Scott Everett, S2 Capital Founder & CEO [Photo: S2 Capital]

Dallas-based real estate investment manager S2 Capital is acquiring Fort Capital, a Fort Worth-based industrial real estate owner and operator, marking “a significant milestone” in S2’s continued growth of its investment platform with a new wholly owned industrial vertical comprising 11 million square feet and a 50-person investment team.

S2 said it hired industry veterans Chris Roach and Parker McCormack to lead the new investment vertical as president and as CIO of the industrial platform alongside S2’s founder & CEO Scott Everett.

Terms of the deal, which is expected to close on Aug. 11, were not disclosed.

“Our vision is to build an industrial platform that matches the scale and operational excellence S2 is known for in residential,” Roach, president of S2 Industrial, said in a statement. “Adding Fort to our platform accelerates that vision—their talented team complements ours culturally, and their portfolio grants us immediate scale to compete in this competitive sector.”

The platform will focus on acquiring and managing value-add and core-plus industrial assets in high-growth markets across the US, with an emphasis on shallow-bay infill industrial, S2 said.

“We’re thrilled this acquisition allows us to provide an additional strategy to offer our investors who are seeking to enhance their portfolio returns in a high-growth sector with needs-based resiliency,” Everett said. “The continued rapid growth of e-commerce, combined with rising transportation costs, is driving the need for proximity to consumers. This correlates well with our residential strategy of ‘following rooftops’ across the country.”

Everett noted that Fort provides a strong entry to the industrial market.

“We knew we needed the right people, the right strategy, and the right partners. Fort brings local expertise, an impressive portfolio and track record, and a culture that aligns with ours,” he said. “This partnership is another step forward in our mission of delivering outperformance for our investors.”

‘Supercharges what both platforms can accomplish’

Founded in 2010, Fort has built a reputation as one of the most active and well-regarded industrial real estate operators in Texas, S2 said. Fort owns and manages more than 11 million square feet of high-performing assets.

“The sale to S2 is an exciting next step for Fort and our investors,” Fort Companies Founder Chris Powers said in a statement. “We’ve always prided ourselves on being entrepreneurial, strategic, and forward-thinking—and those values are deeply aligned with S2’s approach. This partnership supercharges what both platforms can accomplish.”

The combined industrial platform now manages and operates an active pipeline of more than $350 million in targeted acquisitions.

Founded in 2012, S2 Capital is a real estate investment platform specializing in multifamily and industrial across value-add and core-plus strategies. With roughly $11 billion in transaction volume, S2 has acquired and operated more than 50,000 multifamily units, maintaining a fully integrated platform that encompasses acquisitions, development, capital formation, construction, asset management, and property management.

Don’t miss what’s next. Subscribe to Dallas Innovates.

Track Dallas-Fort Worth’s business and innovation landscape with our curated news in your inbox Tuesday-Thursday.

R E A D N E X T

-

S2 Capital said its new fund received institutional backing from U.S. and European investors, including global asset managers, public pension, multi-family offices, and sophisticated wealth management firms.

-

North Texas has plenty to see, hear, and watch. Here are our editors’ picks. Plus, you’ll find more selections to “save the date.”

-

Fort Worth-based Out of Order Studios—whose co-owners executive produced the hit TV show “The Chosen”—said the movie “Monsters vs. Muncy” will be shot in Texas and star Zack Gottsagen (“The Peanut Butter Falcon”) and David DeSanctis (“Where Hope Grows”).

-

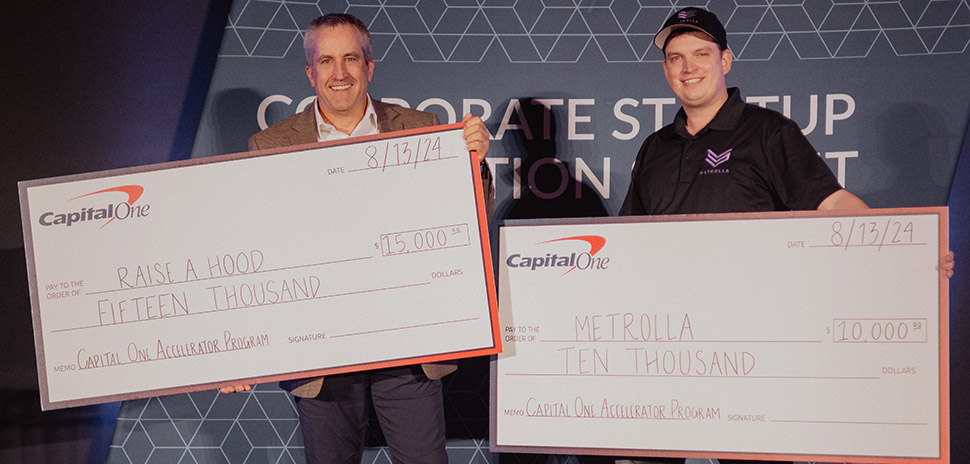

The Capital One program — one of few mobility-focused accelerators in the country — empowers visionary founders to enhance their startup expertise, expand their networks, and attract investors. The latest cohort wrapped up with standout pitches and notable wins.

-

Premature babies diagnosed with bronchopulmonary dysplasia (BPD) face the risk of rehospitalization, delayed brain development, and respiratory problems throughout childhood. No FDA-approved therapies are available for BPD—which is why the new FDA designation for AyuVis’s drug candidate, AVR-48, could lead to game-changing impact.