Property values that were once rising rapidly have slowed dramatically from just a few years ago, bringing both the city and the county’s property tax revenues down with it.

While that dynamic is now forcing San Antonio into a budget crunch, Bexar County isn’t feeling the same pain because rapid new development is more than making up for the losses.

All across Texas, long-established municipalities find themselves hurting for cash this budget season as fast-growing communities continue to bring in more than money than previous years.

Such contrasting financial outlooks were on full display as San Antonio and Bexar County leaders each presented their budget proposals for the 2025-2026 fiscal year this year — including, for the first time in recent memory, a decrease in revenue from property taxes on existing structures.

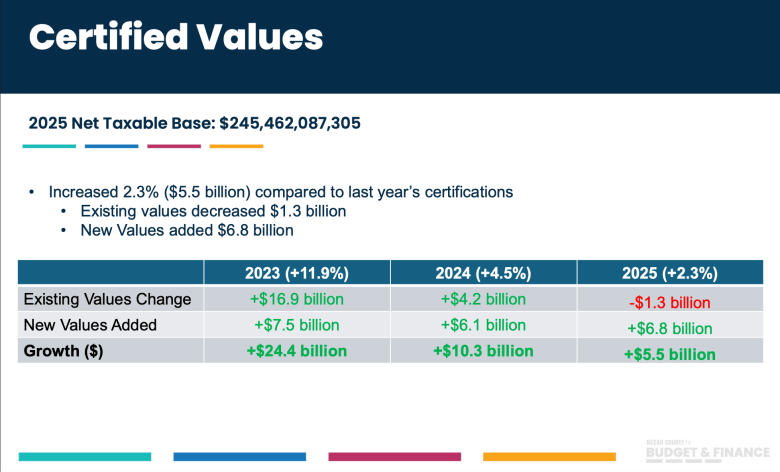

“Existing properties from last year, their net appraisals went down,” County Manager David Smith said in a recent interview with the San Antonio Report.

But when new development is accounted for, the city estimated its total property tax revenue will be about .1% higher than the 2025 fiscal year — about $844,000 in a roughly $4 billion budget proposal that includes revenue from other sources.

Meanwhile in the county, total property tax revenue is expected to come in about 2.2% higher than the previous year, or about $13.3 million in an overall $2.8 billion budget.

“All these new subdivisions, they’re out in the county,” Smith of the disparate financial outlooks. “The city’s basically built. That’s what’s different for us.”

Trending negative

The City of San Antonio has many other revenue sources beyond property taxes — including sales tax, a bond program, permitting fees and money it receives from a profit-sharing model with CPS Energy.

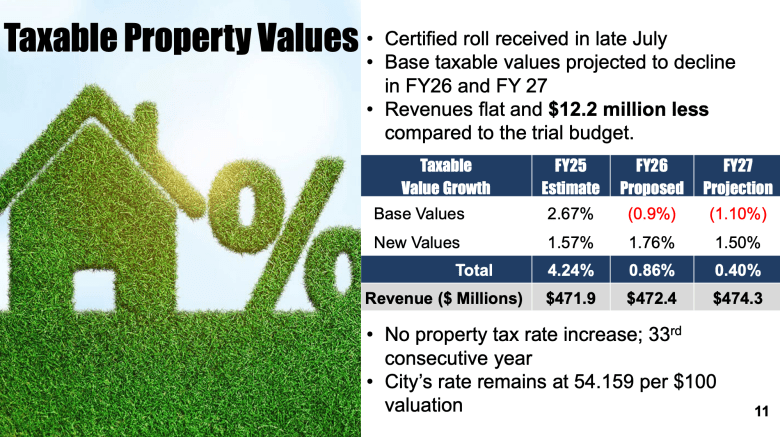

But when early projections showed this year’s property tax revenue growing more slowly than expected, City Manager Erik Walsh warned that spending cuts were inevitable to prevent a relatively small deficit from ballooning to roughly $150 million by 2027.

By the time city staff made its formal presentation on Thursday, the outlook was even worse.

Property taxes from existing structures were in the red, down .9% from the previous fiscal year, and projected to drop another 1.1% in 2027.

The result was a city budget proposal that called for cutting staff positions, scaling back employee raises and increasing parking ticket fees — among other changes — to balance the budget.

City departments were even asked to compose plans for across-the-board cuts, in case further reductions are needed throughout the year.

“What’s compounding it is, we’re going negative,” Walsh said of the property tax revenue.

While new construction kept the city’s overall taxable values in the positive this year, Walsh said that revenue looks less reliable in the future.

Residential building permits were down about 16% in 2025, and commercial building permits were down about 10%, Walsh told the council, citing economic uncertainty, tariff conversations and interest rates as potential causes.

“Building permits are one of our early warning indicators,” Walsh said. “With permitting being down this year and not anticipated to change only marginally going into 2026, those are likely to be pressures we see in future taxable values going forward.”

Michael Berlanga, a San Antonio real estate and tax consultant who has a business helping people challenge their property valuations, said that outlook should give the city some pause as it considers borrowing money for big projects down the line.

“If you’re not growing, you might be dying,” Berlanga said. “Growing enables us to leverage our future, and when we go through periods of slow growth or no growth, then we have to revisit how far into the future do we want to leverage the presumption of growth?”

A fast-growing county

In years of fast-growing property values, municipalities didn’t get to keep all of the additional revenue because the state caps the amount of property taxes they can collect on existing properties at 3.5% growth over the previous year.

That cap forced both San Antonio and Bexar County to lower their tax rates and create new tax exemptions to stay within the state’s limit — and neither has been eager to reverse course on such popular programs even now that values have dipped.

While San Antonio is making big cuts to avoid a tax rate increase, the situation is different in Bexar County, which includes all of San Antonio, as well dozens of other smaller cities and towns, plus unincorporated territory, within its taxing jurisdiction.

This week Smith presented a budget that calls for 70 new employees at the jail, 22 new patrol officers in the Sheriff’s Office, and a major investment in equipment to manage flash flooding on the roads.

That all without making major spending reductions, and while keeping the tax rate even from the previous year.

Smith said he’s able to do it because roughly $6.8 billion in new development was added to the county’s taxable values this year.

“We got that new construction, which gave us some growth,” Smith said.

County leaders are still approaching this budget season with caution — thanks to looming federal policy decisions that could leave local agencies scrambling to make up for cuts to Medicaid and SNAP benefits.

At the same time, the county still has to decide whether to continue a number of programs it started using federal pandemic relief, which is poised to create a fiscal “cliff” when it dries up.

Smith said Wednesday that the county was still three to four years out from that scenario.

“We still need to make annual adjustments to make sure that we adequately address that,” Smith said. “And of course, it partially depends on how much of the [pandemic era projects] that they want to continue to fund.”