneven terrain, avoid obstacles, and make path‑planning decisions without human guidance. This capability is particularly valuable in defense, inspection, and search‑and‑rescue applications.

The dominance of autonomous navigation highlights its status as a core functional pillar in quadruped robotics. Market activity has been increasingly oriented towards enhancing the robustness and reliability of autonomy through continuous algorithmic refinement and enhanced sensor fusion. As reported by leading industry analysts, autonomous systems are viewed as essential for unlocking the full potential of quadruped robots in real‑world scenarios.

Application Analysis

In 2024, the Defense segment led in terms of application, accounting for approximately 28.4 % of quadruped robot deployments. Defense usage is driven by the need for resilient, mobile platforms that can undertake reconnaissance, inspection, supply carriage, and hazardous task execution under challenging field conditions.

Quadruped robots have gained traction in military contexts due to their ability to operate in complex terrain, reduced human risk, and capability to carry payloads such as sensors or equipment. The segment’s leadership is also supported by government-led pilot programmes and funding initiatives focused on deploying mechanised assets in frontline and support roles.

Reports confirm increasing instances of quadruped robots being trialled for perimeter surveillance, explosives detection, and logistics support. The sector’s prominence underlines the technology’s strategic value in defence and security operations.

Key Market Segments

By Type

- Service Robots

- Inspection Robots

- Rescue Robots

- Research Robots

By Technology

- Autonomous Navigation

- Remote Control

- Tele-operated

By Application

- Defense

- Logistics

- Construction

- Healthcare

- Others

Key Regions and Countries

- North America

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Demand for Automation in Challenging Environments

A key factor driving interest in quadruped robots is the surge in demand for automation, particularly in environments where standard equipment struggles. Industries ranging from agriculture and construction to defense and search and rescue are increasingly looking for solutions that can handle rough terrain, unstable surfaces, or hazardous conditions.

Quadruped robots, inspired by four-legged mammals, excel at navigating places where wheels and even human workers may falter. They enable essential tasks like inspections, surveillance, equipment transport, and rescue missions without putting humans at risk. This rise is also linked to ongoing labor shortages and the need to improve safety and efficiency on complex job sites.

Adding to this momentum is the rapid progress in robotics technology – especially sensors, artificial intelligence, and machine learning – that has made these robots much smarter and more adaptable. Today’s quadruped robots can perceive their environment in real-time, learn from obstacles, and perform increasingly complex actions.

Restraint

High Costs and Technical Complexity

Despite their promise, quadruped robots face a significant headwind in terms of cost and technical demands. These machines contain sophisticated sensors, actuators, software, and durable materials – all of which drive up the price tag for both initial purchase and ongoing maintenance.

For many small businesses or organizations with limited budgets, the outlay required to acquire and deploy such robots – along with specialist training for staff – makes adoption difficult. Customizing these robots for very specific tasks can add further expense, keeping them out of reach for some potential users.

Technical hurdles compound this challenge. Developing and supporting quadruped robots with reliable mobility, accurate sensing, and safe interactions in dynamic environments is still a complex endeavor. Frequent updates, troubleshooting, and integration with existing equipment can be resource-intensive, especially if the robots are used for evolving tasks.

If underlying systems malfunction or fail, operations can be disrupted, causing costly downtime. Until advances in design, manufacturing, and software can bring down costs and reduce complexity, growth in the quadruped robot market will face some natural limits.

Opportunity

New Frontiers in Agriculture and Public Safety

Quadruped robots stand out for their potential to transform fields like agriculture and public safety. In farming, these robots can manage labor-intensive work such as crop monitoring, soil analysis, or even targeted spraying, which helps farmers boost productivity and make more informed decisions.

As climate change and population growth increase the pressure on agricultural output, these robots provide a means to do more with less – reducing labor costs and improving yields through real-time data collection and smart analysis. Another powerful opportunity lies in public safety and emergency response. Quadruped robots are uniquely equipped to access collapsed buildings, disaster zones, or dangerous locations after industrial accidents.

Emergency teams can use them to locate survivors, deliver supplies, or assess hazards without putting personnel in harm’s way. As governments and agencies invest further in safety technologies, adoption of quadruped robots is expected to rise alongside growing recognition of their game-changing capabilities.

Challenge

Regulatory, Safety, and Social Concerns

One of the most difficult hurdles for the quadruped robot market is addressing regulatory, safety, and broader social concerns. As these robots enter workplaces and public spaces, questions arise around operational safety standards, privacy for those being filmed or recorded, and the ethical use of robots – particularly when used for surveillance or law enforcement.

Laws and guidelines for robotic systems are still evolving and can differ between regions, creating uncertainty for companies wanting to expand or deploy solutions across borders. At the same time, there is public unease about the increased visibility of autonomous machines, especially those with cameras and advanced sensors.

Ensuring these robots operate safely near people – and don’t inadvertently invade privacy or cause harm – is a critical concern that companies and policymakers need to address. Clear regulations, transparent operational practices, and community engagement are essential for building broad acceptance and unlocking the full potential of quadruped robots in society.

Key Players Analysis

In the quadruped robot market, Boston Dynamics and ANYbotics have maintained strong technological leadership. Their platforms are widely recognized for their stability, mobility, and real-time environment adaptation. These firms have built their reputation on advanced control algorithms, AI-based navigation, and industrial-grade applications.

Companies such as Unitree Robotics, Agility Robotics, and Clearpath Robotics are enhancing market competitiveness through cost-effective and compact quadruped solutions. These players are concentrating on affordability, modularity, and ease of integration. Their robots are increasingly used in academic research, inspection, and warehouse automation.

Smaller firms like Nex Robotics, Sparrow Robotics, and Bionic Robotics, alongside established brands like Sony, Alphabet, and Robotis, are contributing to innovation diversity. Their efforts focus on specific applications such as surveillance, human-robot interaction, and educational tools. Partnerships with defense agencies, universities, and tech startups are helping accelerate product development cycles.

Top Key Players in the Market

- Agility Robotics

- Nex Robotics

- Adept Robotics

- Alphabet

- Sony

- Sparrow Robotics

- Bionic Robotics

- Robotis

- Clearpath Robotics

- Unitree Robotics

- ANYbotics

- Boston Dynamics

- Others

Recent Developments

- On May 1, 2025, Deep Robotics launched the Lynx M20, a mid-sized wheeled-legged robot designed for hazardous terrains and industrial operations.

- On March 18, 2025, Agility Robotics expanded its relationship with NVIDIA to enhance the capabilities of its humanoid robot Digit, focusing on collaborative safety and commercial applications.

- On July 1, 2025, Sony introduced new mobility robotics technologies capable of traversing rough terrains unsuitable for wheel-based transportation, marking a significant step in quadruped robot development.

Report Scope