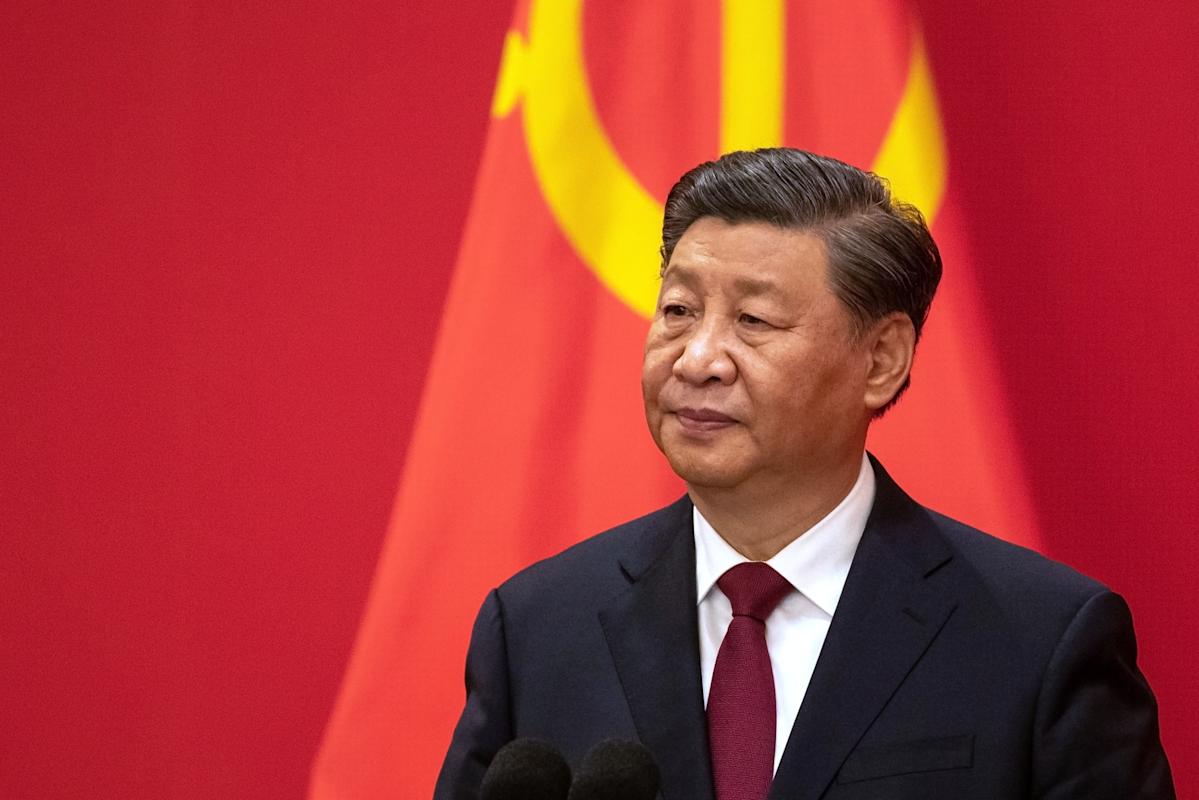

China’s President Xi Jinping.

(Bloomberg) — When President Xi Jinping faced a deflation spiral a decade ago, he not only cracked down on China’s oversupply problem but also unleashed an almost $900 billion housing investment boom.

Most Read from Bloomberg

It’s a similar situation today, except Chinese policymakers are rolling out only half the solution. While Beijing’s recent push to curb overcapacity is helping rein in the glut in steel and solar sectors, the “anti-involution” campaign is missing a stimulus spark and could hurt the economy instead of bringing inflation back.

“It’s going to be hard to simply rerun the 2015 playbook,” said Christopher Beddor, deputy China research director at Gavekal Dragonomics. “The fundamental problem is broad macroeconomic forces such as weak household demand, which probably won’t be fixed by a series of haphazard government interventions to limit competition in a few industries.”

WATCH: Can China Avoid Japan’s Lost Decades?Source: Bloomberg

But more than two years into China’s latest deflation saga, a mega stimulus is still off the table. Total debt has soared to over 300% of gross domestic product — from a little over 200% a decade ago — and with the main policy rate at 1.4%, China’s central bank doesn’t have much room to cut. Price decreases also more widespread this time around, making the task at hand more daunting.

Even so, Xi’s government is finally getting serious about the over-production roiling the world’s second-biggest economy.

Coal output declined last month from a year ago, as government inspectors targeted sites that produce too much. A major lithium mine was suspended for three months, Bloomberg News reported earlier. Bosses from electric vehicle companies and some tech-giants have been hauled before regulators and warned about over-competition.

That’s slowing China’s industrial engine and hurting growth. Yet what’s lacking is a recipe that worked a decade ago, when China’s top leaders not only curbed output to prevent prices falling too far, but also gave households a huge wallop of stimulus, unleashing an estimated 6.3 trillion yuan ($877 billion) in property investment — equivalent to almost a 10th of China’s economy in 2015.

Without a big bang stimulus, economists say policymakers will need to roll out bigger structural reforms. One venue analysts are eyeing for bigger solutions is a twice-a-decade gathering of Communist Party officials known as the fourth plenum set for October, where leaders will chart development plans for the next five years.

Options available to Xi’s government include overhauling the incentive structure for local officials so they will chase faster consumption instead of investment and production, according to Robin Xing of Morgan Stanley, as well as reforms to transfer more income to households.

Morgan Stanley isn’t changing its inflation forecast for China despite the government’s efforts to rebalance its economy toward consumption, according to the bank’s chief China economist Robin Xing.Bloomberg: The China Show.”

Addressing the problem is important for China’s domestic growth and its geopolitical relationships, as US tariffs currently above 50% curtail access to the world’s biggest consumer market.

Xi’s last battle with overcapacity showed the limits of capping production alone to fix the problem. In 2015, as the economy also grappled with a stockpile of unsold homes and deep factory-gate deflation, authorities doubled down on an experiment first pioneered by former Premier Li Keqiang in northeast China in the 2000s.

Under that “shantytown redevelopment program,” the People’s Bank of China provided over 3 trillion yuan worth of cheap loans to help local governments and developers tear down old homes and provide families with cash compensation. Households took on debt to buy new apartments.

Such stimulus accounted for 60% of price increases in coal and steel, playing a more important role than mandated capacity cuts, according to a study by the International Monetary Fund in 2018.

Fast forward to now, Xi’s economic lieutenants have several levers they could pull to fire up demand despite the constraints.

Chief among these is the option of propping up a property market still in distress after a crisis started in 2021. So far, efforts to encourage local governments to buy unsold homes to support real estate have largely failed, prompting officials to consider enlisting companies owned by the central government in Beijing for the task, Bloomberg News reported earlier.

What Bloomberg Economics Says…

“Reducing overcapacity in certain industries could temper the price wars, but worries about the impact on growth and employment will give policymakers pause. A more viable path forward would be to focus on lifting demand through more income and job support.”

— Eric Zhu. For full analysis, click here

Officials might also act with less restraint in stimulating consumer spending. There are more ways for the government to transfer income to the household sector without discouraging work, a key concern for the Communist Party, according to Adam Wolfe, an emerging markets economist at Absolute Strategy Research.

The government could achieve that by raising rural pensions, reducing employees’ health insurance contributions, or implementing a negative income tax for those earning below a certain threshold. Subsidies for families with young children could also become more generous, he said.

“So far, the macro response remains well short of the monetary and fiscal stimulus that pulled China out of its last deflationary slump in 2016,” Wolfe said.

With the launch of massive dam construction in Tibet, speculation also is rife over a big infrastructure push to boost demand. But such big projects take years to plan and execute. And decades of urbanization have already left China saturated with bridges and roads.

Beyond the imbalance of abundant supply and dormant domestic demand, a deeper issue is over-competition among local governments in pursuit of growth driven by investment and production, especially in sectors favored by top leaders.

Subsidies offered to industries in the form of cash, tax benefits, cheap credit and land add up to an estimated 4% of GDP per year, according to a recent IMF study. But maintaining employment and tax income is a high enough priority for officials to keep unprofitable companies — and even zombie firms — alive.

China needs to “shift the tax system towards one that rewards efficiency and income, and change the local government incentives from rewarding output to household well-being,” Morgan Stanley’s Xing told Bloomberg TV.

“If they use the five-year plan in the fourth plenum to address these issues, I think finally these pieces will fall into place” and lead to a rebound of inflation, he said.

–With assistance from Ocean Hou, Yvonne Man and David Ingles.

(Updates with new chart.)

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.