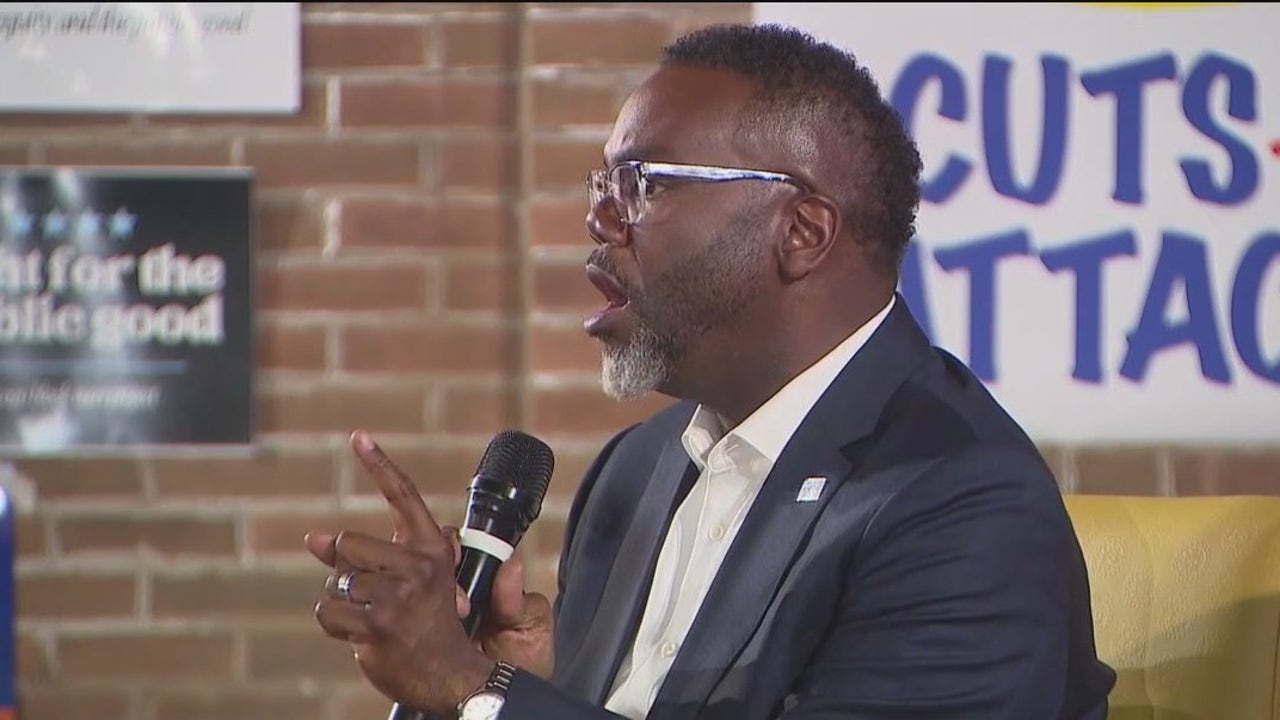

CHICAGO – As Chicago leaders look for ways to shrink a massive budget deficit for next year, Mayor Brandon Johnson, on Tuesday night, took part in a South Side town hall meeting.

What we know:

The city is grappling with a $1.1 billion budget shortfall.

One of the ways Johnson plans to close that gap, he says, is by targeting the ultra-rich.

Tuesday’s town hall meeting was hosted by United Working Families, which is chaired by Chicago Teachers Union President Stacy Davis Gates.

Dozens of South Side residents gathered at St. James Community Church, where Johnson joined Ald. William Hall (6th Ward) to discuss what the mayor has long called ‘The People’s Budget.’

With hearings slated to get underway in the next several weeks, Johnson said the city’s budget needs to prioritize working families over the wealthy.

Among other ideas, he is toying with a corporate head tax, which would charge businesses of a certain size for each Chicago employee. It is estimated to raise about $25 million annually if approved.

“Budgets, historically, have been balanced on the backs of Black, Brown, and working people in Chicago, and it is time as a city that we reject that form of budgeting and that we get to pursue what I believe is more a righteous budget,” Johnson said. “We have to make sure the that the 127,000 millionaires in Chicago, the [300 hundred-millionaires], as well as the 25 billionaires and these large corporations who get tax breaks from the State of Illinois, that they have to put more skin in the game.”

What they’re saying:

Groups like the Illinois Policy Institute are criticizing the mayor’s potential tax hikes, writing that he should focus on cutting bloated costs and addressing the city’s pension crisis instead of enacting policies they say will make the city more “hostile” for taxpayers.

Illinois Policy Institute Director of Fiscal Analysis Bryce Hill issued the following statement to FOX 32 Chicago on Tuesday night:

“Chicago’s budget shortfall is the result of years of irresponsible budgeting, mismanaging funds, and short term fixes that punt large fiscal problems to a later date.

“Proposals to raise taxes on businesses or redirect funds from essential public safety positions are not solutions — they risk driving away jobs, investment and residents at a time when Chicago can least afford it. They also are not fiscally responsible when the state spends astronomically on police overtime.

“The city does need a more affordable environment. But so-called ‘tax the rich’ policies are largely symbolic and impractical and are not the pathway there. Instead, city leaders should be looking for growth opportunities to encourage businesses to open and developers to build. Chicago can’t afford to push businesses and corporations out of the city.

“At a time when Chicago must get serious about long-term stability, leaders should prioritize meaningful reforms: capping spending, restructuring pensions and making Chicago a place where employers feel welcome, not where they’re taxed for existing. This is what other major cities are doing better.”

What’s next:

Johnson is expected to submit a budget recommendation to the Chicago City Council next month.

Budget hearings are slated for October and November; after that, the City Council must approve a budget by Dec. 31.