Indian markets are nothing short of a roller coaster ride on adrenaline. Prices swing either way, people become rich overnight, while some lose a lot at the same time. It is a ride to watch. In such a market, there are some investors who come across as a calm in the storm. One of such investors is the ‘Retail King’ of India, Radhakishan Damani.

One of the most followed and respected investors, a Warren Buffet of India, is a known value investor who currently holds 13 stocks in his portfolio worth Rs 193,940 cr. Of course, the biggest holding is the home turf, Avenue Supermarts worth Rs 187,270 cr.

Two of his favourite long-term holdings have currently slipped to a price that is over a 40% discount form their all-time high prices. But even after the decline, they haven’t lost favour from the retail king. Which makes one wonder, what is it that this Warren Buffett of India sees in them, that an average investor could not. Let us try and find out.

The Ed-Tech Bet: Fading Profits vs. a High Dividend Payout

Established in 1986, Aptech Ltd. is a pioneer in the non-formal education and training business in the country with a significant global presence.

With a market cap of Rs 739 cr cr, Aptech has a presence in diverse sectors ranging from IT training, media & entertainment, retail & aviation, beauty & wellness, banking & finance, and pre-school segment amongst others. It has successfully trained students, professionals, universities & corporates through its two main streams of business – Individual Training and Enterprise Business Group.

Radhakishan Damani has been holding a stake in Aptech since December 2015 (as per as the data on Trendlyne.com), under the name of his younger brother, Gopikishan Damani. Currently he holds 3% stake in the company worth almost Rs 23 cr.

It would be interesting to see what has kept Damani interested and invested in Aptech, despite the decline in share prices.

The company’s sales grew from Rs 158 cr in FY20 to Rs 476 cr in FY25, which is a compound growth of 24%. Up to the quarter ending June 2025, the company has already recorded sales of Rs 120 cr.

The EBITDA (earnings before interest, taxes, depreciation, and amortization) for Aptech however has been moving and saw a dip in FY25.

Similar is the case for net profits, which has been seeing a decline in the recent years.

The share price of Aptech Ltd jumped from around Rs 80 in August 2020 which has gone to127 as on 13th August 2025, which is a 59% jump.

At the current price of Rs 127, the stock is trading at about a 70% discount from its all-time high of Rs 423.

The company’s share is trading at a current PE of 35x, while industry median is around 36x. The 10-year median PE for Aptech is 36x, and the industry median for the same period is a just 26x.

The company has a dividend yield of 3.6% which is probably the highest in the industry and has been maintaining a healthy dividend payout of almost 90%.

As per the last investor presentation in June 2024, Aptech is optimistic about growth potential in the Retail segment despite challenges and plans continuous course upgrades to meet industry demands and stay ahead of trends, when it comes to training.

The Tobacco Play: A Stable Business in a Slow Decline?

Incorporated in 1930, in Hyderabad, VST Industries Ltd (originally Vazir Sultan Tobacco Company) is an associate of British American Tobacco Plc., a global leader in the cigarette industry which is into manufacture and trading of Cigarettes, Tobacco and Tobacco products.

With a market cap of Rs 4,731 cr, VST is the 3rd largest player in the domestic cigarette market, with a significant presence in West Bengal, Andhra Pradesh, Telangana, Bihar, and UP with an 8% market share based on volume. Its cigarette brand Total is among the top 10 brands in the industry.

Damani has held a stake in VST since March 2016 as per data on Trendlyne.com, either in his own portfolio or through his companies, Bright Star Investments Pvt. Ltd or Derive Trading and Resorts Pvt. Ltd.

Currently he holds a 29% stake, including individual a company, as of the quarter ending June 2025, which is worth Rs 1,374 cr.

The company’s sales jumped from Rs 1,239 cr in FY20 to Rs 1,398 cr in FY25 which is a compound growth of just 2%.

EBITDA has seen a decline in the recent years.

As for Net at profits, we can say VST has stagnated in the last 5 years.

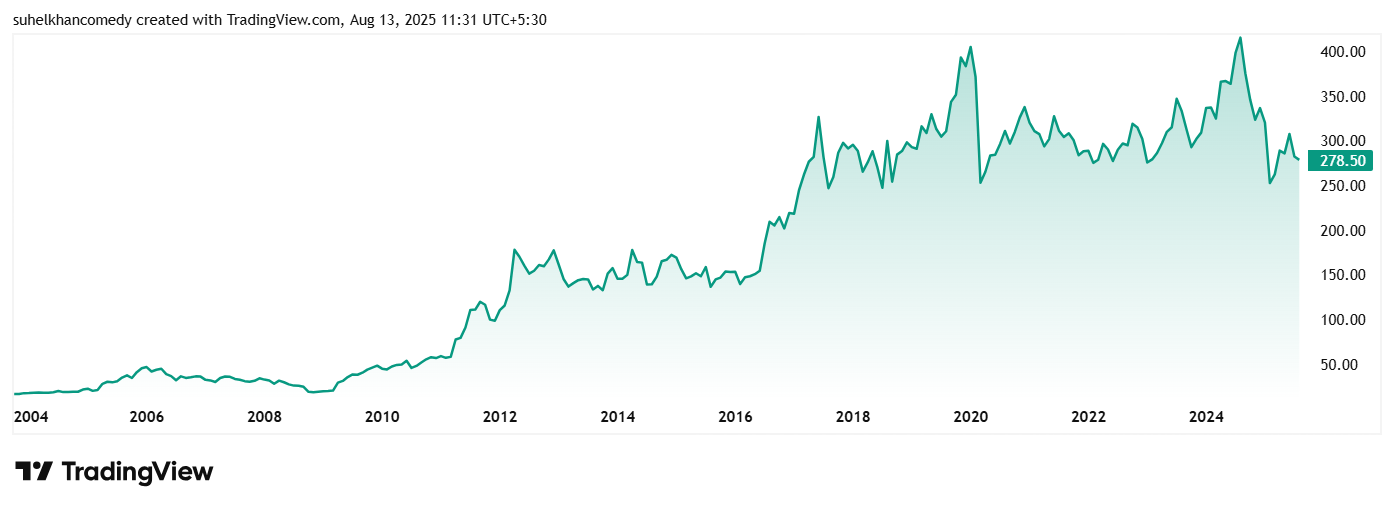

VST’s share price was around Rs 310 in August 2020 which as on 13th of August 2025 has gone down to RS 278 which is a drop of 10%.

At the current price of Rs 278, the company’s share is trading at a discount of 43% from its all-time high of Rs 487.

The share is trading at a PE of 22x, while the industry median is 32x. The 10-year median PE of VST is 19x and the industry median for the same period is 22x.

In the company’s recently released Annual report, Non-Executive Chairman Naresh Sethi says, “we are optimistic. Our actions are grounded on three active pillars—portfolio upgradation, deeper digital enablement, and geographic penetration—across both the value and mid-premium segments. With more robust brand-building efforts and a sharper go-to-market model, we aim to grow ahead of the industry over the long term.”

The Verdict: A Contrarian Opportunity or a Sinking Ship?

VST Industries Ltd and Aptech Ltd have found a place in Damani’s portfolio for almost a decade and still continue to have a place there, despite the recent decline. This could be a window into the ‘Retail King’s’ strategy of not being swayed by market sentiments. After all, he is not one known to pick and drop stocks easily.

Given that these 2 favourites of his are now trading at big discounts, it makes one wonder if these are some hot buying opportunities or traps. Both companies although steady in their business models have seen a drop in operating and net profits in the last few years. But that has not probably affected Damani.

His strong belief in these stocks signal at that he sees beyond short-term market sentiments. It will be a good strategy to add these stocks to a watchlist and keep a close eye on them.

Disclaimer

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.