Global private equity fund Apollo announced on Wednesday an agreement to acquire a majority stake in Stream Data Centers, a Dallas-based builder of “hyperscale” data centers.

Financial terms of the deal were not disclosed, but Apollo stated the agreement with SDC will enable the firm “to potentially deploy billions of dollars into next-generation digital infrastructure.”

Apollo, the fourth-largest alternative asset manager in the world with more than $800 billion in assets under management, now follows in the footsteps of fellow investment giants like Blackrock by getting in on the rapidly growing demand for digital infrastructure.

The firm estimates “several trillion dollars of investment” are needed over the next decade to meet data center demand, powered by rising energy usage, artificial intelligence and semiconductors.

Business Briefing

Apollo expects to scale its investments in this infrastructure through Stream, and other investments. It has already deployed about $38 billion into renewable energy, compute capacity and related areas since 2022.

Related:D-FW data center construction grows to meet record demand

“With deep development expertise and a valuable long-term land fund in key growth markets, we believe [Stream] is uniquely positioned to serve the infrastructure needs of the world’s most sophisticated technology customers,” Apollo partners Joseph Jackson and Trevor Mills said in a release.

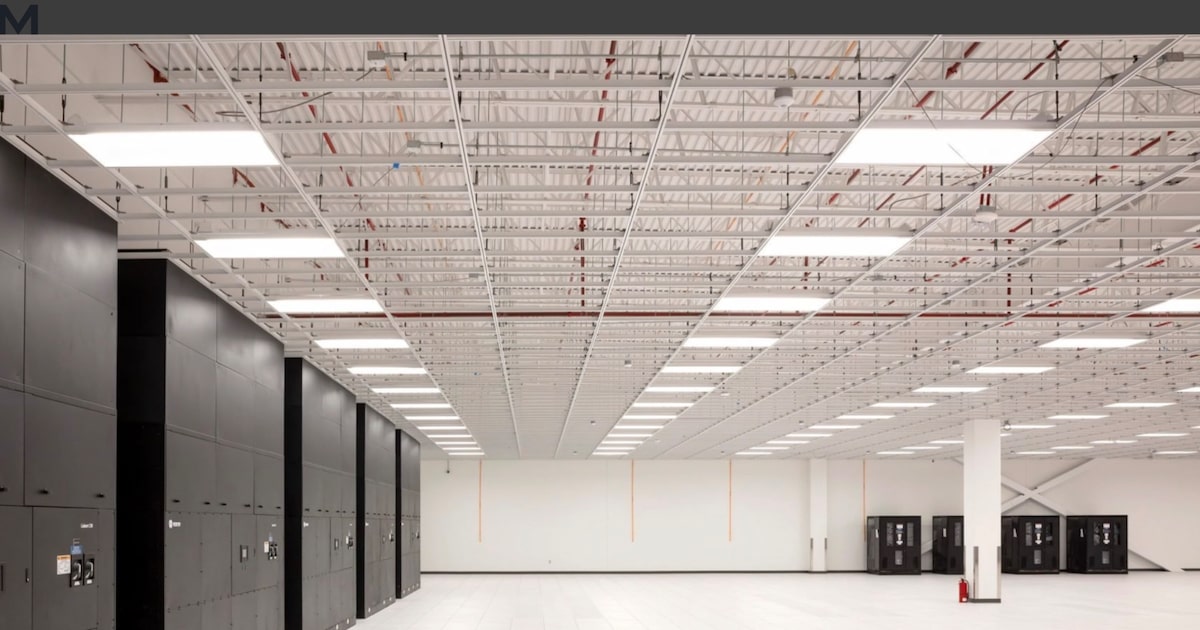

Stream was founded in 1999, and now has active site selection in 25 states. In Texas, it has developed 14 data center projects, ranging from in-development sites to working data centers sold to major companies.

Capital from Apollo will speed the development of 650 megawatts of power capacity across campuses in areas like Chicago, Atlanta and Dallas.

Stream’s management team will maintain a minority interest in the company and continue leading the business, according to the release. Other terms of the deal were not disclosed.

“This symbiotic relationship with Apollo amplifies [Stream’s] existing strength, offering access to the capital required to significantly scale our developments at the rate hyperscale customers demand,” Stream co-managing partners Michael Lahoud and Paul Moser, said in a statement.

Data centers could strain Texas’ infrastructure

The data center industry is booming across the Lone Star State, but it poses challenges to the power grid.

Texas is unique in having a grid that is independent from the rest of the country, and University of Houston researchers estimated recently that the state’s electricity needs could double by 2035, thanks in part to data center expansion.

The researchers also predict data center growth could strain water resources, with a state-wide water deficit reaching 3,600 million cubic meters — about 3 million acre-feet — by 2035.

And because data centers tend to be built away from population centers, meeting these infrastructure demands could pose problems.

Related:Data centers drive ERCOT’s massive power demand forecast

“Much of the increase in water demand, similar to electricity, is coming from regions in the state that were previously not considered significant demand centers,” researcher Aparajita Datta wrote.

Texas has taken steps in the right direction to remedy these issues, but it “needs more responsive and prompt policy action to secure grid reliability, address the geographic mismatch between electricity demand and supply centers and maintain the state’s global leadership in energy,” she said.