Jordan Graft [Composite Illustration: Courtesy photo; istockphoto]]

Dallas-based Highway, a scaling logistics technology company tackling fraud and compliance in freight brokerage, has secured a strategic growth equity investment led by FTV Capital, with participation from Lead Edge Capital.

The minority investment, announced this week, will support Highway’s product development, go-to-market expansion, and customer growth. The funding amount was not disclosed.

Founded in 2022, Highway has carved out a niche in the logistics space as a pioneer in “carrier identity,” a platform purpose-built to help freight brokers verify carriers, prevent fraud, and build secure, trusted networks.

CEO Jordan Graft said the company was built to address one of the fastest-growing challenges in the logistics industry—freight fraud.

“Highway was built to solve an important and growing challenge for freight brokers: combating skyrocketing fraud within their networks in real time,” Graft said in a statement, adding that the partnership with FTV will help drive the company’s next phase of expansion.

Freight brokers play a key role in modern logistics, especially as the industry becomes more complex due to rising shipping volumes, volatile supply chains, and the rise of asset-light carriers. According to the company, brokers now manage roughly 30 percent of all U.S. truckload spend, but that role also makes them a growing target for fraud.

Attackers are becoming more prevalent and more sophisticated, the company said, increasing demand for tools that protect brokers and streamline operations at the same time.

What Highway built

Highway describes itself as the category creator for carrier identity solution that adds a new layer of verification designed to improve security and efficiency for freight brokers. The platform combines real-time data, automated compliance workflows, and fraud detection tools to simplify carrier vetting and prevent bad actors from entering broker networks.

The company said its “network-driven” model has quickly gained traction. Today, Highway serves over 1,050 brokers, including 70 of the top 100 in the U.S. The platform is also used by carriers and insurance partners, helping build what Highway calls a scalable foundation for modern freight operations.

Backing the next phase

FTV Capital, which led the investment, has a two-decade track record in tech-enabled logistics and supply chain companies. Principal Jerome Hershey said the firm sees Highway as a leader in an increasingly critical category.

“As freight brokers continue to gain greater market share with freight volume rising, fraud has intensified,” Hershey said. “To combat this, Highway is creating a more secure, data-enriched ecosystem through its scaled network of vetted brokers and carriers.”

He called Highway’s customer base “highly retentive” and noted the platform’s growth and profitability. “We’re thrilled to help the company build on its strong momentum and reinforce its position as the industry leader in carrier fraud protection.”

What’s next for Highway

With the fresh capital, Highway plans to grow its product suite and customer base while advancing its position as a go-to platform for freight compliance and risk management.

The company said it will continue working with freight brokers, carriers, and insurance partners to build a secure and scalable ecosystem across the logistics sector.

As part of the deal, Raymond James served as financial advisor to Highway, while TD Securities advised FTV Capital.

Quincy Preston contributed to this report.

Don’t miss what’s next. Subscribe to Dallas Innovates.

Track Dallas-Fort Worth’s business and innovation landscape with our curated news in your inbox Tuesday-Thursday.

R E A D N E X T

-

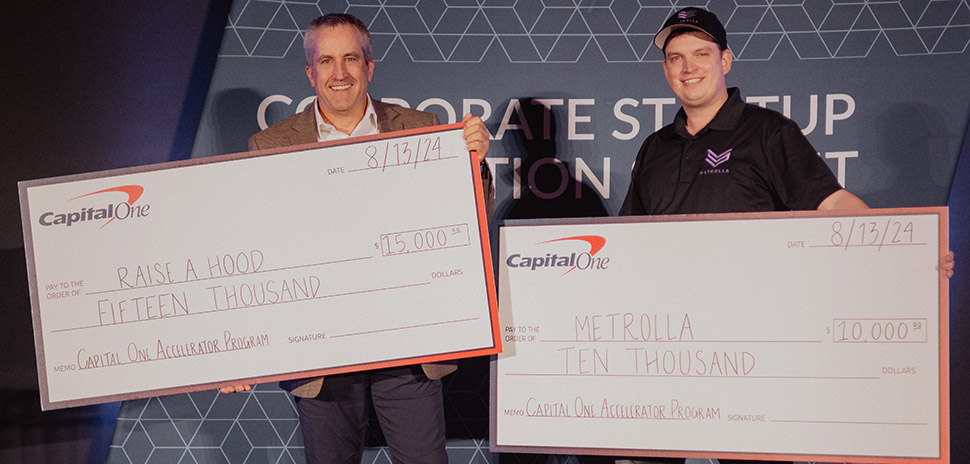

The Capital One program — one of few mobility-focused accelerators in the country — empowers visionary founders to enhance their startup expertise, expand their networks, and attract investors. The latest cohort wrapped up with standout pitches and notable wins.

-

Founded in 2013, RollKall provides end-to-end software that simplifies the management of off-duty programs for law enforcement and public safety agencies. One of its partnerships, since 2024, is with the Dallas Police Department.

-

The new record for the most users to take an online financial literacy lesson in 24 hours involved members of the public and students from Carrollton-Farmers Branch ISD and Richardson ISD. Participants got rousing support from Dallas Mavericks player P.J. Washington, who said “being disciplined for six months can change your life forever.”

-

Fundraising has slowed and valuations are down, but biotech founders could have a lifeline in family office investments, panelists at the recent BioNTX summit in Arlington agreed. They said succeeding with these investors can take time, a lot of education, and a compelling, well-crafted story that connects emotionally with the family.

-

Partners Capital, with over $60 billion in assets under management, said its new Dallas office reinforces its long-standing commitment to local endowments, foundations, family offices, and private clients.