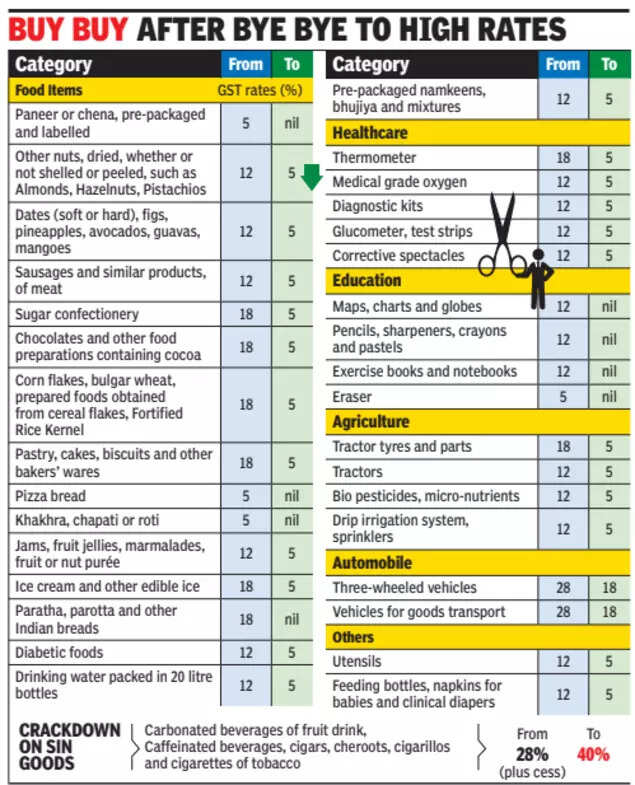

MUMBAI/NEW DELHI: The move to cut GST on a host of regular household staples ahead of the festive season is expected to lift consumption which had just begun to show some initial signs of recovery after several sluggish quarters. Companies expect demand for products ranging from soaps, shampoos and hair oils to namkeen to get a boost. “This is a game changer. Barring sin goods, almost all food items are in the 5% tax slab, said Mayank Shah, vice-president at Parle Products which is betting on the GST rejigging to generate long-term demand revival. Shah, however, said that while bigger packs will see some price reduction, in smaller packs, the benefit of tax cuts will be largely passed on through increase in grammage.

MUMBAI/NEW DELHI: The move to cut GST on a host of regular household staples ahead of the festive season is expected to lift consumption which had just begun to show some initial signs of recovery after several sluggish quarters. Companies expect demand for products ranging from soaps, shampoos and hair oils to namkeen to get a boost. “This is a game changer. Barring sin goods, almost all food items are in the 5% tax slab, said Mayank Shah, vice-president at Parle Products which is betting on the GST rejigging to generate long-term demand revival. Shah, however, said that while bigger packs will see some price reduction, in smaller packs, the benefit of tax cuts will be largely passed on through increase in grammage. The reduction in prices is, however, expected to reflect only on the new stock rolled out in the market, said an industry expert. For packs that are already on the retail shelves, it could be a challenge to do re-stickering. The large size packs could, however, be sold at discounted prices once the new prices kick in after Sept 22, the expert said.

The reduction in prices is, however, expected to reflect only on the new stock rolled out in the market, said an industry expert. For packs that are already on the retail shelves, it could be a challenge to do re-stickering. The large size packs could, however, be sold at discounted prices once the new prices kick in after Sept 22, the expert said.

GST Revolution Ahead: Experts Decode PM Modi’s Plan To Simplify India’s Tax Structure

The broader push to consumption comes at a time when Trump’s tariffs risk hurting growth of labour-intensive export oriented sectors. Slowdown in segments such as IT and gaming had also raised concerns around demand taking a hit. The GST cut is a timely and transformative move that will energise consumer sentiment just as India steps into its vibrant festive season. It’s a confidence booster for consumers and a growth enabler for the FMCG sector. This reform not only makes everyday essentials like shampoos, soaps, and toothpastes more affordable for millions of households, but also signals a strong commitment to inclusive growth and domestic consumption revival,” said Mohit Malhotra, CEO at Dabur, adding that the move will act as a “powerful catalyst” for demand, especially in rural and semi-urban markets.Significant rate reductions on items of common use bring much-needed relief to households, while exemptions on food items help curb classification disputes, reflecting the spirit of GST 2.0, said Mahesh Jaising, Partner & Indirect Tax Leader, Deloitte India. By reducing rates on essentials and electronics, this reform is poised to unlock a new wave of consumption, strengthen investor sentiment, and add meaningful momentum to growth, added Namit Puri, Managing Director & Senior Partner at BCG. The tax roll out kicks in right at the time of Navratri during which the first leg of festive purchases kick in. Companies had been concerned that a delayed tax implementation would crimp demand during the crucial Navratri period. Meds to get cheaperThe GST cut on life-saving, cancer, rare disease and chronic therapies is expected to ease prices of medicines, and make treatment more affordable. “GST reform is a welcome move and a landmark step,” Sudarshan Jain, secretary-general of the Indian Pharmaceutical Alliance told TOI. GST has been reduced from 12% to nil on 33 lifesaving drugs, and from 5% to nil on three lifesaving drugs used for treatment of cancer, rare diseases and other severe chronic diseases. On all other medicines, the GST has been lowered from 12% to 5%.