40m agoThu 14 Aug 2025 at 12:45amMarket snapshot

- ASX 200: +0.6% to 8,876 points (live values below)

- Australian dollar: +0.1% to 65.49 US cents

- S&P 500: +0.3% to 6,466 points

- Nasdaq: +0.1% to 21,713 points

- FTSE 100: +0.2% to 9,165 points

- EuroStoxx 600: +0.5% to 550 points

- Spot gold: +0.5% to $US3,370/ounce

- Brent crude: +0.3% to $US65.84/barrel

- Iron ore: +0.1% to $US102.85/tonne

- Bitcoin: +0.7% to $US123,748

Price current around 10:45am AEST

Live updates on the major ASX indices:

10m agoThu 14 Aug 2025 at 1:16amSouth32 shares down as Mozal smelter ‘deadlocked’

Shares in miner South32 are down 3.4 per cent, as it flagged a financial hit from issues at is Mozambique smelter.

The company it will take a $US372 million impairment on its Mozal aluminium smelt and place the facility into care and maintenance once its current power supply agreement expires.

The diversified miner had warned in July that it would face an impairment at Mozal during the 2025 financial year and was reviewing production after failing to secure affordable power beyond March 2026. At the time, it did not disclose the size of the charge.

South32 said it has since continued engagement with the Mozambique government, hydroelectric producer Hidroeléctrica de Cahora Bassa (HCB) and South African utility Eskom since July.

“These engagements do not provide confidence that Mozal will secure sufficient and affordable electricity beyond March 2026,” South32 said on Thursday.

RBC Capital Markets analyst Kaan Peker said the “power deadlock casts doubt” on the outlook for the current financial year and long-term profitability, but note the risk was “well flagged”.

“The negotiations appear to be deadlocked. Increasingly, the future of the smelter is being called into question, which will be taken as a negative,” he wrote.

HCB, majority-owned by the Mozambique government, is the primary power supplier to Mozal. When it cannot meet the smelter’s needs, Eskom steps in under the current agreement.

July was the second time South32 flagged impairments at its Mozal project. In December, nationwide protests in Mozambique disrupted operations and weighed on production.

Reporting with Reuters

28m agoThu 14 Aug 2025 at 12:58amBroad-based gains as ASX recovers yesterday’s losses

The ASX 200 has bounced back from Wednesday’s fall, up 0.6 per cent after almost an hour of trade.

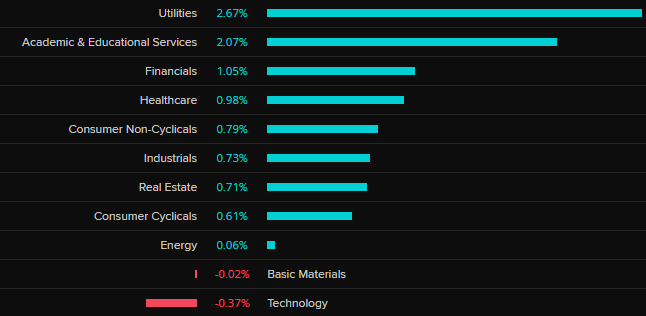

The gains are broad-based, with most sectors on the rise:

ASX 200 sectors (LSEG Refinitiv)

ASX 200 sectors (LSEG Refinitiv)

The best performing stocks so far:

- Temple & Webster +3.4%

- Westpac +5.3%

- Origin Energy +4.4%

- Life360 +4.1%

- Mineral Resources +4.1%

And the biggest falls:

- South32 -3.8%

- Ventia Services Group -3.5%

- Rio Tinto -2.2%

- Telstra -2%

- AUB Group -1.5%

It’s a change of fortunes from yesterday, with a major bank, Westpac, providing a boost the ASX, after reporting a more than 5 per cent rise in its quarterly profit, as margins increased.

That’s compared to CBA, which is down another half a per cent after a fall of more than 5 per cent yesterday on the back of its profit result.

40m agoThu 14 Aug 2025 at 12:45am

Income gap between renters and home owners grows over time

Re the income gap between home owners and renters

Really? I’m paying $1500 a week on my mortgage I’d be lucky to rent it out for $1000-$1200. I have no doubt it’s hard out there for renters but the grass isn’t always greener on the other side

– Martha

Hi Martha.

The point you make is true in the short-term … i.e. now.

But think about what happens over the long term.

Your mortgage payment is likely to decline a bit more as interest rates fall back to neutral levels.

Even if it doesn’t, inflation means your income should rise over time, so the $1,500 a week you are paying becomes smaller in real terms.

That’s why the first few years of a mortgage are generally the hardest.

Now think about the renter.

Sure, they might only pay a $1,000 a week in rent now, but their rent will rise broadly in line with inflation.

Even if rents only rise 2.5% per year, their rent will get to $1,500 a week in 15 years and your mortgage repayment will still probably be about $1,500 a week.

By the time you get close to paying off your 25-30 year mortgage, the renter will be paying a lot more in rent than you are in repayments.

Not only that, but once you have paid your mortgage off, then you are living in your home for “free” — sure there are rates and maintenance costs, etc, but you are not paying a mortgage or rent.

By contrast, the renter is still paying the now much higher (in nominal terms) rent.

Siminski and Wilkins are looking at lifetime incomes, and when you think about it this way you can see how they came to the conclusion that home owners end up, on average, 86% better off.

50m agoThu 14 Aug 2025 at 12:35am

New all-time high for Bitcoin

Bitcoin has just smashed through to a new all-time high of $USD123,624, up 3.60 per cent overnight.

It’s ahead of its previous peak of $123,236, set exactly one month ago on July 14, 2025.

“Bitcoin’s rally is being powered by institutional flows and macro tailwinds,” IG’s Tony Sycamore wrote in a note.

“Corporate treasuries like MicroStrategy and Block Inc. continue to buy Bitcoin while Treasury Secretary Scott Bessent’s calls overnight for a 50bp Fed rate cut in September, and suggestions that the Fed funds rate is 150-175bp too high is fuelling expectations of looser policy.”

We’ll keep an eye out on Bitcoin for you through the day on the blog.

58m agoThu 14 Aug 2025 at 12:28am

Insurance issues among ‘significant breaches’ at Mercer: ASIC

ASIC has lodged legal proceedings against Mercer Super, one of Australia’s largest funds, alleging it failed to report investigations into serious issues to the regulator, as required by law.

Here’s some more detail from the corporate regulator:

Examples of these systems failures include, ASIC alleges, Mercer Super failing to report seven investigations at all, and another investigation being reported more than a year late, including investigations into:

-Insurance premiums not being refunded correctly after members had died

-Member accounts not being created with default insurance, and

-Updates to member information not being processed by the trustee.

ASIC also alleges Mercer Super provided false or misleading information in reports to ASIC, which understated the number of members who were impacted.

‘We allege a pattern of longstanding and systemic failure by Mercer Super to comply with the law,” ASIC deputy chair Sarah Court said.

1h agoThu 14 Aug 2025 at 12:11amASX opens higher despite CBA dipping again

We’re just 10 minutes into the session but the ASX 200 is firmly higher, up 0.6 per cent after falls of a similar magnitude yesterday.

That’s despite CBA again declining, down a modest 0.3 per cent in early trade.

The positivity for the local market follows a strong session on Wall Street overnight.

1h agoThu 14 Aug 2025 at 12:03amSuper fund Mercer sued by corporate regulator

The corporate regulator has launched legal proceedings against one of Australia’s largest superannuation funds, Mercer Super.

ASIC is alleging Mercer failed to inform the regulator about “investigations into serious member services issues, including incorrect insurance premium refunds for dead members”.

The alleged failures occurred between October 2021 and September 2024, ASIC says, claiming Mercer’s systems were inadequate to comply with its requirements to “promptly report ongoing investigations into significant breaches of their core obligations”.

The proceedings have been lodged in the Federal Court.

1h agoWed 13 Aug 2025 at 11:49pm

ICYMI: Finance with Daniel Ziffer

Just 10 minutes until the ASX opens for the Thursday session, so take a look back on how we got here with Daniel Ziffer.

CBA shares entered correction territory yesterday, making a 10 per cent drop from its most recent peak.

Here’s why it had such a big impact on the broader market:

Loading…

2h agoWed 13 Aug 2025 at 11:15pm

Fears for jobs as Star seeks approval for Brisbane casino deal

A deal between gambling giant Star Entertainment and its partners in Brisbane’s Queen’s Wharf casino still faces regulatory hurdles and has left employees with questions about their future at the embattled precinct.

Star told investors on Tuesday morning it had finally signed a deal with its Hong Kong partners, which would see Star give up assets, including its 50 per cent stake in the $3.6 billion Queen’s Wharf casino complex, and the Treasury car park and hotel.

A Queensland government spokesperson said the deal between Star and its joint venture partners — Chow Tai Fook Enterprises (CTFE) and Far East Consortium — was not yet finalised.

The state government would not say whether it held concerns about Queen’s Wharf employees working under owners with chequered legal histories, but said jobs and staff welfare were top priorities.

Read more from Ned Hammond reporting in Brisbane:

2h agoWed 13 Aug 2025 at 11:05pm

🎥 The income gap between home owners and renters widens

Ahead of the federal government’s economic reform round table, two leading economists are calling for a tax on wealth, land or the family home to close the income gap between renters and home owners.

New research finds Australia’s extremely favourable tax treatment of owner-occupied housing is fuelling the problem, encouraging Australians to plough money into housing at the expense of everything else — leaving those without housing even further behind.

It leaves two Australians, similar other than their home-ownership status, facing very different futures, as Rhiana Whitson reports on The Business:

Loading…

The new paper from Peter Siminski from UTS Sydney and Roger Wilkins from Melbourne University considers the untaxed income owner-occupiers get from their homes, via “imputed rent” — the value of living in your own house without paying rent — and capital gains made when the home’s value rises.

Read more from Rhiana Whitson and Gareth Hutchens:

2h agoWed 13 Aug 2025 at 10:50pmASX Ltd profit rises 6pc, boss acknowledges reputational hit

Stock exchange operator ASX has reported a 6 per cent rise in net profit for the financial year, to $502.6 million.

Shareholders will receive a final dividend of 112.1 cents per share.

In the company’s report, ASX CEO Helen Lofthouse began by “acknowledging the challenges faced by ASX”.

“We recognise the status of our operational risk management and resilience has drawn regulator scrutiny and had reputational impact,” she said.

Ms Lofthouse described a 2024 ASX outage, regulatory scrutiny from ASIC and the RBA, and the corporate regulator’s ongoing inquiry as “serious matters”.

Last week, the ASX forecast additional operating costs of between $25 million and $35 million in the financial year ahead, as a result of legal and other costs to manage its response to the ASIC inquiry.

It follows a decade of troubles for the operator and some recent high-profile embarrassments — read more from chief business correspondent Ian Verrender:

2h agoWed 13 Aug 2025 at 10:29pmTelstra profit up more than 30pc, $1b share buy-back

Telco giant Telstra has posted a $2.17 billion statutory net profit for the year — nearly 34 per cent higher than 12 months ago.

The company announced an additional share buy-back of up to $1 billion, after a $750 million on-market buy-back completed in June.

“This has been enabled by growth in earnings, and the strength of our balance sheet,” Telstra said.

Shareholders will receive a total of 19 cents per share in dividends for the year, up 5.6 per cent from a year earlier.

3h agoWed 13 Aug 2025 at 10:10pmCBA boss not too worried about share price drop

Commonwealth Bank‘s CEO Matt Comyn says he does not “worry too much about the near-term movements in the share price”, after CBA’s share price dropped more than 5 per cent yesterday, dragging down the broader market with it.

After a huge run up in the bank’s share price over the past year, leading analysts to highlight how it was impossible for the company to live up to the stock’s sky-high valuation, Mr Comyn said he was conscious that “there’s a lot of Australians that are invested in the performance”.

“Commonwealth Bank is owned by 13 million Australians … directly or indirectly, there’s a lot of interest in the share price for us,” Mr Comyn told The Business.

“[The] most important thing to do is to execute our strategy consistently, deliver a great proposition for our customers.”

Watch the interview with Matt Comyn and business editor Michael Janda:

Loading…

3h agoWed 13 Aug 2025 at 9:55pm

Reporting season continues: Telstra, Suncorp, ASX

The profit reporting season for ASX-listed firms continues, with some big companies on today’s agenda.

You can search this calendar to see when stocks you hold or companies you’re interested in are reporting:

We’ll bring you across the results of the day shortly, they’re starting to hit the ASX.

3h agoWed 13 Aug 2025 at 9:52pm

Market snapshot

- ASX 200 futures: +0.4% to 8,825 points

- Australian dollar: Flat at 65.43 US cents

- S&P 500: +0.3% to 6,466 points

- Nasdaq: +0.1% to 21,713 points

- FTSE 100: +0.2% to 9,165 points

- EuroStoxx 600: +0.5% to 550 points

- Spot gold: flat at $US3,354/ounce

- Brent crude: -0.5% to $US65.78/barrel

- Iron ore: +0.1% to $US102.85/tonne

- Bitcoin: -0.4% to $US122,384

Price current around 7:50am AEST

Live updates on the major ASX indices:

3h agoWed 13 Aug 2025 at 9:47pmASX to recover some of yesterday’s drop

Good morning, I’ll be joining you for the next few hours to take you through the morning’s market moves.

ASX futures are pointing to a modest rebound, after the benchmark index dropped 0.6 per cent, thanks to a 5 per cent-plus slump in CBA shares.

It follows gains on Wall Street overnight, with the Dow gaining 1 per cent and the S&P 500 and Nasdaq closed at new highs.

Reporting season continues, with Telstra, Suncorp and ASX Ltd on the calendar today.

The main economic event will be the labour force data out at 11:30am AEST — forecasts are for the unemployment rate to improve slightly, from 4.3 per cent in June to 4.2 per cent in July.

Stick with us!

Loading