Middle East Building Envelope Market Summary

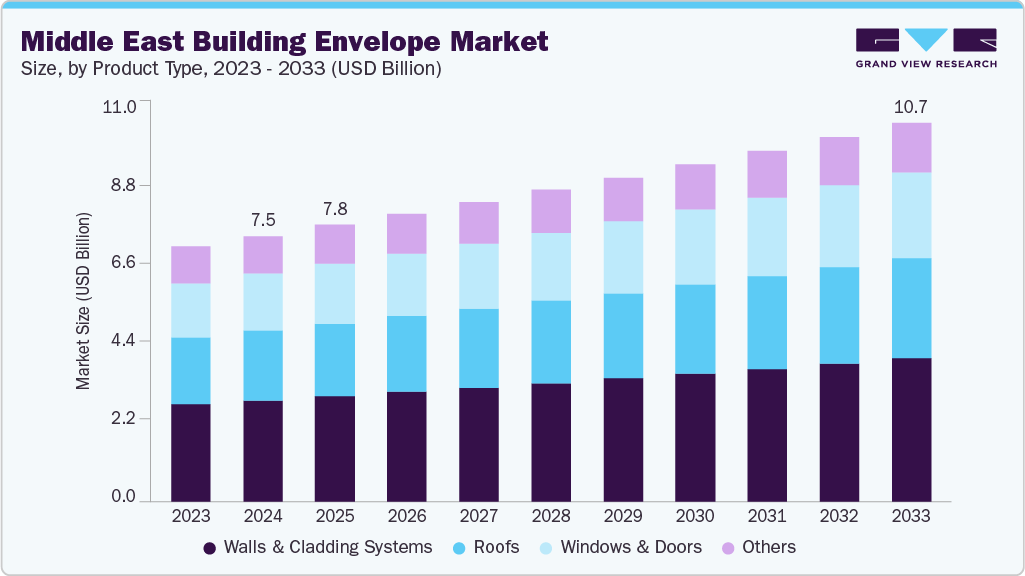

The Middle East building envelope market size was estimated at USD 7.51 billion in 2024 and is projected to reach USD 10.71 billion by 2033, growing at a CAGR of 4.0% from 2025 to 2033. The demand for building envelope solutions in the Middle East is rising due to rapid urbanization and population growth, which are driving large-scale residential, commercial, and mixed-use developments.

Key Market Trends & Insights

- Saudi Arabia dominated the Middle East building envelope market with the largest revenue share of 32.3% in 2024.

- By product type, the windows & doors segment is expected to grow at the fastest CAGR of 4.6% from 2025 to 2033.

- By end use, the commercial segment is expected to grow at the fastest CAGR of 4.5% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 7.51 Billion

- 2033 Projected Market Size: USD 10.71 Billion

- CAGR (2025-2033): 4.0%

The extreme climatic conditions of the region, including high temperatures, dust, and humidity, are creating the need for advanced facades and roofing systems that enhance thermal performance and durability. Energy price reforms and stricter building codes are encouraging developers to adopt more efficient envelope systems. Additionally, the expansion of tourism, healthcare, and education infrastructure requires high-performance and aesthetically advanced envelopes. Post-pandemic trends have also increased the emphasis on indoor environmental quality, further strengthening demand. Renovation and retrofitting of existing buildings in the UAE and Saudi Arabia are providing additional growth opportunities for the Middle East building envelope industry.

Government-led diversification plans such as Saudi Vision 2030 and UAE Net Zero 2050 are key demand stimulants, translating into substantial investment in infrastructure and urban projects. The growth of logistics, data centers, and industrial hubs is contributing to the demand for insulated panels and high-performance envelope systems. The increasing adoption of renewable energy projects has created opportunities for solar-integrated facades and reflective roofing solutions. At the same time, insurance and facility management considerations are pushing developers toward wind-resistant, fire-rated, and long-lasting materials. International developers entering the region are introducing specifications aligned with global green building standards such as LEED and Estidama. The availability of localized production of aluminum, glass, and insulation is also reducing costs and lead times, thereby supporting growth.

The market is witnessing steady technological advancements in facade and roofing systems. High-performance glazing solutions such as double and triple-pane low-E glass are gaining traction in premium developments. Automated shading systems and electrochromic glass are being used to improve energy efficiency and occupant comfort. Prefabricated and unitized curtain wall systems are increasingly adopted to reduce construction time and improve quality control. Roofing solutions are evolving with the adoption of reflective membranes, hybrid waterproofing systems, and liquid-applied coatings. Building-integrated photovoltaics (BIPV) are becoming more common in flagship sustainable projects. The adoption of sensor-enabled facades and digital twin technologies is improving long-term monitoring and maintenance.

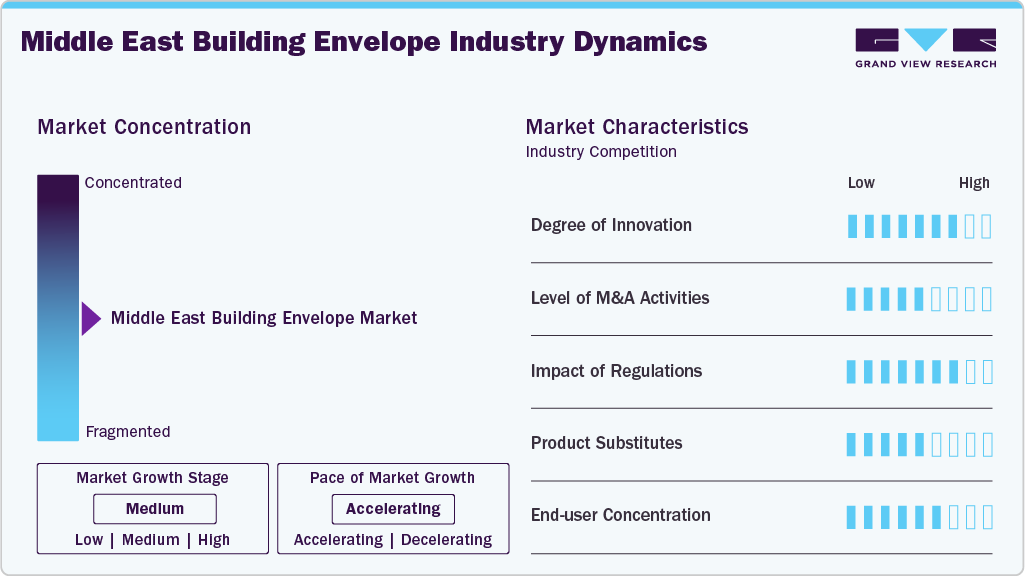

Market Concentration & Characteristics

The Middle East building envelope market is moderately concentrated, with a mix of international facade contractors and regional fabricators dominating system-level supply. Large-scale projects tend to rely on a limited pool of pre-qualified vendors, particularly for curtain wall systems. However, the supply of insulation, glazing, and roofing materials remains more fragmented, with multiple regional and global players active. Roofing membranes are typically provided by a few leading international brands in partnership with local applicators. Retrofit contractors remain fragmented but are gradually consolidating as demand grows for technically complex refurbishment projects.

Substitution exists across envelope components depending on project requirements and cost considerations. Stick-built and unitized systems compete in high-rise facades, while aluminum composite panels, glass-reinforced concrete, stone, and terracotta cladding are common alternatives in exterior finishes. Roofing systems such as single-ply TPO/PVC, bituminous membranes, and liquid-applied systems compete depending on performance and durability requirements. Shading devices and electrochromic glazing can act as substitutes for high-spec glazing in certain cases. Prefabricated volumetric construction may also reduce reliance on conventional site-installed facade systems for selected projects.

Product Type Insights

The walls and cladding systems segment held the highest revenue market share of 38.2% in 2024, supported by widespread use in high-rise towers, commercial complexes, and public infrastructure. The extreme climatic conditions in the region, including high solar exposure and sandstorms, make thermally insulated wall assemblies and durable cladding materials a priority. Aluminum composite panels (ACP), glass curtain walls, stone, and high-pressure laminates are among the most widely adopted systems due to their balance of aesthetics, performance, and fire resistance. Mega-projects in Saudi Arabia, UAE, and Qatar are driving demand for unitized curtain wall systems, while cost-sensitive markets such as Egypt rely more on stick-built façades.

The Windows and doors segment is expected to grow at the fastest CAGR of 4.6% over the forecast period, driven by rising demand for energy-efficient and high-performance glazing systems. Increasing regulatory pressure to reduce cooling loads is fueling the adoption of double- and triple-glazed units with low-emissivity coatings. Smart glass and automated shading-integrated windows are gaining traction in premium commercial and residential projects, particularly in the UAE and Saudi Arabia. Expanding investment in luxury housing, hospitality, and data centers is accelerating the uptake of advanced fenestration systems with airtightness and acoustic control features.

End Use Insights

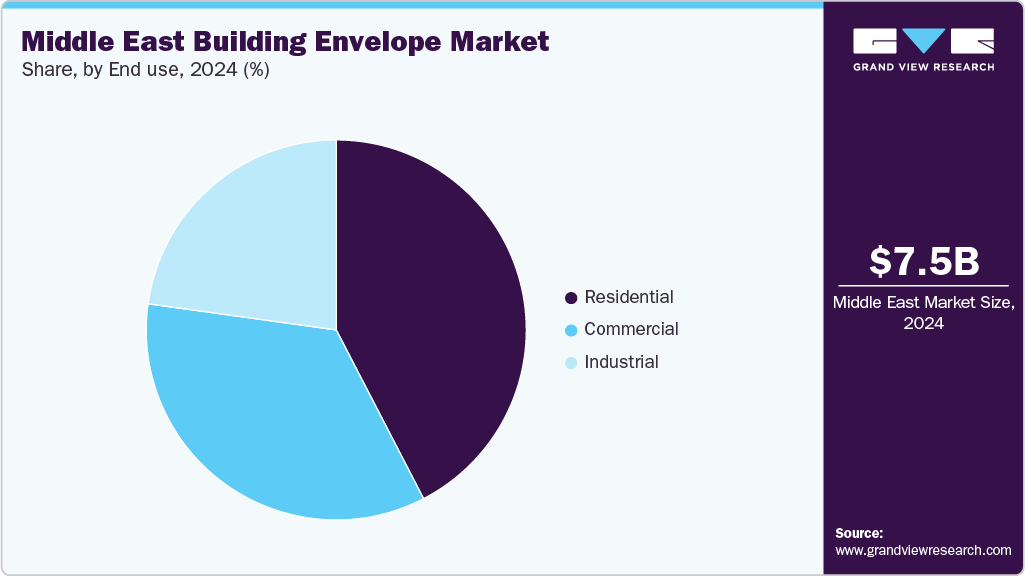

The residential segment led the Middle East building envelope industry with the highest revenue share of 42.4% in 2024, supported by large-scale housing programs and mixed-use urban developments across the GCC and North Africa. Government-backed affordable housing initiatives in Saudi Arabia, Egypt, and Kuwait, along with luxury high-rise apartments in the UAE and Qatar, have created consistent demand for wall assemblies, cladding, and fenestration systems. In residential projects, the focus remains on thermal comfort, energy savings, and compliance with updated building codes, which are driving the use of insulated facades, reflective roofs, and advanced windows. Renovation and retrofitting of existing residential stock, especially in mature markets such as Dubai and Riyadh, are also contributing to sustained demand.

The commercial segment is expected to grow at the fastest CAGR of 4.5% over the forecast period, fueled by investments in offices, retail, hospitality, and mixed-use complexes. Countries such as the UAE, Saudi Arabia, and Qatar are prioritizing diversification into tourism, finance, and services, which has accelerated the construction of hotels, business districts, and shopping centers. These projects typically demand premium curtain wall façades, advanced glazing, and aesthetically distinctive cladding systems to enhance visual appeal while meeting energy efficiency standards. Data centers and healthcare facilities are also contributing to commercial demand, requiring airtight, moisture-resistant, and thermally robust envelope systems.

Country Insights

Government-backed infrastructure and private sector investments largely drive the growth of the Middle East building envelope market. Demand is concentrated in the GCC, where advanced thermal, solar, and fire-resistant performance requirements are standard. Curtain wall systems dominate the high-rise segment, while rainscreen cladding and reflective roofing solutions are gaining traction in mid-rise and institutional developments. Retrofitting of existing building stock, particularly in the UAE and Saudi Arabia, is becoming a major growth driver. Local manufacturing of aluminum, insulation, and glass is strengthening supply chains, though premium products continue to be imported. Project delivery increasingly favors design-assist and early supplier involvement to manage complexity.

Saudi Arabia Building Envelope Market Trends

Saudi Arabia is the largest country in the Middle East building envelope industry, fueled by giga-projects such as NEOM, Red Sea Development, and Qiddiya. The updated Saudi Building Code (SBC) enforces stricter requirements for insulation, glazing, and cladding fire safety. The extreme climate necessitates advanced facade systems, deep shading strategies, and high-performance glazing. Large-scale industrial and logistics developments are driving demand for insulated panels and durable roofing. Localization of aluminum and panel manufacturing is encouraged through Vision 2030 initiatives. Contractors increasingly prefer unitized systems and prefabrication to meet tight project schedules. Public building retrofits add a steady secondary demand stream.

UAE Building Envelope Market Trends

The UAE maintains a strong demand for building envelope systems across commercial, residential, and hospitality sectors. Regulations such as Estidama and Dubai Green Building Regulations continue to raise performance standards. The retrofit market is expanding as existing assets undergo repositioning to meet higher sustainability targets. Growth in data centers and healthcare facilities is creating specialized demand for airtight and moisture-resistant envelope systems. Unitized curtain walls, advanced glazing, and integrated shading are widely used in high-rise and premium projects. Single-ply membranes and hybrid waterproofing systems dominate roofing demand. Local fabricators are well-positioned, competing effectively with international suppliers.

Egypt Building Envelope Market Trends

Egypt’s New Administrative Capital and other infrastructure projects are driving demand for modern facade and roofing systems. Climatic conditions favor the use of thermal mass, external shading, and low solar heat gain glazing. Cost-sensitive projects typically rely on stick-built facades and stone-based cladding systems. Industrial parks and logistics growth support demand for metal panel systems and durable roofing. Financing constraints make life-cycle cost a key selling point for advanced envelope systems. Domestic production of aluminum and glass is improving, but specialized products remain import-dependent. Public sector retrofits provide additional opportunities for growth.

Qatar Building Envelope Market Trends

In Qatar, post-World Cup construction activity has shifted toward selective institutional and commercial projects. Façade systems continue to emphasize thermal efficiency and fire compliance. Demand is emerging in corporate campuses, education, and healthcare facilities. Solar facades and BIPV solutions are being integrated into flagship sustainability projects. Roofing demand remains concentrated in reflective and warranty-backed membrane systems. Procurement practices favor vendors with established performance records in the region. Retrofit and refurbishment cycles are gradually becoming more prominent.

Kuwait Building Envelope Market Trends

Kuwait’s building envelope market is driven by government-led healthcare, housing, and public infrastructure projects. Coastal conditions increase the demand for corrosion-resistant facades and roofing solutions. Energy-efficiency initiatives are leading to greater adoption of high-performance glazing and thicker insulation. Hospitals and civic buildings are being upgraded with advanced envelope systems for resilience and energy efficiency. Bituminous and single-ply membrane systems with proven durability largely support roofing demand. The market relies on a mix of local suppliers and GCC-wide distributors. Regulatory emphasis remains on fire safety and wind-load resistance.

Key Middle East Building Envelope Company Insights

Some of the key players operating in the market include Saint-Gobain and Gulf Glass Industries.

-

Saint-Gobain is a global leader in construction materials with strong operations across the Middle East. It provides insulation, drywall, and high-performance glazing solutions through brands like Gyproc and Isover. The company has supplied products to flagship projects such as the Dubai Metro and Masdar Institute. Acquisitions, including the recent purchase of FOSROC, support its regional growth.

-

Gulf Glass Industries, part of the GIBCA Group, is based in Sharjah, UAE. It specializes in architectural glass processing, producing laminated, tempered, and low-E glazing. The company has expertise in fire-resistant, bullet-resistant, and acoustic glass systems. GGI serves large commercial and residential projects across the Middle East.

Rockwool and Bouygues SA are some of the emerging participants in the building envelope market.

-

Rockwool International, headquartered in Denmark, is a global leader in mineral wool insulation. Its products deliver superior fire resistance, thermal efficiency, and acoustic comfort. In the Middle East, Rockwool supports projects requiring sustainable and energy-efficient envelopes. The brand is well-positioned as regional regulations push for greener construction materials.

-

Bouygues SA is a French multinational construction and engineering conglomerate. It operates in the Middle East through subsidiaries in Dubai and Saudi Arabia. The company provides advanced facade, cladding, and roofing solutions for large projects. Bouygues leverages global expertise to deliver complex, high-specification building envelopes.

Key Middle East Building Envelope Companies:

- Saint-Gobain

- Kingspan Group

- Rockwool

- Gulf Glass Industries

- Lindner Group

- Meinhardt Group

- Bouygues SA

- Seele Middle East FZE

- Koltay Facades

- Zamil Industrial Investment Co.

Recent Developments

-

In January 2025, Saint-Gobain completed the acquisition of OVNIVER Group in Mexico & Central America, further strengthening its worldwide presence in construction chemicals.

-

In January 2024, Kingspan launched PowerPanel, an insulated panel with integrated solar PV.

-

In February 2025, Saint-Gobain completed the acquisition of FOSROC, a leading player in construction chemicals in Asia and emerging markets, further strengthening its worldwide presence in the sector.

Middle East Building Envelope Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.82 billion

Revenue forecast in 2033

USD 10.71 billion

Growth rate

CAGR of 4.0% from 2025 to 2033

Base year for estimation

2024

Actual estimates/Historical data

2021 – 2023

Forecast period

2025 – 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, end use, country

Regional scope

Middle East

Country scope

Saudi Arabia; UAE; Egypt; Qatar; Kuwait

Key companies profiled

Saint-Gobain; Kingspan Group; Rockwool; Gulf Glass Industries; Lindner Group; Meinhardt Group; Bouygues SA; Seele Middle East FZE; Koltay Facades; Zamil Industrial Investment Co.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Building Envelope Market Report Segmentation

This report forecasts revenue growth at the regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East building envelope market report based on product type, end use, and country:

-

Product Type Outlook (Revenue, USD Million, 2021 – 2033)

-

Walls & Cladding Systems

-

Roofs

-

Windows & Doors

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 – 2033)

-

Residential

-

Commercial

-

Industrial

-

-

Country Outlook (Revenue, USD Million, 2021 – 2033)

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Egypt

-

Qatar

-

Kuwait

-

-