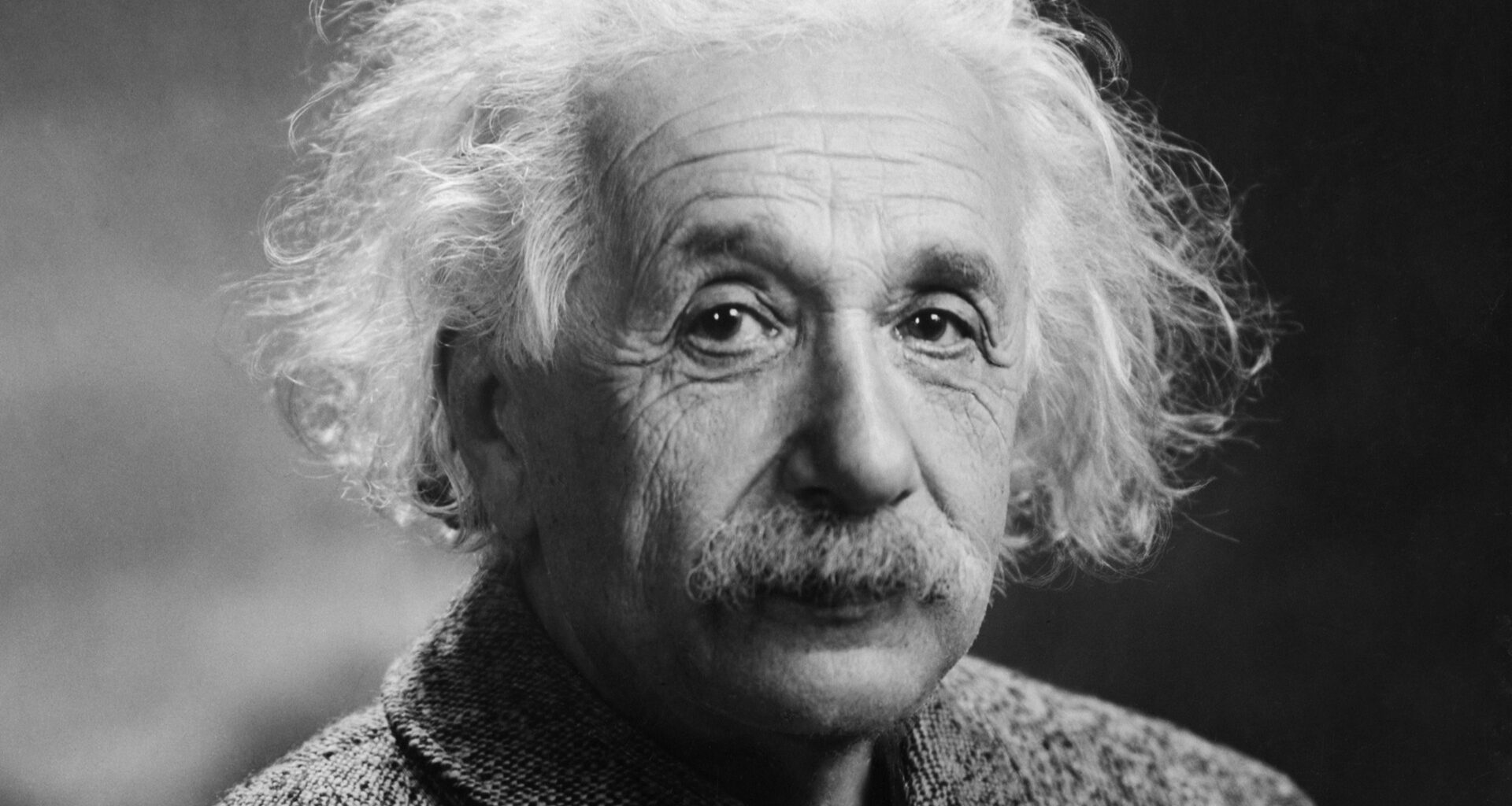

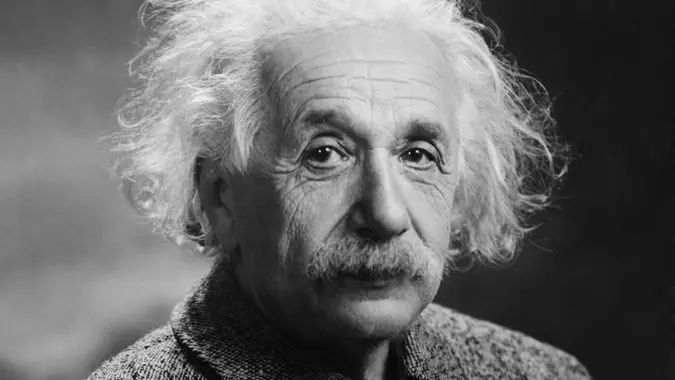

Everett Collection / Shutterstock.com

Commitment to Our Readers

GOBankingRates’ editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services – our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Trusted by

Millions of Readers

As humans go, Albert Einstein was pretty smart. Using nothing but “thought experiments,” he figured out the fabric of the universe (special and general relativity and spacetime), the whole energy is matter and vice versa thing (E = mc2), the existence of gravitational waves, and a dozen other mind-blowing facts.

There was one thing he couldn’t crack, however: compound interest. Einstein supposedly once quipped, “The most powerful force in the universe is compound interest. He who understands it, earns it, he who doesn’t, pays it.” Probably the most powerful thing about it is that anyone — including non-geniuses — can benefit from it. And in a big way. It’s basic math, which might explain Einstein’s trouble with it — it’s too simple.

How Compound Interest Works

Compound interest is merely the interest earned on interest. That grows your money exponentially. For instance, if you invest $1,000 and it earns 5% a year, in a year, you have $1,050. But in the second year, the $1,050 earns 5% interest. So, by the end of that year, you have $1,102.50. Not super impressive.

However, leave it for 10 years and you have $1620. In 25 years, it’ll be $3,400. And if the interest compounds more often — every month, for example — it grows even faster. For doing nothing.

If you don’t think that’s powerful, speak to Warren Buffet, often called the greatest investor of all time. He listed compound interest as one of the reasons he’s one of the world’s richest people and likened it to a snowball rolling down a long hill, getting larger and larger all on its own.

Finance guru David Ramsey said, “Compound interest is proof you can get rich slowly.” And he’s right. It will take time, which is why it’s so important to begin investing young and playing the long game, as Buffett himself has advised. He bought his first stock at 11 years old, and now famously holds onto his investments for years (he sold that first stock when it temporarily dipped and learned his lesson).

Despite Einstein also noting that compound interest is the “8th wonder of the world,” there is a fascinating and easy way to quickly calculate it. It’s called the Rule of 72. To discover how many years it will take to double your money with compound interest, divide 72 by the interest rate. This simple trick shows its power. For example, say you have invested $10,000 and are getting an annual return of 9%. 72 divided by 9 equals 8. Assuming you get the same return for eight years, you’ll have $20,000. Not bad for doing nothing but some easy math.