- Many recent economic indicators reflect a U.S. economy that’s cooling down.

- A new poll found Utahns gloomy over the national economy and personal finances.

- The Utah economy continues to outpace rest of the nation.

Cami Hauver and her husband, Oliver, are in good stead when it comes to their household finances, and it’s a situation they’ve cultivated through thoughtful decision making.

The couple, both in their 30s, attended in-state colleges and got through their undergraduate studies without accruing debt, drive used cars that they paid cash for and bought a home in Sandy in 2021 when mortgage interest rates were still hovering in the 3% range.

“I would say we are doing fine,” Cami Hauver said. “And we feel very lucky compared to other people in our age group.”

Cami Hauver cuts the grass as she and her husband Oliver work in their yard in Sandy on Saturday, Aug. 9, 2025. | Scott G Winterton, Deseret News

But what’s going on in the world in general, and the U.S. economic landscape more close to home, is a cause for concern.

“I do feel a sense of anxiousness for the future,” Cami Hauver said. “One thing that we’re working toward is having kids some day. Bringing kids into this world, with so many things changing, it’s hard not to feel some stress about it.”

And the Hauvers are not alone in their uneasy feelings.

What’s going on with the U.S. economy?Oliver and Cami Hauver work in their garden in Sandy on Saturday, Aug. 9, 2025. | Scott G Winterton, Deseret News

Even ahead of the last two weeks of dismal economic reports reflecting a U.S. economy that’s losing steam, a new Deseret News/Hinckley Institute of Politics poll found a majority of Utahns reporting a loss of faith in the direction of the national economy.

And though President Donald Trump has continued to tout his tariff policies and the economic agenda embodied in the recently passed federal tax-and-spending bill as strategies that will bolster the country’s financial wherewithal, even some in his inner circle have acknowledged there may be cause for worry.

Following the release of a gloomy monthly jobs report last week that enraged Trump, and led to the firing of the head of the federal agency that collects that data, White House economist Kevin Hassett grounded his buoyancy about the U.S. economy with a dose of concern.

An employee works after BNSF Railway, Patriot Rail and the Utah Inland Port Authority hosted a ribbon cutting to mark the official opening of BNSF’s new intermodal facility, 43-acre site located five miles from Salt Lake City International Airport, at BNSF Railway’s new Salt Lake City Intermodal Facility in Salt Lake City on Thursday, July 31, 2025. | Tess Crowley, Deseret News

“There are a lot of really good reasons to be super optimistic about the second half of the year,” Hassett, director of the National Economic Council, told CNBC. “But absolutely that jobs number, if the revision turns out to be true, does suggest that there’s less momentum than we thought.”

But the Labor Department’s June employment report, which underperformed expectations and included a downward revision to May and June numbers that shaved 258,000 jobs off those combined tallies, hasn’t been the only cloud appearing over the domestic economy of late.

The most recent federal inflation data, June’s Consumer Price Index report, found prices on U.S. goods and services rose at a 2.7% annual rate that month, ratcheting up from May’s 2.4% and an increase that may reflect the first signs of trade tariffs impacting U.S. consumer outlays. Prices rose 0.3% on a monthly basis in June as overall inflation, which had been mostly moving down since a January reading of 3%, hit its highest level since February.

A real estate sign is posted near a home under construction in Draper on Thursday, July 10, 2025. | Rio Giancarlo, Deseret News

Beside the costs of basic necessities like groceries and housing continuing to rise, tariff-sensitive goods including appliances, toys, electronics, apparel and sporting goods also saw increases.

“You are starting to see scattered bits of the tariff inflation regime filter in,” Eric Winograd, chief economist at asset management firm AllianceBernstein, told the Associated Press following the report’s release. Winograd added that prices on long-lasting goods also rose in June, compared with a year ago, for the first time in about three years.

In a report published Thursday by investment research firm Morningstar, JPMorgan portfolio manager Priya Misra said the full weight of tariffs has yet to hit the U.S. economy and that the eventual effect on inflation could cause Consumer Price Index increases to hit 3% to 3.5% by December.

Growth in the U.S. gross domestic product, a measure of the total value of goods and services produced in the country, slowed significantly in the first half of the year compared to the last two years, according to a report released last week.

Consumer spending, a primary driver of the U.S. economy, has also been on a cooling trend and a new raft of tariffs went into effect this week, impacting trade fees with over 60 countries and the 27-member bloc of European Union nations. Most economists predict the tariffs will lead to higher consumer prices on some goods, though the extent and timing of those increases remains unclear.

What Utahns say about the world of moneyA cashier sorts money from a customer at a Maverik in Salt Lake City on Friday, June 27, 2025. | Isaac Hale, Deseret News

What is more clear, however, is how Utahns are feeling about the direction of the local and national economies as well as the current state of their personal finances.

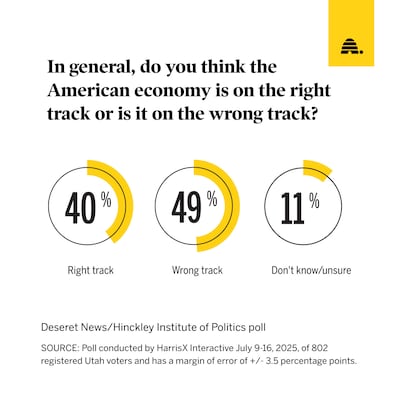

In statewide online polling conducted July 9-16 by HarrisX for the Deseret News in partnership with the University of Utah’s Hinckley Institute of Politics, almost half of Utah voters who participated in the survey, 49%, said the U.S. economy was on the wrong track versus 40% who believe the nation’s economy is headed in the right direction.

When parsed by self-identified party affiliations, 57% of Republican respondents versus 13% of Democrats said the U.S. economy was on the right track while 31% of GOP participants told pollsters the country’s economy was on the wrong track as did 80% of Democrats.

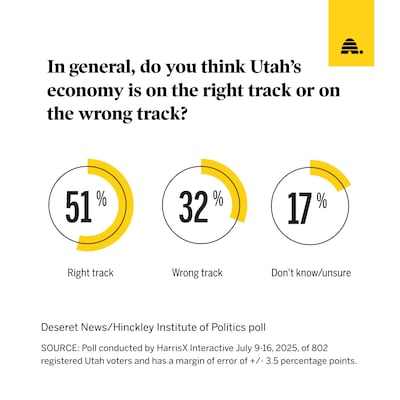

Poll participants were pointedly more optimistic about where Utah’s economy is headed with 51% reporting they believe the state is on the right fiscal path while 32% said Utah is on the wrong economic track.

Again, deep divides became apparent when sifting responses by political persuasion with 67% of Republicans and 31% of Democrats saying Utah is on the right economic track, and 20% of Republicans compared to 50% of Democrats saying the state is off on the wrong track.

When asked, “Would you say your personal financial situation is improving, getting worse or staying the same?”, 26% report their finances are improving, 34% said getting worse and 38% indicated their finances are holding steady.

As for personal finances, 33% of Republicans say they’re getting better compared to 20% of Democrats; 24% of Republicans say they’re getting worse compared to 34% of Democrats, and 42% of Republicans say they’re staying the same compared to 37% of Democrats.

Interestingly, Utahns’ feelings about the U.S. and Utah economies as well as their personal finances have been unwavering since earlier this year. Responses to those same questions in the new Deseret News/Hinckley poll were almost identical to what pollsters found back in February.

An economist breaks it down

In a Deseret News interview, Phil Dean, public finance senior fellow at the University of Utah’s Kem C. Gardner Policy Institute, said he wasn’t surprised by Utahns’ split opinions about the national and state economies, noting the viewpoints in large part reflect Utah’s higher level of performance compared most of the rest of the country.

Utah is easily outperforming the average readings for the rest of the country on inflation, job growth and state gross domestic product or GDP. While the U.S. clocked solid 2.8% GDP growth in 2024, Utah blew past the national rate, and every other state in the country, with a 4.5% year-over-year GDP jump last year while breaking the $300 billion mark in economic activity for the first time last year, totaling $301 billion.

Utah is also holding down the No. 1 spot in cumulative GDP growth over the past 10 years at 64%.

But while the Beehive State’s economy is doing well, Dean noted Utah is still very connected to and reliant upon what’s going on in the rest of the country, and that’s a set of circumstances that’s a little more iffy.

“As far as the overall economy, we’re definitely seeing moderation occur,” Dean said. “I think there are still questions in a number of areas as to the depth and extent of that moderation.”

Dean said that while U.S. inflation has recently been on the rise, the current rate is still in the “high end of normal” range. He also pointed to mixed signals, with inflation on services trending down while broader price increases have been centered on goods. And that’s where tariff pressures could become more notable in the near term.

“Tariffs will exert inflationary pressure over time,” Dean said. “But there is a lot of uncertainty about how that plays out.”